Nano Dimension: A Speculative Trade Emerges

Summary

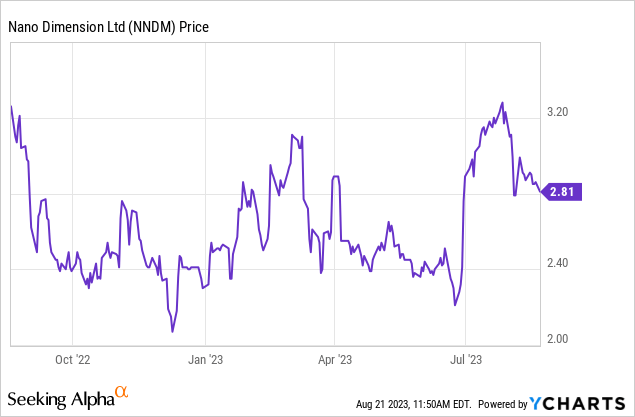

- Shares are pulling back, presenting a speculative trade opportunity.

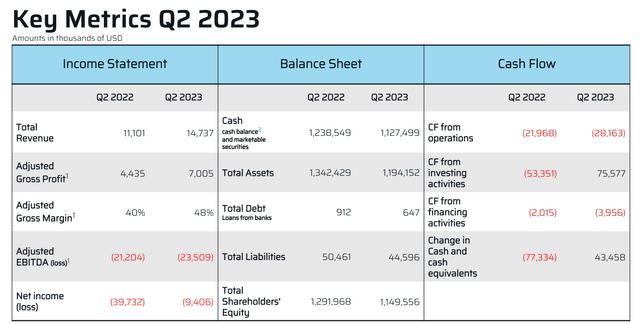

- The company's total revenues for Q2 2022 increased by 32% compared to the same period last year.

- A strong cash position and potential for sustained break-even and to be EBITDA positive in the future.

- Activist pressure.

- This idea was discussed in more depth with members of my private investing community, BAD BEAT Investing. Learn More »

naphtalina/iStock via Getty Images

One of the things that we like to do in our investing group is to highlight high-risk and high-reward plays once or twice a month. In fact, we have a room dedicated to just these kind of plays, and from there we have had some very interesting research articles after looking deeper into some of the more speculative plays. There are two ways to play these speculative names in our opinion. First, when a stock is trading less than $5, we really stay away from options, because the stock is so cheap, it is like buying an option. In that vein, you can place a bet, say 500 shares of a $2 stock and let it run, potentially losing it all. We only on very rare occasion endorse such a move. The second, and more preferred, is to scale in but keep stops in place, stops which are defined by an algorithm we employ to select target ranges, while also embracing a target exit which is determined in similar fashion.

With that said, we believe a speculative trade is emerging as shares of Nano Dimension (NASDAQ:NNDM) pull back. The shares are pulling back in the last week or so with the broader market, and following the just reported earnings today. We see an opportunity to scale in for a trade.

The key to this trade is some patience to build a position, but if the stock does not allow for a full position to be built, we still profit from the legs of the trade we are able to purchase. That is a win. It is much better than buying all at once and watching shares fall 20%, because then you need a 25% gain just to breakeven.

The play

Target entry 1: $2.78-$2.80 (20% of position)

Target entry 2: $2.69-$2.71 (22% of position)

Target entry 3: $2.52-$2.55 (25% of position)

Target entry 4: $2.38-$2.40 (33% of position)

Target exit: $3.00 (if only one or two legs) $2.75 (if 3 or four legs)

Stop loss: $1.99

Discussion

It has been an interesting year, especially the last few months for the company. Most notably, they had a bid to buy Stratasys (SSYS), dealings with activist investors, and other developments for the company. The SSYS deal expired with the conditions not satisfied and Nano Dimension is now looking to move on with alternative M&A plans, thought it still holds almost a 15% stake in the company. For now, SSYS and Desktop Metal (DM) are looking to combine though the Department of Justice wants more information. We recently covered Desktop Metal, another speculative name we have traded successfully, and told you it was now dead money. Expect further consolidation in the space.

With that said, the 3D printing space has been a tough investment of late. Nano Dimension specializes in 3D printing electronics and had branched out into more general 3D printing in recent years. We like a speculative buy here, as there is a ton of cash on hand, as evidenced by the most recent earnings. Sales are also growing.

In fact, total revenues for the second quarter which was just reported today were $14.7 million, versus $11.1 million in the second quarter of 2022. This was a 32% rise in revenues. We also like that the pace of revenue growth is outpacing the cost of sales.

Cost of sales for Q2 was $8.18 million compared to $7.15 million in the second quarter of 2022. The increase compared to a year ago is simply a function of more sales. However, they were only up 14% versus the 32% growth in revenue. What is more, R&D expenses were down from a year ago to $16.4 million, compared to $18.4 million a year ago. There were less payroll expenses, less subcontractor costs, slightly higher material costs and less share-based compensation expenses. Market expenses were down nearly 20% from a year ago as well, to $8.2 million from $10.1 million last year. This is strong. However, general expenses were up sharply to $12.3 million from $7.2 million a year ago, largely due to more professional service expenses, a blemish on an otherwise decent quarter.

Valuation

The company in our opinion is attractive on a few valuation metrics. The overall valuation grade from Seeking Alpha is an A-. A few things stand out, such as the price-to-book value of 0.61. On a price-to-sales things are a bit more expensive at 15X. Of course, the cash on hand is impressive at nearly $1 billion. With a market cap of just over $700 million, the market cap is made up of cash and equivalents, whereas total debt is about $13 million. As such, the risk-reward on this basis is attractive in our opinion.

In our opinion, the company is trending in the right direction. We believe that this can continue, and the company is also burning less cash. We think the company can reach sustained break even in 2024, and work to be EBITDA positive if the pace of sales increases continues and costs are maintained. We also love the cash position here.

The company saw a positive change in cash. With about $1 billion in cash, the company is worth $4.00 per share at minimum and this is what Murchinson is pushing for, a takeover and distribution of the cash, and was noted in the shareholder letter today. While this activist battle will go on, we see upside not just for our speculative trade, but also for investors, who could see gains of 50% from current levels.

Risks

There are of course risks here. While the company does have a lot of cash, a strategic move to use some of that cash, such as another M&A opportunity, could be carried out a too high a valuation, or could take the company off course to being EBITDA positive. Should the company want to raise more cash via debt, rates are certainly high. The market is also in a bit of a mini-correction, which could weigh. The 3D printing subsector has also been pretty weak trading wise. The company is investing heavily in itself and has a limited operating history as well. The company also depends on the commercialization of all its products and may not be able to execute to scale. Operations are also subject to currency risk, as this is an Israeli based company. There is also no guarantee that the impressive growth will continue, especially in a significant economic downturn. However, much of these risks are shared by competitors. For a full risk disclosure, please see the 20-F filing from earlier this year.

Take home

We like the growth on display here, and really love the cash situation with almost no debt. The activist investors are pushing for moves that could benefit existing shareholders. Based on all things considered, overall, we rate this a good speculative buy.

We make winners. Come make money with us

Like our thought process? Stop wasting time and join the traders at BAD BEAT Investing at a 60% off sale!

Our hedge fund analysts are available all day during market hours to answer questions, and help you learn and grow. Learn how to best position yourself to catch rapid-return trades, while finding deep value for the long-term.

- Available all day during market hours with a vibrant chat.

- Rapid-return trade ideas each week from our hedge fund analysts

- Crystal clear entries, profit taking, and stop levels

- Deep value situations

- Stocks, options, trades, dividends and one-on-one attention

This article was written by

We've made several millionaires! We are VERY proud to have created thousands of WINNERS. We are the team behind the top performing investing group BAD BEAT Investing. Quad 7 Capital was founded in 2017 by a team that consists of a long time investor, health researcher, financial author, professor, professional cardplayer, and hedge fund analysts.

The BAD BEAT Investing service is a specialized carve out of Quad 7 Capital and launched in 2018. The service is run by a team of hedge fund analysts. This a top performing investing group service relative to market returns. It is focused on trading opportunistic inflections, and leveraging mispriced stocks and momentum driven events for rapid-return swing trades, options education, and long-term investments. We also teach investors how to hedge their portfolios. Further, it offers a direct access line to our traders all day during market hours and provides daily market commentary.

Quad 7 Capital as a whole has expertise in business, policy, economics, mathematics, game theory and the sciences. The company has experience with government, academia, and private industry, including investment banking, boutique trading firms, and hedge funds. We offer market opinion and analysis, and we cover a wide range of sectors and companies, with particular emphasis on news related items and analyses on growth companies, dividend stocks, banks/financials, industrials, mREITS, biotechnology/ pharmaceuticals, precious metals, and small-cap companies.

If you want to win, follow us, and if you want to make real money, sign up to BAD BEAT Investing today.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in NNDM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.