Etsy: When The Threads Of Growth Start To Fray

Summary

- Etsy is a unique e-commerce platform focused on handmade and custom items, offering potential AI-focused upside for investors.

- The company's revenue growth is driven by services and active seller growth but the increased revenue is not translating well to earnings.

- The e-commerce sector is in a weak position and Etsy trades at high valuation levels relative to their peers, making them extremely exposed.

- Due to these factors, we list Etsy as a 'Sell'

Robert Way

In today's dynamic e-commerce landscape, Etsy stands out as a unique platform that thrives on creativity, innovation, and community. With their focus on handmade and custom items, they are set apart from other large e-commerce companies such as AMZN and WMT. We believe that this unique platform offers a hidden AI-focused upside for investors who believe in the impact that AI will have on art and creators. While its long term growth seems promising, the current valuation, lack of operational leverage, and its exposure to multiple compression makes us rate this a 'Sell' with a fair price target of $65. While we believe in the future of this company, we do not like the current price or lack of verticality in the business. We plan to keep an eye out for a good entry price to sell cash-covered puts, which will allow us to potentially acquire Etsy at a lower price and reward us if at expiration the price stays above our strike price.

Sales Story

Etsy's platform is one that is focused entirely on uniting creators and customers and making e-commerce as easy as possible for creators and artists. They charge $.20 per listing and a 3.5% transaction fee. In addition, they have a few other services that help with marketing and operations for creators. While their overall revenue grew 7.5% YoY, a large part of that growth came from the services side of the business, with it growing 20.8% YoY. With the business being entirely focused on getting creators on the platform, we believe monitoring the active seller growth is almost as important as any revenue growth. Active sellers jumped from 7.4 Million to 8.3 Million YoY, or a 12% jump YoY. The core of our thesis surrounding Etsy is the belief that more sellers bringing more quality items to Etsy, which in turn brings more buyers as quality and cost are both improved.

In addition to this, we believe that AI-driven solutions like Midjourney and OpenAi, combined with established software offerings from giants like Adobe (ADBE) and the affordability of in-home manufacturing through tools such as 3D printers, CNC machines, and laser printers, simplify the creation process, making it more accessible for anyone to be a creator. We believe this accessibility will drive a flywheel of improved customer experience and cost on the Etsy and drive further volume through the platform. They are also starting to expand more and more into what management refers to as "non-core" markets aka geographies outside of the US, UK, and Germany. These new markets can cause additional local flywheels as more creators and buyers are on boarded into the Etsy ecosystem.

While we believe in the long term flywheel, it is also important to note the recent challenges. Year-over-Year, the GMS (Gross merchandise sales) for the first half of the year declined by $168 million to $6.1 billion. This doesn't come as a surprise, considering a lot of the challenges in the whole e-commerce sector and the changing purchase patterns of customers post-covid and in a more selective purchasing environment. Despite this decline, we believe continual onboarding of creators will offset some of this negative pressure.

Operations

Etsy

While growing the core footprint organically, Etsy has also invested in multiple acquisitions: Elo7, Depop and Reverb. Elo7 was acquired in 2021 and was seen as the "Etsy of Brazil" recently they have sold the business due to it not keeping up with growth expectations. The purchase was made at an incredibly poor time with software valuations being at all-time highs in 2021. Depop and Reverb are both focused on fashion and musical instruments, respectively. While the acquisition of Elo7 was a clear mistake, the other two are holding their own and growing.

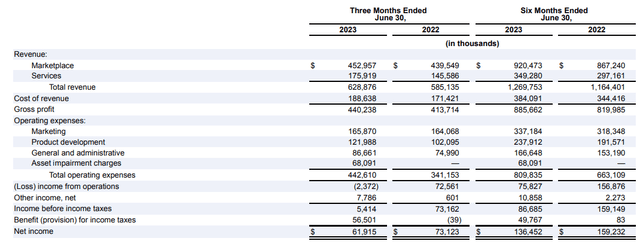

Revenue overall has grown slightly from $1.16 billion in the first half of 2022 to $1.27 Billion (+9.4% YoY), while gross profit has only increased 8% over the same time period. This shows that the cost of revenue has gotten more expensive. Ideally, we see the spread between revenue growth and cost of revenue growth to be >2-3%.

After adjusting for the $68 million in asset impairment charges from the operational expenses (Opex), the total Opex for the quarter stands at $374.5 million, marking a 9.7% year-over-year growth. Notably, there's a slight discrepancy of -0.3% between revenue growth and Opex growth. This indicates that for every dollar of additional revenue generated, the operational expenditure surpasses it, potentially leading to a gradual decline in net income if this pattern persists. While this gap is very narrow, we do believe that it is worth noting.

If we include the asset impairment charges to the pre-tax income, we get a figure of $73.5 million, in comparison to $73.2 million in the second quarter of 2022. This essentially means that despite the rise in revenue, profitability remains stagnant. From an operational perspective, we believe there are evident areas for refinement. Ideally, revenue and Opex shouldn't escalate at comparable rates. While we remain optimistic about the long-term trajectory, immediate enhancements are crucial. We see the growth in services consistently exceeding marketplace revenue growth, amplifying Etsy's operational leverage in the future, but how far away that future is remains to be seen.

Valuation

Seeking Alpha

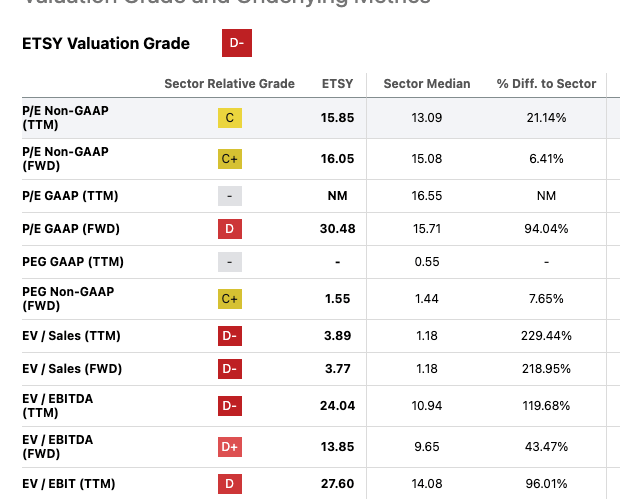

As of their last report, Etsy had roughly $1.08 Billion in cash equivalents and short term investments and long term debt of $2.28 Billion. Despite the debt load, management has focused on share repurchases with an authorization of $1 billion share buy back program in addition to the $114 million that remains on the 2022 program. While these agreements do show the potential for significant buybacks, management has purchased shares in the recent quarter, we question if this strategy will buoy the stock in the current fiscal environment, especially with net income continuing to decline. While Etsy's short-term survival is not in question, we believe their valuation is. Trading at a fwd. EV/Sales of 3.77 vs a sector average of 1.18 we can see that Etsy is trading at significant multiples relative to their current price. We believe that there will continue to be significant pressure on Etsy for these multiples to continue to compress, despite their recent decline already. The repurchase program will help buoy the share price, but we believe that the elevated price is still challenging to justify, especially considering the weakening of their average customer.

Our Ideas

We want to see operational leverage, gross profit improvement and invest more into vertical integration in the business. So much of the business is through creators posting their work, shipping and making their products from their homes. While not possible for all products, we would like to see more Etsy enabled creator production services. There are many print-on-demand services that run through Etsy that allow creators to focus on only making designs and the services will handle order fulfillment and production. The creator doesn't have to handle inventory or handle anything themselves.

We believe opening their own in house service will allow them to capitalize in a variety of ways. With some of the best-selling items on Etsy being stickers and paper and party supplies, integration of a physical operation supporting creators in this can help increase margins dramatically. This would help lower prices across the platform as products would ship and be created from a central location, and most importantly would enable Etsy to build a moat around their prized creator base. We believe more investment in making creators lives easier will allow for more marketplace revenue.

Conclusion

We like the business, hate the price. With declining net-incomes, a money burning acquisition, no operational leverage and trading at significant multiples we believe that despite their anticipated top line growth that there remains to be seen any solid hope for upside at the current prices. We believe that a valuation trading more in line with peers in addition to more verticality in their business strategy can then start to offer more upside. Based on the current share count, we believe a price target of $50-$60 is a very attractive entry point and around $65 is a fair one based on the potential for share repurchases. This will put them more in line with their peers and will then begin to offer more upside to investors. Based on the stock currently trading at ~$75 we place a rating of 'Sell' on the stock until some of our issues are addressed.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)

“www.bbc.com/...