VHT: Overweight Health Care As It Makes Its Seasonal Dip

Summary

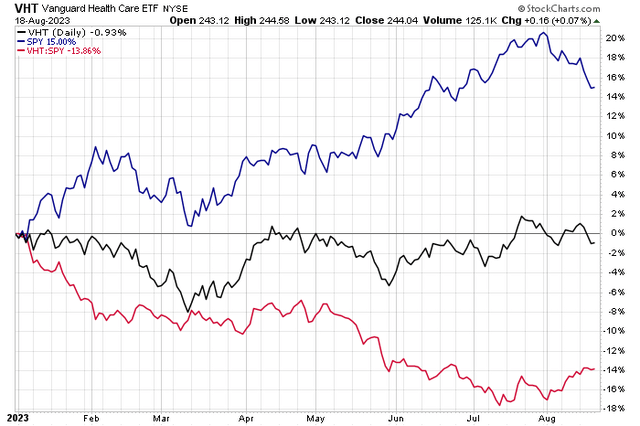

- Health Care sector has shown recent relative strength in the last month after a poor start to the year versus the S&P 500.

- Vanguard Health Care sector ETF is recommended with low expense ratio and solid long-term returns.

- VHT has a bullish rounded bottom pattern and potential for a breakout above $250 as a tough time on the calendar ensues.

ljubaphoto

The Health Care sector struggled mightily through mid-July this year. A risk-on trade favored mega-cap growth through May, then cyclicals and small caps took the lead as the summer got going. Over the last month, though, some defensive areas, including Health Care, have shown some alpha. I assert that relative strength can continue.

I have a buy rating on the Vanguard Health Care sector ETF (NYSEARCA:VHT).

YTD Performance: VHT Showing Recent Relative Strength

According to the issuer, VHT seeks to track the performance of a benchmark index that measures the investment return of stocks in the health care sector. The fund employs a passively managed approach, using a full-replication strategy when possible and a sampling strategy if regulatory constraints dictate. VHT includes stocks of companies involved in providing medical or health care products, services, technology, or equipment.

VHT is a large ETF with more than $17 billion of assets under management and pays a near-market dividend yield of 1.41% as of August 18, 2023. With an exceptionally-low expense ratio of just 10 basis points, investors can capture Health Care sector exposure without paying a high fee. What is also encouraging lately is the pickup in relative momentum with the fund, earning it a solid B+ Momentum ETF Grade from Seeking Alpha.

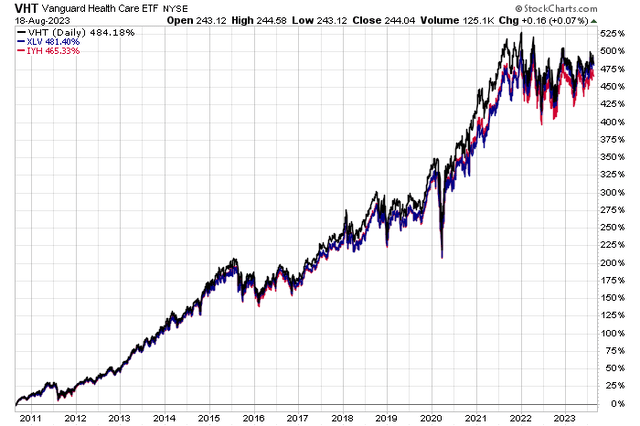

I also like the fund’s strong liquidity – its 3-month average daily volume is not that impressive at barely more than 200,000 shares, but its 30-day median bid/ask spread is just 0.03%, per Vanguard. Investors can also consider the Fidelity MSCI Health Care Index ETF (FHLC) as it is two basis points cheaper, but the iShares U.S. Healthcare ETF (IYH) is considerably more expensive. Long-term returns are similar among VHT, IYH, and the XLV SPDR Health Care sector fund.

VHT Long-Term Returns On Par With IYH & XLV

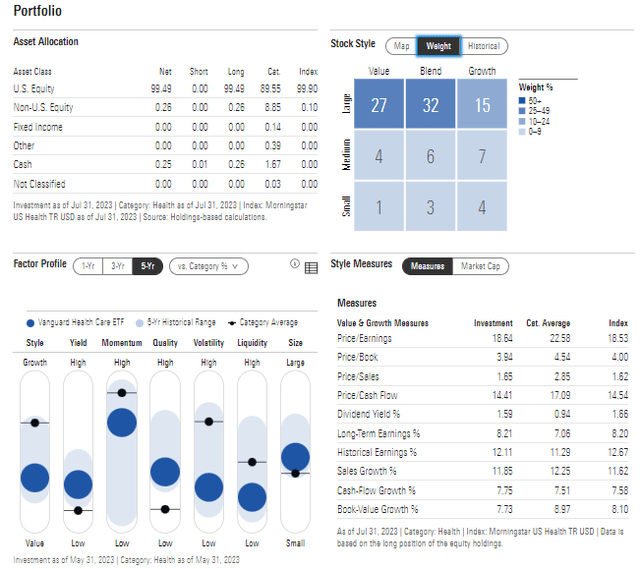

VHT’s portfolio consists of 419 stocks with a high 47% invested in its top 10 holdings, so there is some concentration risk despite the vast portfolio. This is an ideal fund for taxable accounts since annual turnover is just 3%. Also, its 24-month beta is just 0.71, so it tends to move around with less volatility compared to the S&P 500.

Digging into the portfolio, data from Morningstar shows that about 75% of the ETF is invested in large-cap stocks, while a sizable 25% is allocated to SMIDs, which offers some diversification benefit, but it also means there can be more volatility compared to a strictly large-cap fund. On valuation, VHT has a price-to-earnings ratio of just under 19 – near the S&P 500’s P/E. With a bent to the value style and a somewhat modest yield, it differs from the SPX’s growth tilt.

VHT: Portfolio & Factor Profiles

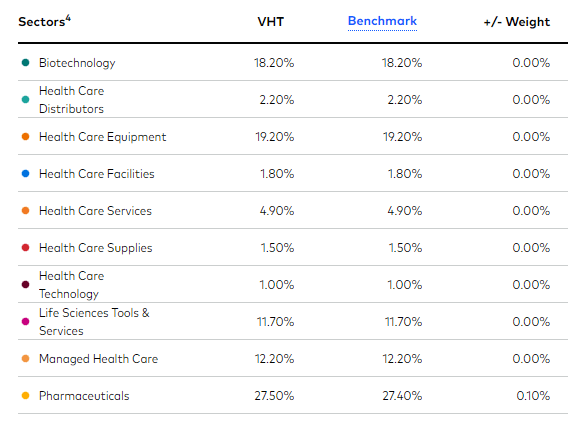

In terms of industry allocation, VHT has significant exposure to the aggressive biotech industry but also a sizable weight to more stable areas. That is the hallmark of the Health Care sector in general – it spans the risk spectrum, but dominance by stable large-cap drugmakers helps make the area commonly a source of stability during market turmoil.

VHT: Industry Exposure

Vanguard

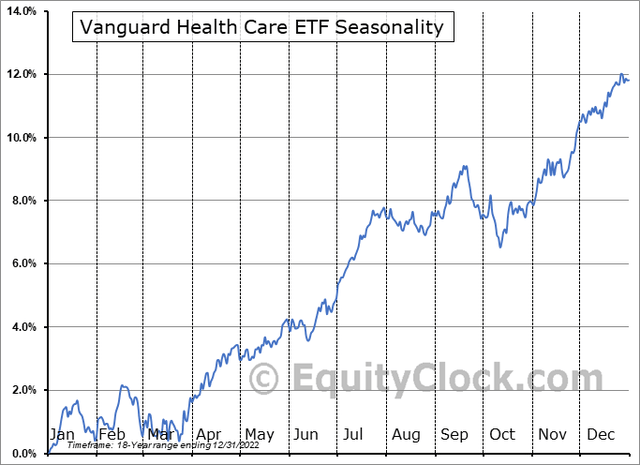

Seasonally, late August is not a bad time to be long or overweight the Health Care sector, according to data provided by Equity Clock. While there can be volatility in early Q4, the fund tends to rally from mid-October through year-end. In its 18-year history, the fund has shown to offer some stability during notoriously volatile stretches for the S&P 500 this time of year.

VHT: Consolidation From Late Q3 Into Q4

The Technical Take

VHT bottomed out in June of last year. Since then, it has been putting in a bullish rounded bottom pattern through a series of higher lows, and just recently, the long-term 200-day moving average has inflected higher with more consistency – that is a positive sign for the bulls.

Still, notice in the chart below that there is a high amount of volume by price up to about $250, making a breakout tough for the bulls in the near term. With some horizontal trendline resistance apparent in the upper $240s and low $250, that is another feature making price action tough on the bulls. If we see a breakout, then a rally toward the late 2021 high near $270 is certainly in play. Downside support is seen just under $240 at the July low and $233 from the late Q2 nadir.

Overall, there is not strong upside momentum, but I like the rounded bottom feature and would like to see a breakout above $250 on a weekly closing basis.

VHT: Bullish Rounded Bottom, $250 An Area of Significance

The Bottom Line

I have a buy rating on VHT. I like its low expense ratio, recent relative strength, and its technical view is somewhat encouraging as we enter a sketchy time on the calendar for the broader market.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)