Osisko Gold Royalties: Back On The Sale Rack

Summary

- Osisko Gold Royalties posted solid Q2 results with near-record gold-equivalent ounces earned and revenue just shy of its prior record set in Q4.

- Meanwhile, we saw multiple positive developments which have continued to strengthen the long-term thesis.

- In this update, I'll dig into recent developments a little closer and whether the stock is offering enough margin of safety to consider it as an investment.

Claude Laprise

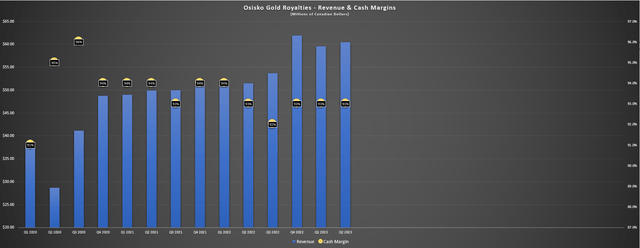

The Q2 Earnings Season for the Gold Miners Index (GDX) is nearing a close and while the results have been mixed overall, Osisko Gold Royalties (NYSE:OR) is one name that posted solid results, with near-record gold-equivalent ounces [GEOs] earned and revenue coming in just shy of its prior record (C$60.5 million vs. C$61.9 in Q4 2022) in what's typically a slower part of the year due to seasonality. These solid results can be attributed to Osisko Gold Royalties' ("Osisko") superior business model that insulates it from inflation, and the record average realized gold price in the period.

As highlighted six weeks ago in my previous update, Osisko had closed its CSA Mine transaction to improve its growth profile (a very positive development), but the stock was outside of its previous a low-risk buy zone after significant outperformance vs. its peer group - hence my Neutral rating. Since then, the stock has underperformed its peer group and come back to retest its major breakout level. However, while the stock has seen an improvement in its relative value vs. peers, the stock has still not triggered a low-risk technical setup to justify adding to my position, hence the Neutral rating. Let's take a closer at the Q2 results below and recent developments:

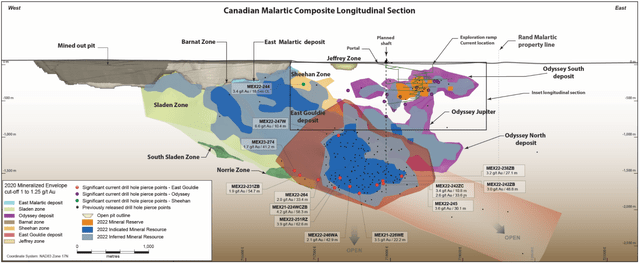

Canadian Malartic Operations - Agnico Eagle Website

All figures are in United States Dollars unless otherwise stated with a C$ in front of the figure.

Q2 Results

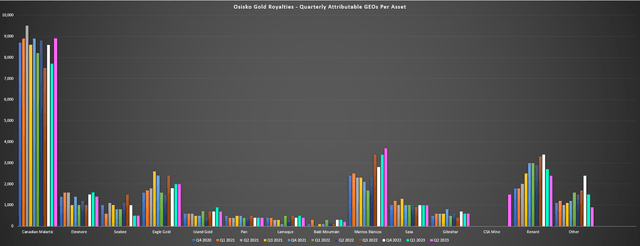

Osisko released its Q2 results earlier this month, reporting quarterly GEOs earned of ~24,600, an 11% increase over the year-ago period. This was helped by higher contributions from Eleonore, Eagle, Island, Lamaque, and a major step up in ounces earned from its Mantos Blancos stream (~3,700 GEOs vs. ~2,300 GEOs), in additional to an initial contribution from its recently closed silver stream on the CSA Mine in Australia. The GEOs earned from these assets offset a softer quarter at Seabee where grades will improve in H2 (lower production related to unplanned downtime in Q1 and tough comps from a grade standpoint), a softer quarter at Renard, and roughly flat production from Canadian Malartic where the first stopes from Odyssey were mined in Q2, but the mine saw lower grades year-over-year which offset the higher throughput in the period.

Osisko Gold Royalties - Quarterly GEOs Earned - Company Filings, Author's Chart

Digging into the operations a little closer below, it's important to note that Osisko's North American focused portfolio was partially impacted by wildfires in the period, with Renard having to shut down temporarily in June, pointing to a slight dip in stream sales in the upcoming quarter. Meanwhile, Island Gold saw unplanned downtime due to smoke from wildfires and lower milled tonnes due to weather-related power outages as well as maintenance on the fine ore bin. Fortunately, multiple assets are likely to see higher production in H2, with Island expected to benefit from higher grades, Seabee will see much higher production with a back-end weighted year, and Eagle typically has its strongest period in H2 due to seasonality, setting up a strong finish for this asset as well (even adjusting for temporary evacuation in late July). So, I would expect a strong finish to the year for Osisko.

Osisko Gold Royalties - Quarterly Attributable GEOs Per Asset - Company Filings, Author's Chart

Looking at the results from a financial standpoint, Osisko reported revenue of C$60.5 million (+17% year-over-year), operating cash flow of C$47.4 million (+35% year-over-year), and a 93% cash margin in the period. The results benefited from higher average realized prices of $1,976/oz and $24.13/oz silver and helped the company to finish the quarter with C$70.0 million in cash, C$250 million in net debt, and significant liquidity remaining to fund both small-size (sub $50 million) and larger ($200+ million deals) if new opportunities come across the plate over remainder of the year. As for recent deals, the company increases its Gibraltar Silver Stream from 75.0% to 87.5% and added a 1.0% copper NSR and 3.0% gold N SR at Costa Fuego, with the potential for this asset to contribute upwards of $10 million in revenue per annum in its first 14 years of production based on an $8,500/tonne copper price and a $1,900/oz gold price assumption.

Osisko Gold Royalties - Revenue & Cash Margins - Company Filings, Author's Chart

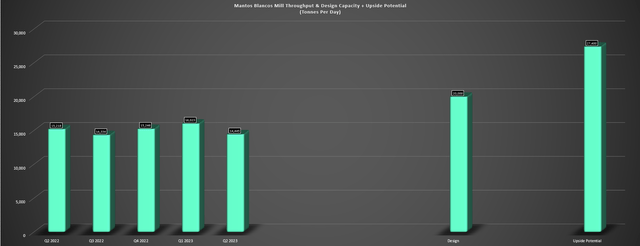

Finally, while Mantos had a disappointing Q2 with a decline in throughput, Capstone Copper (OTCPK:CSCCF) noted that a plan is in place to address plant stability which should ultimately help the asset to consistently operate closer to its design rate of 7.3 million tonnes per annum (~20,000 tonnes per day) and at more consistent rates in Q4. During Q2, production came in at a disappointing ~14,400 tonnes per day, well behind the design of ~20,000 tonnes per day due to mill maintenance downtime for a mill lubrication system and restricted throughput related to tailings dewatering challenges due to clays present in the top benches of Phase 20. Meanwhile, grades were also lower year-over-year due to mine sequencing. However, while the ramp up for this asset has been slower than hoped which hasn't benefited Osisko as much as I expected, these ounces are simply deferred, and the long-term potential for this asset is ~10.0 million tonnes per annum potentially, translating to significantly higher attributable production (18,000+ GEOs per year) vs. contributions were seeing to Osisko currently.

Mantos Blancos Quarterly Mill Throughput, Design Capacity & Upside Potential (10MTPA) - Company Filings, Author's Chart

Recent Developments

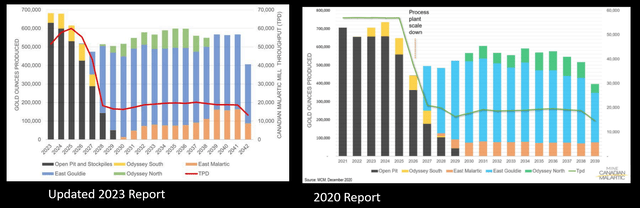

Moving over to recent developments, Osisko had a busy quarter, with several positive developments across the portfolio. Starting with the Canadian Malartic Mine, Osisko received the positive news that the mine life has been extended by three years to 2042 and that the average production profile has increased from ~547,000 ounces from 2029 to 2039 to ~558,000 ounces from 2029 to 2041. Meanwhile, we've seen a 23% increase in life of mine payable gold production vs. the 2020 study, and the total resource base (M&I, inferred, and reserve ounces) now sits at ~15.7 million ounces, up from ~14.6 million ounces in the 2020 study. However, it's important to note that there appears to be a considerable upside to this figure, with Agnico noting that mineralization in the Odyssey internal zones is not included in the mine plan and is low hanging-fruit given its proximity to current and planned underground infrastructure.

Canadian Malartic - 2023 Report LOMP vs. 2020 LOMP - Agnico Eagle Filings, Malartic Partnership TR

Meanwhile, as for other near-mine opportunities, Agnico Eagle has continued to enjoy exploration success west of East Gouldie (gap between East Gouldie and Norrie) and continued to hit mineralization east of East Gouldie, with mineralization extending well over 1 kilometer to the east to the Rand Malartic Property Line (where Osisko's attributable ounces royalty ground ends). So, between upside to the west of East Gouldie, upside in the East Gouldie extension that extends roughly 1 kilometer to the Rand Malartic property line, and upside in the Odyssey internal zones, there ultimately looks like there could be ~20 million ounces of resources attributable to Osisko Gold Royalties' ground at Odyssey alone, suggesting the potential for this royalty to continue paying out into the 2050s potentially.

Canadian Malartic & Odyssey Project Drill Highlights - Agnico Eagle Website

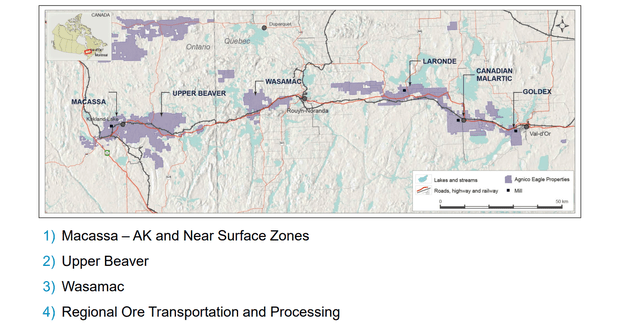

As for the bigger picture standpoint, Osisko Gold Royalties is in the unique position of being able to double-dip at Malartic, benefiting from a 2.0% royalty that covers ~25,500 hectares of land in the Kirkland Lake Camp, which includes Amalgamated Kirkland, Upper Canada, and Upper Beaver, with a combined resource base of ~6.5 million ounces of gold and ~42,000 tonnes of copper. In addition, the company has a per tonne royalty of US$0.30/tonne royalty on any ore sourced outside of the royalty boundaries, meaning that if Agnico were to send ore from the Kirkland Lake Camp to Upper Beaver, Osisko would benefit from a 2.0% royalty and US$0.30 per tonne of processed through the mill. In addition, this per tonne royalty would benefit Osisko at nearby and regional opportunities like Camflo, LTA, and Wasamac, with the potential for ~30,000 tonnes per day of ore coming from non-royalty ground post-2030.

Abitibi Gold Belt & Canadian Malartic - Agnico Eagle Presentation

Assuming ~30,000 tonnes per day were sourced from non-royalty post-2030, this would be an additional $9,000/day ($3.3 million per annum) on top of its already beefy royalties at the Odyssey Project where it's important to note that Osisko owns a 5% NSR on the highest-grade and largest deposit at Odyssey (East Gouldie, ~7.9 million ounces of gold) and the Kirkland Lake Camp which is likely to a source of feed by next decade for the asset. So, to summarize, while Agnico Eagle's costs and sustaining capital may have gone up at Odyssey vs. the previous study due to inflationary pressures ($768/oz cash costs vs. $630/oz), this does not impact Osisko due to its attractive business model as a royalty/streamer. Plus, Osisko's future at Malartic has never been more attractive, with the world's third largest gold producer owning 100% of the asset and looking for ways to take advantage of the 40,000 tonnes per day of future excess capacity (PTR benefit) and with opportunities on Osisko's royalty ground (addition royalty benefit).

Moving to other developments, there were several, with the two runners up being the successful closing of two streams at the CSA Mine in Australia discussed in more detail in my previous update, with 11,000+ GEOs per annum post-2024 with an increase to 14,000+ GEOs per annum from the fifth anniversary to 33,000 metric tonnes of copper being delivered, with upside to this figure if Metals Acquisition Corp (MAC) can successfully increase mined tonnes, allowing for a throughput rate closer to 1.4 million tonnes per annum (above the current mine plan). Meanwhile, in the James Bay Region of Quebec, Gold Fields has taken a 50% interest in Windfall which has three benefits.

1. The asset is now fully funded with both partners being well capitalized based on upfront and deferred payments for this 50% interest

2. The asset is de-risked given that Gold Fields is a very experienced operator with multiple underground mines

3. Exploration can ramp up regionally while the asset is moving through permitting and construction given that Gold Fields will sole fund the first ~$55 million in regional exploration (exploration costs shared thereafter)

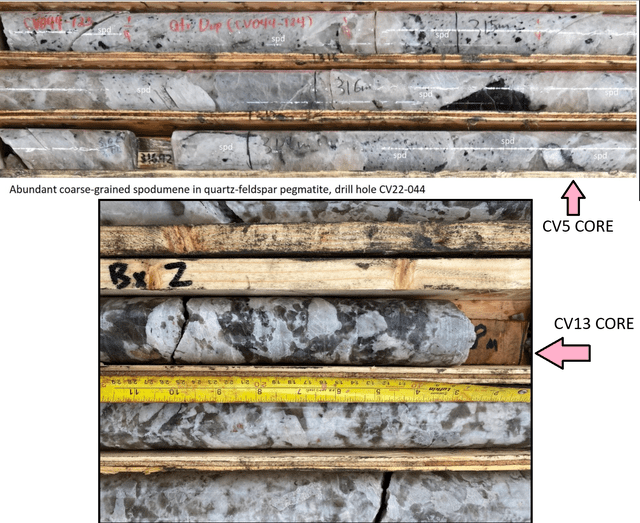

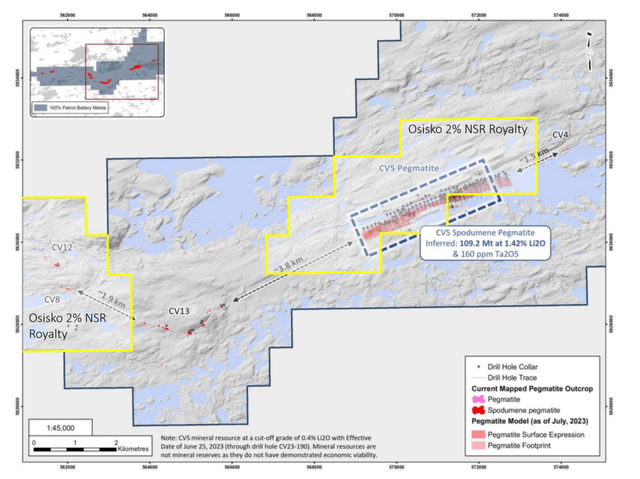

Finally, as for other recent developments, Patriot Battery Metals recently announced an impressive maiden resource at CV5 of 109.2 million tonnes at 1.42% Li2O, the inferred category at a cut-off grade of 0.40% Li2O. It's important to note that this includes only one of the pegmatite clusters on the property, and there looks to be the potential to connect CV13 to CV5 with a ~4.0 kilometer gap between the two deposits, where the company has already hit impressive intercepts at CV13 (22.6 meters at 1.56% Li2O and 22.4 meters at 1.28% Li2O, and with both exuding similar mineralization styles (coarse grained spodumene within quartz-feldspar pegmatite) and favorable metallurgy (amenable to dense media separation processing which means no grinding, no flotation, and high recoveries with the benefit of lowering capex and operating costs).

CV5 Core & CV13 Core - Patriot Battery Metals

While the delineation of a major resource at CV13 wouldn't directly benefit Osisko Gold Royalties given that its royalty ground cuts off before CV13, it would still be positive for two reasons. The first is that if there is a major resource at CV13 as well, it wouldn't be a stretch to assume there's also resources nearby at CV8 and CV12 which are on Osisko's royalty ground, and it wouldn't be shocking that there was another smaller deposit between CV13 and CV5 with room for additional mineralization in the FCI East claim block between the western edge of the currently defined CV5 and Osisko's royalty ground cut-off. As for the second point, if CV13 does prove to be another high-grade resource, this would increase Patriot Battery Metals' appeal to a major given that this is already a world-class deposit. And in the hands of a major, the project would significantly de-risked and a larger operator could look at higher throughput rates at the onset due to being better capitalized.

Osisko Gold Royalties Royalty Coverage At Corvette - Osisko Company News Release

So, what's the opportunity here?

Assuming a conservative $800 million in annual revenue starting in 2031 and an effective ~1.8% royalty on the total resource (90% coverage of future mine plan with a 2.0% NSR), this could translate to ~$14.4 million in annual revenue to Osisko Gold Royalties, or the equivalent of 7,500+ GEOs per annum, translating to ~7% growth from its current production profile from an asset that wasn't being discussed and was a sleeper in the portfolio two years ago. Hence, I see this as quite positive for Osisko Gold Royalties and yet another solid future contributor among a long list of other development-stage assets that could contribute by 2030. And even assuming less than half of these opportunities shown below come online by 2030, Osisko could see another 45,000+ attributable GEOs per annum, translating to roughly ~50% attributable production growth on top of already expected organic growth from Mantos Blancos, Island, Lamaque, Tintic, and its CSA Mine streams (copper stream kicks in next year).

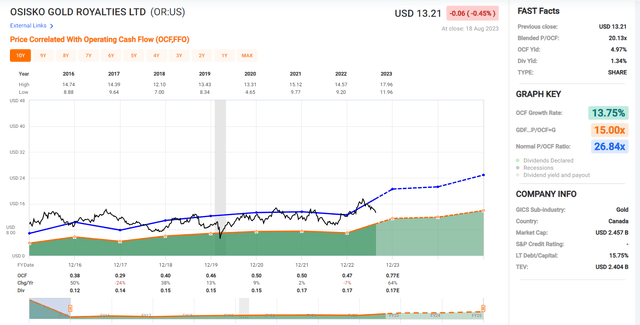

Valuation

Based on ~186 million fully diluted shares and a share price of US$13.20, Osisko trades at a market cap of ~$2.46 billion and an enterprise value of ~$2.71 billion. This leaves the stock trading right in line with its estimated net asset value of ~$2.44 billion, and at just ~16.3x FY2024 cash flow per share estimates of US$0.81, the stock continues to trade at a large discount to the top-4 royalty/streaming companies from a P/NAV and P/CF standpoint. Notably, it also trades at a discount to its historical multiple of ~26.7 P/CF (10-year average).

Osisko Gold Royalties - Historical Cash Flow Multiple - FASTGraphs.com

This reversion from an outperformer to an underperformer over the past two months is likely attributed to the surprise management shake-up, which is unfortunate given that I believe the former CEO, Sandeep Singh, did an exceptional job at the helm over the past two years by simplifying the story (de-consolidation of ODV), achieving a nice balance of development-stage and producing royalties from an acquisition without over-paying, and being disciplined when the sector was hot in H2 2020 to H2 2021 to not do any major transactions and instead choosing to wait for more favorable conditions like those that are present currently. That discipline has left Osisko with nearly $380 million in liquidity in arguably the best environment for royalty/streaming companies in years (royalties/streams are more favorable than high-cost debt or equity, when equity prices are at multi-year lows for many smaller gold/silver producers and developers).

Using what I believe to be a fair multiple of 23.0x cash flow to reflect the depressed multiples sector-wide and FY2024 cash flow per share estimates of US$0.81, I see a fair value for Osisko Gold Royalties of US$18.65. And from a P/NAV standpoint, I see a similar fair value using a more conservative multiple of 1.40x P/NAV; I see a fair value for the stock of US$19.30. So, regardless of how one slices it, the stock appears to have 41% to 46% upside to fair value, making it far more attractively valued than the larger royalty/streaming peers like Franco-Nevada Gold (FNV) and Wheaton Precious Metals (WPM), and the company is in the favorable position of not having uncertainty related to one of its major streams with Wheaton PM (Penasquito).

Summary

Osisko Gold Royalties had another solid quarter in Q3, closing two streams (silver, copper) on the CSA Mine, increasing its stream at Gibraltar, seeing positive developments from the Odyssey Project at Canadian Malartic (longer mine life, slightly higher annual production), as well as positive exploration results at Island Gold and the major news that Gold Fields will purchase a 50% ownership of Windfall. Meanwhile, after quarter-end, Patriot Battery Metals released an impressive resource (8th largest global lithium pegmatite resource and largest in the Americas) at Corvette (effective ~1.8% NSR), prompting lithium giant Albemarle (ALB) to take an equity stake in Patriot Battery Metals. And while this is still years away from first production, this could be an 7,500+ GEO per annum contributor (~$15 million per annum) for Osisko by 2031, and potentially higher in a larger production scenario if a major were to swoop in and take over the project.

Despite these positive developments, Osisko's share price has pulled back sharply from its highs, with the stock now trading at a discount to most of its peers and at levels where the stock could easily see over 50% upside in the next two years. Plus, after three years of near unprecedented inflationary pressures, several producers have become un-investable, shrinking the number of ways to invest in the sector with an attractive reward/risk setup, which has made low-risk and high-reward names like Osisko Gold Royalties even more appealing from a relative value standpoint. So, if we see further weakness, I would view this as a buying opportunity.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of OR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing. Given the volatility in the precious metals sector, position sizing is critical, so when buying small-cap precious metals stocks, position sizes should be limited to 5% or less of one's portfolio.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)