Macro Sentiment Says Sell VOO Before September

Summary

- CPI is still not in the regulator's target range and has likely reached its local bottom.

- Lowering rates now would be quite dangerous, keeping or hiking rates would put more and more pressure on budget increasing interest spending, which would lower the fiscal impulse effect.

- I see two regions that could spread their economic problems to the rest of the world.

- Big tech dominating VOO is another worrisome sign.

photohampster/iStock via Getty Images

Main thesis

S&P 500 (NYSEARCA:VOO) has rallied 17% this year, which is quite impressive considering pessimistic forecasts, 22-year high rates, and easing but still persistent inflation. I have long called on the overvaluation of the stock market, and I'm sticking to this thesis as I believe the system cannot withstand such high rates for so long. This, sooner or later, should lead to a 'something breaks' scenario, which would hammer 'soft landing' hopes and drop the stock market at least to 2022 lows. I expect the first worrisome signs to appear in September. It has historically been the worst month for the stock market.

CPI: Not so 'cool' as they talk about

CPI was 0.17% Month-Over-Month in July (the equivalent of a 4.8% annual inflation rate) and 3.2% YoY. The key role here is played not so much by the value of "0.17%" itself but by the structure of the index. Energy prices grew in July by 0.1% MoM, but there was a significant drop in prices by 12.5% YoY. That reduced the annual CPI by 0.9 percentage points. So the effect of last year's base will decrease sharply from August, and headline inflation should rise.

Goods without energy and food continue to maintain a deflationary trend at -0.3% MoM, but this is largely due to the ongoing correction in prices for used cars (-1.3% MoM and -5.6% YoY).

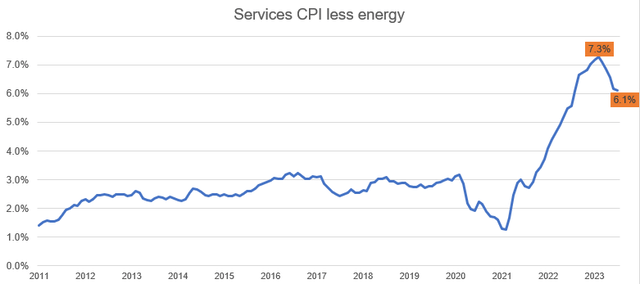

At the same time, the main impact was made by services. Services excluding energy added 0.4% MoM and 6.1% YoY.

All in all, we can say that inflation is really slowing down and is no longer so far from the regulator's targets. However, firstly, the effect of a very high base of last year is still preserved here, and secondly, prices for services continue to maintain impressive growth rates, it will be quite difficult for the Fed to break this. In addition, energy prices are still at fairly low levels and their recovery will lead to an additional burden on consumers.

Fed to keep rates, rates to keep putting pressure

With inflationary pressures softening, the Fed is expected to keep rates at 5.25%-5.50%. Lowering rates in this situation could be quite dangerous in my view, as it would be a strong signal for a complete reversal of the entire policy and a change in the cycle, which would likely accelerate demand and inflation. At the same time, raising rates would also be a strange decision as this level is fully in line with the restrictive policy.

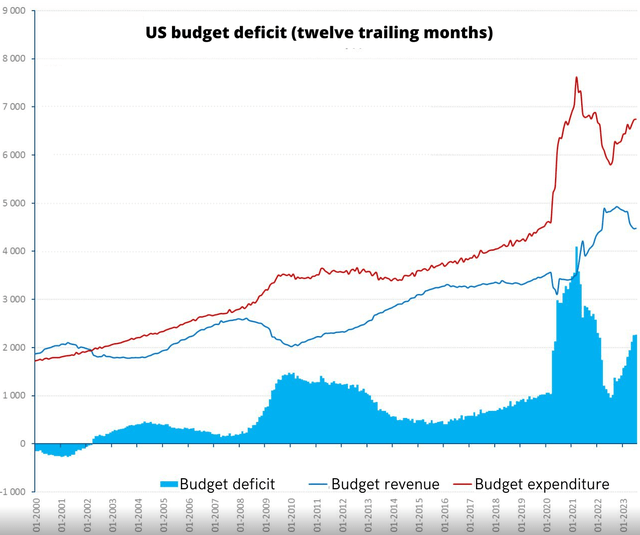

High rates continue to put pressure primarily on the federal budget, raising interest costs to record highs. The budget deficit over the past 12 months amounted to $2.26 trillion, or to 8.6% of GDP. Thus, the fiscal stimulus for the economy is extremely strong and covers any monetary tightening. However, I believe the US will have to normalize the budget, both because of rising interest spending on debt service ($0.87 trillion over the past 12 months) and weak revenue performance.

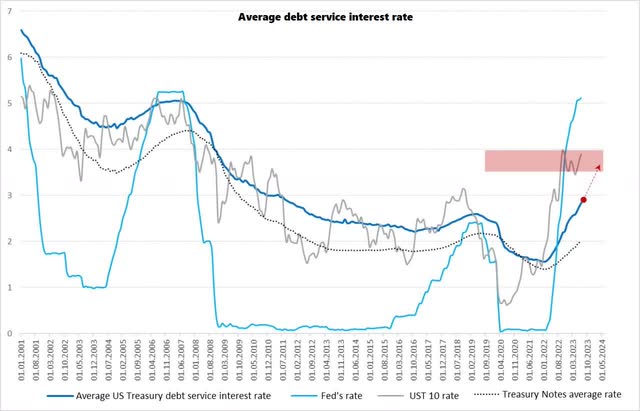

Non-interest spending will have to be cut at some point or taxes will have to be raised, which the Republicans are unlikely to let through. In a high interest rate environment, this will be quite painful for the economy and especially for the stock market. And interest rates should continue to grow. The average US government debt service rate continues to grow by 0.25% per quarter, and in July, amounted to 2.84% per annum. That's not much, but I think growth will continue here since the 10-year UST rate is above 4.2%, and given the size of the debt ($32.7 trillion), payments will become more and more burdensome for the US Treasury.

All around the world

The financial system is not just facing troubles in the US, it's more like a global thing. There are currently two main areas of concern that I see:

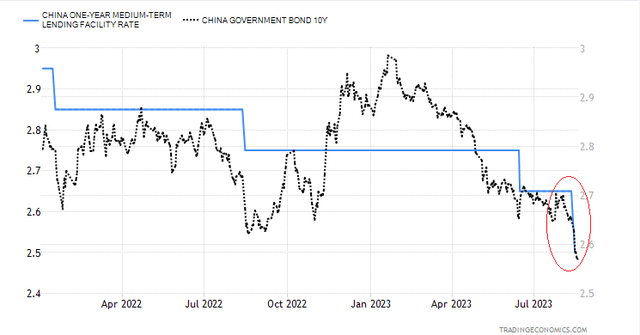

- Chinese deflation. Producer prices fell by 4.4% YoY in July due to lower prices in the extractive industries. Low core consumer inflation reflects weak growth in producer prices for non-durable goods and durable goods (-1.5% YoY) in the face of excess production capacity and weak domestic demand. With excess savings among Chinese households continuing to rise, weak demand is not an income issue in my opinion. The deposits have grown to ¥131.4 trillion, or 106% of GDP. Thus, massive fiscal and monetary stimulus are expected. The bond market has already likely priced it in but real rates are still too high.

The question here is rather whether it will be possible to return the economy to its former path at all. There is a well-founded opinion that China could slide into the Japanese scenario. The population is aging, the birth rate is rapidly declining while wealthy consumers are stuck in a savings model and no longer want to spend. One thing is for sure: China is critical to the stability and healthy growth of the global economy, and this quarter is likely to be a troubled one already for companies that have a great share of revenue coming from this country.

- Japanese troubles. Since the beginning of the year, the Bank Of Japan has bought almost ¥80 trillion ($550 billion) worth of government bonds. The volume of purchases came close to the annual budget expenditures. So far, interest payments are only 1.5% of GDP. Further, they should only grow as the share of the Bank of Japan in owning debt, since the real bond rate looks unattractive with stable inflation above 3% and a weak trade balance. The Bank of Japan controls almost nothing now and, in my opinion, just goes with the flow in the hope that the problems will resolve themselves. There is no room for maneuver here, since the regulator can neither raise the rate nor even stop large-scale purchases of government bonds. Against this background, Japan is the main contender for the 'something breaks scenario', in my opinion. This region is very large for the world economy, with $10 trillion of external assets.

Why we likely will fall in autumn

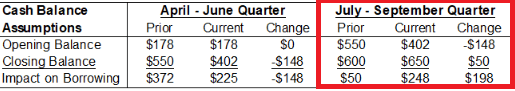

First, why would we start falling in the first place? Well, the US Treasury revised its end-of-quarter cash balance to $650 billion and total market borrowing to $1 trillion. Thus, it is on track to withdraw $250-300 billion from the system by the end of September.

U.S. Treasury

Moreover, it looks like we'll be forced to watch yet another fight for government spending in September. The House of Representatives, which returns from recess on September 12, has only 3 weeks (until the end of the fiscal year) to pass appropriation bills, just like the Senate did last year. President Biden is likely to veto pending bills, raising the possibility of another total government shutdown. All in all, the Democrats will have to make concessions, which means more spending limits are more than possible.

That is, the momentum of monetary tightening will remain at the same level (if not higher), taking into account QT, and the fiscal impulse would be reduced.

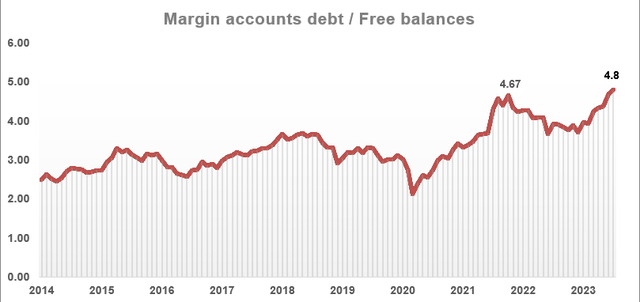

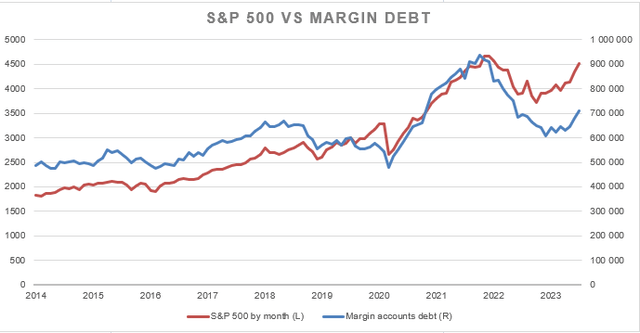

Second, it is important to understand that the growth of the US stock market is accompanied by an unprecedented increase in margin lending. The ratio of the volume of margin debt to free balances on margin accounts in July reached an absolute maximum for the entire history of observation since 2010 and amounted to 4.8x.

Judging by the correlation with the S&P 500 index, these margin positions are long on the stock market. Large leverage is always the pain of margin calls and corrections when the market trend changes. And the most frightening thing here is that this is by no means cheap debt, as it was in 2021, given the massive rates hike. So a very fragile situation has been created here, which could crumble on any market fall.

Big tech dominating VOO is another worrisome sign

I think the big tech stocks seem to be detached from reality. Historically, the weight of the largest stocks has usually almost always been below their earnings weight. Now, however, the opposite is true, and the gap has become too large. The share of the top 10 companies by capitalization from the S&P 500 is 31.7%, and their profits are only 21% of all companies in the index.

JPMorgan

The incredible growth of the 'Big 10' share in 2020-2021 could justify the rapid earnings growth thanks to the incredibly favorable economic environment. However, earnings since then have fallen to normal values, but capitalization has not.

AI-mania and the faith in a 'soft landing' - that's what sustains big tech, and, accordingly, the entire market at these levels in my opinion.

Conclusions

Given the general instability in the macro environment, the reduction in fiscal momentum (which means the US Treasury will be taking money out of the system), as well as the record margin debt that the market has been growing on all this time, and the massive weight of the top 10 stocks in VOO, I believe that we can drop a few hundred points in September.

VOO is a Sell.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)

This entire perception is against all common sense for the investors out there .