Kinder Morgan: Higher Leverage, But Lower Profitability Vs. Its Peers

Summary

- Kinder Morgan predicts a 20% growth in natural gas demand from 2023 to 2028, leading to profitable opportunities.

- European countries will likely increase LNG demand to replace Russian pipelines, while Asian countries may see declining demand due to high prices.

- Kinder Morgan's financials show higher leverage and lower profitability compared to its peers, but it consistently pays dividends.

imaginima

Introduction

Kinder Morgan (NYSE:KMI) is a well-separated midstream company with operations in several fields. Among all, natural gas is the most important element that brings opportunity for the company from the management’s point of view. That is because natural gas has a crucial role in the energy market in the following decades. In this analysis, I investigated the LNG market outlook for the next several years while analyzing KMI’s financial outlook versus its peers.

In my previous update on Kinder Morgan, I rated the stock as a buy, and after that, it rose by approximately 6%. In my previous update, I investigated KMI’s first quarter results and mentioned that according to the higher short-term demand outlook for natural gas, Kinder Morgan has strong opportunities for higher export. In this analysis, however, aligned with the short-term outlook, I investigated the long-term outlook for LNG supply and demand. Based on the prediction for lower LNG prices after 2026 and KMI’s high leverage condition, I realized that the stock is not profitable for growth investors. As a result, I have downgraded my rating to a hold.

LNG's short-term market outlook

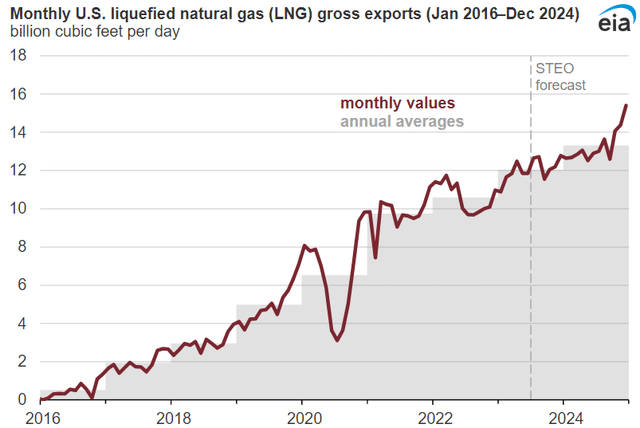

The management predicts a 20% growth in natural gas demand in the years 2023 to 2028. Moreover, Kinder Morgan’s pipelines are connected to almost every key natural gas resource in the United States. That is why that growth and higher demand will lead to profitable opportunities in the coming years. As it is indicated in Figure 1, U.S. natural gas export has surged considerably since 2016, not considering the downturn of 2020. During the next two years, a lower global supply of LNG will likely lead to higher LNG export opportunities for U.S. exporters. It is anticipated that U.S. LNG exports will reach approximately 12 billion cubic feet per day (Bcf/d) by the end of 2023. Additionally, the export of LNG is expected to incline to 13.3 Bcf/d by the end of 2024.

Figure 1

The management noted that although they have several projects in backlog, they are sure these projects will be getting done at attractive returns, well higher than the capital spent on them. Similar to their update on the first quarter of 2023, they have targeted $3.7 billion in committed growth capital on their backlog projects. But the point is what if these projects reach lower returns than what the management expects? In that case, they may lead to higher leverage for the company and lower distributed cash flow. For example, KMI’s Wabash Valley RNG projects, which are part of the Kinetrex acquisition, have been more expensive than expected.

What will likely happen in global LNG markets in the following several years?

During the following years, European countries will likely keep importing significant volumes of LNG to replace Russian pipelines. On one hand, the global LNG market will likely see additional supply moderately. As a result, higher demand versus weak supply growth will keep global LNG prices escalating in the next few years. On the other hand, in the growing Asian countries, LNG has become a costly fuel. Continuously elevated LNG prices will put downward pressure on most Asian countries’ demand growth because most of these emerging countries are more price-sensitive. As a result, higher LNG prices will undermine buyers of emerging Asian markets. Additionally, European efforts regarding boosting energy security, cutting energy costs, and meeting emission reduction targets will impact the demand for LNG in the long term.

On the supply side, after years of modest supply growth, IEEFA predicts that the supply of global LNG will boost, and companies will embark on new projects by 2025. Based on the anticipations, approximately 64 million metric tons of annual liquefaction capacity will be added by the end of 2026, which is the highest surge in the history of the global LNG industry. However, the point is that notwithstanding short-term LNG demand from Europe to replace its lost pipeline imports from Russia, a likely tightening demand from Asian and European countries in the long-term will push the LNG prices lower, tight margins, and decline profits of LNG exporters.

KMI’s financials vs. its peers

During the second quarter of 2023, Kinder Morgan’s distributable cash flow declined slightly by 8% and sat at $1,076 million versus $1,176 million in 2Q 2022. Moreover, KMI’s dividend yield is in the top 10-yield in the S&P 500, which is an attractive element of the company. Meanwhile, the company’s net debt amount is at a high level of $31.7 billion in 2Q 2023, which was almost constant with $31.6 billion at the end of 2Q 2022. Albeit high net debt levels are almost normal for companies in this industry, I believe the management is required to have some plan for deleveraging to reduce its interest expenses. With decreasing inflation rates, there is no need for high-interest rates in the future. However, we do not know when the Fed will decide to drop interest rates back to previous levels. As the management has no specific plan for deleveraging, it seems they have relied on lower interest rates in the near future, which I assume is not reliable.

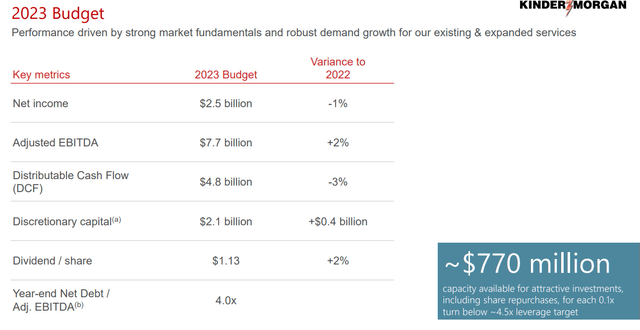

In the 2023 budget plan, Kinder Morgan anchored to have $4.8 billion of distributed cash flow. Moreover, they would keep the capital expenditures around $2 billion by the end of 2023. The point is that after paying dividend payments and CapEx, there will be almost no excess cash flow for deleveraging. Kinder Morgan expects to keep its net debt-to-Adj EBITDA at 4x, which is not a high ratio for a big company like KMI. However, we should investigate if KMI has been able to use its debt effectively in comparison to its peers. The management expects to receive high returns from its capital spending on backlog projects. Furthermore, as the management announced at the end of 2022, approximately 25% of KMI’s debt is with a floating interest rate. If we assume that their interest payment is inclined by 4%, it would have a significant impact on their expenditures. As you can see in Figure 2, notwithstanding higher Adjusted EBITDA by 2% versus the same time in 2022, their DCF fell by 3%, which shows the impact of higher interest rates. However, what begs a question in my mind about KMI’s deleveraging process is that as the interest rates increased slowly, also after the inflationary environment resulting from the COVID-19 pandemic, we mostly expected higher interest rates to combat inflations, KMI had an almost good time to refinance its debt by lower interest rates, thereby improving its leverage condition, but the management did not.

Figure 2

KMI Second Quarter 2023 Presentation

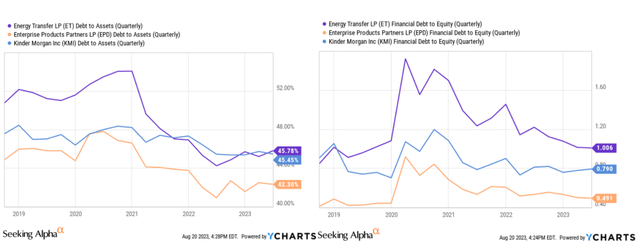

To investigate KMI’s financials more accurately, I have analyzed its leverage and profitability conditions in comparison with its peers: Energy Transfer (ET) and Enterprise Products Partners (EPD). In the case of leverage condition, Kinder Morgan’s debt-to-Asset ratio is 45.4%, which is almost the same as ET’s amount of 45.7%, while EPD has performed better and sat at 42.3% of the debt-to-asset ratio. Additionally, KMI’s debt-to-equity level is circa 0.8x, which is slightly lower than ET’s debt-to-Equity of 1x. Again, PDE has had the lowest level of circa 0.5x during the last 5 years (see Figure 3).

Figure 3 – KIM’s leverage condition vs. peers

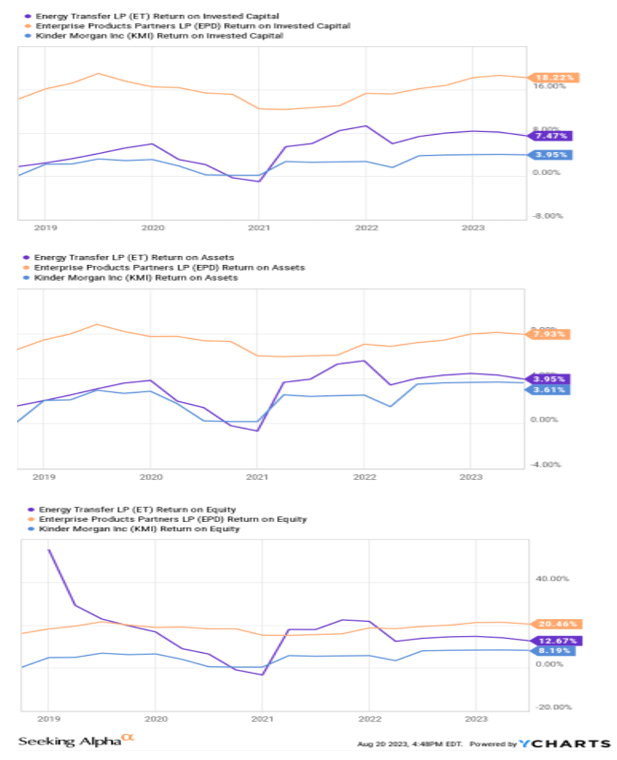

Moreover, analyzing KMI’s return ratios versus the peer group indicates that ET and EPD have used their debt more efficiently. As it is indicated in Figure 4, KMI's return on invested capital is 3.9%, which is far lower than ET’s and EPD’s levels of 7.4% and 18%, respectively. This ratio indicates that EPD has been able to turn its capital from investments to profits more successfully. Additionally, KMI has the lowest return on assets level among its peers. Its ROA is 3.6%, which is in line with ET’s 3.9%. However, well below EPD’s ROA of 7.9%. Ultimately, KMI’s return on equity sat at 8%, which is beneath ET’s 12.6% and EPD’s 20.4%. All in all, considering Kinder Morgan’s leverage and profitability conditions in comparison to its peers indicate that the management could use debt more efficiently and thus provide more benefits for investors.

Figure 4 – KMI’s return ratios vs. its peers

YCharts

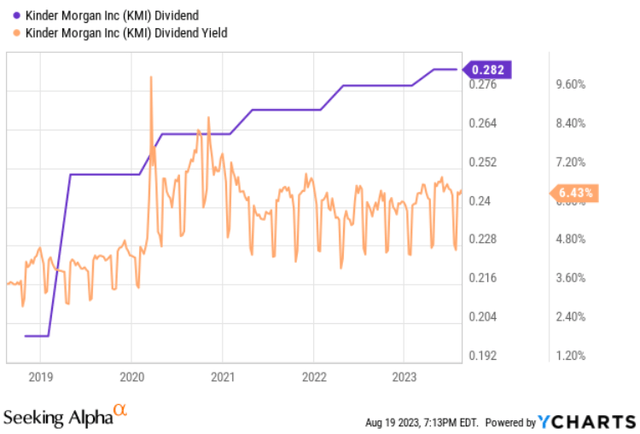

Furthermore, considering KMI’s dividend payment indicates that the company has paid dividends consistently and is growing slowly. Their last payment of dividend, which was paid on August 15th, was in line with the previous quarter of $0.282 per share. Also, their dividend yield is 6.43%, which is very attractive. As a result, although Kinder Morgan is not an appropriate choice for growth investors in my point of view, the company is strong, and reliable for paying back dividends, thus a good choice for investors who would like reliable dividend payments albeit with slow growth (see Figure 5).

Figure 5 – KMI’s dividend payment and yield

Conclusion

Kinder Morgan is one of the prominent midstream companies in North America. The company has a diversified portfolio of operations like services, refinery products, and infrastructure. Thankfully, their potentials and pipeline networks bring the opportunity to soak economic downturns and commodity price fluctuations. In this analysis, I have investigated short-term and long-term outlooks for LNG market supply and demand. Also, I have analyzed KMI’s leverage and profitability conditions in comparison with its peers: Energy Transfer and Enterprise Products Partners. KMI has almost higher leverage ratios vs. its peers, while it has provided less profitability for its investors. When all was said and done, I believe a hold rating is appropriate for KMI stock.

Thank you for your time, and I welcome your opinions and comments.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (13)

Oke is a stronger play in midstream without a K1

Jepi