Texas Roadhouse's Adaptability And Strong Brand Promise Impressive Investment Returns

Summary

- Texas Roadhouse's strong brand and adaptability offer investors a stake in a resilient legacy in the competitive restaurant sector.

- Texas Roadhouse consistently outperforms industry in key metrics such as terms of ROIC and comparative restaurant sales growth.

- Texas Roadhouse consistently rewards shareholders with dividends and share buybacks, reflecting its financial strength and confidence in its business model.

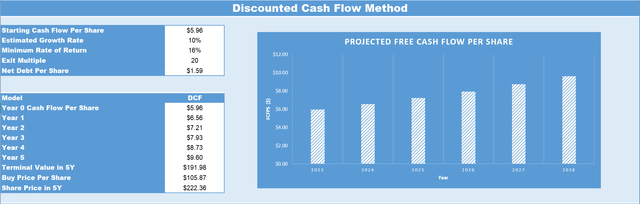

- A DCF analysis suggests anannual return of 16% over the next five years.

chapin31

Investment Thesis

I believe Texas Roadhouse, Inc. (NASDAQ:TXRH) stock is a promising buy, given its resilience and adaptability in the competitive restaurant landscape. With a strong brand and consistent performance in key metrics like ROIC and comparative sales growth, it highlights operational excellence. The company's commitment to shareholders is evident through regular dividends and share buybacks, reflecting its financial strength. A DCF analysis further suggests a potential 16% annual return over the next five years, making Texas Roadhouse a compelling investment in the restaurant sector.

Company Overview

Texas Roadhouse, Inc., established in 1993, has cemented its reputation in the casual dining sector with its distinctive offerings of hand-cut steaks, succulent ribs, and vibrant ambiance. The brand, renowned for its quality cuisine and warm service, has always prioritized community engagement. Their flagship, Texas Roadhouse, captivates diners with its western-themed settings, complete with peanut shells underfoot and spontaneous staff line dances. Bubba's 33, another brand under their umbrella, targets younger patrons and sports aficionados, serving an array of pizzas, burgers, and beers, all while broadcasting live sports. Jaggers, a more recent introduction, emphasizes fast-casual dining, spotlighting premium sandwiches and hand-breaded chicken. Domestically, Texas Roadhouse's presence is undeniable, with establishments in 49 states, ensuring its accessibility to a vast American audience. Internationally, the brand has ventured into ten regions, skillfully blending its core values with local tastes. Committed to staying at the forefront of the industry, Texas Roadhouse has consistently innovated its menu based on customer feedback and current culinary trends. Furthermore, they've adeptly integrated technology into their operations, introducing online ordering and a customer loyalty program, underscoring their dedication to enhancing the dining experience.

Robust Brand Protects Texas Roadhouse

From an investor's perspective, Texas Roadhouse stands out as a compelling business, primarily due to its robust brand strength in the intensely competitive restaurant sector. Since its inception in 1993, TXRH has not only positioned itself as a premier casual dining brand but has also curated an experience that deeply resonates with its patrons. Central to its investment allure is its unwavering commitment to quality. Whether it's the meticulously hand-cut steaks or the delectable ribs, every offering is a testament to its dedication to authentic, premium-grade cuisine. This commitment is palpably felt in the ambiance of its outlets, reminiscent of a lively western roadhouse, replete with country melodies and the iconic peanut shells scattered on the floor.

Tasting Table

This strong brand identity provides Texas Roadhouse with a significant competitive advantage. In an industry where customer loyalty is paramount, TXRH's distinct brand image ensures top-of-mind recall among consumers. This brand recognition translates to repeat business, shielding the company from the whims of transient market trends and ensuring a steady revenue stream. Furthermore, TXRH's adaptability, rooted in its brand ethos, is noteworthy. While staying true to its core values, the brand's agility in adapting to evolving consumer preferences sets it apart. Whether it's introducing menu items based on feedback or leveraging cutting-edge technology to enhance the dining experience, TXRH's proactive approach is indicative of a brand that's future-ready.

In a sector teeming with fleeting brand names, Texas Roadhouse's enduring presence and consistent growth trajectory underscore its formidable brand equity. This strong brand not only acts as a bulwark against competition but also as a magnet, attracting and retaining customers. For investors, TXRH isn't merely an investment in a restaurant chain; it's a stake in a legacy characterized by excellence, community engagement, and steadfast authenticity, all of which confer a significant competitive edge in the marketplace.

TXRH are Strong in Key Metrics

Texas Roadhouse has consistently showcased its ability to generate value from its investments, a fact underscored by its return on invested capital. ROIC is a crucial metric for investors as it indicates how effectively a company is using its capital to generate profits. A high ROIC often signifies efficient management and the potential for future growth. As we can see below, apart from 2020 (a year effected by restricted dining as a result of Covid-19), ROIC is consistently around an excellent 15%. I anticipate that over the next five years, the ROIC will remain in the double digits each year as long as there isn’t a significant economic downturn.

DJTF Investments

Another pivotal metric for restaurant chains like Texas Roadhouse is the total store weeks. This metric provides insights into the company's expansion efforts and its ability to manage and operate multiple outlets efficiently. We can see over the past 15 years total store weeks have consistently grown each year as Texas Roadhouse continue to expand their restaurant count. Moving forward it is expected that Texas Roadhouse will grow total store weeks by approximately 5-7% per year as the management continues to push restaurant count.

DJTF Investments

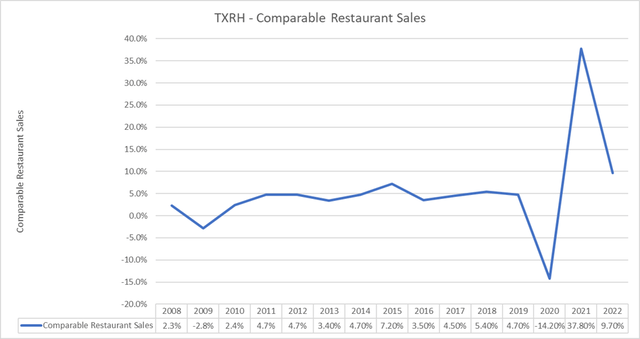

Lastly, comparable restaurant sales, often referred to as "comps," are vital for gauging a restaurant's performance. It measures the sales generated by a restaurant over a specific period compared to the same period in the previous year. Positive comps indicate growth and are a testament to a brand's enduring appeal and its ability to attract and retain customers. For Texas Roadhouse, we can see that the historical comparable restaurant sales have been around the 5% mark and have improved over time. This is well above the historical industry average of approximately 2-3%, indicating that overall foot traffic per store is increasing, as well as the amount of money spent per visit is increasing, highlighting TXRH’s ability to deliver organic growth.

DJTF Investments

'Order to Go' Shows Managements Adaptability in Tough Times

Texas Roadhouse showcased remarkable adaptability and foresight in its response to the unprecedented challenges posed by the COVID-19 pandemic. As the global crisis disrupted traditional dining models and forced restaurants to rethink their operational strategies, TXRH swiftly recognized the shifting landscape and the emerging importance of off-premise dining. Capitalizing on this insight, the brand bolstered its 'order to go' services, ensuring that its patrons could continue to enjoy their favorite dishes without compromising on safety.

The enhancement of the 'order to go' model served as a dual strategy for TXRH. Firstly, it provided a lifeline during a period when in-person dining faced severe restrictions, helping to mitigate potential revenue losses. This move not only demonstrated the brand's agility but also its commitment to meeting customer needs, even in the face of adversity. Secondly, by refining and promoting this service, Texas Roadhouse tapped into a growing consumer trend towards convenience and takeout, positioning itself favorably for the future.

Texas Roadhouse

Furthermore, the successful pivot to the 'order to go' model underscored TXRH's resilience and its ability to navigate turbulent times. It highlighted the brand's capacity to innovate on the fly, ensuring business continuity while also safeguarding the health and well-being of its customers and staff. This strategic maneuvering during the pandemic not only helped Texas Roadhouse maintain its revenue streams but also reinforced its reputation as a customer-centric brand, ready to adapt and evolve based on the needs of the moment. For stakeholders and potential investors, such adaptability and foresight further solidify TXRH's standing as a resilient and forward-thinking player in the restaurant industry.

Shareholder Friendly Capital Allocation

Texas Roadhouse has consistently demonstrated its commitment to returning value to its shareholders through both dividends and share buybacks. For over two decades, the company has been a reliable dividend payer, underscoring its financial stability and dedication to its shareholders. This long-standing history of dividend payments speaks volumes about the company's ability to generate consistent profits and manage its cash flows effectively. The company's dividend policy reflects its strong financial health and confidence in its future growth prospects. Over the years, Texas Roadhouse has maintained a steady dividend payout, which is a testament to its stable cash flows and profitability. The current payout ratio stands at 46.5%, indicating a balanced approach between retaining earnings for future growth and rewarding shareholders. The dividend yield, which stands at 1.98%, further solidifies its position as an attractive proposition for income-seeking investors. Such consistent dividend payouts not only enhance shareholder returns but also signal the company's robust financial position and its commitment to sharing its success with investors. In essence, Texas Roadhouse's dividend history and its current payout ratio highlight its prudent financial management and unwavering commitment to enhancing shareholder value.

DJTF Investments

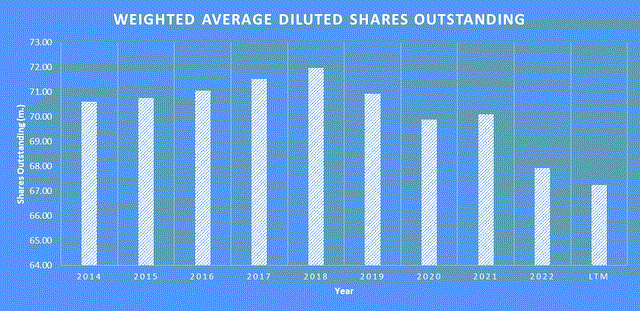

In addition to dividends, Texas Roadhouse has also engaged in share buyback programs. Share buybacks are a strategic move to repurchase company shares from the open market, effectively reducing the number of outstanding shares. We can see that the management team have consistently reduced the share count since 2018, reducing the share count from 71.96 million to 67.24 million. Texas Roadhouse's decision to buy back shares underscores its confidence in its business model and its dedication to maximizing shareholder value.

Financial Analysis

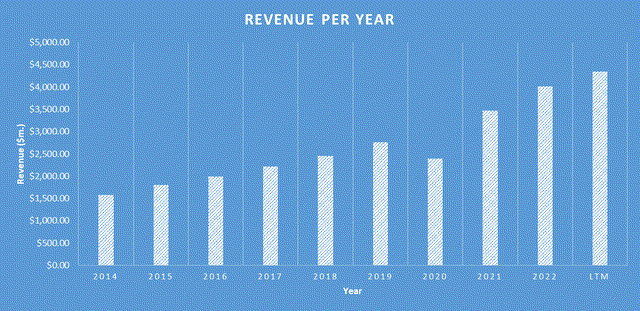

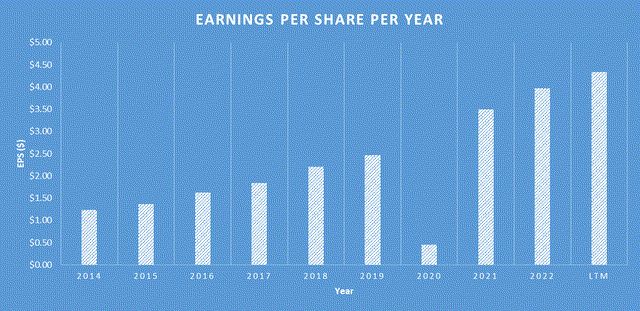

Over the past 5 years, the company has demonstrated remarkable financial performance. Its revenue has shown a consistent and strong growth, increasing from $2,457.45 million in 2018 to $4,348.39 million in the last 12 months in 2023, representing a compound annual growth rate ((CAGR)) of approximately 12%. The earnings per share ((EPS)) has been equally impressive, growing steadily from $2.20 to $4.33, reflecting a compound annual growth rate ((CAGR)) of approximately 14.5%.

DJTF Investments

DJTF Investments

As of the most recent quarter, the company reported cash and cash equivalents of $107.32 million. The company's total long-term debt stands at $0, an amount that reflects the company's conservative approach to leverage.

I expect TXRH’s upcoming quarterly earnings to be again to be affected by labor and raw materials inflation which will continue to place downward pressure on gross margins. Looking beyond the next 12 months, assuming a slowdown in inflation and no major worsening of the macro, I fully expect the gross margins to stabilize.

Valuation

When considering valuation, I always consider what we are paying for the business (the market capitalization) versus what we are getting (the underlying business fundamentals and future earnings). I believe a reliable way of measuring what you get versus what you pay is by conducting a discounted cashflow analysis of the business as seen below.

TXRH’s current owner’s earnings per share as of 2022 is $5.96. Based off continued store week growth and comparative restaurant sales growth, I believe that TXRH’s owner’s earnings per share should grow at 10% annually for the next five years. Therefore, once factoring in the growth rate by the end of 2028 TXRH’s owner’s earnings per share is expected to be $9.60. If we then apply an exit multiple of 20, which is based off a conservative multiple below historic averages for the businesses price to free cashflow ratio for the previous 10 years, this infers a price target in five years of $222.36. Therefore, based on these estimations, if you were to buy TXRH at today's share price of close to $105.87, this would result in a CAGR of 16% over the next five years.

DJTF Investments

Risks

Firstly, the restaurant industry is notoriously cyclical, heavily influenced by economic conditions. In periods of economic downturn or recession, discretionary spending on dining out can decrease, potentially impacting TXRH's revenue streams.

Secondly, TXRH operates in a highly competitive market, with numerous players vying for consumer attention. New entrants, changing consumer preferences, or innovative offerings from competitors can pose challenges to Texas Roadhouse's market position. The brand's strong identity, rooted in its western roadhouse theme, while a strength, can also be a limitation if dining trends shift significantly.

Operational risks are another concern. Factors such as supply chain disruptions, rising commodity prices, or labor shortages can increase operational costs, squeezing profit margins. Given the current global landscape, unforeseen events like the COVID-19 pandemic can drastically affect operations, as seen with mandatory shutdowns and capacity restrictions.

Furthermore, TXRH's expansion strategy, especially in international markets, carries inherent risks. Cultural differences, regulatory challenges, or geopolitical tensions can impact the success of outlets in foreign territories.

Lastly, reputation is vital in the restaurant business. Any negative publicity, whether due to food safety issues, customer complaints, or other controversies, can have a lasting impact on the brand's image and, consequently, its financial performance.

Conclusion

Texas Roadhouse stands as a beacon of resilience and adaptability in the fiercely competitive restaurant industry. Its robust brand identity, coupled with its ability to evolve, presents investors with an opportunity to invest in a lasting legacy. The company's performance, particularly in key metrics like ROIC and comparative restaurant sales growth, consistently surpasses industry standards, underscoring its operational excellence and strategic prowess. Furthermore, its unwavering commitment to shareholders is evident in its regular dividends and share buyback initiatives, which are a testament to its robust financial health and confidence in its future trajectory. Additionally, a DCF analysis projects a promising outlook, suggesting an impressive annual return of 16% over the forthcoming five years. In essence, Texas Roadhouse not only exemplifies growth and stability but also offers a promising investment avenue in the dynamic world of restaurant businesses.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TXRH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.