InPlay Oil: Make This Play On The O&G Sector

Summary

- Free cash flows may not be as strong as they were in 2022 as commodity prices are weaker.

- Stronger commodity prices in the second half of the year should result in stronger returns to shareholders via dividend/buybacks.

- I estimate the stock is as much as 264% undervalued and is a screaming buy.

zhengzaishuru

All figures are in CAD unless otherwise noted as that is the company's reporting currency.

My most recent article on InPlay Oil (TSX:IPO:CA) was in May 2023 after Q1 2023 results were released where I made the following conclusion.

The script has certainly flipped on this company as previous articles marketed IPO as more of a high growth at a reasonable price company. That is looking to no longer be the case as it looks to be positioning itself to return capital to shareholders rather than prioritizing growth. Management has indicated that this can be accomplished should WTI prices stay above US$55/BBL, I see this as optimistic given their natural gas curtailments and weaknesses in that market and would put that number at closer to US$60/bbl. I still firmly believe this is a low risk ~7% yield investment and investors should be able to realize double digit returns over the next few years through further dividend increases or share buybacks.

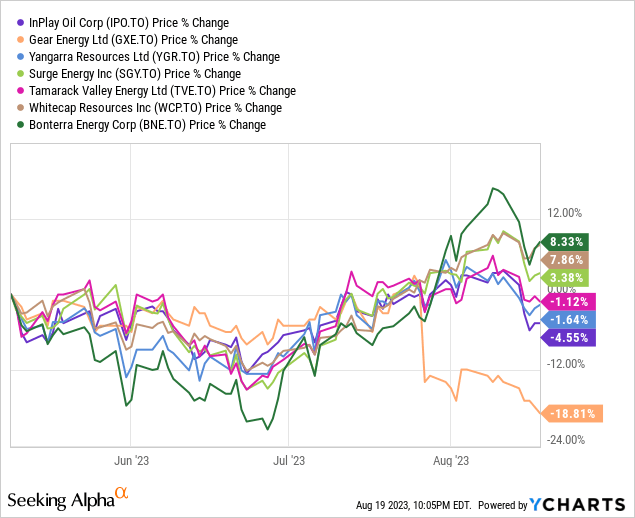

The stock has unfortunately been fairly flat since I wrote on it despite the recent increases in oil and natural gas prices. WTI averaged $85/bbl USD is August up from $65/bbl in May primarily because of extended voluntary cuts to Saudi Arabia’s crude oil production and increasing global demand. To be fair many of the small cap producers have not benefited from the recent surge in oil prices. Most Alberta producers experienced one-time drops in production in May-June because of wildfires which the market is likely taking into account.

I analyze Q2 2023 results and provide my outlook.

Q2 2023 Results

Q3 2023 MD&A (InPlay Oil)

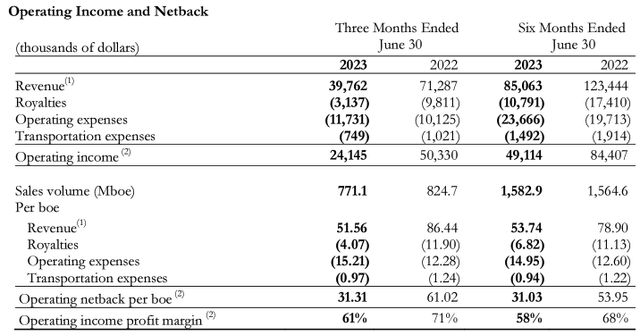

Revenue fell 44% and 31% respectively compared to the three and six months ending June 30, 2022. This was in part due to production declines for the three and six months ending June 30, 2023 which was 6% lower compared to Q2 2022. This was due to the aforementioned wildfires which forced IPO to halt production at Drayton Valley from May 4, 2023 to May 19, 2023, impacting production for the quarter by ~300 boe/d. In addition, curtailments were imposed by a third party natural gas processing facility due to capacity constraints starting February 2023 impacting production by ~500 boe/d over the second quarter.

The larger contributor to the large decline was the decrease in commodity prices. In Q2 2023 WTI oil prices decreased 26% averaging $74.96/bbl USD compared to $101.35/bbl USD in the first half of 2022. IPO sells oil at monthly average Edmonton Par prices less quality differentials adjusted for transportation and marketing fees. Light, sweet oil differentials between Cushing, Oklahoma and Edmonton, Alberta are affected by pipeline and railway capacity, refinery turnarounds, and market supply/demand conditions. Monthly index differentials averaged a $3.08/bbl USD discount for the second quarter of 2023 compared to a $0.50/bbl USD discount for the second quarter of 2022. Monthly index differentials averaged a $2.98/bbl USD discount for the first half of 2023 compared to a $1.73/bbl USD discount for the same period in 2022.

IPO's averaged net realized price for crude oil was $92.97/bbl USD for the second quarter of 2023, 32% lower than the second quarter of 2022 realized price of $136.40/bbl USD. IPO's average realized natural gas sales price was $2.61per Mcf for the second quarter of 2023, 66% lower than the second quarter of 2022 realized price of $7.61 per Mcf as a result of depressed natural gas prices. IPO's average realized NGL price was $33.73 per boe for the second quarter of 2023, 44% lower than the second quarter of 2022 realized price of $59.73 per boe as a result of lower realized propane price and lower butane, condensate and pentane prices which track WTI pricing.

Fortunately this large decline in oil prices was largely offset by the 40% decrease in royalties per barrel of oil (or equivalent) from the first six months of 2022. Production coming from new wells drilled by IPO on crown lands qualify for royalty incentives that reduce crown royalties for periods of up to 48 months from initial production depending on where commodity prices are at. After which point crown royalties from these wells will be subject to the regular Alberta royalty structure. Excluding the adjustments the average royalty rate would have been 12.5% and 15.0% higher respectively for the three and six months ending June 30, 2023. Unfortunately operating netbacks still fell 49% and 42% respectively compared to the three and six months ending June 30, 2022.

Outlook

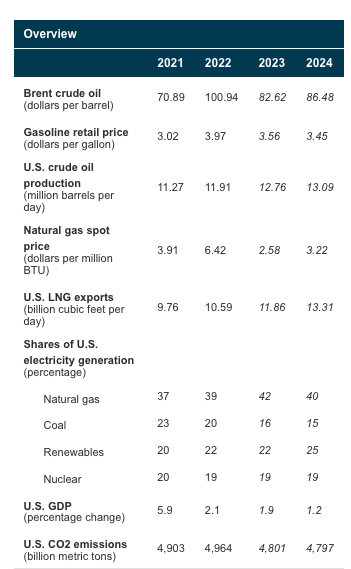

The August 2023 EIA Short-Term Energy Outlook is bullish on crude oil prices.

The Brent crude oil spot price averages $85 per barrel (B) in August in our forecast. Crude oil prices have increased since June, primarily because of extended voluntary cuts to Saudi Arabia’s crude oil production and increasing global demand. We expect these factors will continue to reduce global oil inventories and put upward pressure on oil prices in the coming months, with the Brent price averaging $86/b in the second half of 2023 (2H23), up about $7/b from our July Short-Term Energy Outlook (STEO) forecast for the same period. Rising global oil production in 2024 in our forecast keeps pace with oil demand and puts moderate downward pressure on crude oil prices beginning in the second quarter of 2024 (2Q24).

Source: EIA Short-Term Energy Outlook

Oil prices hovered near three-month highs in August, on expectations that Saudi Arabia would extend voluntary output cuts into September and tighten global supply. Saudi supply cuts have brought back deficits, according to a Goldman Sachs analyst adding that they see the extra Million bpd Saudi cut to last through September and be halved from October. Brent Crude prices are expected to be at least $80/bbl USD for the remainder of the year and may go as high as $95/bbl USD yet.

EIA Forecast (EIA)

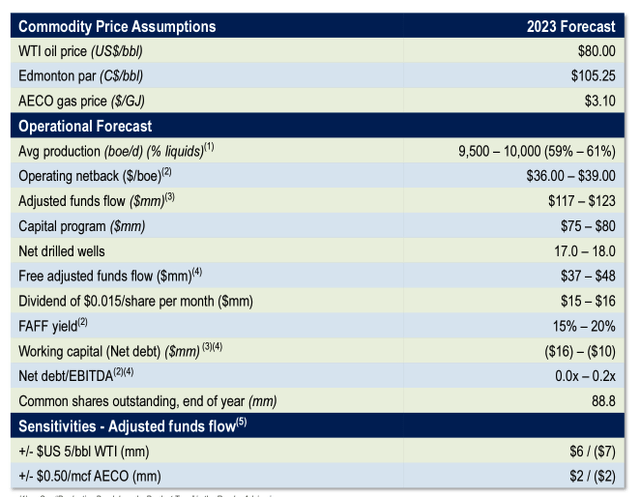

As one-time production constraints are now largely in the past, IPO management has indicated they can get back to their initial target of 9,500-10,000 boe/d with the weighting being constant from 2022 at 59% crude oil and 41% natural gas or liquid natural gas.

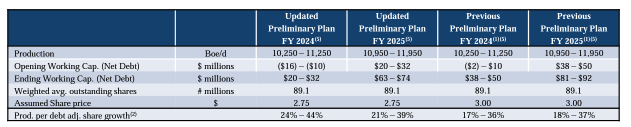

Canadian producers may never see free cash flows like they saw in 2022 again due to the significant rise in OPEC spare capacity over the past year, the return to growth in international offshore projects, and declining U.S. oil production costs, but that doesn't mean E&Ps like IPO are not good investments. Although management's expectations for natural gas pricing may be slightly aggressive with AECO pricing being closer to $2.60/GJ the last couple months, the FAFF yield at current prices is still at ~15% even at the lower end of their production guidance. Moreover the $0.015/share monthly dividend which provides a ~7% yield is covered by cash flows after CAPEX by ~2.5X and would still leave $22 Million to increase the dividend or buyback shares which is 10% of its market capitalization.

Q3 2023 Investor Presentation (InPlay Oil)

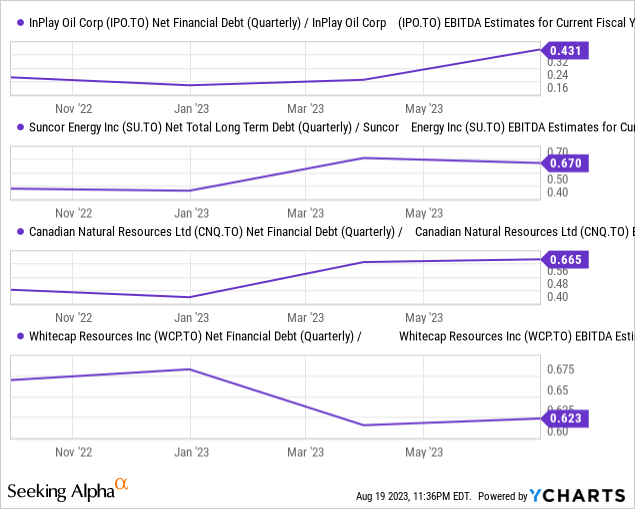

Its leverage is extremely low at ~0.4X this year's expected EBITDA which is among the lowest in the industry and even better than the Canadian Super majors like Suncor (SU:CA) and Canadian Natural Resources (CNQ:CA). With debt repayment largely out of the way I foresee greater cash flows going towards dividend increases or share buybacks.

As it has enough inventory to last 15-20 years we should expect steady production increases at 5-10% a year with minimal CAPEX expenses as efficiencies are realized which will increase returns to shareholders in years to come.

Q3 2023 Investor Presentation (Inplay Oil)

Valuation

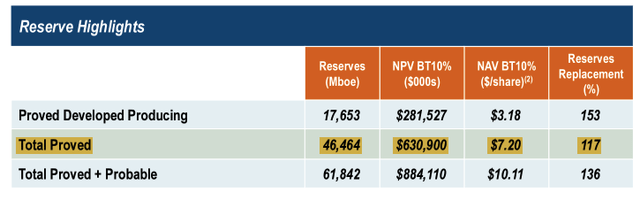

Management has valued total proved reserves at $631 Million or $7.20/BOE CAD which is almost 3X the current market capitalization of $225 Million or $4.80/BOE. It should be pointed out that natural gas reserves are as much as 15% overvalued. Still this does not account for the $884 Million in probable reserves so I am comfortable assigning a fair value of $6.60/share.

Q3 2023 Investor Presentation (InPlay Oil)

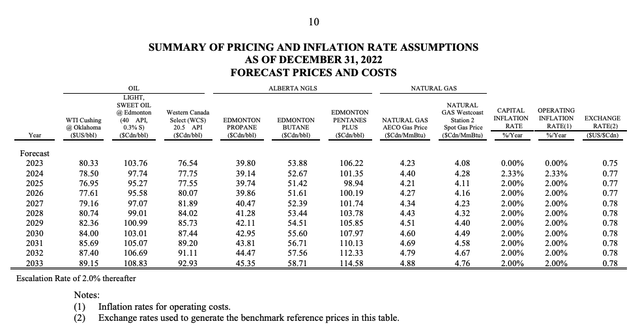

2022 Annual Information Form (InPlay Oil)

Conclusion

IPO may not repeat its stellar 2022 performance as commodity prices at those levels may be a thing of the past. The company still trades well below its fair value and its low debt load should allow for ample returns to shareholders.

IPO is as much as 264% undervalued at current commodity prices and is a pound the table buy. In the meantime one can enjoy the 7% dividend yield which is as safe as they come.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of IPO:CA, SU:CA, CNQ:CA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.