U.S. Bancorp: 5% Dividend Yield And A Strong Buy Opportunity

Summary

- U.S. Bancorp rated strong buy today, more bullish than the consensus and quant system.

- Positives: 5% dividend yield above average, valuation, capital strength, earnings growth, share price vs 200-day SMA.

- Asset risk exposure to CRE/office loans has been addressed and determined not to be a major risk.

Sundry Photography

Research Brief

After a hiatus from covering the banking sector, I am back to it again in today's analysis covering U.S. Bancorp (NYSE:USB), which had its Q2 earnings call a few weeks ago in mid-July. For simplicity in this article, I will refer to it just as US Bank, the name of its branch banking brand.

For those unfamiliar with this equity, here are a few key summary points to mention about this firm, according to its website: trades on the NYSE, 77K employees, $24B+ annual revenue, #150 on Fortune 500, branches in 26 states, HQ in Minneapolis with strong branch penetration in Midwest & West US region.

This bank is no small regional player, however, but actually is ranked #7 in the largest banks in the US according to Wikipedia, putting it right behind Morgan Stanley (MS) and ahead of PNC Financial (PNC) :

largest banks in US (Wikipedia)

Rating Methodology

To get a "holistic" rating score of buy, sell, or hold, I break down my analysis into 5 categories: dividends, share price, valuation, earnings growth, & capital strength.

If I recommend the stock on at least 3 of these categories it gets a hold rating, and at least 4 will give it a buy rating. A score of less than 3 is a sell rating.

Dividends: Recommend

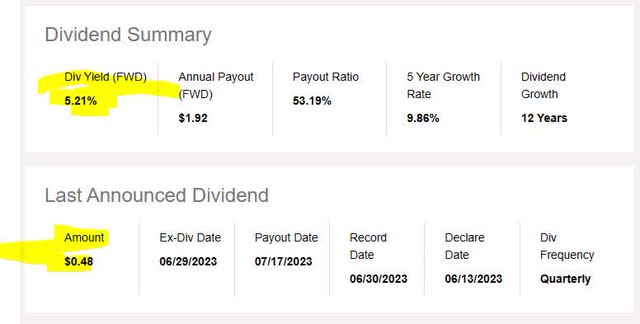

You read it right... the current dividend yield as of Aug. 20th for this stock is 5.21%, which qualifies this stock to be added to my "dividend quick picks" for the week (stocks with dividend yields above 5%).

According to official dividend data, you are looking at $0.48 per share and steady quarterly payouts, another plus.

US Bank - dividend yield (Seeking Alpha)

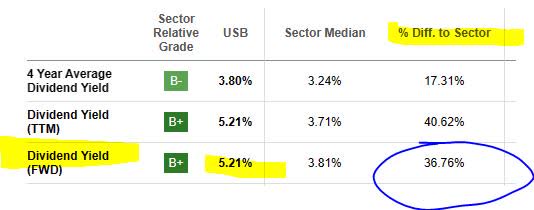

In addition, what makes this stock stick out is that its forward dividend yield is almost 37% above the sector average, which hovers around 3.8%. This even earned it a "B+" grade from Seeking Alpha, so I am impressed.

US Bank - dividend yield vs sector (Seeking Alpha)

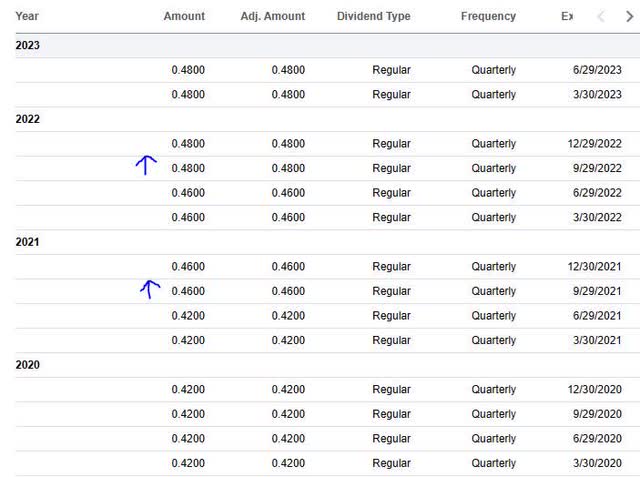

Further, if you look at the payout history since 2020, it has been steady without breaks, and has increased twice. This is a sign of financial fundamentals strength and the ability to return capital back to shareholders, always a positive for dividend investors.

US Bank - dividend history (Seeking Alpha)

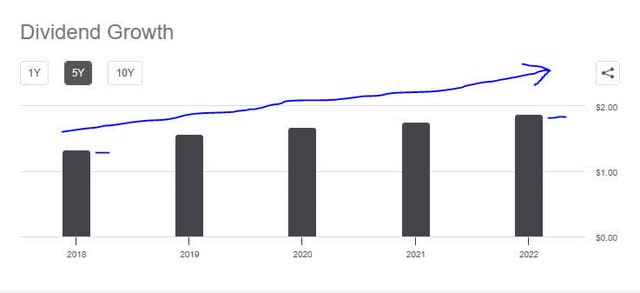

Also in tracking the 5 year dividend growth, we see a steady upward trend going from an annual dividend of $1.34 in 2018 to $1.88 in 2022, a 40% increase in 5 years. Though not a guarantor of future dividends, it certainly shows past growth & resilience, which should increase investor confidence going forward as well.

US Bank - dividend 5 year growth (Seeking Alpha)

In comparing to a peer, I chose PNC Financial, as it trails right behind US Bank in the largest banks in the US. US Bank beats its dividend yield of 5.03%. It also beats that of Morgan Stanley, which is currently 4.01%.

Based on the evidence, I would gladly recommend this stock on the category of dividends.

Share Price: Recommend

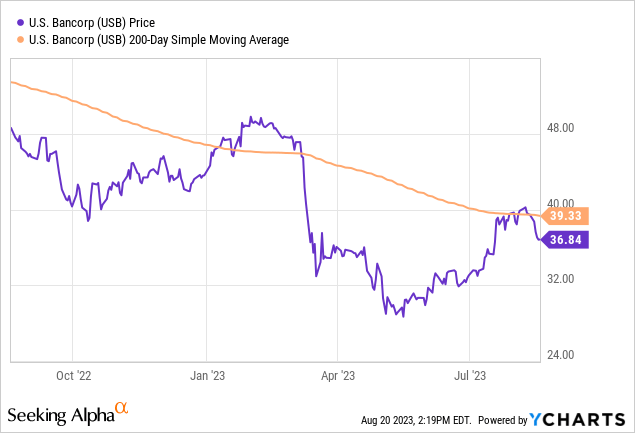

To determine if the current share price is a buying opportunity, I first pulled the YCharts for this stock, showing the last market close price as of Sunday Aug. 20th, which was $36.84 (blue line), and compared it to the 200-day simple moving average of $39.33 (orange line), over a 1 year period:

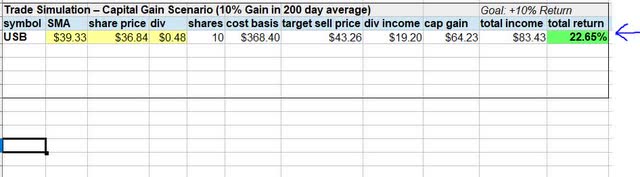

Next, I created two trade simulations where I buy a fictitious 10 shares at the current price and hold them for 1 year until next August, to earn the full year dividend income.

In the first simulation below, I assume the moving average will increase by 10% in a year to $43.26 and that will be my target sell price. This scenario is projected to achieve a 22.65% total return on capital invested.

US Bank - trade simulation 1 - gain scenario (author analysis)

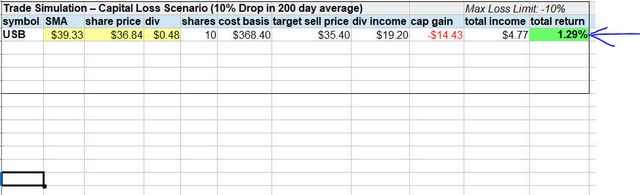

In the 2nd trade simulation, I am testing a 10% drop in the current 200-day moving average to $35.40, and that would be my target sell price, with a maximum risk tolerance of negative -10% return on capital. In this scenario, though, I am actually achieving a +1.29% positive return on capital, because the dividend income offsets the potential capital loss.

US Bank - trade simulation 2 - loss scenario (author analysis)

In both simulations, I am either exceeded my goal for return on capital or staying within my loss limits.

Therefore, buying at the current share price would be recommended, if using this model. Your own portfolio goals and risk tolerance may differ, so this is simply a rough framework by which to think about long-term investing and tracking the moving average but also assuming potential risk of capital losses as well. Another item to do further research on is tax impact, as these simulations create two potential tax events: dividend income and realized capital gains.

Valuation: Recommend

From official valuation data, I will be looking at two key valuation metrics: the forward price-to-earnings and the forward price-to-book values.

In the first one, the forward P/E of 9.54 as of Aug. 20th is looking attractive, being over 4% lower than the sector average, which is hovering near 10x earnings. I think paying up to 10x earnings is a reasonable valuation for this sector right now, which presents many opportunities.

US Bank - P/E ratio (Seeking Alpha)

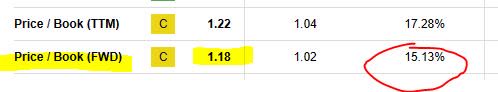

The price to book of 1.18 is just over 15% above the sector average, which the sector hovering near 1x book value. I am willing to accept a book value of up to 1.20x for this sector so I think that this is still within reason.

US Bank - P/B ratio (Seeking Alpha)

Consider that the banking peer we mentioned earlier, Morgan Stanley, has a price to book of 1.52x, or 49% above the sector average. Though these are very different kinds of banks, I wanted to highlight some of the valuation differences as well. PNC is at 1.12x forward book value right now, so I think it along with US Bank are reasonably valued, and can be recommended in the valuation category.

Earnings Growth: Recommend

Let's first start with top-line revenue growth before talking about the bottom line. On a positive note, but not surprisingly, the top line net interest income grew YoY, and did significantly:

US Bank - net interest income YoY (Seeking Alpha)

I think this trend will continue into the next quarterly results, especially since the CME FedWatch survey of rate traders predicts the Fed will maintain rates after their next rate meeting, after they correctly predicted the Fed raising rates at the last meeting. This should continue to add a tailwind to interest income assets, which are a major part of this bank's asset portfolio.

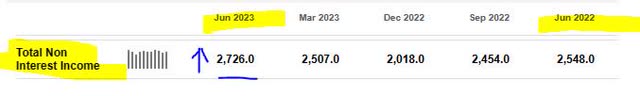

However, their income is also diversified so you can see the non-interest income also grew YoY:

US Bank - noninterest income YoY (Seeking Alpha)

The bottom line, however, shows a YoY decrease in net income, even though there had been an improvement trend going for a while between 2022Q4 and 2023Q1.

US Bank - net income YoY (Seeking Alpha)

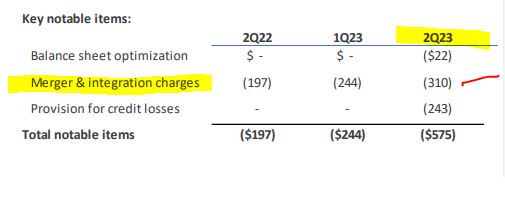

Although this slight YoY drop in net income is disappointing, on closer examination it seems the quarter was impacted by one-time costs tied to the merger with Union Bank.

According to the Q2 presentation, "charges include the continued impact of merger and integrations costs associated with the Union Bank acquisition."

US Bank - merger charges (company q2 presentation)

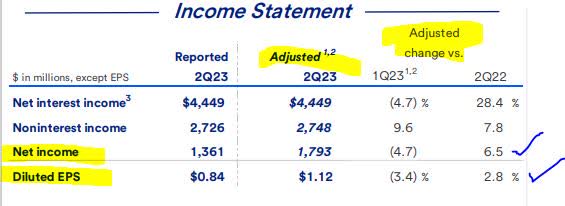

Also, although the reported net income YoY was lower the "adjusted" net income actually was YoY higher:

US Bank - adjusted net income (company q2 presentation)

So, in this case, I would recommend this stock on the basis of YoY earnings growth and will not ding them on one quarter that saw a merger impact, and I forecast that Q3 should have even better figures as the Union Bank merger costs should have been settled by then.

Capital Strength: Recommend

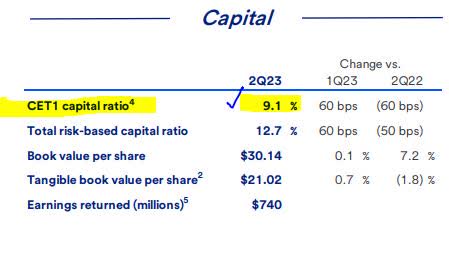

A key metric I look at with banks is the CET1 ratio, and US Bank is well above regulatory standards with a CET1 of 9.1%, which actually increased YoY.

US Bank - CET1 ratio (company Q2 presentation)

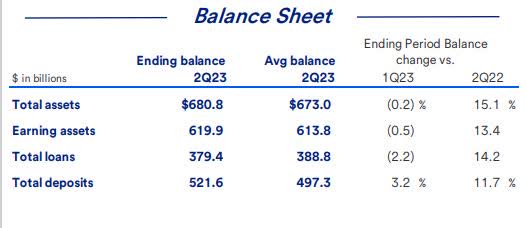

In addition, I see balance sheet strength and expansion as well, with a 13% increase in earning assets as well as a near 12% YoY increase in deposits:

US Bank - balance sheet (company Q2 presentation)

It is, however, worth mentioning that this bank was one of the firms subject to the annual Fed stress test, which resulted in it being subject to a preliminary stress capital buffer "SCB" of 2.5 percent, according to a company news release, and this also causes common stock repurchases to be suspended for now.

In the release, CEO Any Cecere did have some positive commentary on this issue, though:

The results of this year’s stress test demonstrate that we are well-capitalized and remain prepared to withstand a severe economic downturn following the acquisition of Union Bank. Our highly diversified business mix, well-established financial discipline, and conservative risk profile demonstrates our unwavering commitment to create and deliver value for our shareholders.

So, an additional buffer of less than 3% is hardly something to be spooked over, in my opinion, and I think this bank should be recommended in the category of capital strength.

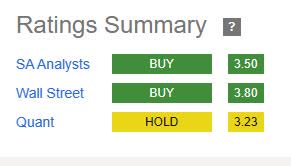

Rating Score: Strong Buy

In today's analysis, this stock won in all 5 of my rating categories, earning a strong buy rating. This is even more bullish than the consensus from SA analysts and Wall Street, as well as the quant system.

US Bank - rating consensus (Seeking Alpha)

Risk to my Outlook: CRE Exposure

A risk to my bullish outlook is investor concern over banks' exposure to commercial real estate loan books, particularly office properties, a hot topic lately in some financial media who have been bringing this up.

According to a June article in American Banker:

Loans backed by office buildings are currently drawing major scrutiny, as the rise of remote work has led to higher vacancy rates and sparked fears that some lenders will face big losses in the coming years.

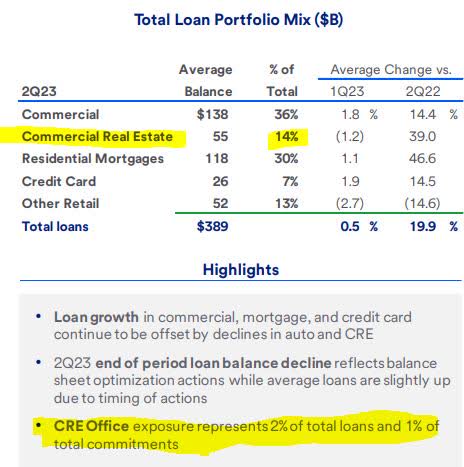

To address this, I will discuss the company's own data on its loan exposure, which does not look so grim in terms of office property risk.

The CRE portfolio is less than 15% of the total loan book, and the office sub-sector is just 2% of the total book, hardly a major risk in my opinion:

US Bank - CRE book (company q2 presentation)

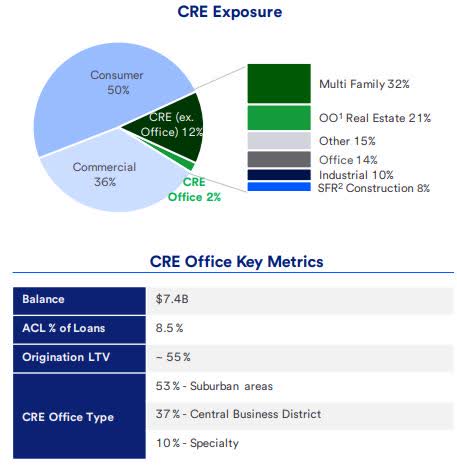

In addition, you are looking at a loan-to-value of less than 60%, and office properties diversified across regions:

US Bank - CRE book - continued (company q2 presentation)

So, I think the risk is always justified to look at but does not imminently present any danger to this firm, and investors going into panic mode over office loans is not backed by the data.

Analysis Wrap Up

Here are the key points we went over in today's article:

The stock was rated a strong buy rating, which is more bullish than the analyst consensus and the quant system.

Positives: dividends, share price, valuation, capital strength, YoY earnings growth.

Headwinds: None.

The risk of CRE exposure has been addressed.

Concluding thoughts & outlook for Q3:

The banking sector still presents interesting opportunities, particularly these top 10 US banks. At the same time, the March dip in banking seems to be long past us, but the sector is not quite fully out of the woods yet, so buying opportunities can present themselves like with this stock.

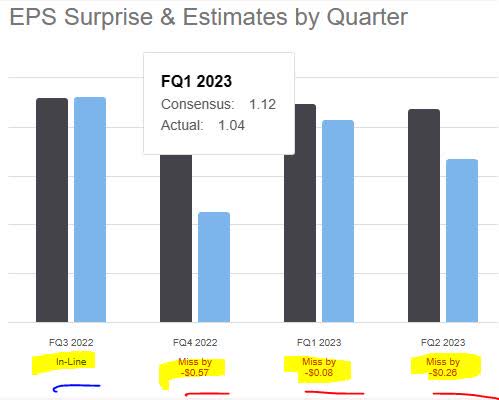

Consider that it missed analyst earnings estimates in 3 of the last 4 quarters, as per the chart below, so I think for Q3 it may have a 75% chance of a slight miss again. However, if it ends up beating estimates, it could also bring out the bulls.

US Bank - earnings misses (Seeking Alpha)

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.