Flowserve: Benefiting From Global Infrastructure Spending

Summary

- Flowserve has seen strong revenue growth supported by global infrastructure spending.

- The company's 3D strategy focusing on revenue diversification, decarbonization, and digitization has contributed to its success.

- Flowserve's stock is fully valued and may not have much upside left, making it a hold for long-term investors.

RealPeopleGroup/iStock via Getty Images

I was wrong thus far about Flowserve (NYSE:FLS) when I placed a hold rating in May. The company had more gas left in its tank and has delivered a total return of 11.2% compared to the S&P 500 Index (SP500) return of 3.3% since the article’s publication. Although the company saw another quarter of record revenue growth and margin expansion, some of its stock gains came from expanding multiples. As a long-term investor, I look for companies trading at a reasonable valuation with scope for future gains driven by stock price appreciation and dividend yield. The stock may have priced in the upbeat revenue growth and profitability for the year at current valuations and may not have much upside left. I continue to rate it a hold.

Revenue growth supported by global infrastructure spending

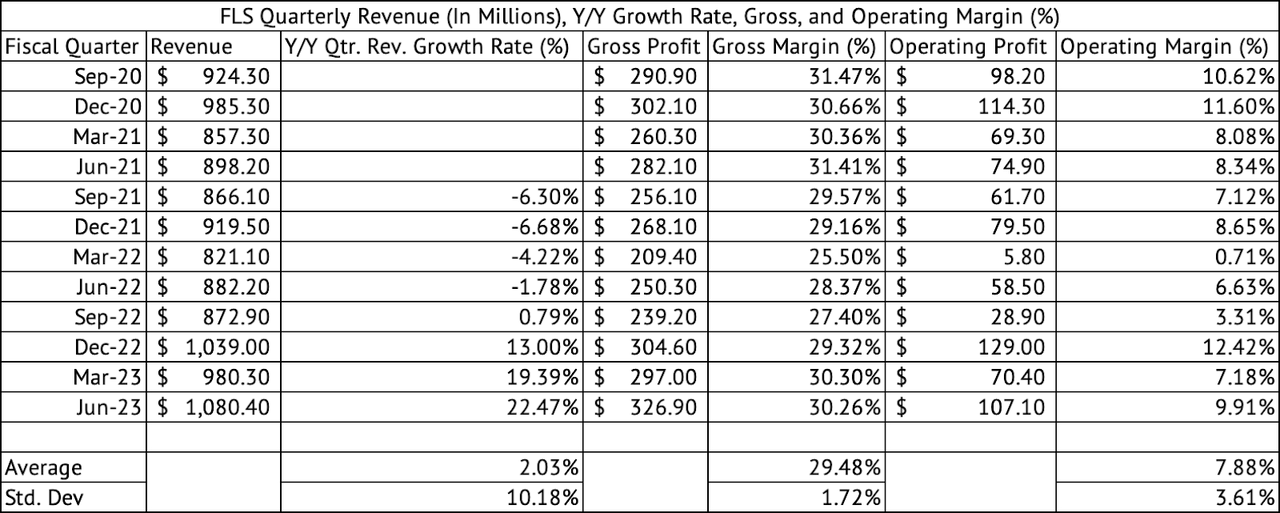

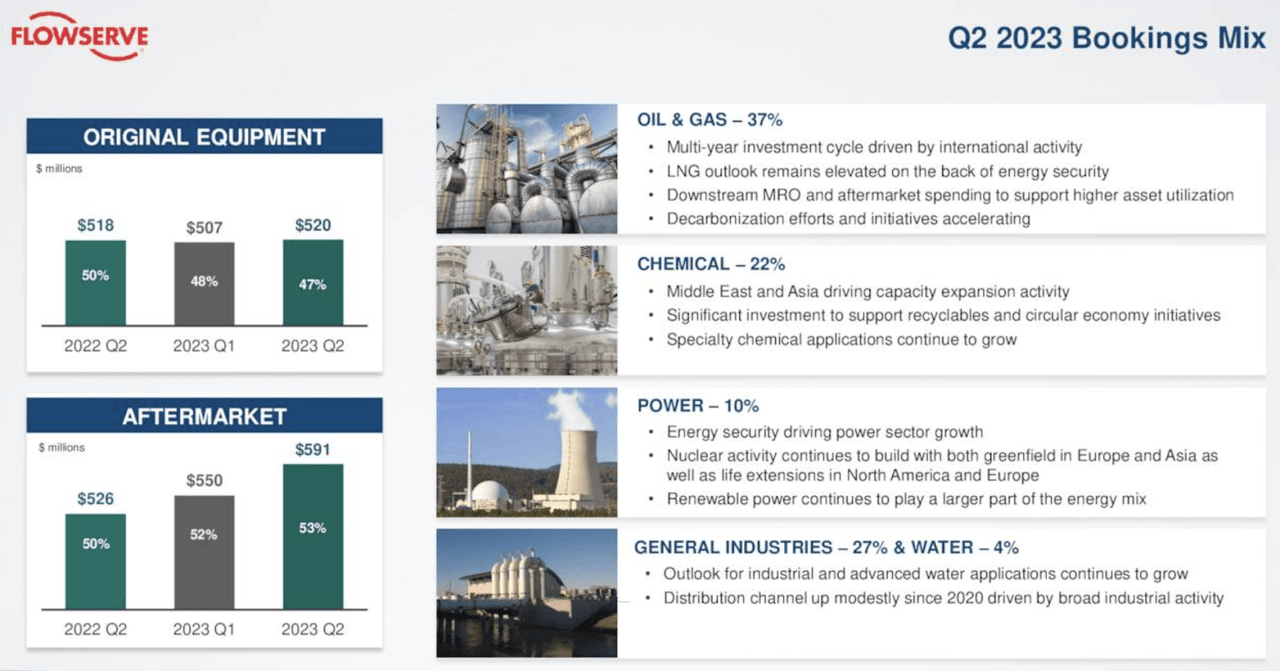

Flowserve has grown its revenue at a double-digit pace since its December 2022 quarter (Exhibit 1). The company’s revenues are reasonably balanced between selling original equipment and after-market services and support (Exhibit 2). The June quarter was the sixth consecutive quarter where the company registered more than a billion dollars in booking, meaning its revenue growth should remain strong.

Exhibit 1:

Flowserve Quarterly Revenue and Margins (%) (Seeking Alpha, Author Compilation)

Exhibit 2:

Flowserve Revenue from Original Equipment and Aftermarket Sales (Flowserve Investor Presentation)

Bookings were driven by the oil and gas sector, where the need for energy security and the demand for LNG has led companies and countries to invest in infrastructure (Exhibit 3). The management pointed out that the bookings were primarily driven by aftermarket demand for maintenance parts and services. In the long run, this after-market demand may be more sustainable, driving revenues and cushioning the uncertainty in demands from large new projects.

Exhibit 3:

Flowserve Booking Mix (Flowserve Investor Relations)

Scott Rowe, the CEO, mentioned that the company’s 3D strategy, focusing on diversifying its revenue mix, decarbonizing, and the digitization trends, is paying off. The company may have executed well, but some of its success is due to massive stimulus and infrastructure plans enacted by the U.S. Federal Government to spur investments in green energy and semiconductors, among other things. Europe rushed to blunt Russia’s threats about withholding gas to the continent, leading it to make massive investments to diversify its LNG sources.

In short, I am not entirely convinced the company can achieve such growth over many years. However, the green energy transition could accelerate, leading to more investments globally. The New York Times recently wrote about the accelerated pace of change in the energy transition in the U.S. The question remains whether the investments in infrastructure and energy projects will continue without government subsidies. The benefits of the massive investments by the Federal government have propelled the industrial economy, with the Vanguard Industrials Index Fund ETF (VIS) gaining 7.08% over the past year compared to the 9.08% gain for Flowserve.

The company regained and rebuilt its gross margins, which it lost at the beginning of 2022 when it registered a 25.5% margin (Exhibit 1). It has consistently registered 30% gross margins over the past two quarters. The company has also improved its operating margin, registering 9.9% in the June 2023 quarter. Both these margins have been above their average since September 2020.

Fully valued

Flowserve trades at a forward GAAP PE of 23x, compared to the 20x PE for the companies in the Vanguards Industrials Index ETF. Its industrial peers, such as the Timken Company, trades at a forward GAAP PE of 11.9x. However, the Timken Company operates in industrial bearings, while Flowserve manufactures pumps and valves. Flowserve trades at a forward EV to EBITDA multiple of 12.2x, close to its five-year average of 12.8x. The sector median for the EV to EBITDA multiple is 11.1x.

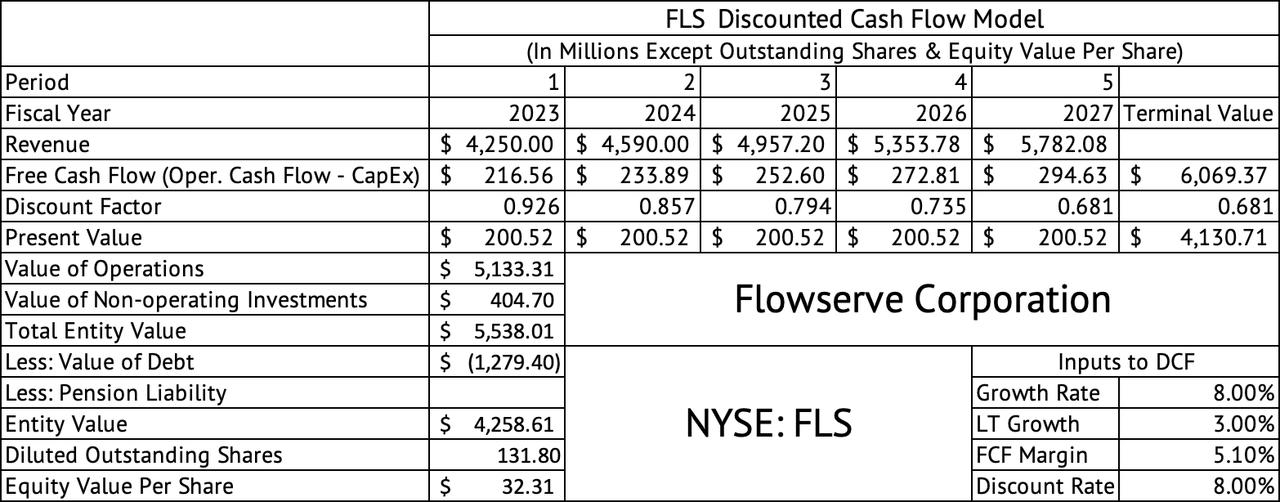

A discounted cash flow model estimates the per-share equity value at $32. This model assumes an optimistic 8% revenue growth rate for the next few years and a long-term growth rate of 3% for calculating the terminal value. A 5% free cash flow margin (Operating cash flow - Capital Expenditure), the company’s long-term average, is assumed by this model.

Exhibit 4:

Flowserve Discounted Cash Flow Model (Seeking Alpha, Author Calculations)

The company has averaged only a 3% free cash flow margin since September 2020. Flowserve has averaged an EBITDA margin of 10.4% since September 2020, with a standard deviation of 3.2%. The Timken Company (TKR) has averaged an EBITDA margin of 18.2% with a standard deviation of 2.1%. In short, Flowserve has lower EBITDA margins with higher variability. Free cash flow may be better for valuing companies, while EBITDA may be better for comparing different companies in a sector.

Unimpressive dividend yield

The dividend yield is not impressive, given the rate environment and the higher yields offered by U.S. Treasuries. The stock yields 2.1%, the Vanguard Industrials Index ETF yields 1.4%, and the Vanguard S&P 500 Index ETF offers 1.5%. The stock has not offered much dividend growth, growing at a minuscule 1% CAGR over the past five years. The company pays about $104 million in dividend payments annually.

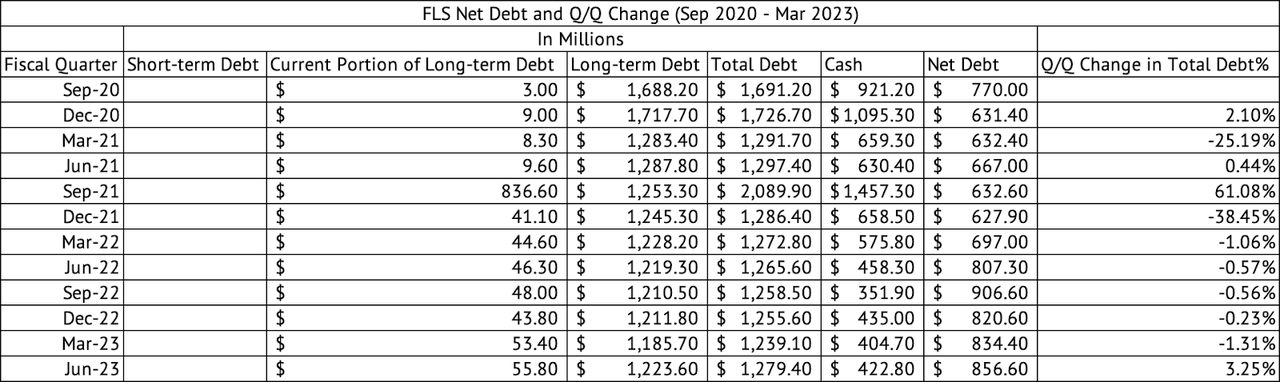

The company did not generate much operating cash in the first two quarters of the year since it built up its inventory and its accounts receivables balance increased. The company’s debt increased, too, during the last quarter. The company now carries a total debt of $1.2 billion, an increase of 3.2% Q/Q, and net debt (after cash) of $856 million (Exhibit 5). The company generated EBITDA of $407 million over the trailing twelve months, leading to a Total debt-to-EBITDA ratio of nearly 3x and a net debt-to-EBITDA ratio of 2x.

Exhibit 5:

Flowserve Debt and Q/Q Change (Seeking Alpha, Author Compilation)

Exhibit 6:

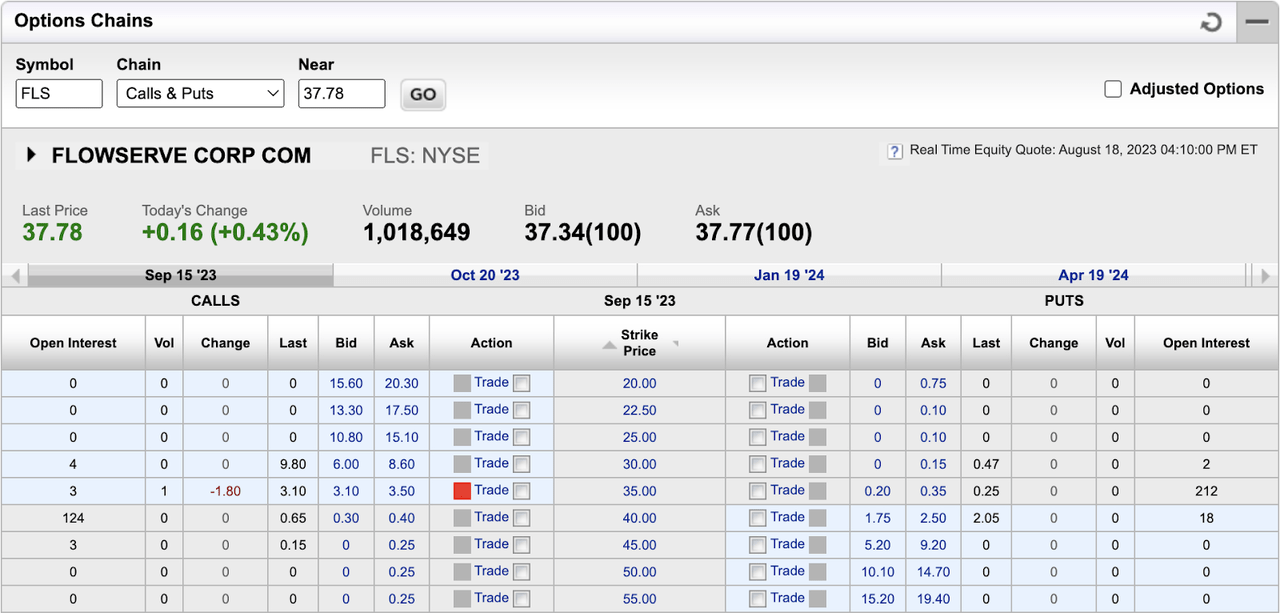

Flowserve Options Chain (E*Trade)

Although the company benefits from a resurgence of infrastructure spending globally, the stock is fully valued. The entire industrial sector has benefitted from this spending and Flowserve trades above the weighted average PE of companies in the Vanguard Industrials Index ETF. Other industrial companies, such as the Timken Company, with a durable competitive advantage and diverse end markets, trade at a much lower valuation. Given a choice between Flowserve and Timken, I instead own Timken. Investors owning the stock may want to consider selling covered calls to generate income and increase returns. The September 15, 2023, $40 Strike Calls last traded at $0.65 and could generate a 1% premium (Exhibit 6). Investors looking to own Flowserve may have to wait for an attractive valuation.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VOO, VIS, TKR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.