Dividend Reduction At Medical Properties Trust

Summary

- Medical Properties Trust has cut its dividend payment, which is seen as a positive move to improve its cost of capital.

- The company has been selling off assets to reduce debt and strengthen its financial position.

- MPW's dividend reduction has been well received by the market, and it's performing better than other highly-leveraged REITs.

- The REIT Forum members get exclusive access to our real-world portfolio. See all our investments here »

It's a dividend horror film for shareholders. xijian/iStock via Getty Images

Medical Properties Trust (NYSE:MPW) did exactly what it should do. MPW chopped off a huge portion of their dividend payment. Let the anger commence!

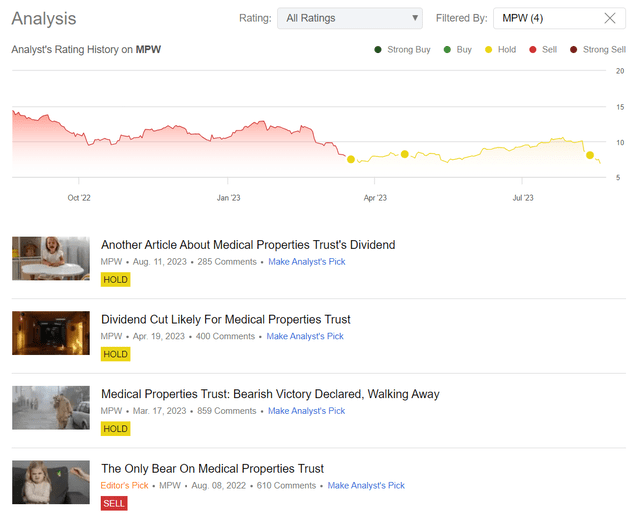

If You Only Read Seeking Alpha for Medical Properties Trust

Hi readers, for those who only use Seeking Alpha to read about MPW, you may not remember me. I was the only bear on Seeking Alpha for a long time. These are my prior articles:

Seeking Alpha

You can be forgiven for thinking that Seeking Alpha is a website devoted to Medical Properties Trust. There were often 1 to 5 articles about Medical Properties Trust in the trending section. That's a bearish sign to me, by the way. When there's that much interest, readers are seeking confirmation. Just my view. No stats to back that one up.

Why did I go neutral? The upside from buyout risk was offsetting the downside from bad decisions. That made it hard to call a direction, and I don't like to make predictions about coin flips.

Why Did Medical Properties Trust Cut The Dividend?

Cash flow.

End of article?

You probably want more detail.

Selling Off Assets

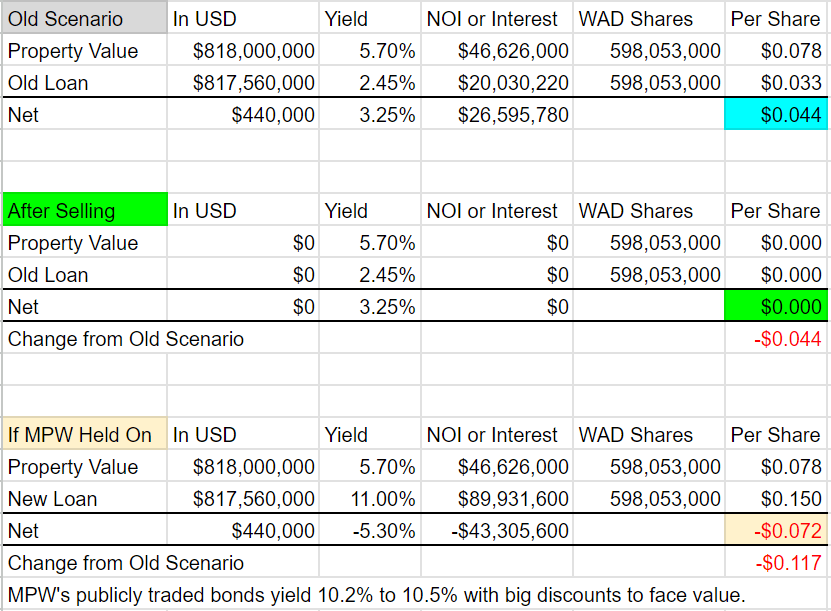

As you know, MPW has been selling some assets. That was a good move. However, it was going to be dilutive to AFFO. Somewhat dilutive. Not exactly. Math is needed.

They used to finance properties with really cheap debt. For instance, maybe a mortgage at 2.45%. Pretty much any real estate can be accretive to AFFO if you can finance it at 2.45%.

However, as interest rates went up and credit spreads for MPW increased, the cost of new debt was going to rise dramatically. MPW could hold on to the assets and seek new financing at higher rates, or they could sell the assets.

I prepared the following table previously to demonstrate their options regarding a prior property:

Author's calculations and projections

Because MPW's publicly-traded bonds offered price upside and big yields, I determined an 11% yield was an appropriate estimate for new financing.

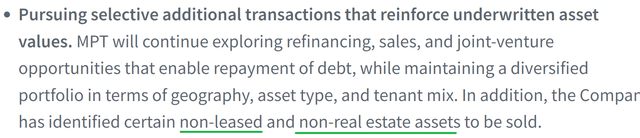

Unfortunately for shareholders, real estate isn't the best assets to sell off. There are other assets that contribute less to AFFO.

MPW has identified some other assets that need to be sold.

Prepared by The REIT Forum

MPW does own a few jets. Some might feel that management should buy their own jets for personal use. For instance, I'm "some" in the prior sentence.

MPW Debt Reduction

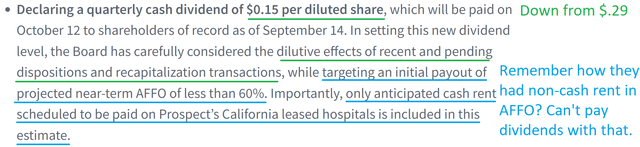

In reducing the dividend, MPW issued a reasonable press release. They focused on recent and pending transactions, looked for a low payout ratio, and focused on "AFFO" that was not including non-cash rent:

MPW

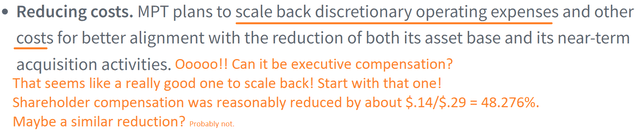

Medical Properties Trust Plans to Reduce Operating Expenses

Medical Properties Trust also is taking aim at operating expenses:

MPW

Operating expenses are another great area to look for reductions. Hopefully, it's not just property operating expenses. They might as well look at all operating expenses to find areas for reduction.

Dividend Corrected

The absurd dividend has been handled. They made the big cut rather than setting themselves up to need several cuts. That was a good choice.

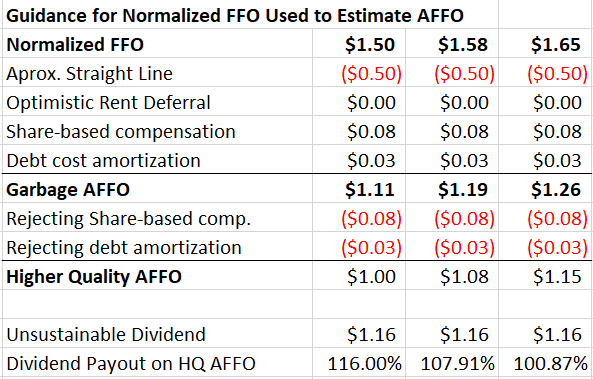

When I was covering the high dividend payout ratio, I provided the following table:

Author's calculations and projections

For a little context, the metric I used as "Garbage AFFO" is what MPW refers to as "AFFO."

I eliminated other adjustments I felt shouldn't be present, and the analysis demonstrated that dividends were too high. Despite having math in the article, something most people despise, it generated more than 800 comments. Some were from people who claimed to be accounting experts but demonstrated minimal understanding of accounting. In other words, it was about what you expect in the comments.

Clearly, an annualized dividend rate of $.60 per share looks much more reasonable in this scenario.

Conclusion

The dividend reduction for MPW is a good thing. It can significantly improve their cost of capital. They can pay down their debts and strengthen the company. For all MPW's flaws, they still have a material amount of cash flow. It wasn't enough to keep paying out that dividend, but it should be enough to keep them going.

While some investors blamed the bears, they were right to assume the dividend would need to be reduced. If the dividend was not reduced, MPW's cost of capital would keep going up. They needed a way to pay down those debts. This was an important step in the right direction.

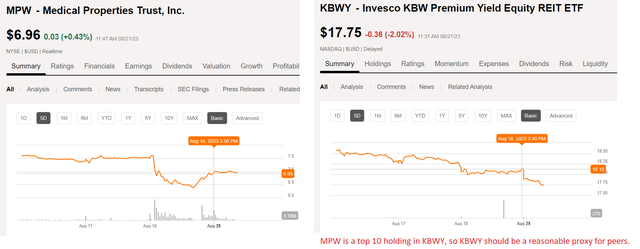

You can even see that the market is fine with this move. MPW is actually doing much better than other highly-leveraged REITs with big dividend yields and weak or negative AFFO per share growth:

Seeking Alpha

The other potential "shoe to drop" would be MPW being removed from some high-dividend indexes. However, MPW still has a very high dividend yield. It's still about 8.6%. So I wouldn't expect this cut to have a big negative impact on their position in indexes.

With the dividend cut already announced, two major bear catalysts fade away:

- The dividend cut (obviously).

- The potential for MPW to get hammered by higher rates on debt because they were bleeding out so much money through the dividend.

Higher rates can still hurt MPW, but the potential impact is reduced. Remember interest rates were going up for MPW in two ways:

- Higher Treasury rates.

- Wider credit spreads on their debts.

Reducing debt can improve the situation in two ways:

- Reduce the outstanding principal.

- Encourage thinner credit spreads on debts.

Outlook

My view is still neutral. Seeking Alpha shows "neutral" as "hold." There's no option to market an article as "neutral". In finance terms, either rating indicates the analyst is choosing to end a rating or not to assign a bullish or bearish outlook. In my opinion, the risk/reward today is better than it was at any prior point.

That's not enough to actually tip me into the bullish camp, but it moves me further away from the bearish camp. If I had to come down as either a bull or a bear, I would probably land with the bulls now that MPW is under $7.00 AND slashed the dividend by nearly 50%. However, I'm not forced to go into either camp.

Our equity REITs have dramatically lower fundamental risks. They use less debt relative to the entire capital structure and dividends are easily covered by AFFO. I seek intelligent opposition to my thesis because sometimes I'll find a good argument that can change my view. It's a lower volatility strategy, but it has performed quite well for us over the years.

I find preferred shares and baby bonds are useful tools to enhance the yield on the portfolio. It gives us a lower-risk way to enhance the yield while picking REITs based on expected total returned (dividend + price change). There was no need for investors to grasp for the MPW yield. This is how grasping for yield typically ends: A much lower share price and a dividend reduction.

Remember, MPW was more than $24.00 less than two years ago. Avoiding those traps is an important part of success.

Thanks for reading.

This article was written by

You’ll find several reports on The REIT Forum that don’t get posted to the public side of Seeking Alpha. Many of our public reports are dramatically reduced versions of subscriber articles. If you enjoy our public articles, you’ll love the content we keep for subscribers.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No position in MPW debt or equity in any form. We are long several other REITs. Exact positions are included for all members of The REIT Forum. By exact positions, I'm referring to relative weights, share counts, transaction dates, prices, dividends earned, and total returns for both open and closed positions.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (35)

Even a stopped clock….

Are you still a miserable long? I covered my short at $7.50 a day before the bottom. Now that the dividend cut is out of the way, I'll wait for a bounce into the ex-date and re-short for another 30-50% decline.