Zoom Q2: Key Metrics Weaken Further (Rating Downgrade)

Summary

- Zoom's Q2 revenues beat estimates at $1.139 billion, but revenue growth has significantly declined from the pandemic peak.

- Key business metrics, such as customer growth and net expansion rate, show significantly weakening performance.

- Zoom's revenue guidance for Q3 was slightly below expectations, while the company's key metrics raise concerns about future revenue growth.

ALEKSEI BEZRUKOV/iStock via Getty Images

After the bell on Monday, we received fiscal second quarter results from Zoom Video Communications (NASDAQ:ZM). Perhaps the biggest pandemic darling, the company has seen its revenue growth rate and stock price fall dramatic from their highs. While shares popped on some initial numbers that looked pretty good, the company continued to report significant weakening across all of its key business metrics.

For Q2, revenues came in at $1.139 billion, which beat street estimates by roughly $30 million. However, it's important to note that a year ago analysts were looking for $1.26 billion in the period, so expectations have come down quite a bit. Revenue growth over the prior year period was down to less than 4%, after peaking at 369% during the height of the coronavirus sales boom. On the bottom line, non-GAAP EPS of $1.34 beat by 28 cents, which one might normally see as quite large, but we should remember that there has been a 23-cent average beat over the last four quarters.

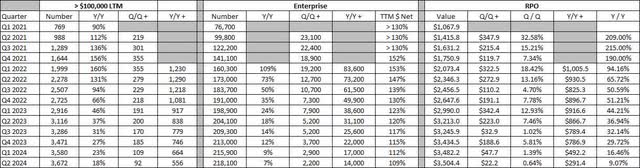

As I've detailed in many prior reports, like the one seen three months ago, Zoom's growth story has all but evaporated. Beyond just the revenue growth rate nearing zero in recent periods, key metrics and major customer data continue to show very troubling trends. In the chart below, you can see three of the key items management presents to us each quarter. Dollar values are in millions.

Key Business Metrics (Zoom Earnings Presentations)

The number of customers delivering over $100,000 in trailing twelve-month revenues increased by 92 in Q2, but this was the non triple-digit number reported in several years, with the year-over-year percentage growth rate under 20% now. The year-over-year numerical increase has been more than halved in just two years. The number of Enterprise customers added also hit a new multi-year low both numerically and in terms of the growth rate, with the net expansion rate now under 110%, down more than 40 percentage points from its high a few years back.

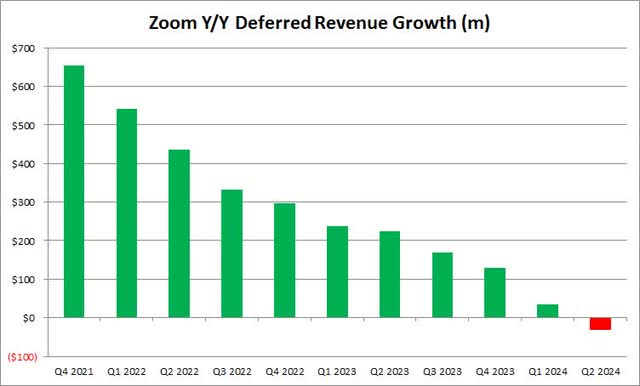

Remaining performance obligations ("RPO") barely increased in the quarter, and the year-over-year growth rate is now in the single digits. This shows that the company is having a major problem adding new business, and we could see the RPO total actually decline rather soon. Additionally, as the chart below shows, the amount of total deferred revenue on the balance sheet actually declined over the prior year period.

Zoom Deferred Revenue (Company Earnings Reports)

When it comes to guidance, management said total revenue for fiscal Q3 is expected to be between $1.115 billion, and $1.120 billion, and revenue in constant currency is expected to be between $1.117 billion and $1.122 billion. This headline guidance was a little light, as estimates were calling for $1.12 billion. For the fiscal year, total revenue is expected to be between $4.485 billion and $4.495 billion, and revenue in constant currency is expected to be between $4.516 billion and $4.526 billion.

Management did raise its guidance for the year, but not as impressively as one might think. The bottom end of the headline guidance was only up by $20 million and the top end by $10 million, despite the company beating the midpoint of its Q2 guidance by more than $25 million. Perhaps management is being a little conservative here, but you'd like to see better overall guidance after what seemed like a solid revenue result for the second quarter.

I will be very curious to see one notable investor's reaction to this news. Zoom is a key holding in Cathie Wood's flagship ARK Innovation ETF (ARKK) as well as the ARK Next Generation Internet ETF (ARKW). The ETF firm put out a $1,500 price target for Zoom just a little more than three years from now in a model released last year. However, Ark's model featured thousands of Monte Carlo simulations that have Zoom, delivering over $54 billion in revenues for that fiscal year. That's quite a bit of growth acceleration from the near $4.5 billion in revenue guidance for this fiscal year detailed on Monday.

Zoom shares rose about $4 in the after-hours session, and that gain might seem small to someone who only looked at the headline beats and full-year guidance raise. The internal numbers here still were not great, making me wonder about the next couple of quarters, especially if the US enters a recession. The average price target on the street remains above $83, implying a double-digit upside from current levels, but we're only about two years removed from that average valuation approaching $500.

As for my personal rating, I'm moving shares to a sell now from the hold I had when I previously covered the name. Shares have risen about 10% since then, but the company's key metrics are showing major signs of trouble. If these trends continue, we could actually see revenue growth turn negative in the coming quarters. Should that happen, I think the 52-week low just above $60 is in play, and that's more than $10 of downside from here. For me to upgrade the name back to a hold, I need to hear some commentary on how the future revenue situation can again improve. Perhaps the company will use some of its $6 billion cash pile on some acquisitions to bolster the top line, but the status quo certainly needs to change here.

In the end, Zoom delivered an okay set of results on Monday, but the report was far from a home run. Q2's headline numbers came in better than thought, but the full-year guidance raise wasn't as much as it could have been. All of the company's key metrics continue to weaken, and quite considerably, leading future revenue growth to be a major question mark. Shares are initially up a few dollars on the news, but this is a company that needs to show some more impressive results for me to be a believer.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (6)