Douglas Elliman: A Niche Real Estate Play With A Possible Catalyst

Summary

- Home sales volume is declining due to inflationary pressures and higher interest rates, causing pain for companies in the housing market.

- Douglas Elliman, a real estate services firm, is facing significant challenges but has an interesting niche in the higher-end market.

- The company has no debt, a substantial amount of cash on hand, and potential catalysts in its technology-oriented investments, making it a speculative but potentially attractive investment opportunity.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

PeopleImages/iStock via Getty Images

2023 is not looking to be a particularly pleasant year for companies that rely on the purchase and sale of homes. Inflationary pressures that pushed home prices up to record highs last year, combined with higher interest rates that should have the impact of making home ownership more costly, have worked in tandem to drive the volume of home sales down. For any company in this space, that is guaranteed to result in some pain. But one interesting player in this market that has its hands in an intriguing niche and that also has an interesting catalyst for the long run, might very well be worth investors taking a gamble. The company is facing some significant pain right now. And that trend is likely to continue for several quarters. But between the aforementioned strengths that it has, and the tremendous amount of cash it has on hand relative to its overall size, I believe that it is definitely worth some consideration. That company is none other than Douglas Elliman (NYSE:DOUG), a firm that I have decided to rate a soft ‘buy’.

An interesting niche

Before I get into more details regarding Douglas Elliman, I believe that it is appropriate, nay, necessary, to address the problems facing the housing market. In prior articles, I discussed the homebuilding space and how troubled it is at the moment. Even though the near term outlook for the industry will be painful, the long term picture, I have asserted, should be quite bullish. But that focuses largely on the sale of new homes. The other side of the market involves existing homes. And sure enough, that space is facing the same kind of problems.

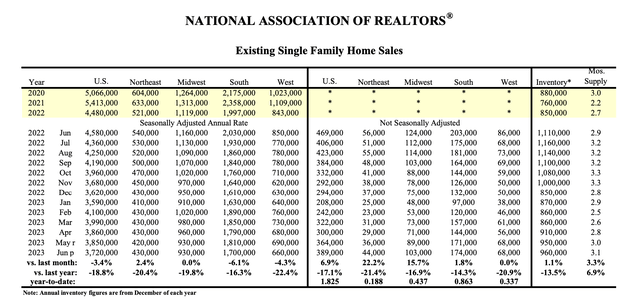

National Association of Realtors

There are multiple data points that we could look at as an example. But to keep things simple, we need only examine existing single family home sales. According to data from the National Association of Realtors, home sales in the month of June of this year came in at 3.72 million on an annualized rate. That's 18.8% lower than what it was the same month last year. Even the southern portion of the US, which has seen tremendous amounts of migration because of demographic shifts involving baby boomers, has seen some pain. In June of this year, existing single family home sales there were 16.3% lower than what they were one year earlier. But it's also important to note that this is not the first sign of weakness that we have seen. In 2022 as a whole, home sales in the US came 17.2% lower than what was seen in 2021. So this trend has been building for some time.

These kinds of results should not bode well for any player in this space. That is even true of a company like Douglas Elliman. According to the management team at the firm, it operates as a real estate services and property technology investment business. It owns one of the largest residential brokerage companies in the New York metropolitan area. In fact, management has gone so far as to say that it is the 5th largest real estate services firm in the country. It boasts around 120 offices in operation with approximately 6,900 real estate agents in the areas in which it operates. And it has grown to that point by focusing largely on the residential real estate market that involves higher end real estate. To put this in perspective, the average home sale that the company facilitated in 2022 was $1.62 million.

There are other operations that the company has. For instance, it operates a sales and marketing division. On top of this, the company also provides management services of cooperative, condominium, and rental apartment buildings through one of its subsidiaries. It provides a range of fee-based management services for 353 properties that represent a combined 46,000 units. It has a full-service title insurance business and even provides escrow services.

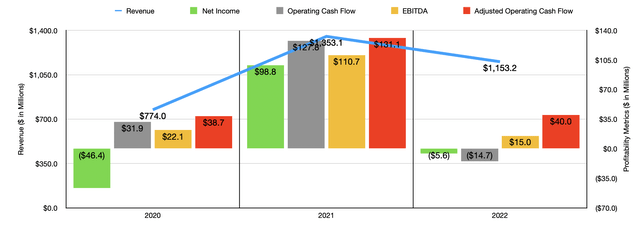

I don't think it would be a stretch to say that the higher end market would likely be more resilient to volatility in the demand for housing than the middle market or lower end of the market. But this does not mean that the company has gotten by the past couple of years without some pain. As you can see in the chart above, revenue for the business tanked from $1.35 billion in 2021 to $1.15 billion in 2022.

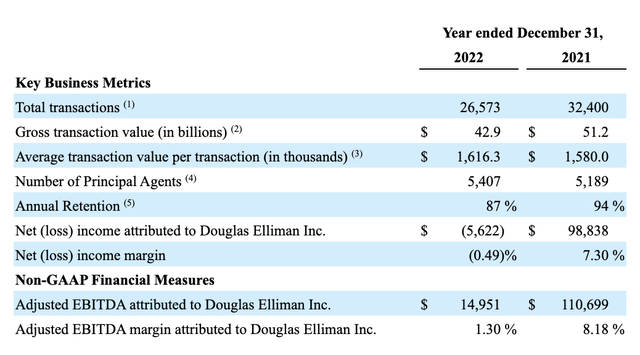

Even though the company benefited from a rise in the number of principal agents from 5,189 in 2021 to 5,407 in 2022, it reported a drop and the total number of transactions from 32,400 to 26,573. That's a year over year decline of 18%. The company was aided by the fact that the average transaction value increased from $1.58 million to $1.62 million. However, gross transaction value plunged from $51.2 billion to $42.9 billion because of the reduction in total transactions. It's also worth noting that the tough market conditions proved painful when it came to retaining agents. Agent retention dropped from 94% to 87%.

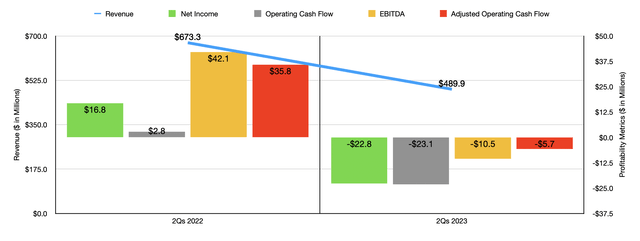

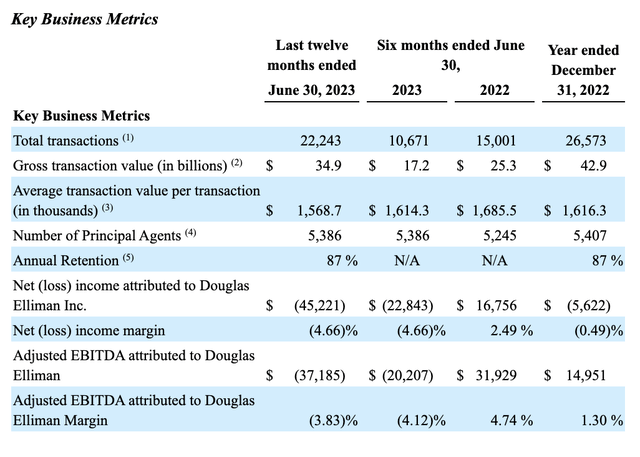

This shift in market conditions pushed net profits for the company down from $98.8 million to negative $5.6 million. As you can see in the first chart in this article, operating cash flow, adjusted operating cash flow, and EBITDA, all declined significantly as well. In the chart above, meanwhile, you can see that the pain for the company has continued into the 2023 fiscal year. Revenue of $489.9 million was 27.2% lower than the $673.3 million reported one year earlier. This came as the number of transactions dropped a whopping 28.9% year over year while gross transaction value plunged from $25.3 billion to $17.2 billion. Even average transaction value worsened, dropping from $1.69 million to $1.61 million.

Normally, I would stay far away from a company like this. This is especially true when you consider my stance that the housing market is going to be experiencing pain for at least a few more quarters. It might even be toward the middle or end of next year before we start to see a real recovery. However, there are a couple of reasons why I like the company. For starters, it has no debt on its books. On top of this, it boasts $130.4 million in cash and cash equivalents. So even though the company is hemorrhaging cash at the moment, it is in pretty solid financial condition. And with a market capitalization of $187 million, that brings its enterprise value down to only about $58 million. Even if the company reverts back to the kind of performance it achieved in 2020, it would become drastically undervalued.

On top of all of this, there is another interesting catalyst. And this involves the investments that the company has made over the years. Most of these investments occur through a subsidiary called New Valley Ventures. As of the end of the second quarter of this year, the carrying value of these investments came in at only $13.9 million. That's a small part of the company's overall size. However, these investments have been made into a variety of technology-oriented companies. Most of these seemed to still be small players in the property technology market and in similar markets. But there are a couple that the company got into early that have gone on to be worth a tremendous amount of money.

At the very top of the list is Bilt Rewards, which is a loyalty program and co-branded credit card for renters to earn points on their rental payments. At present, the company has a network of more than two million rental units that benefit from this loyalty program. I performed A tremendous amount of due diligence in an attempt to find out how much of Bilt Rewards Douglas Elliman actually owns. But I could not find anything that is publicly available. What we do know is that management participated as a minority investor in a $60 million round in the company back in September of 2021. And by October of last year, Bilt Rewards ended up growing to be worth around $1.5 billion.

Another big venture that Douglas Elliman ended up getting into is a company called Envoy. It operates as a shared mobility company that sets up fleets of electric vehicles that residents can share. Normally, these are made available to a group residing in a condominium development, hotel, or other shared space. In January of last year, Envoy had grown its valuation to $1.4 billion. Once again, we don't know how much Douglas Elliman actually owns. But given how small the company is already, it doesn't take much to necessarily be very profitable for shareholders.

Takeaway

From the data that I see, it looks as though Douglas Elliman is definitely going to be facing some additional fundamental pain in the near future. But the good thing is that the absence of debt and the surplus of cash gives the company plenty of fuel to get by. The business as a whole is incredibly cheap and it has a potential catalyst in the form of the different investments that it has made in recent years. Add all of this together, and I still recognize that the company is somewhat speculative. But the combination of the positives do outweigh the negatives in my book and, for those who don't mind risk, I would say that it makes for a decent ‘buy’ prospect.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.