Getaround Makes Moves To Fix Reporting But Risks Abound

Summary

- Getaround went public through a reverse merger with SPAC InterPrivate II Acquisition Corp.

- The company enables users to rent cars from local car owners in multiple cities worldwide.

- Getaround recently acquired competitor HyreCar's assets, aiming to accelerate its path to profitability.

- GETR faces numerous risks, including low stock price delisting, delinquent financial reporting and potential legal risks.

- However, the company has acquired HyreCar assets from bankruptcy for a small sum, indicating capacity for dealmaking, so I'm Neutral on GETR for now.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

Joe Corrigan

A Quick Take On Getaround

Getaround (NYSE:GETR) went public in a reverse merger transaction in December 2022 with SPAC InterPrivate II Acquisition Corp. (IPVA).

The firm enables users to rent cars from local car owners in hundreds of cities worldwide.

While management needs to get the financial reporting in order and may need to engineer a reverse stock split, I’m willing to remain in a wait-and-see mode, so I’m Neutral [Hold] on GETR for the time being.

Getaround Overview And Market

San Francisco, California-based Getaround was founded in 2009 to develop a network of car owners who rent their vehicles to users.

The firm is headed by founder and CEO Sam Zaid, who previously founded Apption, an enterprise software consulting company and 360pi, a retail price intelligence firm.

Getaround acquires new users through its mobile apps, online marketing and partner referrals.

The company recently announced the acquisition of competitor HyreCar’s assets for $9.45 million. HyreCar filed for Chapter 11 bankruptcy in February 2023.

The deal is expected to ‘add up to $75 million of run-rate annualized Gross Booking Value and to contribute positive Adjusted EBITDA, accelerating Getaround’s path to profitability.’

According to a 2022 market research report by ResearchAndMarkets, the global market for peer-to-peer car sharing was estimated at $1.6 billion in 2021 and is forecast to reach $7.2 billion by 2030.

This represents a forecast CAGR (Compound Annual Growth Rate) of 17.6% from 2022 to 2030.

The main drivers for this expected growth are a desire by consumers to own fewer vehicles and the growing adoption of car-sharing systems by individuals and companies.

Also, government initiatives in developing countries, especially large countries such as India and China, may also play a role in encouraging more efficient use of resources.

Major competitive or other industry participants include:

Turo

Social Car SL

GoMore ApS

SNCF Réseau Group

Car Next Door Australia Pty. Ltd.

Hiyacar Ltd.

JustShareIt

Zoomcar

Getaround’s Financial Trends

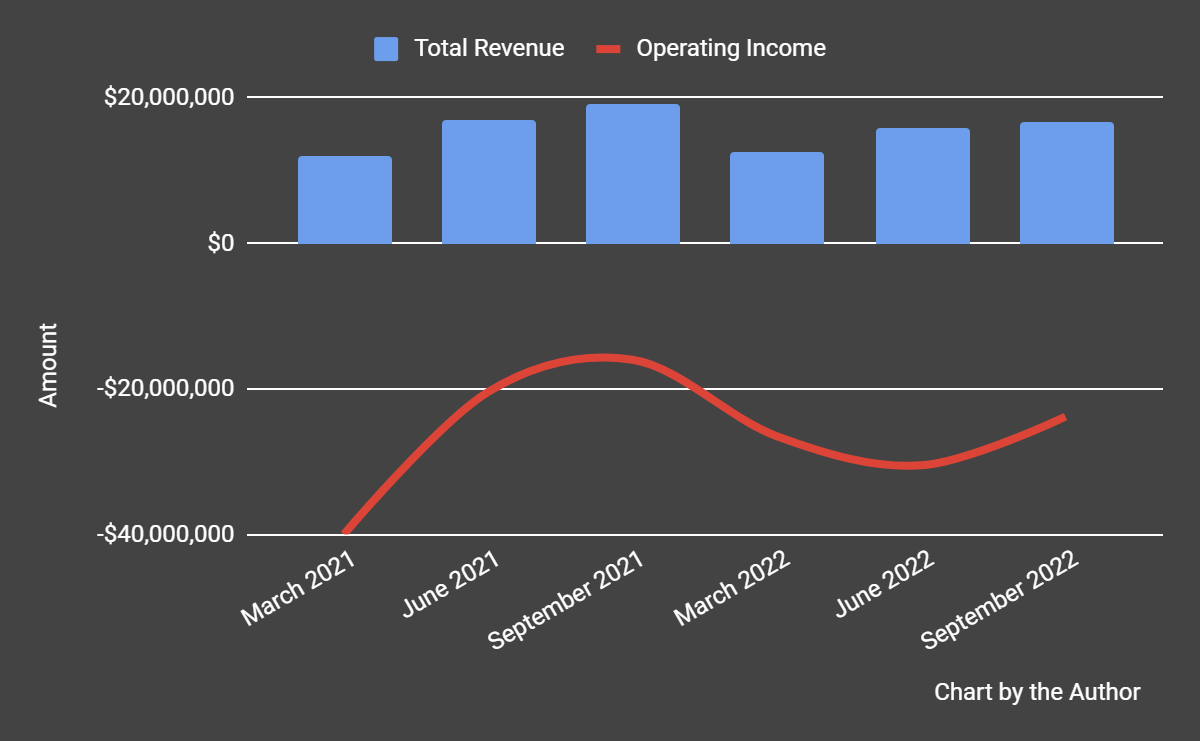

Total revenue by quarter has shown the trajectory in the chart below, through Q3 2022, the latest quarter we have reported financial information; Operating income by quarter has been heavily negative through Q2 2022.

Total Revenue and Operating Income (Seeking Alpha)

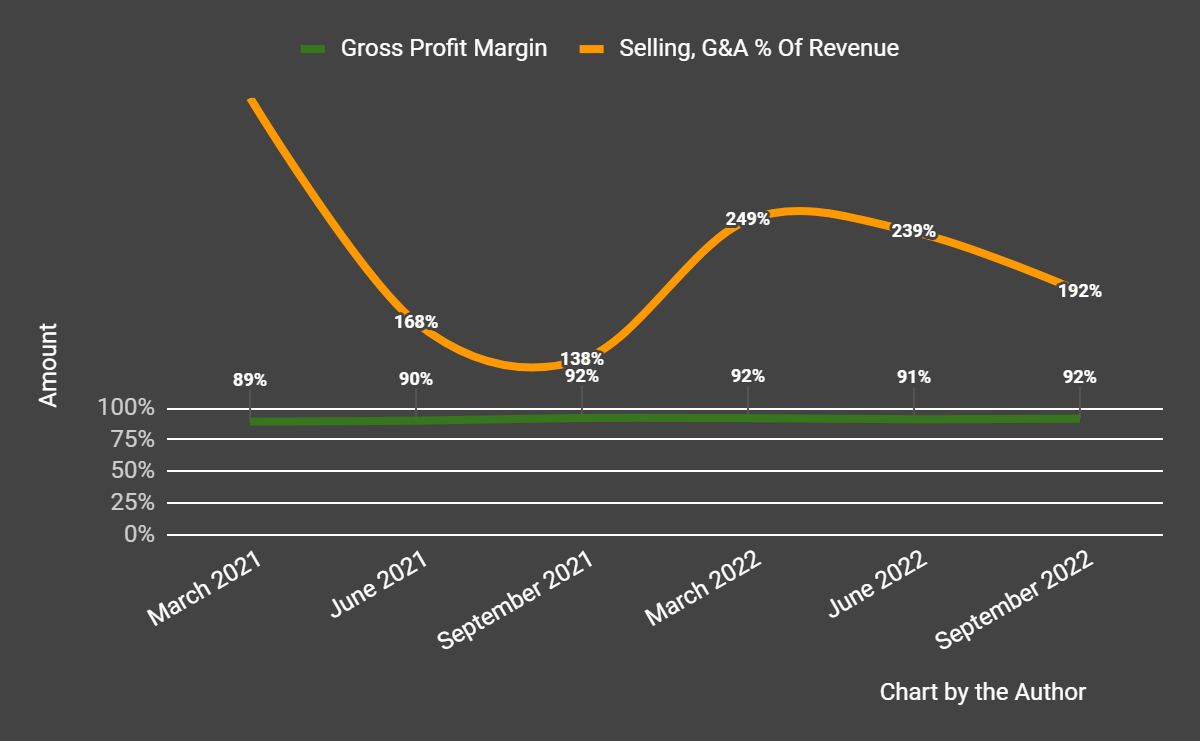

Gross profit margin by quarter has remained relatively high through September 2022; Selling and G&A expenses as a percentage of total revenue by quarter have fluctuated at extremely high levels, as the chart shows here:

Gross Profit Margin and Selling, G&A % Of Revenue (Seeking Alpha)

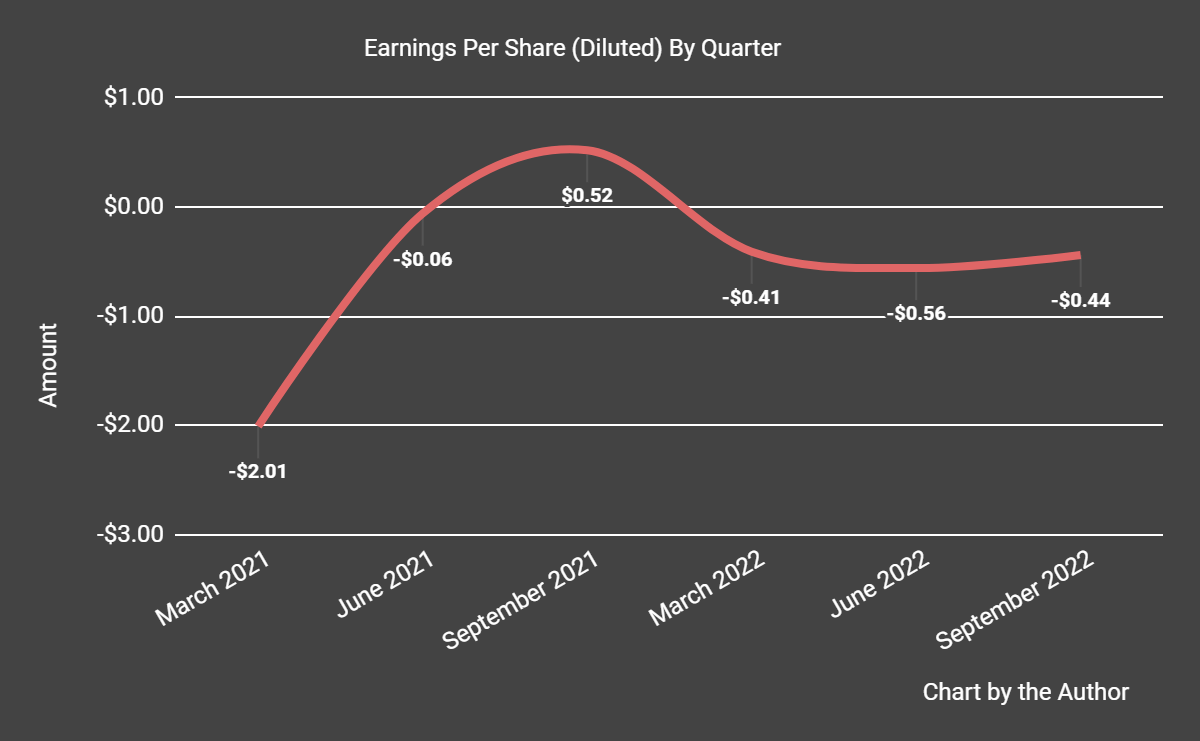

Earnings per share (Diluted) have followed the trajectory shown below:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

Valuation And Other Metrics For Getaround

Below is a table of relevant capitalization and valuation figures for the company, with financial metrics as of the end of Q3 2022:

Measure [TTM] | Amount |

Enterprise Value / Sales | 10.0 |

Enterprise Value / EBITDA | NM |

Price / Sales | 0.6 |

Net Income Margin | -192.7% |

EBITDA % | -157.8% |

Market Capitalization | $50,250,000 |

Enterprise Value | $595,690,000 |

Operating Cash Flow | -$90,910,000 |

Earnings Per Share (Fully Diluted) | -$0.44 |

(Source - Seeking Alpha)

Sentiment Analysis

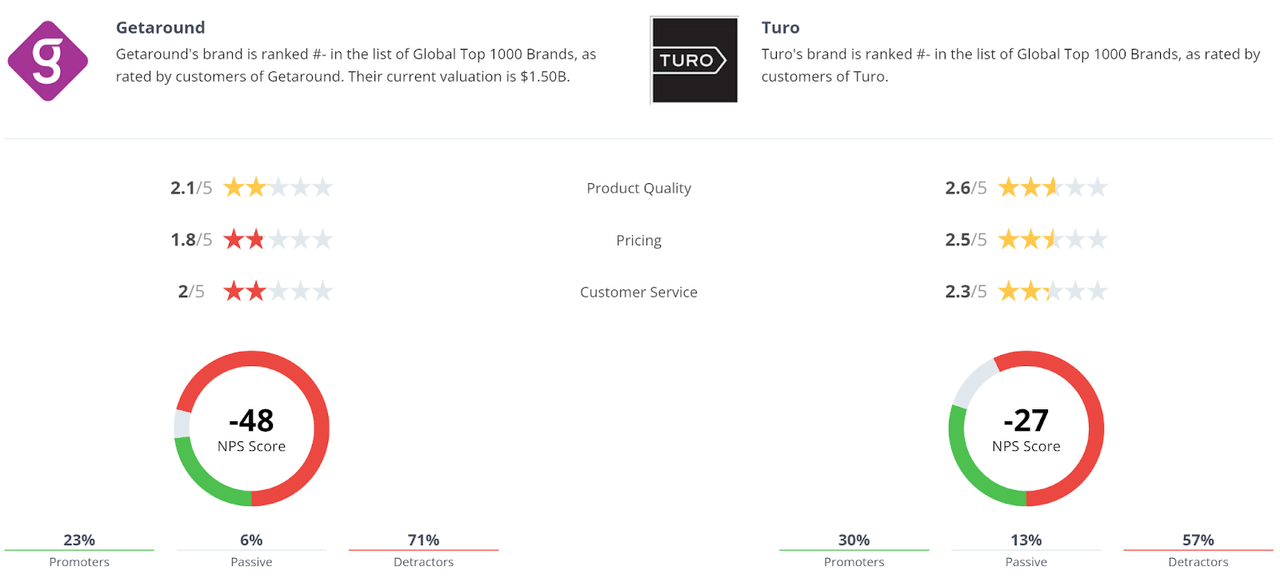

Getaround’s net promoter score comparison to competitor Turo, as compiled by Comparably, is shown in the graphic below:

Net Promoter Score Comparison (Comparably)

Getaround performed worse than Turo in each category of Product Quality, Pricing and Customer service.

The surveys include 475 rankings for Getaround and 460 rankings for Turo. I could not determine the methodology or the date of the survey.

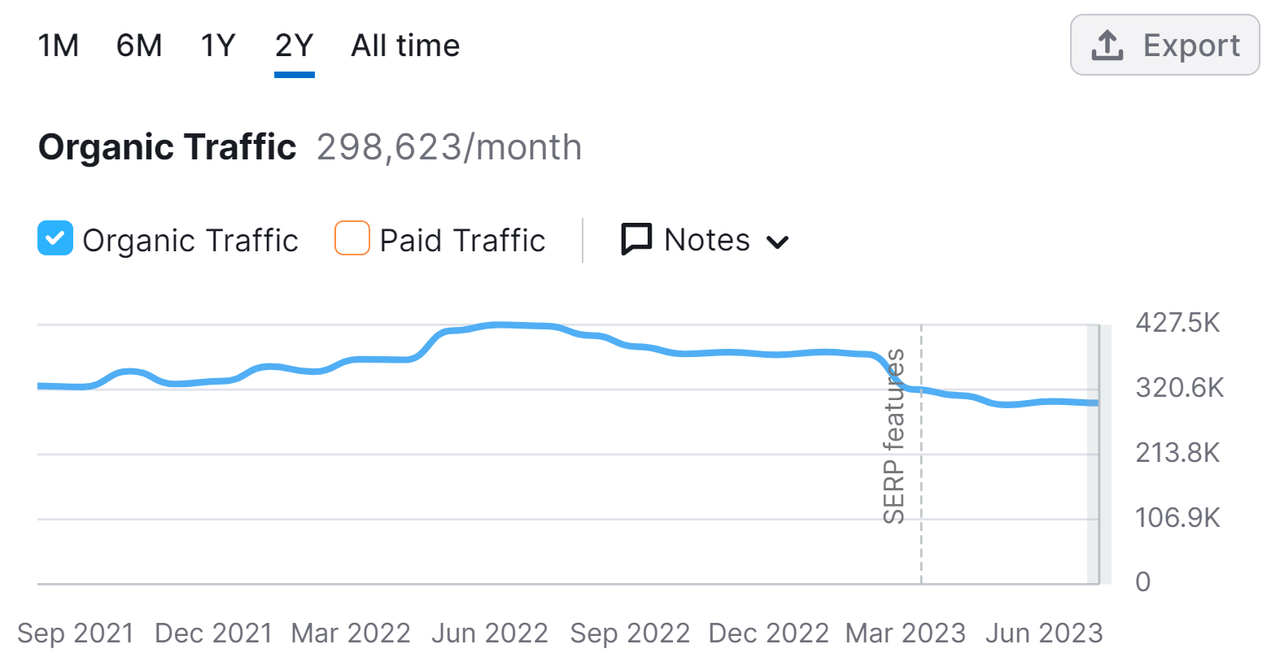

On the web analytics firm SEMRush, Getaround’s web traffic has dropped since approximately March 2023, as the chart shows below:

Website Traffic Trend (SEMRush)

Commentary And Risks On Getaround

The firm has received notices from the NYSE for its stock price being under $1.00 and for its failure to timely file its annual report for 2022.

GETR has recently replaced its accounting firm BDO, which is never a good sign, although the company did state: ‘Since BDO’s engagement by the Company on December 8, 2022, through the date of their dismissal effective August 10, 2023, there has not been any matter that was the subject of a disagreement (as described in Item 304(a)(1)(iv) of Regulation S-K and the related instructions).’

However, the previous accounting firm’s report Legacy Getaround’s 2021 financial results included a ‘going concern’ note.

Also, there were ‘material weaknesses relat[ing] to the lack of proper segregation of duties relating to access controls and risk assessment process and lack of documentation for management review controls, as previously disclosed in the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on December 14, 2022.’

BDO was only the firm’s accounting company since December 8, 2022, so its engagement was short, also not a good sign.

Total revenue for the three quarters ended September 30, 2022, fell by 6.64% compared to the same period in the previous year while gross profit rose slightly.

Selling and G&A expenses as a percentage of revenue rose sharply for the two-period comparison and operating losses increased sharply in the first three quarters of 2022 over the previous year’s same period.

The company's financial position is currently undetermined, although as of September 30, 2022, the company had $27.4 million in cash against $141.7 million in total debt, of which the current portion was $38.4 million.

For cash flow, over the three quarters ended September 30, 2022, the firm used $64.8 million in free cash versus using $54.1 million in the same period of the previous year, so as of the most recent financial reporting, the company was burning through more cash.

However, management has provided preliminary results for full year 2022 indicating $59.5 million in revenue at the midpoint of the range, gross profit margin of 85.5% and cash and equivalents of $64.3 million as of December 31, 2022.

Looking ahead, management estimated that 2023 gross booking value would be $175 million and trip contribution margin to be 47.5% at the midpoint of the range.

Leadership has also made repeated references to intending to cure its NYSE notices and to file its annual report for 2022.

My guess is that with the recent hiring of DBBM as a replacement accounting firm, the company will work hard to regain NYSE compliance and file its annual report.

The question is whether the NYSE will remain flexible enough or decide to delist the stock.

So, the firm faces various financial, business, regulatory and reputational challenges and risks.

Despite this, management has the bandwidth to acquire HyreCar’s assets from bankruptcy, which is likely a smart and cost-effective move.

While the firm needs to get its financial reporting in order and may need to engineer a reverse stock split, I’m willing to remain in a wait-and-see mode, so I’m Neutral [Hold] on GETR for the time being.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.