MDY: A Time For Lowered Tech Exposure And Mid-Caps

Summary

- The SPDR S&P MIDCAP 400 ETF Trust (MDY) is a large ETF targeting the mid-cap blend sector, with over $20 billion in assets.

- MDY has been volatile and in a downtrend relative to the S&P 500 for over a decade, but its low expense ratio makes it a cost-effective choice.

- Mid-caps may be in a longer-term sweet spot with less idiosyncratic risk, but past recessions have resulted in significant declines in MDY's value.

Iryna Drozd

The SPDR® S&P MIDCAP 400® ETF Trust (NYSEARCA:MDY), launched on May 4, 1995, is a passively managed ETF that provides broad exposure to the mid-cap blend segment of the US equity market. With assets totaling over $20 billion, it's one of the largest ETFs targeting the mid-cap blend sector.

MDY tracks the S&P MidCap 400 Index, a benchmark for mid-sized companies. Mid-cap firms typically have a market capitalization between $2 billion and $10 billion, offering investors a balance of growth potential and stability.

A Snapshot of MDY's Performance

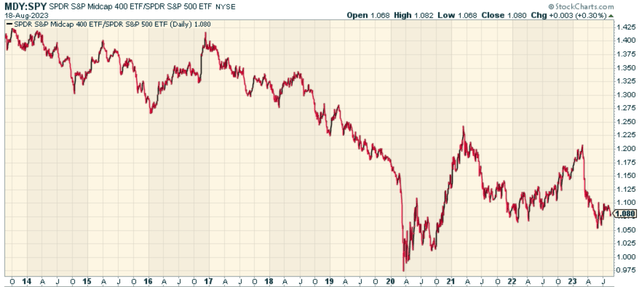

It's hard to beat the S&P 500 and large-caps more broadly when they are the only game in town. If we look at MDY relative to the S&P 500 (SPY), we can see it's been volatile and broadly in a downtrend of relative strength for over a decade.

This doesn't disqualify the fund from investment. Much of this is due to large-cap technology dominance in terms of broader momentum since QE3 in 2012. This in turn may be now the exact reason to consider an allocation. And given the fund's gross expense ratio of 0.23%, it's a cost-effective choice for most investors.

I think there's a good case here that mid-caps are potentially in a longer-term sweet spot. They have less of the "zombie company" dynamics of small-caps in terms of being unable to survive higher interest rates, and it's arguably a part of the marketplace that has less idiosyncratic risk given portfolio weightings being more broadly spread out. However, keep in mind that in the past two recessions in 2008/2009 and 2020, the fund's value dropped by over 55% and 30%, respectively. This suggests that in the event of a recession, we might see a decline of 30% or more in MDY's fund price, depending on the severity.

ssga.com

Sector Exposure and Top Holdings

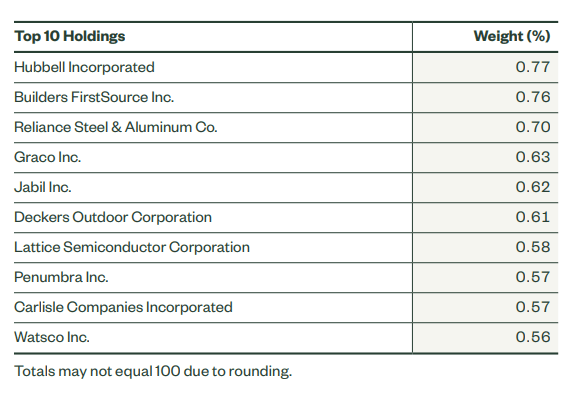

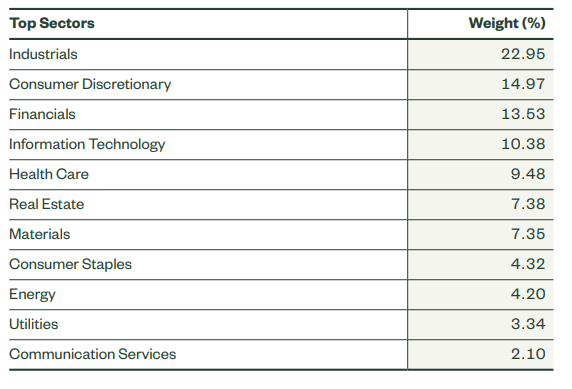

An examination of MDY's sector exposure and top holdings provides valuable insights into the fund's investment strategy and potential risks. The fund's largest allocation is in the Industrials sector, making up about 22% of the portfolio. Consumer Discretionary and Financials round out the top three sectors.

ssga.com

Should You Invest in MDY?

The decision to invest in MDY should be based on individual investment objectives, risk tolerance, and investment horizon. For long-term investors, the fund's track record of dividend growth, low expense ratio, and diverse exposure to mid-sized firms may be appealing, particularly if you believe large-cap momentum is coming to an end as the Magnificent 7 breaks down. I like the low expense ratio, diversification, and passive management aspect of this as a tool for traders and investors. And if I absolutely had to be investing in stocks and this was part of my opportunity set, it's one I would consider for a longer-term allocation. I would just wait to buy into equities until a broader credit event, which I suspect has a high likelihood of happening in the short term.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The Lead-Lag Report is provided by Lead-Lag Publishing, LLC. All opinions and views mentioned in this report constitute our judgments as of the date of writing and are subject to change at any time. Information within this material is not intended to be used as a primary basis for investment decisions and should also not be construed as advice meeting the particular investment needs of any individual investor. Trading signals produced by the Lead-Lag Report are independent of other services provided by Lead-Lag Publishing, LLC or its affiliates, and positioning of accounts under their management may differ. Please remember that investing involves risk, including loss of principal, and past performance may not be indicative of future results. Lead-Lag Publishing, LLC, its members, officers, directors and employees expressly disclaim all liability in respect to actions taken based on any or all of the information on this writing.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.