Intel Stock: Returns Potential Does Not Match The Risks

Summary

- Intel reported good quarterly numbers but there are several challenges that can derail any bullish momentum in the stock.

- Intel stock has outperformed S&P 500 in the year-to-date but it has lagged the tech-heavy Nasdaq 100 index.

- Intel is trying a number of steps that include improving process technology, expanding foundry business, AI chips, better server chips and more.

- This will continue to hurt the free cash flow which stood at negative $17 billion over the trailing twelve months, increasing the risk associated with the stock.

- Intel will need to deliver home run in terms of execution for the next few quarters in order to gain Wall Street’s trust and build a sustainable bullish sentiment towards the stock.

JHVEPhoto

Intel (NASDAQ:INTC) was able to beat the consensus guidance in the recent quarter. However, the company’s guidance for the next quarter is quite modest. The management is trying to deliver success in a number of different areas which can divert the focus. Intel is trying to build a robust foundry business for which it will need to invest heavily in order to compete with giants like TSMC (TSM) and Samsung. It is also trying to build an AI chip pipeline where it will compete with Nvidia (NVDA), AMD (AMD), and other tech goliaths that have launched their own AI chips.

At the same time, Intel is trying to execute its “five processes in four years” plan in order to regain process leadership. Intel continues to face challenges from AMD in the traditional Client and server business which can be seen from the better forward guidance by AMD’s management. As mentioned in the previous article, Intel is also losing the R&D race against AMD, Nvidia, and TSM all of whom have massively increased their R&D expense in last few quarters.

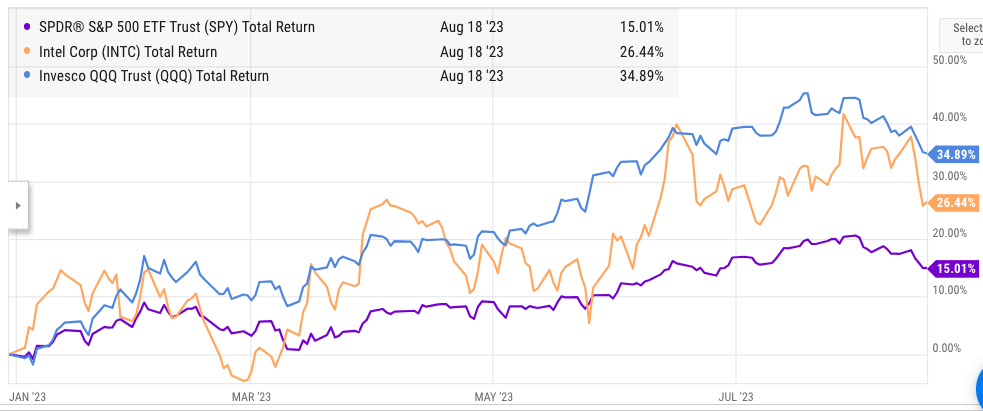

There are a lot of risks associated with the company at the current stage. This has been reflected in the recent stock price movement. Intel stock has shown 26% growth in stock price in the year-to-date. On the other hand, the tech-heavy NASDAQ 100 index has seen 35% YTD growth. Intel is also burning through cash in order to set up new foundries and reported a negative $17 billion in free cash flow over the trailing twelve months.

The recent cancellation of a deal to buy Tower Semiconductors shows that there are several risks in the current strategy of the management. A few setbacks can easily erode all the gains in the stock. It is better to keep a distance from Intel stock until there is some concrete progress.

Lack of focus

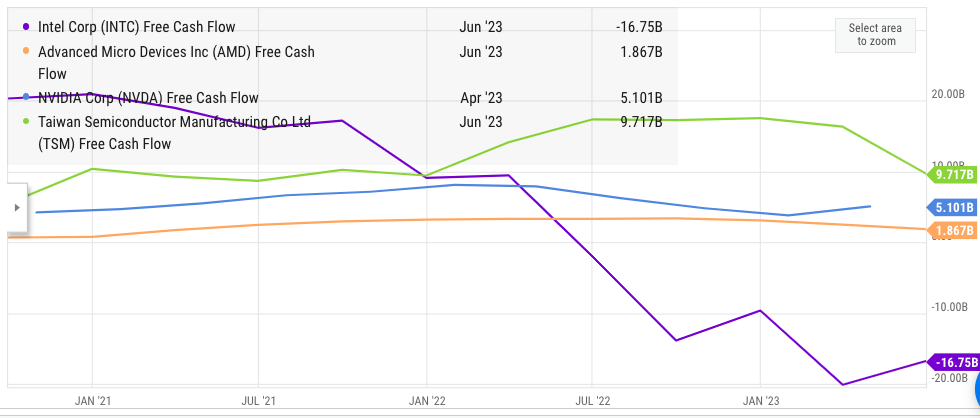

It seems that Intel’s management is trying too many things at the same time. This can erode the focus of the key executives and end up delivering modest results. Most of the tech companies that have delivered good returns have focused on a few key areas where they have expertise. This can be seen in Nvidia, AMD, TSM, and even bigger tech giants. All these initiatives are costing Intel significant resources. It reported a free cash flow of negative $17 billion in the trailing twelve months. Most of the resources go into building a foundry business where it is competing against TSMC and Samsung.

Ycharts

Figure 1: Free cash flow of Intel and other competitors. Source: YCharts

Intel has received massive subsidies of over $10 billion from Germany. Despite this support, Intel will have to dig deep into the cash reserves in order to show good progress in the foundry business. We can clearly see from the above chart that Intel’s FCF has seen a big dip compared to TSM, AMD, and NVDA.

Intel is also trying to build an AI pipeline with its Gaudi chips. It is a latecomer in the AI chip industry and will be competing against entrenched players who have massive resources. In the recent earnings report, Intel used “AI” word 61 times which shows that the management is trying to build some momentum in this business.

However, all these initiatives will be of no use if the company cannot meet the roadmap of five process nodes in four years. This is an ambitious goal. Even TSM faced significant delays at lower nodes due to technical issues. It is certainly possible that Intel will also face issues as it moves towards 18A and lower nodes. Due to earlier delays, Wall Street might not give the company a benefit of doubt and wait till the company actually delivers on its promises in terms of progress in nodes.

It is good that the management is trying different initiatives but they can also cause distraction and lack of focus.

Intel stock is not outperforming

Some analysts have pointed out that Intel stock has returned 26% in YTD compared to only 15% by S&P 500. This is a sign that the company is outperforming the wider market. However, Intel stock’s gain was a lot lower than tech-heavy QQQ ETF which tracks NASDAQ 100. It is better to compare Intel with QQQ because there is additional tech-related risk associated with the company. We saw this last year when QQQ underperformed S&P 500 as the tech stocks took a beating. The reverse has happened this year as the tech industry regained momentum and was able to beat S&P 500.

Ycharts

Figure 2: Intel’s performance compared with S&P 500 and QQQ in YTD. Source: YCharts

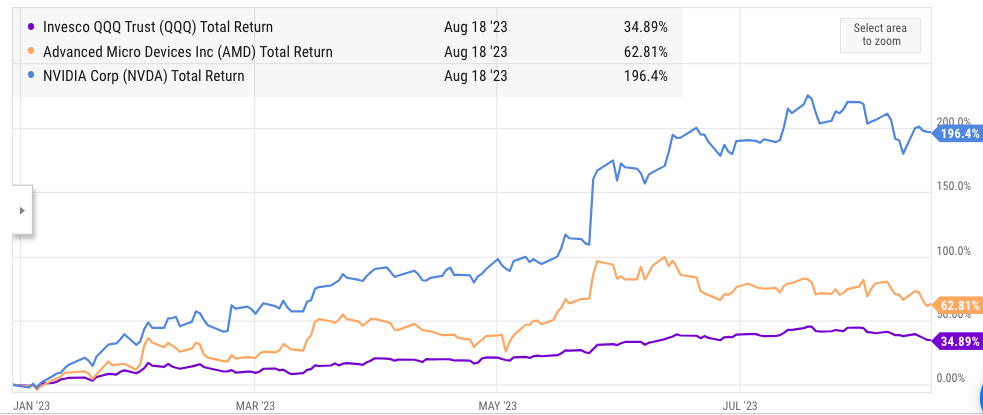

Intel’s main competitors AMD and Nvidia have outperformed QQQ in YTD as they gained momentum due to AI hype.

Ycharts

Figure 3: Performance of AMD and Nvidia in comparison to QQQ. Source: YCharts

We could see AMD and Nvidia stock outperform Intel stock until it is able to deliver strong progress in its process roadmap or its AI chips gain good traction.

Returns potential does not match risks

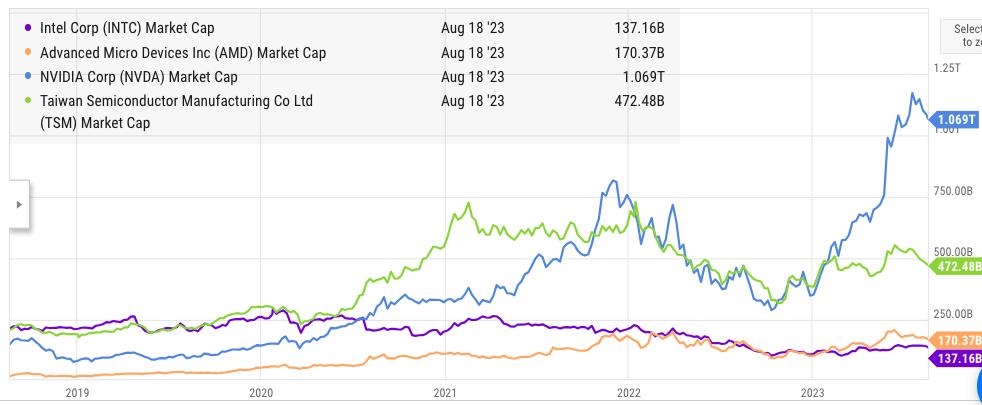

Intel’s market cap is at $140 billion compared to $170 billion for AMD, $470 billion for TSM, and a staggering $1.05 trillion for Nvidia. This would have been unthinkable a mere five years ago. Back in 2018, Intel’s market cap was higher than all these competitors. Some analysts have mentioned that Wall Street might have overreacted and the current low price of Intel makes it a good value stock.

Ycharts

Figure 4: Intel’s market cap compared with AMD, Nvidia, and TSM. Source: YCharts

However, the risks associated with the current strategy of Intel are also very high. We saw a good example of it recently when the deal with Tower Semiconductors fell through. Intel will be paying $353 million to Tower Semiconductors due to the cancellation of the deal. There is also a risk that the current roadmap of the company will not succeed. It takes only one or two delays to erode all the bullish gains in the stock.

The massive investment in the foundry business also has a lot of risks. TSM is also investing huge resources in building additional capacity. This can lead to a glut in the market driving the prices lower. As mentioned above, Intel has announced massive subsidies in the past few months but the stock has not shown a big improvement when compared to the broader NASDAQ 100 index.

Future stock trajectory

Intel stock is back to low 30s per share. This is closer to the recent bottom of $25 per share which it reached in the second half of 2022. We could see some minor improvement in the stock but it is likely that there will be sideways momentum until the company successfully launches 18A process which is scheduled for the end of 2024.

Ycharts

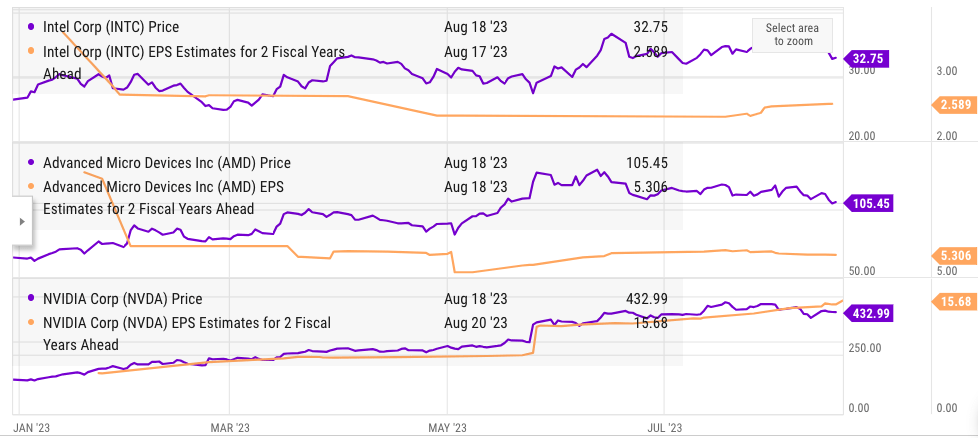

Figure 5: Comparison of stock price and EPS estimate for 2 fiscal years ahead. Source: YCharts

Even if we look at EPS estimates for 2 fiscal years ahead, Intel stock does not appear to be significantly undervalued. Intel is trading at 13 times the EPS for 2 fiscal years ahead. On the other hand, AMD is trading at 19 and Nvidia at 26 in terms of stock price to EPS for 2 fiscal years ahead ratio.

Considering the risks associated with the company’s strategy and the lack of focus, we can say that Intel stock is fairly valued and it might not see a big bullish jump in the near term.

Investor Takeaway

Intel is trying a lot of new initiatives hoping to get success in a few of them. However, this can cause a lack of focus for the management and also needs massive resources. The trailing twelve months FCF for the company is at negative $17 billion while all other competitors have reported healthy positive FCF.

The stock performance in the YTD has also been modest when we look at the broader NASDAQ 100 index. Even for a longer time horizon of 2 fiscal years ahead, the stock is not undervalued as it is trading at 13 times the EPS for 2 fiscal years ahead compared to 19 for AMD and 26 for Nvidia. Both AMD and Nvidia have a stronger revenue growth projection and a better moat. Hence, a wait-and-watch approach is better for Intel stock at the current price.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.