Drilling Tools International: Significantly Undervalued Oil, And Gas Play

Summary

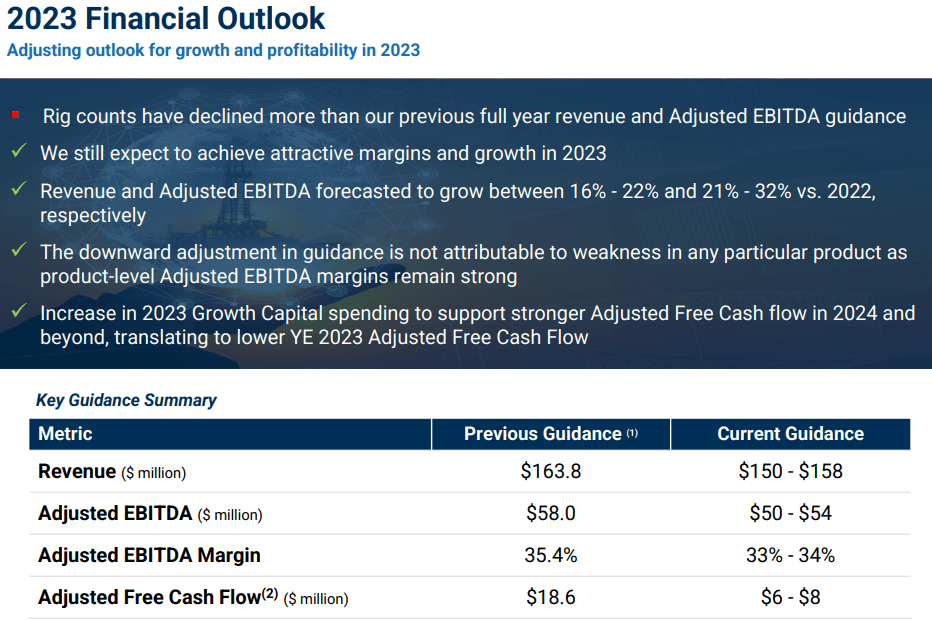

- Drilling Tools International has lowered its guidance but still expects close to 2-3x adjusted EBITDA with a 33.5% EBITDA margin.

- The directional drilling solutions services market is expected to grow at a CAGR of 9.5% from now to 2030, which could lead to FCF margin growth.

- The company's solid balance sheet, lack of debt, and potential for increased stock visibility suggest that it is significantly undervalued.

Jeremy Poland

Drilling Tools International (NASDAQ:DTI) recently lowered its guidance, but the adjusted EBITDA expected continues to imply close to 2x-3x Adjusted EBITDA with an EBITDA margin close to 33.5%. I believe that further increase in the price of tools rented and the directional drilling solutions services market growing at close to 9.5% CAGR would lead to FCF margin growth. There are some risks from the recent merger, volatility of the oil price, or lower demand for tools. With that, I believe that DTI is significantly undervalued.

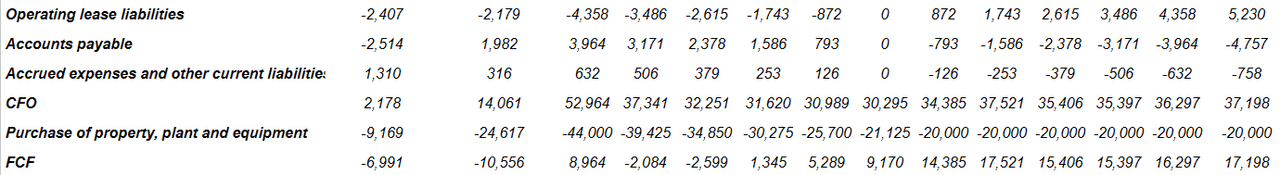

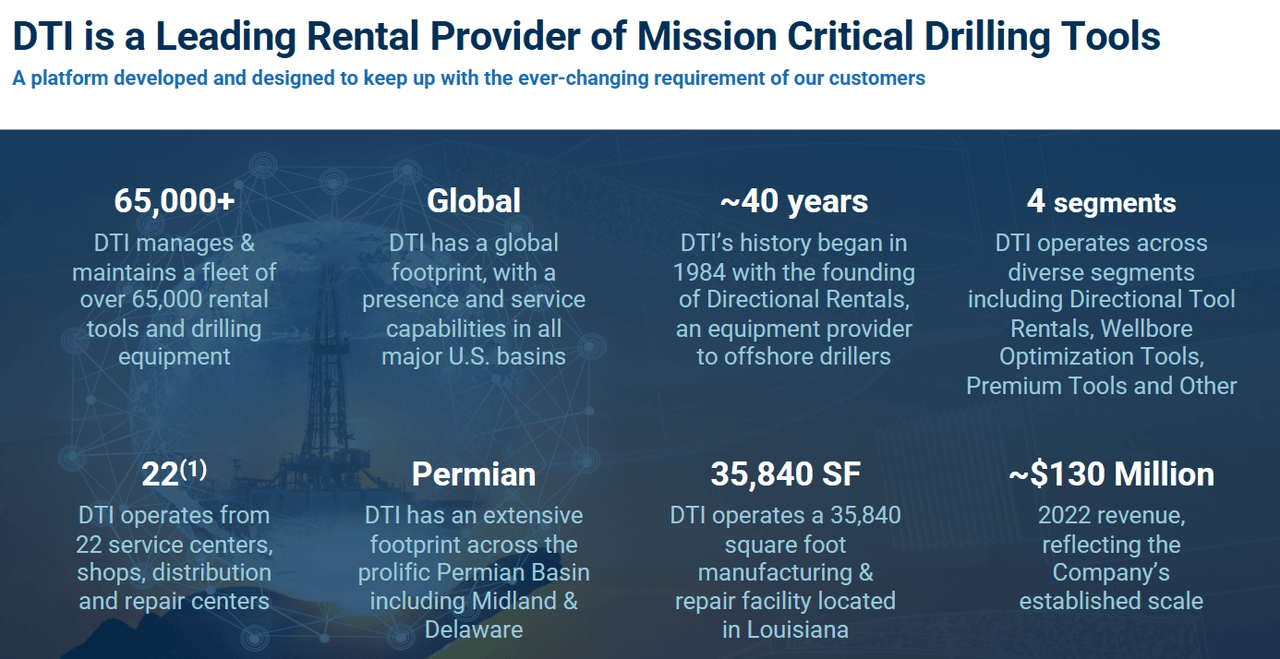

Drillings Tools International

Drillings Tools International is an international operating company in the field of exploration and production of liquefied gas, oil, and natural gas. The company currently operates in more than 22 locations throughout the United States, the Middle East, and Europe, and brings about 40 years in business and know-how accumulated.

Source: Quarterly Investor Presentation

Close to 60% of the total amount of revenue reported in 2022 came from directional rental tools. The directional drilling solutions services market is expected to grow at close to 9.5% CAGR from now to 2030. With these figures in mind, I believe that the company may receive more attention from market participants. I included these figures in my financial model.

By 2030, the directional drilling solutions & services market is expected to be valued at US$ 25.05 billion with a CAGR of 9.5% over the forecast period. Source: Directional Drilling Solutions & Services Market Size by 2030

Source: Quarterly Investor Presentation

The company seeks to grow within the non-operated segment in the upstream distribution market for oil and liquid and natural gas. This market is a highly fragmented market, in which private investors have stopped participating due to the low choice of alternatives and the few available outflows of capital and funds. In my view, the strategy is smart. Market behaviors may have changed, and the assets currently designed are economically stable, with promising projections on their investment capacity.

In the oil and gas industry, non-operated assets are those that have an undivided interest, and are owned by companies or affiliates other than those that operate them. In this framework, the investment interest of the company passes punctually on the upstream distribution lines among other asset opportunities that it considers attractive. This type of practice is not common, and the presence of private investors in this business is unusual.

Supported by low level of competition in the sector and the experience that the company has, I think that it offers the opportunity to buy high-quality assets at attractive prices and with good reinvestment capacities.

In my view, certain investment professionals may want to know that Drillings Tools International executed a reverse merger, which could, in my view, bring certain risks. An IPO process is more expensive and slower, however there is more certainty about the assets and liabilities of the business.

The Merger was accounted for as a reverse recapitalization in accordance with U.S. GAAP. Under this method of accounting, ROC was treated as the acquired company for financial reporting purposes (see Note 1 for further details. Accordingly, for accounting purposes, the Merger was treated as the equivalent of the Company issuing shares for the net assets of ROC, accompanied by a recapitalization. The net assets of ROC were stated at historical cost with no goodwill or other intangible assets recorded. Source: 10-Q

The Outlook Appears Quite Beneficial

The reverse merger was executed recently, which means that there are not many analysts out there reviewing the financials of Drillings Tools. With that, management offered beneficial expectations for 2023.

The outlook for 2023 includes double digit revenue growth around Adjusted EBITDA growth. The company recently lowered its 2023 net sales guidance, Adjusted EBITDA margin, and adjusted FCF. However, I believe that the number continues to lead to a valuation that appears significantly larger than the current stock price.

The company expects EBITDA margin close to 33%, which would imply an adjusted EBITDA of $50-$54 million. The company reports a market capitalization of close to $100-$130 million, and does not report debt. It means that it trades at 2x-3x Adjusted EBITDA. It is significantly lower than the median EV/EBITDA ratio in the industry.

Source: Quarterly Investor Presentation

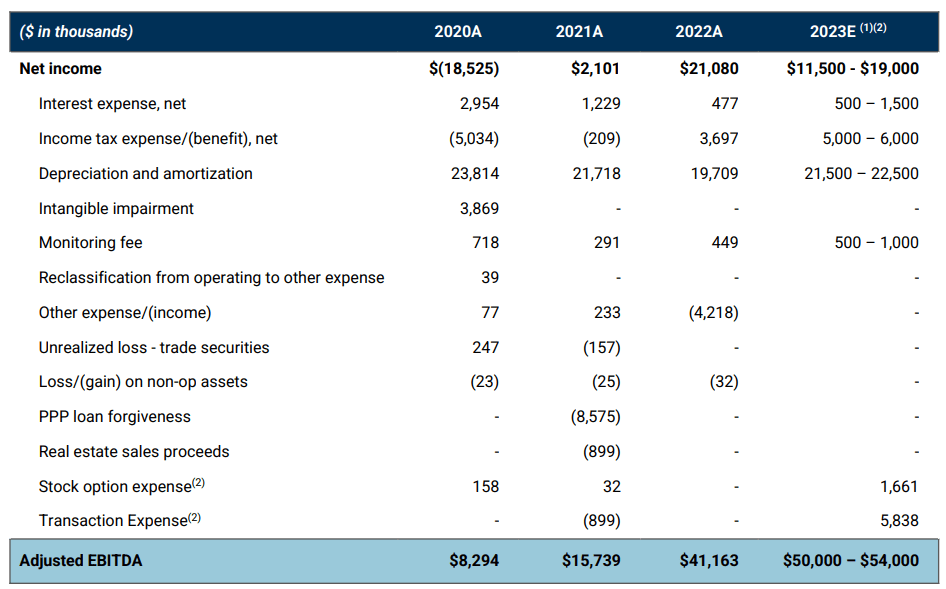

Net income expected for 2023 is equal to $11.5-$19 million, with D&A of $21.5-$22.5 million, interest expense of $0.5 million, and monitoring fee of $0.5 million. I made many other assumptions in my financial model, however I believe that investors may want to have a look at the numbers reported by management.

Source: Quarterly Investor Presentation

Solid Balance Sheet With No Debt

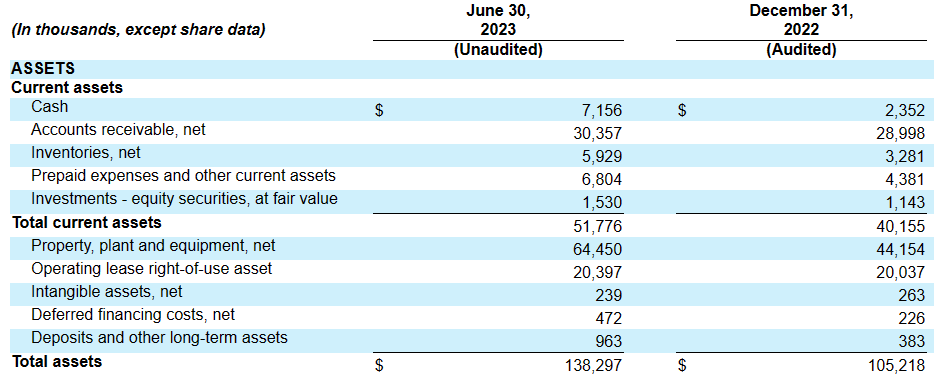

Current assets are larger than the total amount of current liabilities, and the asset/liability ratio is larger than 1x with no debt. I believe that the balance sheet appears quite solid. As of June 30, 2023, the company reported cash worth $7 million, accounts receivable of $30 million, inventories worth $5 million, and total current assets close to $51 million. Management also reported property, plant, and equipment of $64 million, operating lease right-of-use asset of $20 million, and total assets of $138 million.

Source: 10-Q

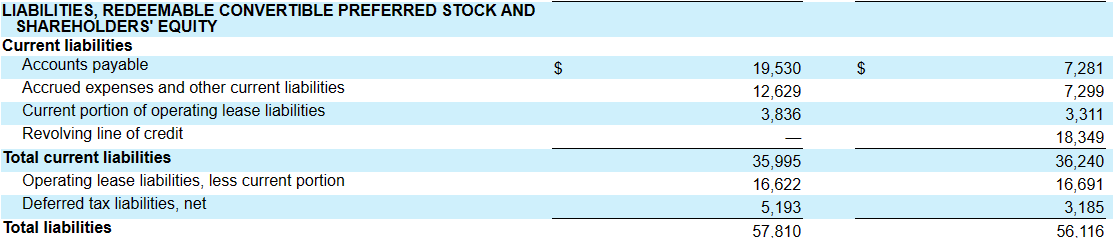

I would not be afraid of the total amount of liabilities. The company reported accounts payable of $19 million, with accrued expenses and other current liabilities worth $12 million and total liabilities close to $57 million. It is worth noting that the company paid a revolving line of credit in 2023, so I think that the debt may not pose a problem right now.

Source: 10-Q

FCF Margin Growth, Headcount Growth, Further Demand For Tools, And More Stock Visibility Would Imply Undervaluation

I am optimistic about the company because the oil and gas business appears to need more and more drilling technologies. According to management, operators need to drill faster and more efficiently, which would require more tools and more quality. In sum, I believe that price increases would most likely lead to revenue growth.

We expect our product sales revenue to increase over time as a function of oil & gas companies drilling faster and harder thereby pushing the limits of downhole drilling tools and often contributing to tools being lost-in-hole or damaged-beyond-repair. In addition, product sales revenue should increase as drilling contractors replace aged and consumable products to maintain or increase capacity. Source: 10-Q

It is also worth noting that gross margins could trend north because of economies of scale. Management believes that price increases will increase at a higher pace than inflation, which would most likely have a positive effect on the EBITDA margin.

We expect that gross margins will continue to improve slightly as we leverage our existing cost structure to support an increase in our business activity. In addition, we expect that customer price increases will help offset cost inflation. Source: 10-Q

I think that headcount growth would also have a positive effect on revenue growth. I believe that employee headcount to support customers as well as to maintain manufacturing will most likely bring better customer service and more commercial opportunities.

Finally, in my view, as more investors have a look at the expectations of management, and perhaps some analysts offer their own estimates, the demand for the stock could increase. As a result, I believe that the cost of capital would lower, which may enhance the stock valuation.

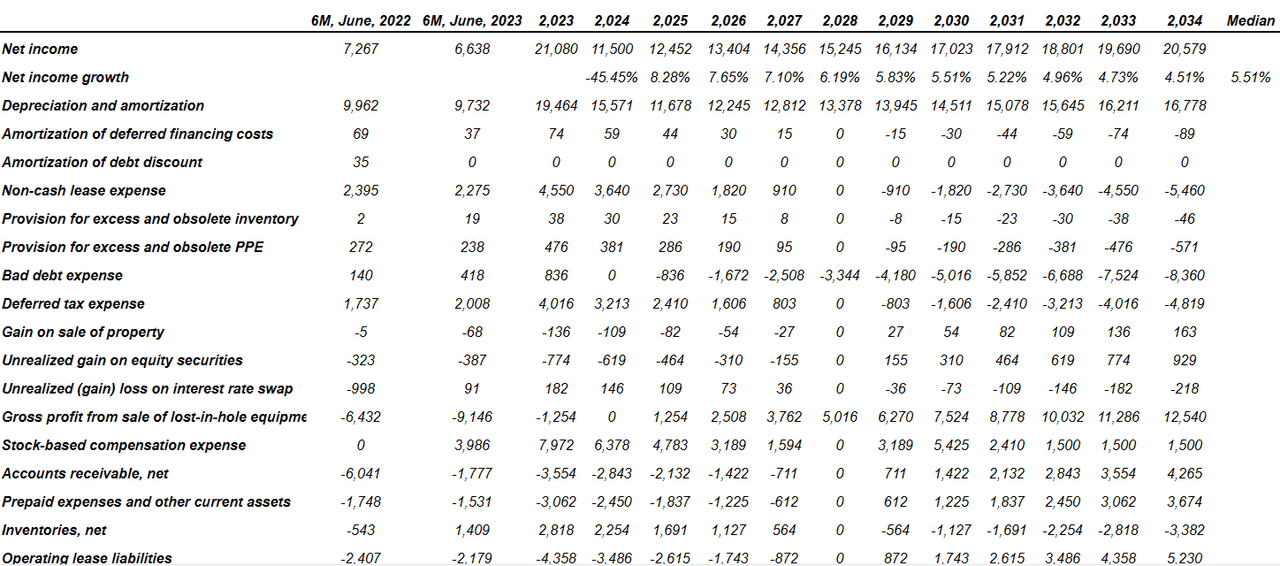

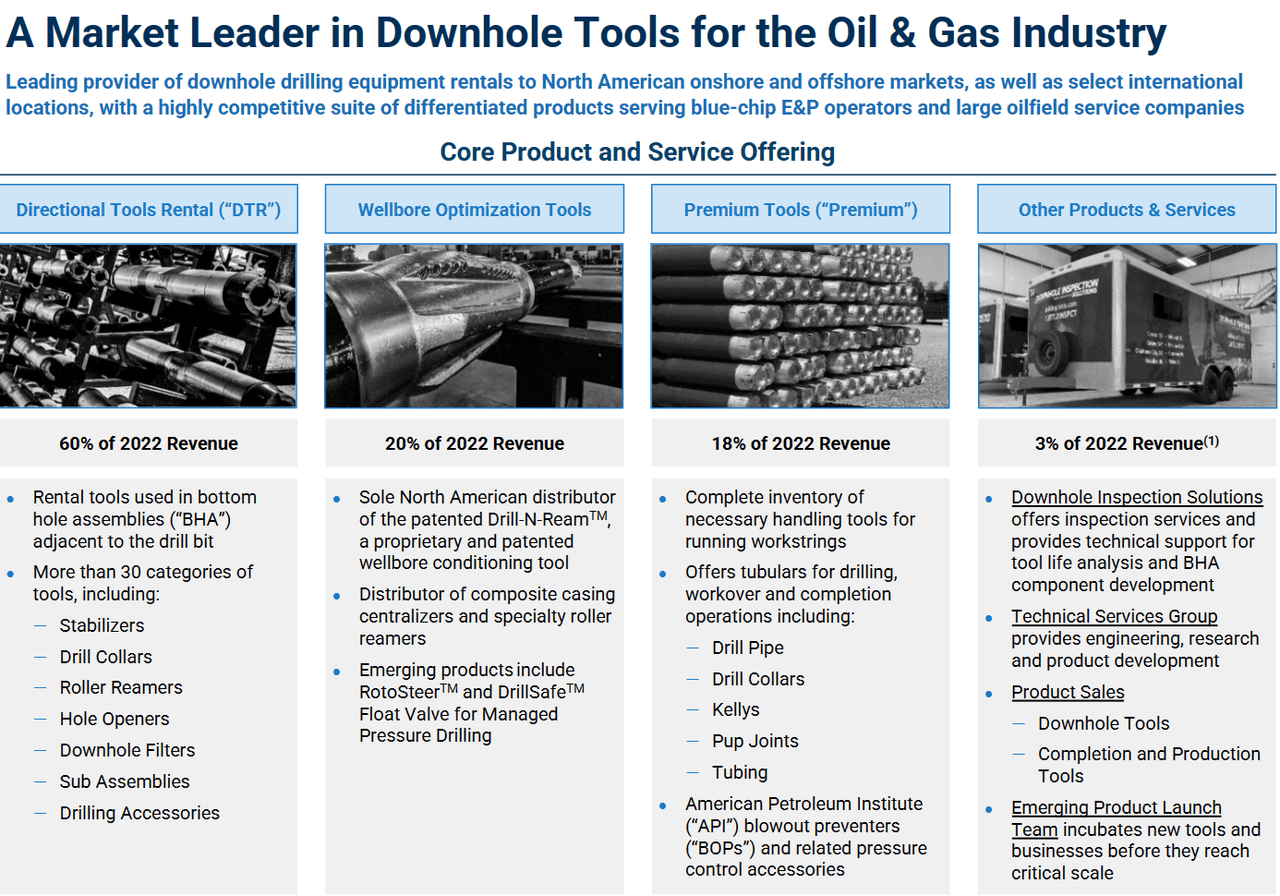

To assess future financials, I used previous figures reported by management concerning changes in accounts payables, changes in working capital, D&A, net income, and the outlook. I believe that my figures are conservative.

Source: Ycharts

More in particular, I included 2034 net income close to $20 million, 2034 depreciation and amortization of about $16 million, non-cash lease expense close to -$6 million, and deferred tax expenses of about -$5 million. I also included gross profit from sale of lost-in-hole equipment of about $12 million, stock-based compensation expense worth $1.5 million, changes in accounts receivable of about $4 million, and changes in prepaid expenses and other current assets worth $3 million.

Finally, changes in inventories worth -$4.55 million, operating lease liabilities of close to $5.055 million, and changes in accounts payable of -$5.055 million imply 2034 CFO of $56.055 million. Moreover, assuming 2034 purchase of property, plant, and equipment of about -$20 million, 2034 FCF would be $36.055 million.

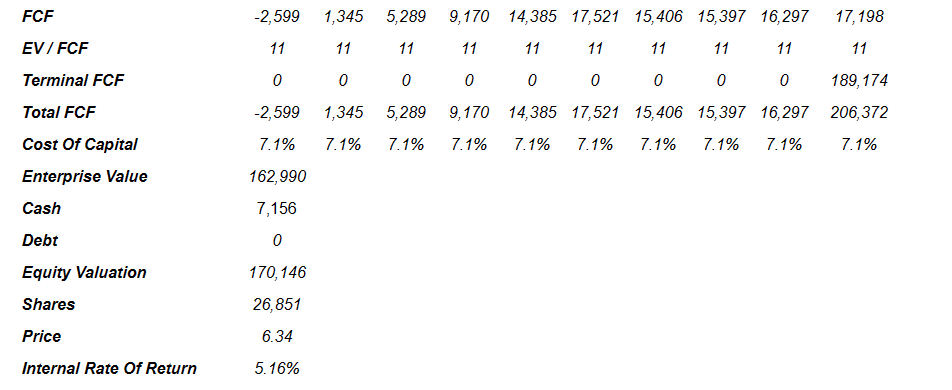

If we imply a conservative EV/FCF of about 11.05x and cost of capital of 7.105%, the enterprise value would stand at about $162.989 million. Finally, if we add cash worth $7 million, the equity valuation would be of $170 million, with a fair price of $6.755 and an internal rate of return of close to 5.155%.

Source: DCF Model

Competitors, And Risks

There may be intense competition from businesses or companies with similar objectives. Due to the drastic changes in the industry at present, it is difficult to make an early assessment of a real competition framework in this regard. Competitors in most cases are companies with resource capabilities and experience that are above the company's business conditions and management ability.

The company is currently in a particular situation that has the condition of the merger of the businesses and the strategy to carry it out. Risk management in this framework is essential for financial and operational success as well as the credibility and recognition that generate confidence in potential investors.

In addition, based on its lack of registration due to the recent merger, there are no statistics on income, returns, or the true capacity or ability to carry out the selection and acquisition of non-operated assets in the future, both short and long term. In this sense, the initial success of the acquisition of Drilling Tools is not assured, and the inability to integrate or develop the business may be drastic factors in relation to its future recognition.

The retention of key employees and the agreement between shareholders who want to continue in the business against those who want to redeem their position within the company also generate instability in the consignment and search for investment funds.

It is also worth noting that volatility in the price of crude oil or supply chain disruptions represent major risk factors.

Conclusion

Drilling Tools delivered 2023 adjusted EBITDA guidance, which would imply a valuation of 2x-3x Adjusted EBITDA. The expectations include headcount growth, FCF margin increases, and further demand for tools as customers drill faster and more efficiently. Besides, if the price of tools continues to increase faster than inflation, we could expect even a more positive effect on FCF growth. There are some risks from the fact that the company executed a revenue reverse merger. With that, Drilling Tools does look quite undervalued.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DTI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.