Upstart Holdings: Price Plunge Creates Massive Opportunity (Technical Analysis)

Summary

- Upstart Holdings' stock price has crashed by more than half after 2Q-23 earnings, falling from over $70 to $32.

- The drop in stock price suggests an overreaction to the fintech's recent financial results, as its business is expected to bounce back in a low-rate environment.

- Upstart Holdings is active in a highly attractive market with potential for penetration in ancillary markets such as auto, homes, and small businesses.

jamesteohart/iStock via Getty Images

Upstart Holdings, Inc. (NASDAQ:UPST) has seen multiple double-digit percentage stock price moves on good days and bad days, but the recent devastation that has been brought upon the fintech has truly been something else.

The fintech’s stock priced has crashed by more than half after 2Q-23 earnings, falling from more than $70 on August 1, 2023 to merely $32 last Friday.

Though I already had a favorable opinion on Upstart Holdings in May ('Buy' rating due to short squeeze potential), the drop after earnings strongly suggests that the market is overreacting to the fintech’s most recent financial results.

Taking into account that Upstart Holdings' stock is now selling for less than half the sales multiple it sold for two weeks ago and that the fintech’s business is set to bounce back in a low-rate environment, I have doubled my investment in this AI lending startup.

What’s Wrong With Upstart Holdings?

The artificial intelligence lending platform suffers from higher interest rates and inflation which are headwinds to its credit business, a fact that was already demonstrated in the fintech’s 1Q-23 results.

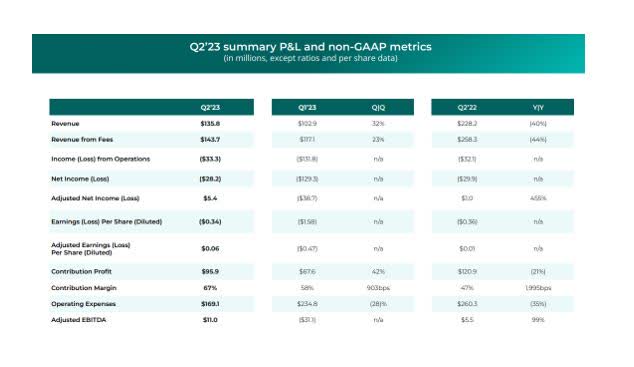

Upstart Holdings’ sales were down 40% YoY to $135.8 million in the second quarter and all the other key metrics that can be used to evaluate business performance also look just as bad.

Fee income was down 44% to $143.7 million and the fintech continued to rack up losses in the second quarter, though they were not as high as in the first quarter. Upstart Holdings’ net loss in 2Q-23 was $28.2 million which followed a net loss of $129.3 million in 1Q-23.

2Q-23 Summary (Upstart Holdings)

Upstart Holdings’ key metrics are pointing south primarily because of higher interest rates which make new loan originations unattractive. Since higher interest rates make loans more expensive, Upstart Holdings has seen a dramatic decline in the number of personal and auto loans it has made in the last year. The number of personal unsecured loans declined 66% YoY to 107K in 2Q-23. The number of auto loans declined 74% YoY to 2.5K in 2Q-23 as car payments became substantially more expensive in the last twelve months.

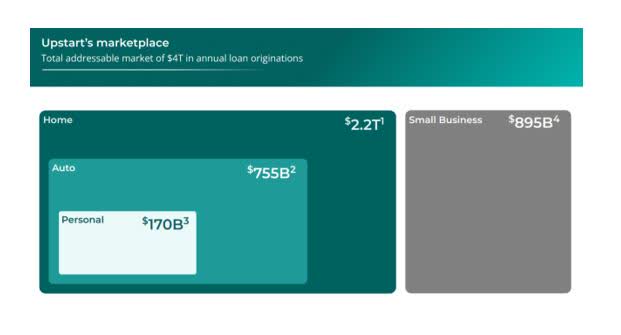

With that being said, though, this doesn’t change the fact that Upstart Holdings is active in a highly attractive market that carries a lot of potential in terms of penetration moving forward.

Upstart Holdings has been focused primarily on personal loans, but the fintech is dealing with a much bigger opportunity to deploy its AI technology at scale, including loan origination potential in ancillary markets such as auto, homes and small businesses.

Upstart Holdings is dealing in a market with a size exceeding $4 trillion. The company’s AI technology helps financial companies automate the lending process and make credit decisions faster. In 2Q-23, 87% of Upstart Holdings’ loans were fully automated.

Total Addressable Market (Upstart Holdings)

In the long run, however, as interest rates come down and inflation eases (see risk section) there is a good chance that Upstart Holdings’ lending business will pick up again.

Technical Analysis

From a technical perspective, Upstart Holdings is not oversold, but the short-term picture has clearly been negatively influenced by rapidly changing investor sentiment.

Upstart Holdings fell through the 50-day moving average line which sits at $44.05, the break of which constituted a sell signal and the fintech may very well retest its 200-day moving average line as well.

Long-term investors, however, should be less concerned with the technical situation and rather with the fintech’s much cheaper sales multiple available after the August price plunge.

Moving Averages (Stockcharts.com)

Buy Upstart Holdings For A Substantially Lower Sales Multiple

A moment of panic is also always a moment of opportunity and an opportunity to take advantage of emotion-driven transactions. Upstart Holdings sees $140 million in revenues for 3Q-23 and the market expects a quite substantial sales rebound next year which is related to expectations of falling interest rates.

The market presently models $529.17 million in sales this year which implies a 4.9x sales multiple. Before the drastic correction in August, Upstart Holdings’ stock sold for more than 10.0x this year’s sales. Though this was admittedly a high multiple, fintechs tend to be valued based on their potential for sales growth and Upstart Holdings is set to see a big sales recovery as interest rates fall. The implied sales growth rate for next year is 41%, though analysts may mark their estimates down if rates are likely to stay high.

Revenue Estimate (Yahoo Finance)

Why Upstart Holdings Could See A Higher Or Lower Valuation Multiple Moving Forward

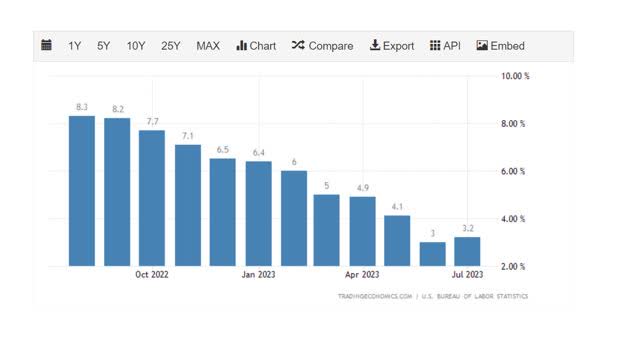

I think the key to whether Upstart Holdings will see a higher or lower valuation multiple primarily relates to the path of interest rates and inflation, which are obviously positively correlated.

Inflation ticked up to 3.2% in July, but only slightly, and the long-term trend is still favorable. The lower inflation goes, the more probable it is that the central bank will reverse its interest rate hikes in 2024, which in turn could restart Upstart Holdings’ lending business. If this doesn’t happen and inflation continues to march upward, then Upstart Holdings’ sales and originations may continue to suffer.

Inflation Rates (Tradingeconomics.com)

My Conclusion

I have increased my position in the artificial intelligence lending startup by 2x after the August drop and the only thing I regret is that I didn’t have more money to make Upstart Holdings an even larger position.

Though it is obvious that the fintech suffers from higher interest rates and inflation (and thus slowing demand for personal and auto loans at a time when they are extraordinarily expensive), inflation is subsiding, which should point to lower interest rates in the medium term, at which point Upstart Holdings could see a strong return of loan demand.

Particularly compelling is the fact that Upstart Holdings has a large penetration opportunity not just in the personal loan market, but also in the auto, home, and business loan markets.

Investors now seem to be overly focused on Upstart Holdings’ short-term sales potential when what actually matters is the company’s long-term outlook in a market with a normalized interest-rate environment.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UPST either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.