5 Mistakes That Can Destroy Your Financial Independence

Summary

- Financial literacy is a mandatory responsibility for everyone.

- You are never too young or too old to become financially independent.

- The money habit mistakes covered in this article could turn retirement into a costly and stressful endeavor; remediate them immediately!

- Looking for a helping hand in the market? Members of High Dividend Opportunities get exclusive ideas and guidance to navigate any climate. Learn More »

shapecharge/E+ via Getty Images

Co-authored with “Hidden Opportunities.”

Growing up comes with responsibilities. As children, we are often shielded from life's harsh realities and expectations, as parents do their best to provide an affordable yet comfortable upbringing. But as we grow up, we inherit responsibilities in small increments until - suddenly - everything is ours to decide and manage.

Adults are answerable for every life obligation, including employment, paying bills, house chores and upkeep, and keeping up their word. We are responsible for what we sign up to do in our public and private lives, such as what we say, write, and commit to do. We are accountable for our actions and commitments in relationships, marriage, and friendship. We must abide by the rule of law and participate in miscellaneous responsibilities as citizens of our respective countries.

From reading and understanding all the terms when we sign contracts, maintaining a good credit history, and keeping a clean driving record, we have responsibilities closely tied to our everyday life. Our responsibilities are prevalent and perpetual. You may get a second chance if you make a mistake on some of these, but it can be very costly, and the incident can leave a lasting scar on your general well-being. The most significant part of adulthood is taking care of one's finances. Studies and surveys tell us that money is one of the biggest causes of stress among all age groups. Source.

Here are five critical errors you are making that are slowly ruining your prospects of financial independence.

1. You don’t live on a budget

During your earning years, it can be easy to spend without thinking. After all, paychecks come in regularly to support our requirements, right?

Keeping track of income and expenses are fundamental aspects of sound financial management that empower individuals to take control of their money effectively. It gives you visibility into essential and discretionary expenses and helps you prepare for unplanned events like job loss or a leave of absence for personal reasons. Having a budget tells you what size emergency savings you need to build to support yourself (and your family) through these unplanned events. You may also identify areas where you overpay for goods and services and shop for better deals.

I have been tracking my expenses since college. It started with a small book and evolved into a simple smartphone app. It takes some time to update every day (or every few days), but it is worth it as it gives me much-needed visibility into my cash flows. Having a budget in place can alleviate financial anxiety and stress. Knowing where the money is going and having a plan gives me better control over my finances.

When you retire, the line items in your budget might change, but the usefulness of having a budget doesn't.

2. You entertain debt

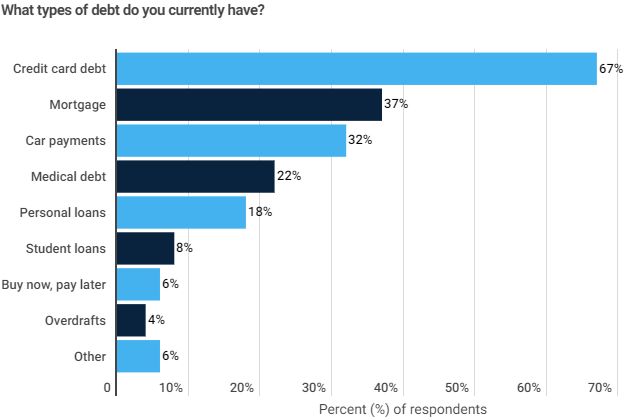

Do you have student loans, credit card balances, or car loans where you shell out interest every month? Achieving a debt-free retirement is the American dream, but three-quarters of retiring Americans have significant debt that impacts the quality of living.

ListWithClever Website

The most common types of debt retirees hold are credit card debt, mortgage, car payments, and medical debt. Debt generally challenges your financial flexibility and often prevents you from pursuing your dreams.

Individuals seeking financial independence should start by paying the highest interest-bearing debt first. Credit card debts and personal loans bear crippling interest rates above 20%. Prioritize settling these debts first by employing the debt avalanche process. Alternatively, you could improve your confidence by seeing quick progress with the settlement of smaller loans.

Becoming debt-free is the first step towards financial independence and an essential prerequisite for a comfortable retirement. In retirement, having high cash flow is more important than ever, precisely because you don't have the option of working more overtime if you need some extra cash. Retirees who limit or eliminate debt will have a lot more cushion in their monthly budget, and that means a lot less stress.

3. Retirement savings are an afterthought

Conventional retirement is defined as achieving financial independence in the third stage of life, typically at or around 60. But the number of years you plan to (or want to) work doesn’t have anything to do with your current age. Financially independent individuals can hang up their boots while they are very young.

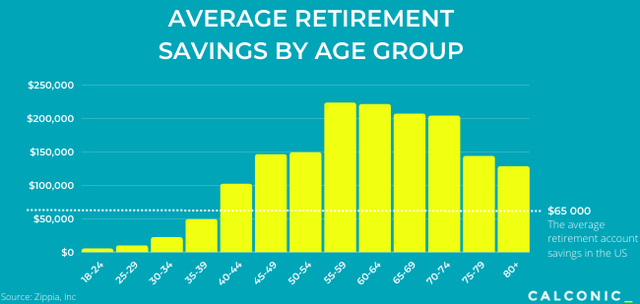

A significant number of surveyed American adults across age groups have very little in retirement savings. Whether you use the 4% rule or any other retirement strategy, most of the population is not ready to retire. Source.

Having the financial means to support yourself without depending on an employment paycheck is the most critical measure of retirement readiness. It is never too early or too late to begin. The important thing is to recognize the importance and budget your finances to accommodate a healthy portion for savings.

4. You don’t take investing seriously

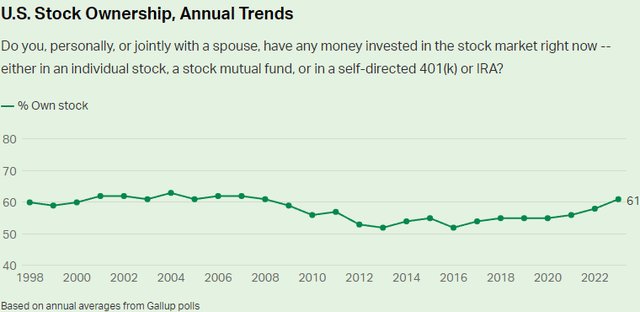

While setting aside money for future needs is an essential prerequisite to financial independence, it doesn’t by itself prepare you for retirement. Despite the popularity of no-commission trading and the plethora of digital and easily accessible ways to the financial markets, U.S. stock ownership remains below the levels of the Great Financial Crisis ("GFC"). Source.

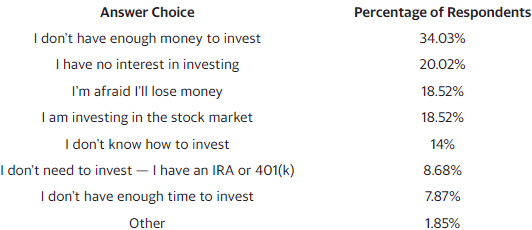

Two out of five Americans have no money invested in the markets, which is detrimental to retirement as rising prices can erode your savings over time. The biggest concerns pointed out in surveys are lack of money to invest, lack of interest, fear of losing money, and not knowing how to invest. Source.

Yahoo Finance

Financial literacy is a prerequisite to retire on your terms. If you aren't going to put in effort to improve the life of your future self, who will? Fortunately, you don’t have to do this by yourself. In today’s digital ecosystem, there are plenty of ways to get educated about investments and portfolio management.

The wise words of the Sage of Omaha couldn’t be more applicable in this context.

"If you don't find a way to make money while you sleep, you will work until you die." - Warren Buffett.

Making money in your sleep can be done by prioritizing passive income generation, so your time and effort aren’t the bottlenecks anymore for monetary returns. There are many publicly accessible financial instruments on the stock market, with several options for various age groups and unique requirements. You are only one person; why not utilize the mighty American economy to help grow your wealth?

5. You depend on a single source of income

60% of American adults, including four in ten high-income earners, live paycheck to paycheck. During your earning years, there is a strong likelihood of the next paycheck for the foreseeable future, but do you want to live this way in retirement?

And what if there is a risk to the next paycheck? Anything can happen tomorrow:

Job loss and inability to find one due to an economic downturn.

Insufficient earnings to tackle rising costs.

Unexpected expenses.

Moreover, you will not have the time or the energy to pursue passion projects, and life will be all about working to earn a living.

There have got to be better ways, and we consider dividend investing to be one of the most impactful and simple-to-adopt strategies to expand your income sources. Corporate America strives to keep shareholders happy; many well-established companies share their profits. You can collect your share of the profits with dividend stocks in your portfolio. The best part is that the money flows in with no extra time or effort on your part!

Conclusion

Money can be a very stressful topic for individuals of all age groups. Bad decisions are often costly to remediate, while the good ones reap the rewards over time. With discipline in your daily life, money doesn’t have to be as stressful of a commodity as it is for many. This article discusses five common yet critical mistakes in destroying one's financial independence. While four of the concerned items are lifestyle-related changes that we highly recommend everyone implement at the earliest, our team is particularly experienced with helping you through the last item.

You can prepare your own food, buy your meals, or hire a cook; at the end of the day, you have to eat to live. Similarly, financial matters are a responsibility regardless of age and profession. Like other everyday items, it doesn’t hurt to seek help getting yourself on the right path with your finances.

Our service focuses on transforming our hard-earned assets into a cash-producing machine to supplement our employment paycheck. This way, we have not one, not two, but 45+ unique sources of income that provide a much-needed cushion for our lifestyle and mental health. Like my employment income, I know exactly when my next dividend payment is coming, and that feeling lets me confidently pursue things I care about. What are your plans to achieve financial independence?

If you want full access to our Model Portfolio and our current Top Picks, join us at High Dividend Opportunities for a 2-week free trial.

We are the largest income investor and retiree community on Seeking Alpha with +6000 members actively working together to make amazing retirements happen. With over 45 picks and a +9% overall yield, you can supercharge your retirement portfolio right away.

We are offering a limited-time sale for 28% off your first year. Get started!

Start Your 2-Week Free Trial Today!

This article was written by

I am a former Investment and Commercial Banker with over 35 years of experience in the field. I have been advising both individuals and institutional clients on high-yield investment strategies since 1991. I am the lead analyst at High Dividend Opportunities, the #1 service on Seeking Alpha for 6 years running.

Our unique Income Method fuels our portfolio and generates yields of +9% alongside steady capital gains. We have generated 16% average annual returns for our 7,500+ members, so they see their portfolios grow even while living off of their income! Join us for a 2-week free trial and get access to our model portfolio targeting 9-10% overall yield. Our motto is: No one needs to invest alone!

In addition to being a former Certified Public Accountant ("CPA") from the State of Arizona (License # 8693-E), I hold a BS Degree from Indiana University, Bloomington, and a Masters degree from Thunderbird School of Global Management (Arizona). I currently serve as a CEO of Aiko Capital Ltd, an investment research company incorporated in the UK. My Research and Articles have been featured on Forbes, Yahoo Finance, TheStreet, Investing.com, ETFdailynews, NASDAQ.Com, FXEmpire, and of course, on Seeking Alpha. Follow me on this page to get alerts whenever I publish new articles.

The service is supported by a large team of seasoned income authors who specialize in all sub-sectors of the high-yield space to bring you the best available opportunities. By having 6 experts on your side, each of whom invest in our own recommendations, you can count on the best advice. (We wouldn't follow it ourselves if we didn't truly believe it!)

In addition to myself, our experts include:

3) Philip Mause

4) PendragonY

We cover all aspects and sectors in the high yield space including dividend stocks, CEFs, baby bonds, preferreds, REITs, and more! To learn more about “High Dividend Opportunities” and see if you qualify for a free trial, please check out our landing page:

High Dividend Opportunities ('HDO') is a service by Aiko Capital Ltd, a limited company - All rights are reserved.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Treading Softly, Beyond Saving, PendragonY, and Hidden Opportunities all are supporting contributors for High Dividend Opportunities.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (22)

I agree this should be a subject in schools.

now to be applied to the next "target." The point of paying "down" debt is to free up your card(s) for repeat misuse, opposite to paying OFF and staying OFF.When you keep a budget and seek ways to beat it in every category, it's amazing how unspent dollars leak INTO your savings! This money you can reinvest or hold for planned near-term uses, the better to leave more of your dividends (say) at work.Compliments to Rida for mentioning unplanned expenses, not "unexpected.". What possible mishap should you keep ever surprised and unready for? When you THINK ready and STAY ready with some handy cash and budgetary recourses, accidents, setbacks, and disasters seem to come less often and be less stressful when they do Good for today. Thanks, everyone!

Is that all you got out of his article? One risky investment opportunity to pan him on?Seriously? I own MPW as well, along with 30 other of Rida’s profitable recommendations that I am quite thrilled about.

I am not expecting him to be 100% omnipotent any more than I would Warren Buffett- his article is about making serious financial mistakes on a daily basis and is full of sage advice. Perhaps you should heed it.

Carolanne

Glad to be of help in your financial journey.

We are providing our update on CEQP.PR to subscribers today. In short, we remain optimistic about the merger and see positive synergies and improved distribution coverage for the preferred investors.