EFA Vs. HEFA: Hedging International Exposure Still Working

Summary

- Both the EFA ETF and HEFA ETF invest based on the MSCI EAFE Index, giving investors the choice of being hedged against the currency risk or not.

- This article updates my review from last February in terms of ETF holdings, distributions, and most importantly, returns.

- For investors who do not believe the USD will decline precipitously against other major currencies over a long period, I would give EFA a Sell rating and HEFA a Buy.

- Looking for a portfolio of ideas like this one? Members of Hoya Capital Income Builder get exclusive access to our subscriber-only portfolios. Learn More »

Andrey Semenov/iStock via Getty Images

Introduction

I just doubled the assets in my traditional IRA by transferring funds from my Pre-tax 401k plan. With funds to invest and my only international exposure in that account being the 33% allocation the iShares MSCI ACWI ETF (ACWI) has, I started reviewing pure international ETFs like the iShares MSCI EAFE ETF (NYSEARCA:EFA) to add exposure. ACWI ETF gives me minor exposure to EM stocks, which the EFA ETF would not if I chose to swap them out.

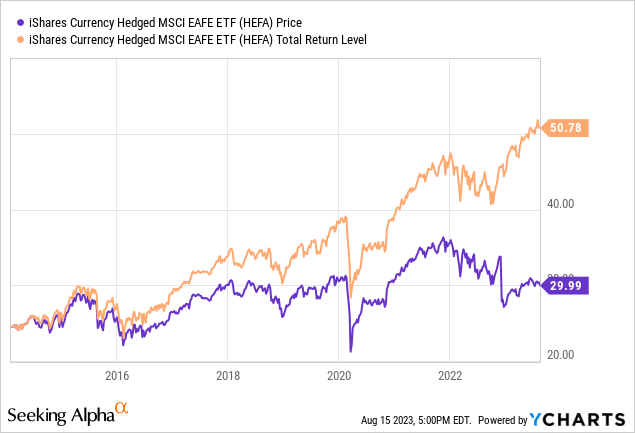

With the additional risk an investor takes on when investing outside their home country, as EFA would do for any investor in different increments, is you take on currency risk. For USD-based investors, owning the iShares Currency Hedged MSCI EAFE ETF (BATS:HEFA) instead of the EFA ETF helps eliminate that risk. When the USD is strong, a hedged ETF should result in higher returns compared to an unhedged fund. The opposite should happen when the USD loses value relative to foreign currencies the ETF is exposed to.

I use the term risk in the sense that there is an extra variable to consider as hedging should cut both ways. That said, results since 2014 clearly show that owning HEFA was the better choice.

For investors who do not believe the USD will decline precipitously against other major currencies over a long period, I would give EFA a Sell rating and HEFA a Buy rating. This article builds on and updates this same comparison I did last winter (article link). I chose to be more focused this time so reading the prior article next is suggested.

Index overview

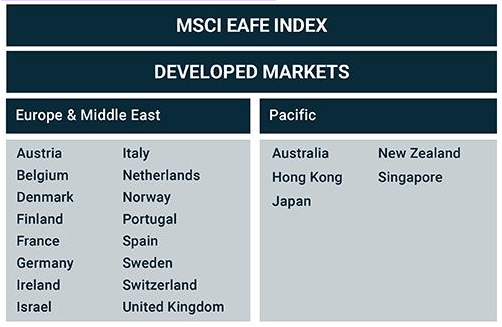

The only difference with the indices used by these two ETFs is one is USD-hedged, the other is not. MSCI provides this description and facts on the Index.

The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries around the world, excluding the US and Canada. With 798 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

Source: msci.com Index

Currently, the index includes the following 21 countries: notice EM ones are excluded.

msci.com Index

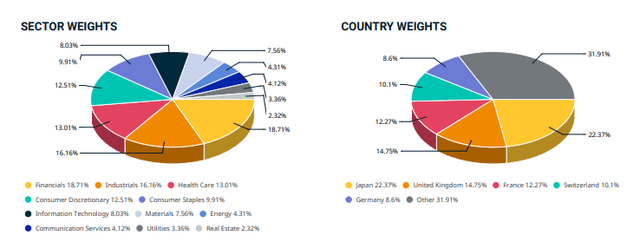

As of the end of July, the Index sector allocations and top country weights were, and these are reflected in both ETFs reviewed.

iShares MSCI EAFE ETF review

Seeking Alpha describes this ETF as:

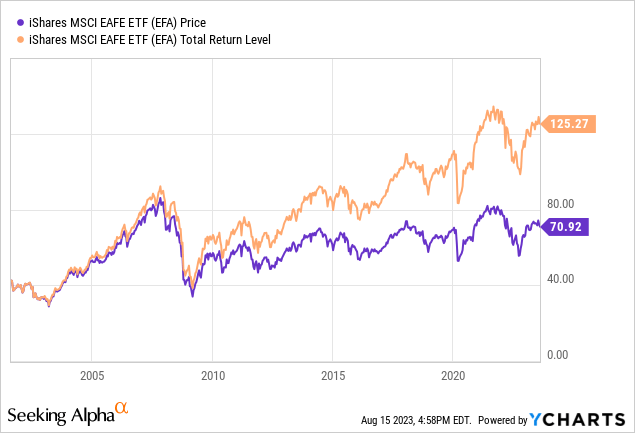

The investment seeks to track the investment results of the MSCI EAFE Index composed of large- and mid-capitalization developed market equities, excluding the U.S. and Canada. EFA started in 2001.

EFA has $9.4b in AUM and has 33bps in fees. The TTM Yield is 2.2%.

EFA holdings review

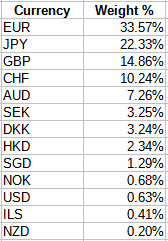

Since the ETF holds the Index in the same allocations, I chose not to repeat what is shown in the above pie charts; only include additional details. The Index Country allocations shown above does not reveal the currency risk EFA holders have. Since all currencies do not move the same against the USD, this information could be important to some investors.

ishares.com; compiled by Author

The EURO and Japanese Yen account for over half the currency exposure, with the British Pound and Swiss Franc accounting for another 26%. The USD represents both cash and ADR holdings.

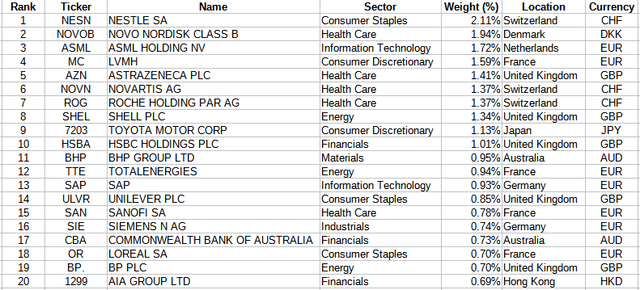

Top holdings

ishares.com; compiled by Author

With over 800 positions, the Top 20 stocks still account for 23% of the portfolio. The 400 smallest positions come in at 14% of the weight, little but still somewhat meaningful.

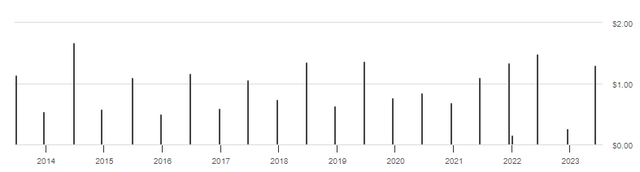

EFA distribution review

Seeking Alpha Quant grades EFA's distribution history as a "C+". The EFA ETF shows no pattern of growing its distributions over the past decade. With a yield near 2%, this might not be a concern as income-needing investors would look elsewhere for that goal.

iShares Currency Hedged MSCI EAFE ETF review

Seeking Alpha describes this ETF as:

It invests in public equity markets of global ex-US/Canada region. The fund invests directly, through derivatives and through other funds in stocks of companies operating across diversified sectors. It uses derivatives such as forwards to create its portfolio. It invests in growth and value stocks of companies across diversified market capitalization. It seeks to track the performance of the MSCI EAFE 100% Hedged to USD Index. HEFA started in 2014.

HEFA has $3.5b in AUM and the fees are 35bps, only two more than EFA. The large year-end payout makes the current TTM Yield meaningless. A more typical yield is between 2-4%. While it should have payouts close to EFA, plus/minus hedging income, we see later that is not always the case.

HEFA holdings review

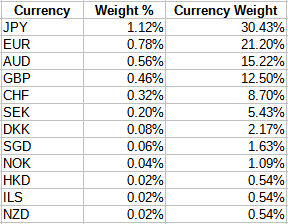

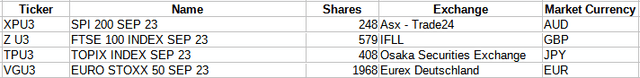

With the goal to hedge the MSCI EFA Index, the only equity holding HEFA has is owning the other ETF reviewed here: that accounts for 98% of the portfolio weight. All the other assets are designed to provide for the hedging strategy, which has 2 positions for each of these currencies.

ishares.com; compiled by Author

When you compare the hedging weights to the currency weights shown for EFA, they are not 100% aligned. I assume there are reasons for that that a hedging expert could explain. HEFA also has several futures contracts.

ishares.com; compiled by Author

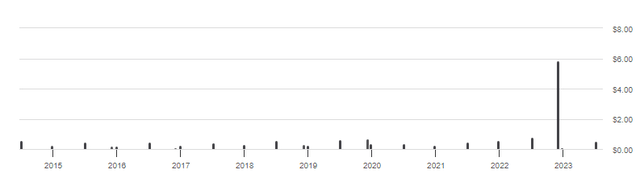

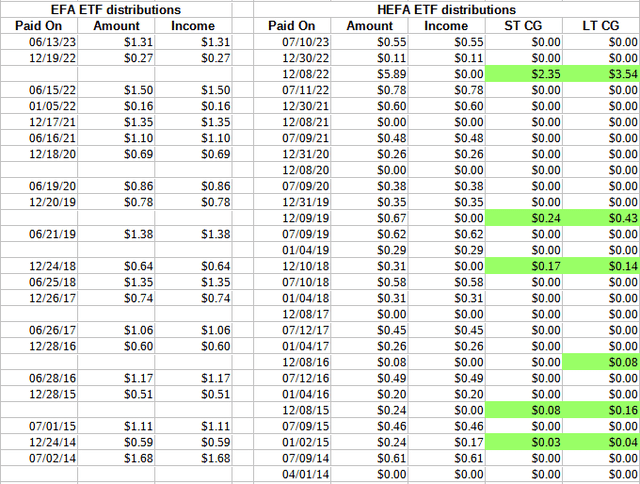

HEFA distribution review

I will compare the two payout levels later, but one difference is HEFA has a history of making year-end (mostly) additional payments sourced from ST & LT Capital Gains, as was the case last year. Since the only real difference is the hedging strategy, these must come from those profits.

Comparing ETFs

Since HEFA owns the EFA ETF, except for hedging-generated income, I would have thought the regular payouts would match up well; they do not. I lined up the payments dates as best I could to ease the comparisons.

ishares.com; compiled by Author

Picking a yield for the HEFA is tough as the TTM yield, thanks to the large CG payment, is shown as 21%; not realistic going forward. iShares lists the SEC yield for HEFA as 1.8% versus 2.1% for the EFA ETF. Not counting 2022, HEFA's income distributions were more each year than for EFA, but not by enough to make a real difference or reason to own HEFA over EFA.

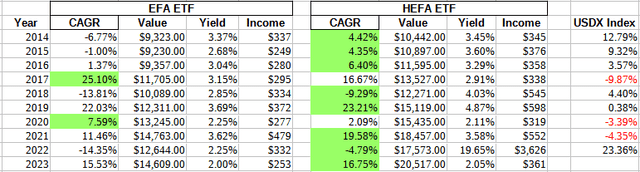

The next chart includes income and CAGR results for each year back to 2014 when HEFA started. The last column is an index that measures the USD against a basket of other currencies.

multiple sites; compiled by Author

Except for 2021, as expected, owning HEFA benefited investors when the USD was strong against foreign currencies; EFA in years with a weak USD.

Performance since last review

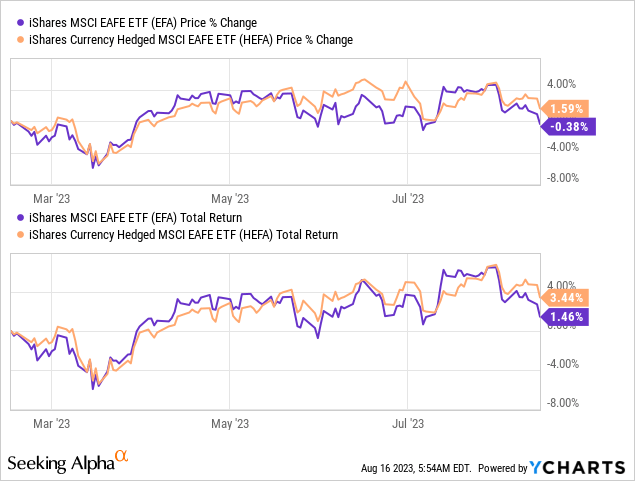

First, I will show the returns only since the review last February.

Over the past six months, the better performer has changed several times, with HEFA currently ahead.

Seeking Alpha | Stock Market Analysis & Tools for Investors ticker charting

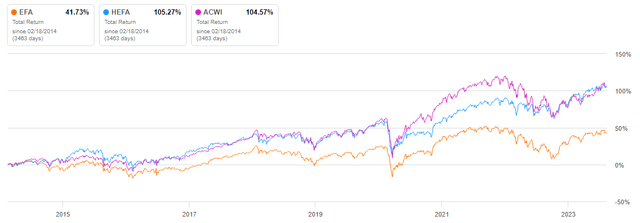

Since I mentioned that I might sell my ACWI for one of these ETFs, I included that ETF in the next chart and data points.

seeingalpha.com ticker charting

As indicated above, hedging has been a positive for international investors. What was somewhat of a surprise was HEFA outperforming ACWI with its large US holdings. Translation: Take away the currency effect and international stocks are performing as well as their US counterparts. Risk wise, as measured by Beta, HEFA is .70; EFA .84, and ACWI .91, which results in HEFA having the best Sharpe and Sortino ratios among these ETFs.

Portfolio strategy

With most major companies drawing revenue across the globe, the concept of assigning a stock to a country based on incorporation or headquarters location (standard practice) seems archaic. This can be seen in the fact that international stocks have a closer correlation to US stocks over the past 20 years than over the past 50 years. That said, stocks like those in the MSCI EAFE Index still provide some diversification benefit as they are still below a 90% correlation rate. That might be enough justification to have an international allocation despite their underperformance compared to US stocks. Hedging has greatly reduced that difference as shown above.

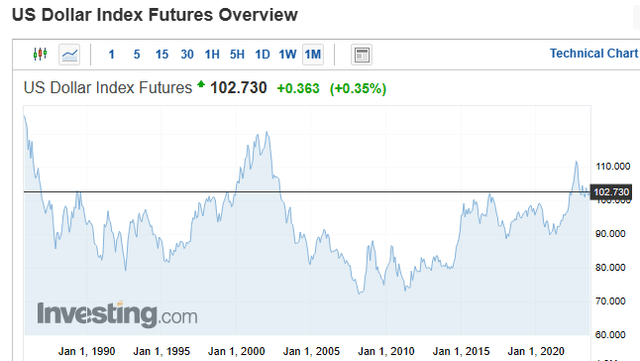

The above is the past; as for deciding between EFA and HEFA now, the question becomes, "Where is the USD heading?". The next chart shows some history.

Recently, the USD reached levels last seen over Y2K concerns, and has been trending downward recently. Various experts listed factors that influence the direction of the USD, those being:

- Monetary policy decisions made by the Federal Reserve and equivalents overseas.

- Political events, as well as geopolitical events.

- Interest rate differentials between currencies. High rates attract foreign investment, lifting demand for the currency.

- Current and expected inflation rate differences between countries with lower rates compared to other currencies providing strength.

This article contains what various expects are predicting for several major currencies.

Final analysis

The easy part is the HEFA ETF deserves a Buy rating and EFA a Sell rating for investors determining where to hold their international equity allocation. It also appears that a 60/40, US/INTL ETF like ACWI allows for some international exposure without the need to hedge.

My international exposure is 14% of my equity allocation. I already own two hedged international ETFs that have focused strategies, not more widespread ones like HEFA, and they account for 37% of that exposure. One of those was reviewed here: IHDG Vs. IQDG: 6-Month Update. My next step is to compare HEFA against IHDG or other diverse hedged ETFs to see which I might want to switch my ACWI ETF into or maybe use unallocated cash. Once I decided, I will submit an article on the process and decision I made.

Final thoughts

Almost a decade of history indicates hedging definitely works as expected and across different equity groupings or factor strategies. Despite talk/concern that the USD will lose its status as the world’s reserve currency, neither the Euro or Chinese Yuan seemed poised to replace it. That gives the USD special demand no other currency has.

For more thoughts on the USD, see Seeking Alpha articles about the US Dollar Index (DXY).

I ‘m proud to have asked to be one of the original Seeking Alpha Contributors to the 11/21 launch of the Hoya Capital Income Builder Market Place.

This is how HCIB sees its place in the investment universe:

Whether your focus is high yield or dividend growth, we’ve got you covered with high-quality, actionable investment research and an all-encompassing suite of tools and models to help build portfolios that fit your unique investment objectives. Subscribers receive complete access to our investment research - including reports that are never published elsewhere - across our areas of expertise including Equity REITs, Mortgage REITs, Homebuilders, ETFs, Closed-End-Funds, and Preferreds.

This article was written by

I have both a BS and MBA in Finance. I have been individual investor since the early 1980s and have a seven-figure portfolio. I was a data analyst for a pension manager for thirty years until I retired July of 2019. My initial articles related to my experience in prepping for and being in retirement. Now I will comment on our holdings in our various accounts. Most holdings are in CEFs, ETFs, some BDCs and a few REITs. I write Put options for income generation. Contributing author for Hoya Capital Income Builder.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)