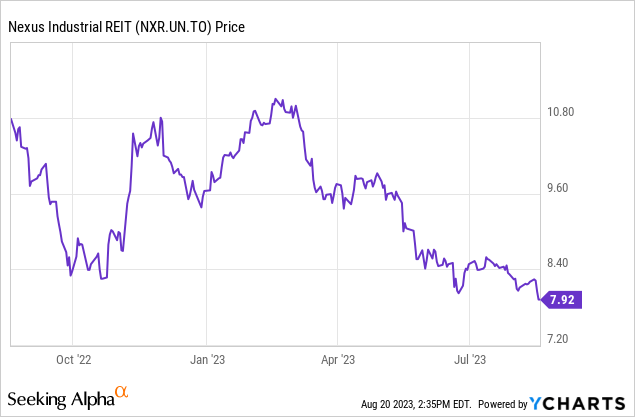

Nexus Industrial REIT: An 8% Yield From Industrial Real Estate

Summary

- Nexus Industrial REIT's AFFO per share has been relatively flat due to new share issuances and higher interest expenses on debt.

- The second quarter financial results were weaker than expected, primarily due to non-recurring items and increased cost of debt.

- Despite challenges, Nexus expects an acceleration of FFO and AFFO next year, with re-leasing properties and new developments contributing to increased NOI.

- Looking for a helping hand in the market? Members of European Small-Cap Ideas get exclusive ideas and guidance to navigate any climate. Learn More »

Luis Alvarez/DigitalVision via Getty Images

Introduction

Nexus Industrial REIT (TSX:NXR.UN:CA) (OTC:EFRTF) has seen its AFFO result come in pretty flat on a per-share basis in the past little while. The company issued new shares to pursue acquisitions in 2022 and this, in combination with the higher interest expenses on its debt, resulted in a relatively conservative interpretation in my previous article. I expected 2023 to be a transition year before the new acquisitions would start to contribute for an entire year in 2024. That being said, I think I was still a bit too optimistic as I thought the AFFO per share could come in at $0.72 this year and after reviewing the H1 results, this may be a tad optimistic.

The second quarter was weaker than I expected

In this article, I will solely focus on Nexus’ recent financial results and updates. For a breakdown of the REIT’s business model, focus and assets, I’d like to refer you to my previous article which you can find here.

The financial result of Nexus in the second quarter wasn’t great when you just look at the bottom line. This doesn’t mean the REIT put in a poor performance, but there was just a non-recurring item while the average cost of debt on the variable debt component in its capital structure definitely hurt the bottom line.

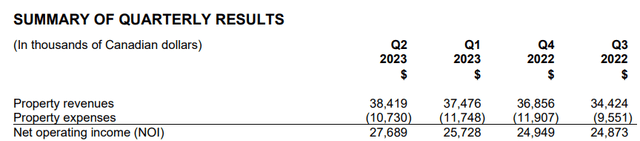

Nexus Investor Relations

And that’s a pity. Because as you can see above, the NOI increased nicely by about C$2M and reached the highest level ever. And even if you would look at the same property results (below), it is clear the NOI is definitely moving in the right direction.

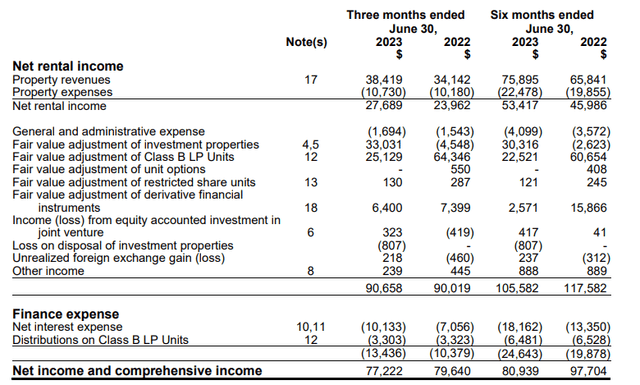

Nexus Investor Relations

The main culprit is not a poor letting performance, but the rapidly increasing cost of debt. During the second quarter of this year, Nexus paid about C$10.1M in interest on its debt, compared to just C$7.1M in the second quarter of last year. Of course, there is an impact from the recent acquisitions as well, but it is clear the higher interest expenses are holding the REIT back.

Nexus Investor Relations

That’s a pity, but it’s also not something we should crucify the management team for. The vast majority of the debt has a fixed interest rate so having some exposure to floating rate debt is generally okay, but it does provide a drag in the current climate.

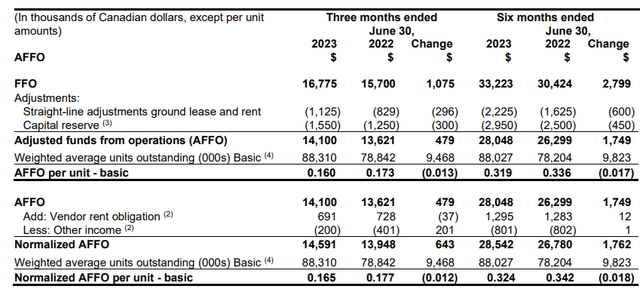

Despite the increased interest expenses, the FFO actually increased by C$1.1M to C$16.8M. However, the increased share count weighs on the results per share and the image below shows an FFO/share of just C$0.19.

Nexus Investor Relations

This included about C$0.5M in non-recurring items and the normalized FFO per share was approximately C$0.196. Looking at the AFFO calculation below, you end up with a reported AFFO of C$0.16 per share, and approximately C$0.165 per share on a normalized basis.

Nexus Investor Relations

This means the distribution of C$0.16 per quarter (paid out in equal monthly tranches of C$0.0533 per share) is still covered but the payout ratio is high. Too high for my liking.

This also means I think I should give up on my expectation to see a C$0.72 AFFO per share result for this year. In order to achieve that, Nexus should generate almost C$0.40 per share in normalized AFFO in the second half of the year and I don’t think that’s realistic.

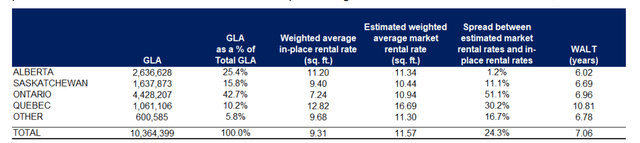

I do expect an acceleration of the FFO and AFFO next year. Several properties will be re-leased and the leasing spread should be in the double-digit range. As you can see below, the spread is about 24% across the portfolio.

Nexus Investor Relations

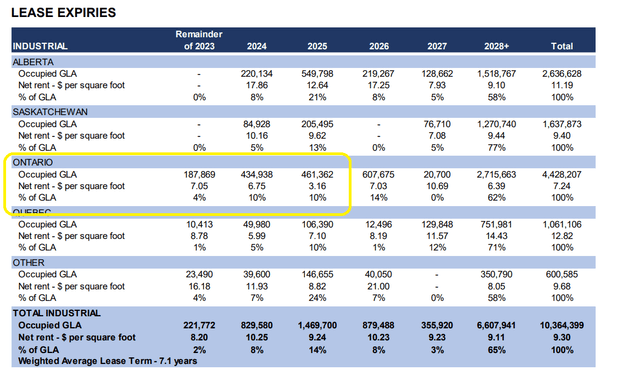

Of specific importance is the leasing spread in Ontario with a current spread of 51%. And between now and the end of 2024, in excess of 600,000 square feet will have to be released. With an average market rental rate of C$10.94 per square foot (see above) and considering the expiring leases are priced at less than C$7/sq.ft., we should see another substantial increase of the NOI in 2024 thanks to the new, higher rent kicking in. That was also confirmed on the Q2 conference call.

Nexus Investor Relations

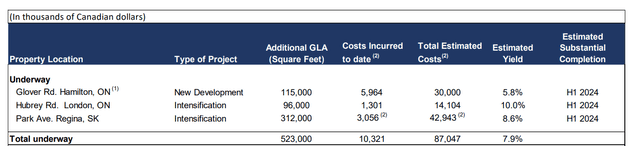

Additionally, we shouldn’t discard Nexus’ development portfolio. The REIT is currently working towards completing three new assets by the summer of next year. As you can see below, an additional C$77M in capex will be required to finish the assets, but Nexus is expecting a 7.9% rental yield. This would add almost C$7M in NOI which for sure will boost the FFO and AFFO.

Nexus Investor Relations

And Nexus also remains quite active on the M&A front. Subsequent to the end of the second quarter, the REIT acquired an industrial property for C$48.4M.

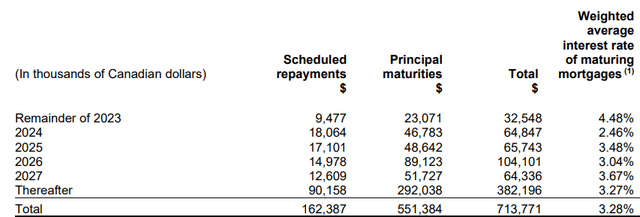

This also means we will have to keep an eye on the total debt situation at Nexus. I think it would be a better idea to reduce the dividend and use the retained cash to fund a portion of these acquisitions. As of the end of 2023, Nexus had about C$700M in mortgages payable with an additional C$355M in credit facilities (this does not include the July acquisition yet). Capital management will be important as the cost of debt of the credit facility is now close to 7% while the London property acquisition which will be completed in October is realized at a 6% capitalization rate. Fortunately, the seller has agreed to take half of the sales price in stock priced at C$11.30, that’s a premium of more than 40% to the current share price.

As you can see below, the REIT will have to refinance about C$100M of the mortgages between now and the end of next year and considering the average weighted cost of debt will increase (likely by 200-250 bp), the interest expenses will continue to increase.

Nexus Investor Relations

That being said, the REIT is also looking to offload its entire retail and office portfolio and it could recycle a decent amount of cash from those assets.

Investment thesis

While I understand Nexus’ quest to expand its asset base, it remains important to make sure the NOI increases can fully compensate for the increasing interest expenses. I think 2023 will remain difficult so I’m no longer counting on an AFFO of C$0.72 per share and I think C$0.65-0.67 is now more realistic.

I do expect the REIT’s NOI and AFFO to increase again in 2024 on the back of the completion of the development pipeline and the stabilization of the interest rates on the financial markets (Nexus’ average cost of debt will still increase as sub-4% mortgages will have to be refinanced at a higher rate). I am now expecting Nexus’ AFFO in 2024 to come in at C$0.68-0.70 followed by an additional acceleration in 2025 as that will be the first full year the new assets from the development pipeline will contribute to the result while an additional 1.5M square feet of industrial assets will be up for lease renewal in 2025.

I didn’t have a position in Nexus yet, but I am getting ready to pull the trigger. 2023 won’t be a great year but the payout ratio should remain below 100%. And I do expect the AFFO to increase and the payout ratio to decrease from next year on. At the current share price of less than C$8, Nexus is currently trading at 11-12 times next year’s AFFO.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)