ServiceNow: A Business Powerhouse

Summary

- ServiceNow empowers large companies to run their IT departments efficiently by providing a suite of digital workflow products.

- The company has experienced impressive growth, with a market capitalization of $114 billion and consistent revenue streams from recurring subscriptions.

- ServiceNow aims to expand globally and diversify its offerings, with a revised revenue target of $16 billion by 2026.

svetikd

ServiceNow (NYSE:NOW), a leading software company, has carved a remarkable niche for itself by empowering large companies to run their IT departments efficiently. Its journey began back in 2003 when entrepreneur Fred Luddy recognized a crucial disconnect between business teams and IT departments. Luddy, envisioning a unified platform, set up ServiceNow, with a mission to harmonize the operations between the two entities.

The Core of ServiceNow

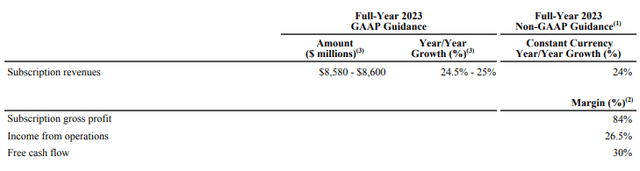

At its inception, ServiceNow aimed to streamline, and in many cases replace, outdated IT systems, addressing inefficiencies head-on. The core value proposition was and continues to be a suite of digital workflow products, accounting for 88% of its subscription revenue. The remaining 12% comes from IT Operations Management products. 2023 subscription revenues are expected to $8.6 billion, up 25% from 2022.

From Humble Beginnings to a $114 Billion Valuation

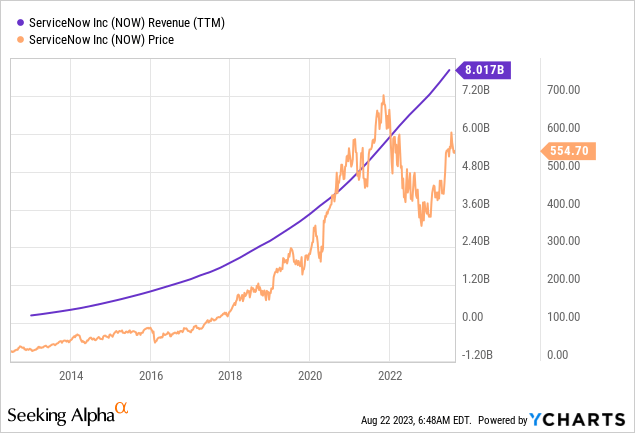

The company's success story has been nothing short of impressive. Today, ServiceNow boasts a market capitalization of $114 billion. With $7.5 billion in cash and investments and $1.5 billion in debt, the enterprise value stands at $108 billion. Revenue has expanded consistently, increasing every single year for at least the last 10 years.

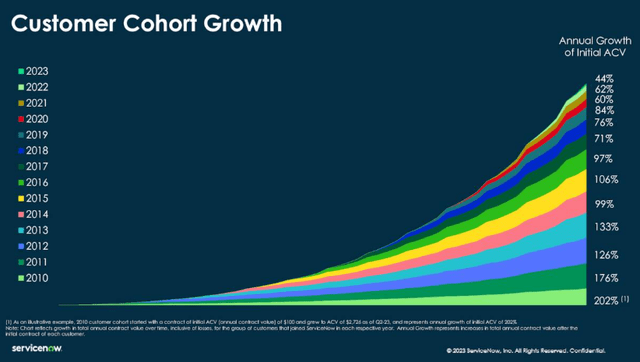

The company is highly profitable with net income totalling $1.4 billion over the last 12 months. Additionally, the company has free cash flow in excess of $2 billion. What’s most striking is that 97% of revenue is recurring with a renewal rate of 99% and highly attractive cohort graph. This really indicates the quality of ServiceNow's revenues and the standard of its product.

Company presentation

The Power of Retention and Expansion

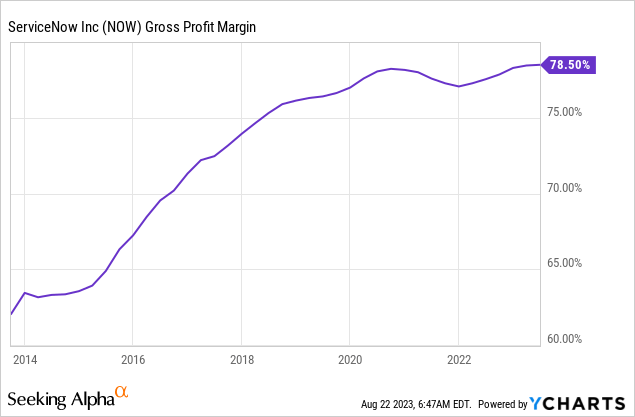

ServiceNow's products have earned the trust of the corporate elite, with 85% of the Fortune 500 companies leveraging their solutions. This trust is evident in the company's impressive 99% renewal rate in the third quarter and a 125% net expansion rate. Their prowess doesn't end there. Gross margin has held strong at 78.5%. This speaks volumes about ServiceNow's ability to not only retain customers but also generate incremental revenue from each one. And it has kept its gross margins expanding even during higher inflation that has hurt the top line of so many other companies.

Stock Performance: Riding High

The company's stock has also been a beacon of growth. Between May 2017 and May 2022 the stock provided almost 35% annualized returns. While the software industry often raves about the 'rule of 40', ServiceNow claimed in 2022 that it was in fact in the 'rule of 60', having previously posted a 30% revenue growth and a 32% free cash flow margin.

Since then, ServiceNow has seen a dip in revenue growth, which fell to 23% last year. And revenue growth rates have experienced a steady and consistent decline over time as the company has grown. That said, free cash flow margin is guided to remain at 30% for 2023 meaning the company is still well within the 'rule of 40' category.

The Road Ahead: Global Expansion and Diversification

Despite some slowdown in top-line growth, the company remains forward-looking and optimistic. Management recently revised its 2026 revenue target from $15 billion to $16 billion. This confidence stems from their belief in the software's potential to permeate other departments like sales, legal, and human resources. Moreover, ServiceNow is laying the groundwork for international expansion, further widening its horizon.

Analyzing the Valuation: A Double-Edged Sword

ServiceNow's journey up until now has been awe-inspiring, but the current valuation raises some questions. On its face, the stock trades at multiples that make it one of the most expensive in the market. The trailing twelve month PE is 81. Based on guidance for the whole of 2023, the stock trades at 13.2 times revenue. Assuming the company hits its 30% margin, the company is valued at 44x times this year's free cash flow.

Company Q2 filings

Nevertheless, ServiceNow still allocates large amounts (almost 40%) of its revenue towards sales and marketing. It's evident that as the company matures, it should be able to reduce this expenditure in order to boost earnings. A capital light business model and ability to generate cash mean shares should remain supported by future buybacks.

What’s in Store for ServiceNow?

Assuming the company reaches its $16 billion revenue target by 2026 and continues to grow from there on at 15%, we could see a net income of approximately $11 billion in a decade based on a net income margin of 25%. Assuming a 30x multiple to that figures gets us to a potential valuation of $318 billion which translates to an investment return of 10.8% per year.

Author workings

While this figure might seem modest, it's hard to bet against ServiceNow. The company's growth has been achieved without any major acquisitions. The company's strong product suite and best in class retention metrics all point to a promising future. Horizontal expansion across departments such as HR and sales is the most obvious path towards further success.

In conclusion, ServiceNow stands as a testament to what vision, innovation, and customer-centricity can achieve. Its stock might appear expensive today, but its fundamentals and future prospects still justify a bullish outlook.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.