Liberty Global: A Risky Bet Amid Subscriber Decline

Summary

- Liberty Global plc is struggling to modernize and retain its paying subscriber base, leading to doubts about its investment prospects.

- The company is heavily leveraged and faces challenges in adapting to modern market dynamics.

- While it continues to repurchase shares, its ability to sustain this strategy is uncertain due to its high levels of debt.

- I do much more than just articles at Deep Value Returns: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

metamorworks

Investment Thesis

Liberty Global plc (LBTYK)(NASDAQ:LBTYB) is an overleveraged business that is struggling to modernize and stop its paying subscriber base from shrinking.

The bull case points to its continued effort to repurchase shares. But what I see is a business that offers investors a poor risk reward. I recommend that investors avoid this investment.

Why Liberty Global plc?

Liberty Global is a telecommunications and television company operating in multiple countries, primarily Europe and Latin America. It provides cable television services to millions of subscribers in various markets, via a wide selection of channels, on-demand content, and premium packages.

The advantage of the business to its end customers is that it offers a full bundle of services, including cable television, broadband, and mobile service, as well as many high margin value-adds, for example, telephone service features and customer support to enhance the overall customer experience.

It's a John Malone company, and as such, is one that investors often recognize as a very well-operated and strong free cash flow generating company. However, with time, the business has struggled to modernize, and some of its biggest supporters decided that it was time to call it a day on the business.

Case in point, Berkshire Hathaway (BRK.A) decided in Q2 2021 that enough is enough, and sought to start disposing of its stake in the business.

So What Now?

Close followers of my work will know that I always look toward customer adoption curves as an indication of the company's viability.

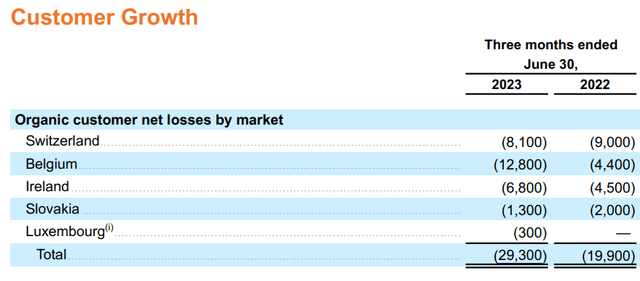

The table above shows the progress the company is making in growing its customer base.

There's no need for any explanation, these figures speak for themselves. Paying customers no longer value this business the way they once did. And the only tool that Liberty Global has left is to increase its prices in an effort to stabilize its revenues. And that will work for a while, but at some point, customers will question their value proposition and exit the company's service, in their own respective market.

Moving on, as noted already, this is a John Malone company. And as customary for the media mogul, it's a business that is significantly levered. And these highly leveraged businesses can have a lot of appeal when the business is flourishing. But when the business stops growing at some point, investors start to question its balance sheet.

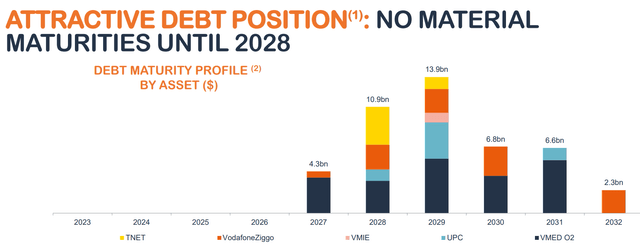

Whilst it's true that Liberty Global has no debt maturities for another 4 years, starting 2027, management will either have to renegotiate its debt or start to pay back some of its debt.

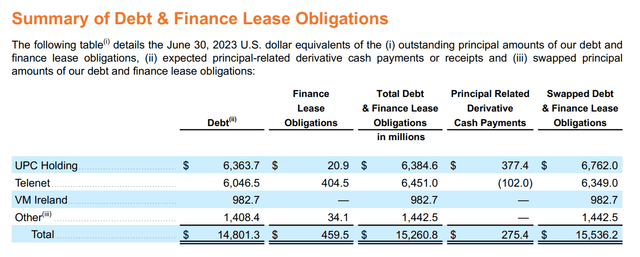

And given that its market cap is approximately $8 billion, while its debt runs at approximately twice that figure, at approximately $15 billion, this echoes investors' overall skepticism of the strength of the underlying business.

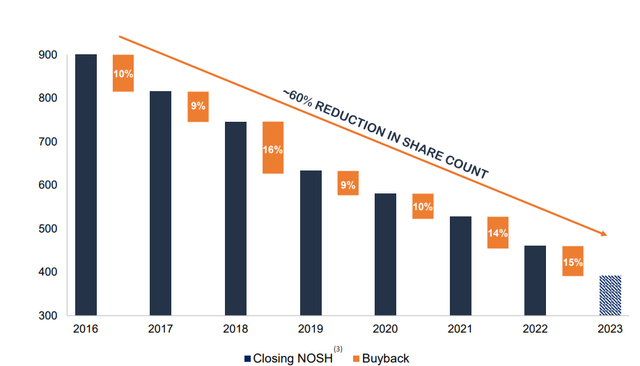

For their part, Liberty Global's management continues to articulate the bull case that they are repurchasing their total number of shares outstanding at a rapid rate.

LBTYK NOSH (number of shares outstanding)

However, as I've already remarked, given its leverage, at some point soon, management will no longer be able to repurchase its shares as aggressively, as the bulk of its cash flows will need to start to make a significant dent on its outstanding debt.

After all, not only are interest rates very high right now but also, creditors will be asking onerous terms to refinance their debt. So, as cash gets diverted to tackle its balance sheet rather than repurchase its debt, that will fully erode what's left of its bull case.

The Bottom Line

Liberty Global plc appears to be facing significant challenges, leading to doubts about its investment prospects. The company is grappling with high levels of debt and struggles to adapt to modern market dynamics, as evidenced by a shrinking paying subscriber base. While some see potential in its share repurchase efforts, it's hard to ignore the overall unfavorable risk-reward profile.

With substantial debt looming in the coming years, Liberty Global's ability to sustain its share buybacks is in question, casting doubts on the bullish case for the stock.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

Our Investment Group is focused on value investing as part of the Great Energy Transition. For example, did you know that AI uses thousands of megawatt hours for even small computing tasks? Join our Investment Group and invest in stocks that participate in this future growth trend.

I provide regular updates to our stock picks. Plus we hold a weekly webinar and a hand-holding service for new and experienced investors. Further, Deep Value Returns has an active, vibrant, and kind community. Join our lively community!

We are focused on the confluence of the Decarbonization of energy, Digitalization with AI, and Deglobalization.

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

DEEP VALUE RETURNS: The only Investment Group with real performance. I provide a hand-holding service. Plus regular stock updates.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.