Africa Oil: Doubling Down

Summary

- A drilling campaign should increase production in Nigeria.

- Africa Oil has already received more cash than it borrowed to obtain the interest in Nigerian production.

- The company holds interests in three development-stage companies that have speculative upside potential.

- AOIFF purchased interests from Eco Atlantic to increase its exposure to a South African discovery.

- The evaluation of the Venus discovery is underway.

- This idea was discussed in more depth with members of my private investing community, Oil & Gas Value Research. Learn More »

Jeremy Poland

Africa Oil (OTCPK:AOIFF) recently announced a purchase from Eco Atlantic (OTCPK:ECAOF) of a material interest in some awarded blocks located in South Africa. This gives Eco Atlantic some badly needed cash because Eco Atlantic has no source of income otherwise. It also allows Africa Oil to concentrate in an area where the subsidiary Africa Energy (OTCPK:HPMCF) also has a considerable interest as well.

Equity Investments

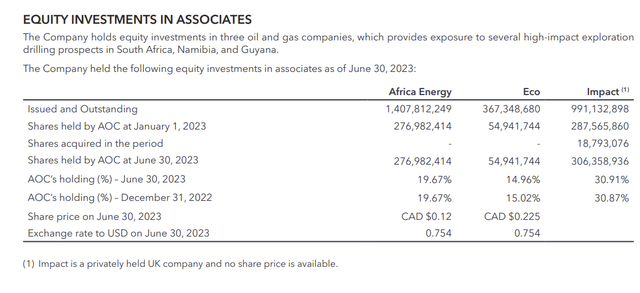

The company has additional growth opportunities through other companies owned as shown below:

Africa Oil Investments In Other Companies (Africa Oil Second Quarter 2023, Filed Earnings Report)

It needs to be noted that Africa Oil has a significant investment in the companies with which it has contracted (at one time or another) for either additional interests or to purchase more shares.

There are other companies within the Lundin Group of companies that have interests in these companies as well. Therefore, it is probably valid to consider that the Lundin Group of companies controls these companies that Africa Oil has invested in.

Africa Oil itself began as part of the Lundin Group of companies. Several key officers have held other positions within this group of companies. That close association is likely to continue well into the future. This relationship gives the company access to a lot more resources than would be typical for a company of this size.

This association also makes the transition to a new CEO far less risky than would be the case with a typical small company. Most new senior officers come from elsewhere in the Lundin Group of companies.

Africa Oil further announced its intention to withdraw from the Kenya projects. This further focuses the company on established production as well as the discovery in South Africa. The withdrawal focuses the company on the projects with the best cash flow chances while eliminating some more speculative prospects.

Africa Oil is a relatively small player in some offshore projects that tend to be very large. So far, management has proven to be very adept at right sizing the risk. This has allowed the company to grow considerably since it obtained a material income source. Now it appears that the company will expand into South Africa in the future to diversify into another revenue source.

Cash Flow Growth

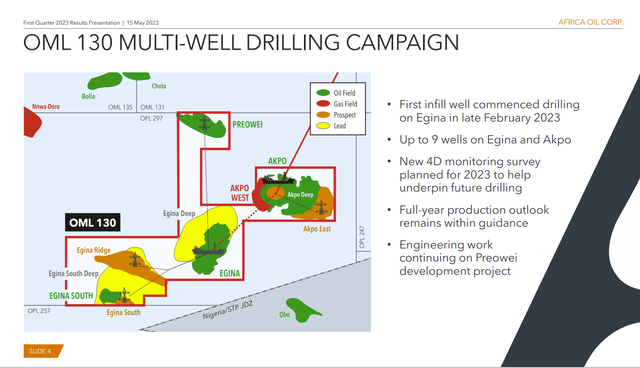

Cash flow should grow at a material pace from the operator led program to drill more wells.

Africa Oil Nigerian Production Enhancements Planned (Africa Oil First Quarter 2023, Earnings Conference Call Slides)

The established production in Nigeria that provides all of the company cash flow should see considerable growth from the proposed campaign shown above. Free cash flow will be either non-existent or negative due to the investment required for this drilling plan. However, cash flow should climb as the program proceeds to enhance free cash flow significantly in the future.

Drilling already began for two water injection wells. The third well, a potential oil producer, has now begun drilling also.

The overall risk of this plan is considered less than is the case with pure exploration plays. There is still a reduced risk of dry wells or unexpected complications. But overall, the chances of a successful production increase are pretty high.

Operators Of Nigerian Interests

The operators of the producing properties in Nigeria are Chevron (CVX) and TotalEnergies (TTE). Operators of this stature add credence to the project in an area that is probably considered riskier than most.

Since the production is offshore, this production is insulated from the onshore issues of Nigeria and therefore reduces the perceived risk of operating in Nigeria.

The government of Nigeria does support the industry. But it is also considered somewhat ineffective.

Management has noted several times that they have already received the purchase price of the interest back (and more). This is an important consideration when operating in an area with above average risk.

Finances

The company itself is debt free. Now the company it has an interest in (which is called Prime) does have some debt and also has just announced a refinancing of that debt.

However, the cash position has deteriorated somewhat from the first quarter. But it is still strong. Management does have a conservative note that the company may need financing in the future depending upon how things go. Management made the decision to advance some cash to Impact so that Impact has the money needed to fund some commitments. But this came at the same time as the drilling campaign in Nigeria got underway. Therefore, cash flow is at best tight until that drilling campaign completes.

The key is that this is a small company that is participating in some very large projects. That often means some creativity until the company gets larger. Fortunately, this company has the resources of the Lundin Group of companies to help out if the need arises.

The risk of course would be that other partners to Prime fail and the company would have more than expected liability. Right now, that does not appear to be a consideration as Prime does generate a fair amount of cash.

South Africa

The company does have an interest in a discovery and it has interests in some nearby prospects through its ownership of Africa Energy. The company has additional interests as well through its ownership of Eco Atlantic shares. The managing operator of the discovery is Total. The operator of the discovery has applied for an operating permit. That process will likely take about a year. Then it likely would take another several years before initial production is established.

Total is also drilling some extension wells and will proceed to test them.

Fortunately, Africa Oil has established production from its Nigeria interests that can be used to finance the discovery in South Africa to production. The debt free balance sheet would also allow for some debt as well should that be needed.

The risk is of course large cash needs in South Africa combined with large cash needs in Nigeria. While that currently appears to be unlikely to happen. The chance is definitely not zero.

South Africa is probably the country (along with Namibia next door) with the best infrastructure to support an oil industry on the African continent. The government is stable and comparable to European governments. An income source from this area would be more highly valued than the income from Nigeria.

Key Takeaways

Africa Oil has transitioned from a development stage company to one with substantial production through its interest in Prime. That interest will likely allow it to fully participate in the development of the South Africa discovery as well as potentially develop some other interests there should that prove to be a favorable way to go.

The current income source in Nigeria has repaid the debt incurred to obtain that interest (and more). Now there is a good possibility of more income through a drilling campaign by one of the operators. All this is important once the approval to bring the South African discovery to production happens. The South Africa project would of course then need considerable cash.

The extension of a lease in Nigeria has resulted in a reduction of future taxes owed. That amount turned out to be relatively larger. In fact it was far larger than any costs associated with the exit from Kenya.

Since Africa Oil does have a considerable income source, the risk to shareholders of dilution in the future is not great. Currently, there are several projects that have demanded cash. So far, that need has been met with cash on hand. There is a conservative warning in the financial statements that a possibility exists for the need for outside financing at some point in the future. The company can also choose to maintain its interest in the invested companies. Those companies have periodic financing needs as none of them have an income source.

Now the future is one of growth. Clearly this company has above average risks due to the source of cash flow being in Nigeria. However, the debt free balance sheet and overall negative net debt (when consolidating Prime) appear to somewhat minimize that risk. The diversification into South Africa brings a much more supportive atmosphere for a cash flow source. That makes this company a strong buy consideration for those investors willing to accept the risks.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

I analyze oil and gas companies like Africa Oil and related companies in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies -- the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that are not published on the free site. Interested? Sign up here for a free two-week trial.

This article was written by

Occassionally write articles for Rida Morwa''s High Dividend Opportunities https://seekingalpha.com/author/rida-morwa/research

Occassionally write articles on Tag Oil for the Panick High Yield Report

https://seekingalpha.com/account/research/subscribe?slug=richard-lejeune

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AOIFF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)

www.upstreamonline.com/...This quote from the new CEO as well:

“I will present my business plan with an unwavering focus on shareholder returns during the autumn.”