Sterling Infrastructure: Put This Stock On A Watchlist

Summary

- Sterling Infrastructure had a positive Q2 2023 earnings report and increased future earnings estimates for a potential stock catalyst.

- Sterling's long-term outlook is positive due to expected robust infrastructure spending until 2027.

- Investors should be cautious in the short-term as the stock is overbought.

- I would place Sterling on a watchlist and wait for a pullback.

Bim/E+ via Getty Images

While searching for a stock with a low valuation and strong expected future growth, I discovered Sterling Infrastructure (NASDAQ:STRL). The company had a positive Q2 2023 earnings report with increased future earnings estimates which should provide a catalyst for the stock. The long-term outlook for Sterling is likely to be positive as infrastructure spending is expected to be robust to 2027.

Sterling is involved in e-infrastructure, transportation, and building solutions in various regions in the United States. The company is involved in infrastructure projects such as roads, highways, airports, bridges, light rail, water/wastewater, and storm drainage systems. The company's customers include departments of transportation of various states, airports, port authorities, transit authorities, railroads, and water authorities.

Sterling's Positive Q2 2023 Results

Sterling's earnings results should have a positive influence on the stock over the next several months. Multiple positives came from Q2. Sterling's revenue increased by a robust 13%. Acquisitions accounted for 2% of total revenue, while organic growth comprised the other 11% in Q2.

Sterling achieved growth in each business segment during Q2. E-infrastructure is the largest segment and comprised 50% of Sterling's sales. E-infrastructure revenue increased 11% while operating margin for the segment increased 2.5% for a 32% increase in operating income. Growth in this segment was attributed to advanced manufacturing projects and data centers. The advanced manufacturing growth was driven by projects for Hyundai (OTCPK:HYMTF) and Rivian (RIVN).

The Transportation Solutions segment (29% of total revenue) achieved revenue growth of 5.9% and a 1.3% increase in operating margin contributing to operating income growth of 33%. This segment experienced a significant increase in aviation project bids in Q2.

The Building Solutions segment (21% of total revenue) increased revenue by 30% in total and by 16% organically (not including acquisitions). Operating margin increased by 0.7% to contribute to operating income growth of 38%. Residential revenue increased 21% and set a record for the number of poured slabs and for the amount of revenue generated. Commercial revenue increased 50% on strong market demand and higher margins.

The company's combined backlog increased 42% since the end of 2022 to $2.39 billion. That should help drive future revenue growth as projects are completed.

Net income increased by 40% while diluted EPS increased by 37%. The strong earnings were driven partly by an increase in gross margin from 15.4% from Q2 2022 to 17.7% in Q2 2023.

The stellar Q2 results and record backlog led Sterling to increase guidance for the full year. Sterling expects revenue for 2023 to end in the range of $1.95 billion to $2.05 billion. The company expects net income to be $125 million to $131 million and EPS to be $4.00 to $4.20. The mid-point of Sterling's guidance would be a 13% increase in revenue and 32% increase in net income. The excellent Q2 results along with increased guidance could help drive the stock higher until the next earnings report or until other catalyst-related news is reported by Sterling.

Industry Growth Tailwinds

Sterling's business segments are poised to benefit from strong expected industry growth. The global digital infrastructure market is expected to grow at 23% per year to reach $1 trillion by 2032. The growth for the E-infrastructure market is expected across numerous end markets such as IT, telecom, retail, governments, manufacturing, healthcare, and more. This can be a significant growth driver for Sterling since E-infrastructure is their largest segment comprising half of total revenue.

The next important growth driver for Sterling is transportation infrastructure as it comprises 29% of total revenue. The company should get a boost from the industry growth in this space. The global transportation infrastructure market is projected to grow at about 7.2% annually to reach over $3 trillion by 2029.

The global infrastructure construction market is expected to grow at about 6.5% annually to reach over $3.2 trillion by 2027. Sterling can benefit from a variety of projects in this area for both residential and commercial building markets.

The fact that growth is expected in each of Sterling's business segments makes it likely for the company to benefit in terms of revenue growth. The company's largest segment (E-infrastructure) has the highest expected growth which should drive a lot of Sterling's growth through the next several years.

Valuation

At first glance, Sterling doesn't appear to be attractively valued if we only look at the forward PE of 18.8x. This is slightly higher than the Engineering and Construction industry's forward PE of 18.2x. However, Sterling seems actually attractively valued on other key metrics that hold weight for the company's valuation analysis.

The PEG ratio is a more appropriate measure in my opinion for Sterling since the company has strong multiple-year expected growth. Sterling has a low PEG ratio of 0.94x. This is based on Sterling's strong expected 3 to 5 year annual earnings growth of 20%. I typically like to see PEG ratios between 1 and 2 for high growth companies. So, Sterling is valued more attractively with a PEG below one.

Another metric that is important for Sterling is the low price/cash flow of 6.6x. This is much lower than the sector median P/CF of 13.4x. P/CF is important for Sterling since cash flow is the lifeblood of the business, allowing the company to expand the existing businesses and to acquire new companies.

Sterling increased cash flow every year since 2017. Sterling increased operating cash flow by 38% in 2022. With 11% expected revenue growth and 26% expected EBITDA growth for 2023, Sterling should continue to increase cash flow at a strong pace.

Technical Perspective

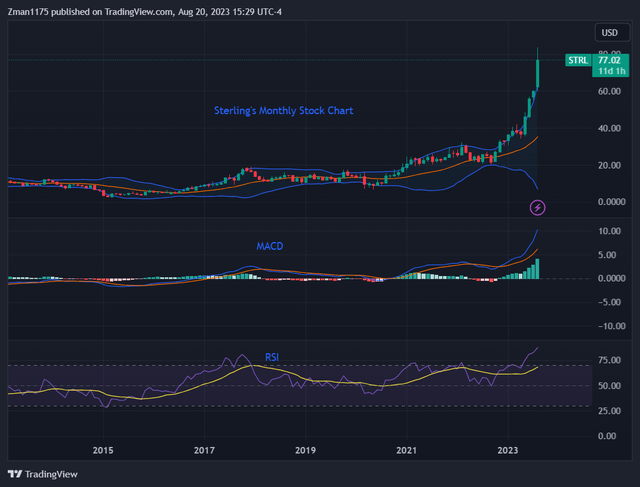

Sterling's Monthly Stock Chart (tradingview.com)

The main issue I have with Sterling's stock at the moment is that it is overbought on the monthly chart with the RSI indicator above 75 at about 88. I zoomed all the way out to the monthly chart because it provides a long-term perspective. The stock had a great run in 2023. However, the stock is due for a pullback on profit taking.

The last time the stock rose to an overbought level on the monthly chart, it declined by about 42%. I don't know if a pullback will occur or if it will be of a similar magnitude as the one in the beginning of 2018. I point this out because the overbought condition creates a certain degree of risk for potential investors. Some profit taking by large investors seems reasonable at this overbought level.

Sterling Infrastructure's Near and Long-Term Outlook

There is a lot to like about Sterling Infrastructure. The company has an attractive valuation along with strong expected future growth. The expected industry growth in each of Sterling's business segments is likely to provide long-term, multiple-year catalysts for the stock.

However, I would not jump into the stock right now at this overbought technical level. This is the largest risk for the stock in my opinion. Another risk would be growth coming in less than expected in future quarters. There could be cancellations or delays for projects in Sterling's backlog.

Overall, I like Sterling's valuation and growth outlook. I would rather wait for a pullback in the stock before jumping in due to the overbought condition. For that reason, I rate the stock as a hold for right now.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The article is for informational purposes only (not a solicitation or recommendation to buy or sell stocks). David is not a registered investment adviser. Investors should do their own research or consult a financial adviser to determine what investments are appropriate for their individual situation. This article expresses my opinions and I cannot guarantee that the information/results will be accurate. Investing in stocks involves risk and could result in losses.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.