Energy Sector: Monetary Easing Will Probably Follow Soon And Lift The Oil Prices

Summary

- China's economic indicators are deteriorating, which is good news for the oil market and oil ETF investors.

- Chinese statistics show falling trade surplus, industrial production, and retail sales, indicating a struggling economy.

- The Chinese government is implementing measures to stimulate economic growth, which could lead to increased global demand for oil.

zhengzaishuru

China's economy is slowing down, and the oil prices take a hit. On the surface it seems logical. But paradoxically bad news is good news. Because the global economy seems overheated, and the interest rates are near their all-time highs. The more the economic indicators deteriorate, the better it is for oil. Oil ETF investors will also be here to gain. But let me explain this in some more detail.

Oil market

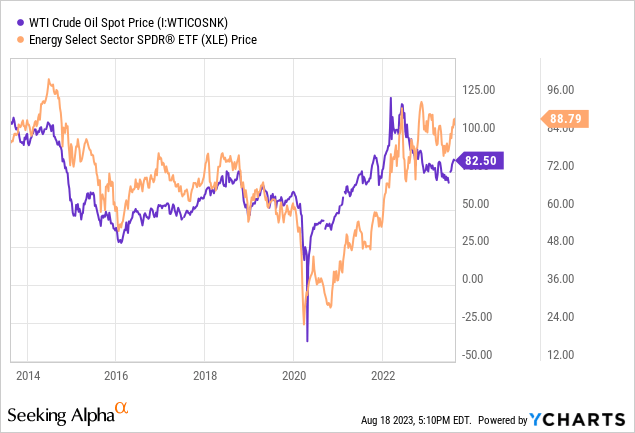

My first article published here on Seeking Alpha was about Transocean (RIG), an offshore driller that took quite a hit during the coronavirus pandemic for obvious reasons. The oil prices were negative at the time, whilst everyone thought the oil sector was doomed for failure. Everyone also thought Transocean was about to go bankrupt at the time. But in fact, it was an outstanding moment to buy oil assets. The oil market nowadays is nowhere near as cheap as it was at the time. But I would still say that the more the economy struggles, the better it is for oil just like the broader stock market.

The reason why I am saying this is because poor macroeconomic indicators make central banks reconsider their monetary policies. For example, the Fed has been able to keep hiking the interest rates in response to high inflation readings for many months already because the employment figures have been quite strong. But if the economy deteriorates significantly, the Fed would obviously have to change its monetary course. It can start a quantitative easing (QE) program and/or it can lower the interest rates. This will make the oil prices go up if nothing else changes.

Right now the People's Bank of China is forced to change its course. That is because quite recently the Chinese statistics disappointed investors. It was a highly important piece of news. The reason why I say that it is so important is because China, the biggest manufacturing economy, is accountable for 70% of the total oil consumption.

Anyway, here is a summary of the macroeconomic indicators published in China.

Exports, manufacturing activity, and house prices are falling in China. The country is facing a rising youth unemployment rate. The debt crisis, meanwhile, is worsening.

In July China's trade surplus decreased to $80.6 billion from $102.7 billion for the same period a year ago. The country's exports fell more than imports amid weak domestic and foreign demand.

China's industrial production increased by 3.7% year-on-year in July. This was in contrast to a 4.4% rise in June. The retail sales increased 2.5% year-on-year in July. So, the growth rate dropped from 3.1% in June.

In the first seven months of the year, the retail trade increased by 7.3%. The country's fixed-asset investment increased by 3.4% year-on-year to CNY 28.59 trillion in the first seven months of 2023. Again, this is an ease from the 3.8% increase over the January to June period.

Chinese new bank loans slumped a whopping 89% compared to a month earlier, totaling CNY 345.9 billion in July. This was the lowest since late 2009. Noteworthy that it was the second decline this year after the central bank decreased the rate by 10 bps on June 13.

Home prices plunged for the fifth time this year. This is another proof of the country's prolonged property crisis and its stalling economic recovery. This all looks very grim. But on Tuesday, China decreased the key interest rates to support its economy. More positive announcements are likely to follow because the Chinese government seems to be determined to stimulate economic growth.

In other words, there is absolutely no need to ease the monetary policies when everything is fine. But now the economy is not doing great and needs additional stimuli. On Wednesday China's Premier Li Qiang said the country would work to meet its economic targets for the year. During the meeting, Li called for expanding domestic demand and boosting consumption. So, both fiscal and monetary policies will likely be used.

If the Chinese economy grows steadily thanks to the government, the global demand for oil will also keep rising. Moreover, the Chinese economic slowdown might spread to other economies, including the EU and the US. So, the central banks might have to cancel their planned rate hikes, which will also be a great positive for oil.

Oil ETFs

There are numerous ways to benefit from growing oil prices. It is possible to compose a portfolio of large and profitable oil majors. But it is often easy to make a mistake, whilst choosing the best companies to invest in.

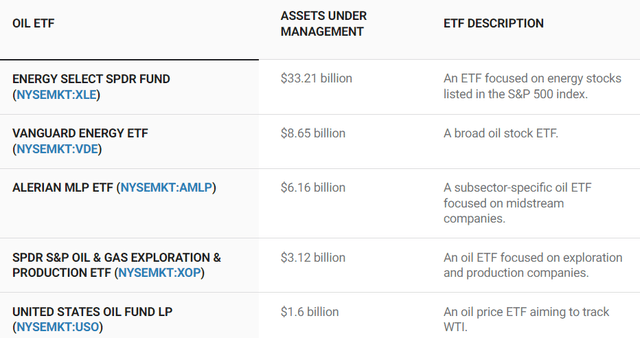

So, an alternative many oil believers invest in is energy ETFs. The table above shows the five largest ETFs, namely Energy Select SPDR Fund (NYSEARCA:XLE), Vanguard Energy ETF (VDE), Alerian MLP ETF (AMPL), SPDR S&P Oil & Gas Exploration & Production ETF (XOP), United States Oil Fund LP (USO).

Oil ETFs (assets under management as of 7 June 2023)

In my view, the most reliable option is to invest in the largest ETF. As I have mentioned in my other article, XLE encompasses the most profitable and stable companies. After all, XLE focuses on the companies listed in the S&P 500 index. Its largest investors include but are not limited to Bank Of America Corp /de/, Morgan Stanley, Susquehanna International Group, LLP, Wells Fargo & Company/mn, Royal Bank of Canada, UBS Group AG, LPL Financial LLC, Citadel Advisors LLC, Parallax Volatility Advisers, L.P., and Citadel Advisors LLC.

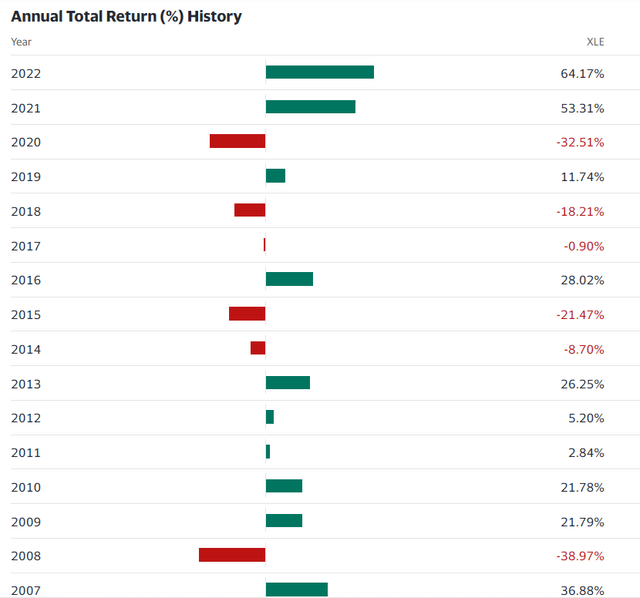

In the last 30 years, the Energy Select Sector SPDR Fund (XLE) ETF generated an 8.02% compound annual return. It might not seem excellent compared to other assets. But oil prices are quite cyclical.

Basically, your return would depend on the timing. Because if you had invested in 2020, your return would have been much better.

As I have mentioned above, XLE is composed of the largest companies with the highest credit ratings, which makes this ETF quite reliable, in my opinion.

XLE companies

| Name | Ticker | Sector | Credit Rating |

| Exxon Mobil Corporation | (XOM) | Oil, Gas & Consumable Fuels | Aa1 (Moody's) |

| Chevron Corporation | (CVX) | Oil, Gas & Consumable Fuels | Aa2 (Moody's) |

| Schlumberger | (SLB) | Energy Equipment & Services | A2 (Moody's) |

| EOG Resources, Inc. | (EOG) | Oil, Gas & Consumable Fuels | A3 (Moody's) |

| ConocoPhillips | (COP) | Oil, Gas & Consumable Fuels | A2 (Moody's) |

| Marathon Petroleum Corporation | (MPC) | Oil, Gas & Consumable Fuels | Baa2 (Moody's) |

| Pioneer Natural Resources Company | (PXD) | Oil, Gas & Consumable Fuels | Baa1 (Moody's) |

| Phillips 66 | (PSX) | Oil, Gas & Consumable Fuels | A3 (Moody's) |

| Occidental Petroleum Corporation | (OXY) | Oil, Gas & Consumable Fuels | Baa3 (Moody's) |

| Valero Energy Corporation | (VLO) | Oil, Gas & Consumable Fuels | Baa2 (Moody's) |

| Devon Energy Corporation | (DVN) | Oil, Gas & Consumable Fuels | Baa2 (Moody's) |

| The Williams Companies, Inc. | (WMB) | Oil, Gas & Consumable Fuels | Baa2 (Moody's) |

| Hess Corporation | (HES) | Oil, Gas & Consumable Fuels | Baa3 (Moody's) |

| Kinder Morgan, Inc. Class P | (KMI) | Oil, Gas & Consumable Fuels | Baa2 (Moody's) |

| Halliburton Company | (HAL) | Energy Equipment & Services | Baa1 (Moody's) |

| ONEOK, Inc. | (OKE) | Oil, Gas & Consumable Fuels | Baa2 (Moody's) |

| Baker Hughes Company Class A | (BKR) | Energy Equipment & Services | A3 (Moody's) |

| Diamondback Energy, Inc. | (FANG) | Oil, Gas & Consumable Fuels | Baa2 (Moody's) |

| Coterra Energy Inc. | (COG) | Oil, Gas & Consumable Fuels | Baa2 (Moody's) |

| Marathon Oil Corporation | (MRO) | Oil, Gas & Consumable Fuels | Baa3 (Moody's) |

| APA Corp. | (APA) | Oil, Gas & Consumable Fuels | BBB- (Fitch) |

| Targa Resources Corp. | (TRGP) | Oil, Gas & Consumable Fuels | Baa3 (Moody's) |

| EQT Corporation | (EQT) | Oil, Gas & Consumable Fuels | Ba1 (Moody's) |

Source: prepared by the author

But what ETF to choose depends entirely on you.

Risks

It might seem a very strange decision to invest in oil when its prices are not near their all-time lows. At the same time, if there is a "soft landing" of the global economy thanks to many central banks' monetary easing, the commodity will be here to gain.

Not to mention the oil supply is also very tight thanks to Saudi Arabia's and Russia's output cuts. Some market analysts, including Standard Chartered, predict the oil prices could reach a high of $100 per barrel thanks to that fact alone.

However, many economists predict a recession is absolutely inevitable. There were announcements that Michael Burry plays against the stock market by short-selling the major US stock indices. Warren Buffett got rid of some of his assets in order to pile up some cash. The outlook looks gloomy. But it is in no one's interest to force the global economy into a full-scale recession with many consecutive rate hikes.

Conclusion

Whilst it does indeed seem the oil assets will be there to lose, China could be a very good growth stimulus. The market is also quite tightly supplied. But most importantly central banks all over the world do not want their national economies to suffer an economic downturn. XLE is composed of the best oil companies. They are all financially stable and profitable. With all that being said, there are risks to any investment.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.