U.S. Leading Indicators Still Point To A Recession

Summary

- The latest data on leading economic indicators for the US economy suggests a recession is still likely.

- The US Leading Economic Indicators fell for the sixteenth consecutive month in July, signaling an uncertain outlook.

- The Conference Board forecasts a short and shallow recession in the Q4 2023 to Q1 2024 timespan. We believe it will be driven by a financial crisis in China.

niphon/iStock via Getty Images

The Conference Board just released the latest data on the leading economic indicators for the US economy and they still point to a recession. This aligns with our view that the stock market is in the midst of forming a large, four year trading range that will oscillate between 3,500 and 4,800 on the S&P 500.

We believe a U.S. recession is coming driven primarily by our entanglement with the world economy and a possible financial crisis in China. It should lead into the second bear market in three years. The obvious question is, “When?”

The U.S. Leading Economic Indicators

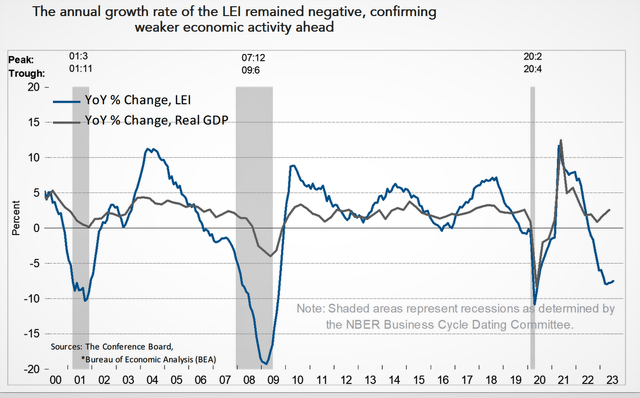

The chart below plots year over year changes in the LEI (blue line) against year over year changes in the GDP (grey line).

Conference Board Leading Economic Indicators (Conference Board)

The LEI is kept by the Conference Board and they wrote the following about the latest July numbers:

“The US LEI—which tracks where the economy is heading—fell for the sixteenth consecutive month in July, signaling the outlook remains highly uncertain” said Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board. “On the other hand, the coincident index (CEI)—which tracks where economic activity stands right now—has continued to grow slowly but inconsistently, with three of the past six months not changing and the rest increasing. As such, the CEI is signaling that we are currently still in a favorable growth environment. However, in July, weak new orders, high interest rates, a dip in consumer perceptions of the outlook for business conditions, and decreasing hours worked in manufacturing fueled the leading indicator’s 0.4 percent decline.

The leading index continues to suggest that economic activity is likely to decelerate and descend into mild contraction in the months ahead. The Conference Board now forecasts a short and shallow recession in the Q4 2023 to Q1 2024 timespan.”

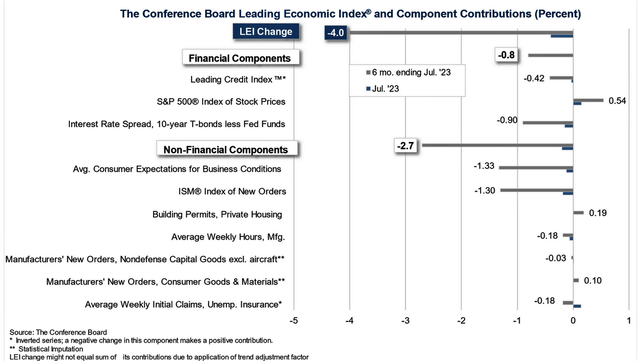

The 10 Components of the LEI

The table below shows the status of the ten components that make up the LEI, four of which were referenced in the quote above. Only two components - average weekly initial claims and the S&P 500 - were positive for the month.

Components that make up the LEI (Conference Board)

Crying Wolf

It will be hard for those investors and advisers who forecast a recession last year, and missed the market turn, to now agree with the view of another bear market and the arrival the recession they predicted far too early. They were burnt, feel wrong and don't want to make that mistake again. But we believe it is the correct view to hold.

So, when will all this occur? We think it will start in the first quarter of 2024 and will be part of a global recession, driven primary by a financial crisis in China. Americans have to stop thinking just of themselves and look at how the world situation affects our economy. Unfortunately, far too many just look at the U.S. stock market to form their economic opinions, instead of the actual world economic situation that determines it.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (5)

I know I read a THESIS somewhere about these cycles coming...inflationary something or other? Oh, well it's only money folks! I mean our kids and grandkids money or lack there of....