SHY: Smart Duration Play, 4.9% Yield

Summary

- SHY is an exchange-traded fund managed by iShares/BlackRock. It focuses on the very short end of the Treasury curve and has a duration of 1.8 years.

- With the expectation that the Fed is done raising rates but will maintain current levels for a longer period, the market is adjusting its expectations for intermediate and long-term rates.

- 2-year yields have a close correlation with Fed Funds, and they have historically tended to anticipate and 'front-run' Fed Funds.

- To that end 2-year yields have spent most of 2022 at a high positive spread to Fed Funds, indicating the market's expectations for an ultimate terminal rate.

- The same will occur when the Fed starts cutting rates, providing for a nice positive backwind for SHY next year, in addition to the fund's carry.

pcess609/iStock via Getty Images

Thesis

The iShares 1-3 Year Treasury Bond ETF (NASDAQ:SHY) is an exchange-traded fund. The vehicle comes from the well-known iShares/BlackRock family and has a significant AUM exceeding $25 billion. SHY is a cornerstone of portfolio construction and represents a view on the very short end of the Treasury curve. The fund is composed solely of U.S. Treasuries and has a duration of 1.8 years with a weighted average maturity of 1.9 years.

Because this fund does not have a duration below 1 year, it is not necessarily a cash parking vehicle, and we can observe that from the fund's total return profile in the past two years:

While very short-duration funds such as the iShares 0-3 Month Treasury Bond ETF (SGOV) and the iShares Treasury Floating Rate Bond ETF (TFLO) exhibit nice upward sloping total return profiles, SHY does not.

In this article we are going to have a look at SHY's analytics, the performance and shape of the yield curve in the past year, and our expectations for SHY in the upcoming twelve months.

Analytics

- AUM: $25 billion

- Sharpe Ratio: -1.52 (3Y)

- Std. Deviation: 1.9 (3Y)

- Yield: 4.86% (30-day SEC yield)

- Premium/Discount to NAV: N/A

- Z-Stat: N/A

- Leverage Ratio: 0%

- Composition: Fixed Income - Short-Dated Treasuries

- Duration: 1.8 yrs

- Expense Ratio: 0.15%

Yield Curve Shape and Expectations

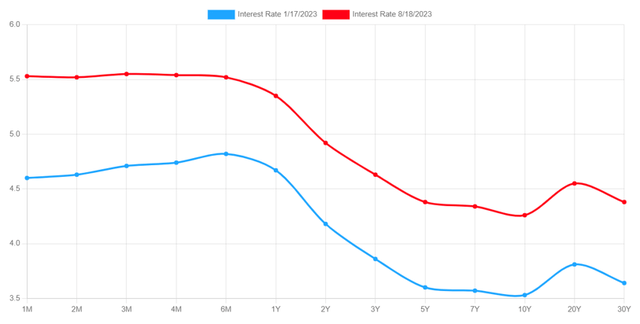

We are currently witnessing an environment where 'higher for longer' rates expectations are pushing the long end of the yield curve higher. Not so long ago, at the beginning of 2023, the market was expecting rate cuts as early as September 2023. When we talk about 'rate cuts' we are referencing the Fed cutting the target Fed Funds limits. Those expectations kept the long end of the curve lagging in terms of yield versus the front end. That dynamic is changing:

Yield Curve (US Treasury Yield Curve)

While the long end of the curve has a bit more of a 'catch-up' to do, the front end is very close to the Fed Funds rate (2-year Treasuries yield 4.98% versus the lower Fed Funds bound of 5.25%).

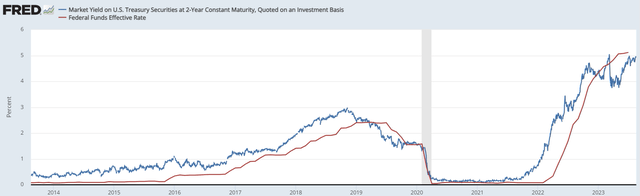

Historically, 2-year yields have been extremely well correlated to Fed Funds:

The red line above reflects the effective Fed Funds rate, while the blue line is the constant maturity yield for 2-year Treasuries. If we look at the historic relationship, we can see the 2-year yield 'anticipating' Fed Funds to a certain extent. As the monetary policy tightened, 2-year yields kept trading much above Fed Funds, basically showing the market views on where the Fed is going to stop.

Conversely, on the back of the March/April regional banking crisis, 2-year yields collapsed, pricing in Fed cuts. The Fed ended up creating a new facility called the Bank Term Funding Program (BTFP) rather than cut rates in order to stem the flow of deposits out of regionals. Unless the market starts pricing in more Fed rate increases, the 2-year yields should be capped by the 5.25% Fed Funds lower bound. Most economists think the Fed is done increasing rates, and see rate cuts in either Q1 or Q2 of 2024.

The same way we saw 2-year yields 'front-run' Fed Funds on the way up, they will move in anticipation of cuts. That will translate into 2-year yields moving lower than the target Fed Funds once the Fed starts cutting rates. That is where the 'smart duration' for SHY will start kicking in. Given its 1.8-year duration, expect a +2% back-wind in 2024 when the Fed starts lowering rates. Why? Because the tenor will have a negative spread to target Fed Funds, anticipating the new forecasted level.

SHY Holdings

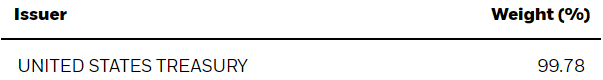

The fund holds exclusively Treasuries, thus, has no credit risk:

Holdings (Fund Website)

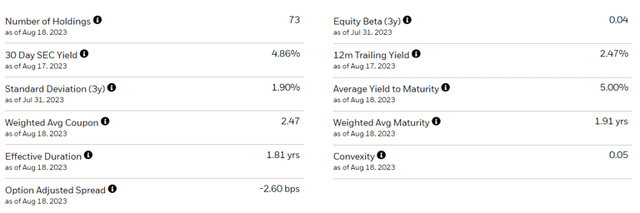

The portfolio of securities has the following characteristics:

There are 73 individual securities here, with an average yield to maturity of 5% and a very small positive convexity.

Why is SHY a Smart Duration Play

The intermediate and long ends of the yield curve represent high-duration plays. There is an army of investment bankers and hedge fund analysts who get paid enormous amounts of money to forecast where those tenors will head, because there is a lot of money to be made via leverage. As retail investors, we cannot beat those quant armies, but we can make smart plays.

It is pretty clear at this point that with current rate levels, the U.S. government interest payments are spiraling out of control and are not sustainable. Long-term rates need to come down, but the Fed is absolutely set to slay inflation. With most economists in the 'higher for longer' camp, assuming the Fed is done raising rates is a smart play. SHY is not a money market fund, but a Treasuries ETF with a short duration of 1.8 years. Even if there is one more hike, the impact on SHY should be muted given the extremely low duration.

Conversely, as we have seen from the historic graph above, 2-year rates will anticipate Fed Funds moves. As 2-year yields spent most of 2022 at a high positive spread to Fed Funds, they will do the same at a negative spread in 2024 when the Fed starts cutting rates. Expect a +2% windfall from that historic relationship, in addition to the fund carry, which is close to 5%.

Conclusion

SHY is a Treasuries fund with a 1.8 years duration. The vehicle is a cornerstone of portfolio construction, addressing the short end of the yield curve. With expectations for the Fed to be done raising rates, but keeping current levels for longer, the market is repricing the intermediate and long end of the curve.

SHY is a good proxy for 2-year yields, which have historically had a very good correlation with Fed Funds. We can actually see how 2-year yields 'front-run' Fed Funds, forecasting where they will end up. To that end, 2-year yields spent most of 2022 at a high positive spread to Fed Funds. The reverse is going to occur in 2024 when the Fed will start cutting rates.

SHY is currently yielding 4.86%, and we anticipate the fund to generate a total return close to 7% in the next 12 months, composed of its carry profile as well as its duration backwind when the Fed starts cutting next year.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SHY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)