TransUnion: A Great Business, But Quite Expensive

Summary

- TransUnion is a leading global information company focused on collecting and analyzing credit data, with potential for global expansion, particularly in India.

- The company is leveraging big data analytics through acquisitions and quickly growing its international presence, which opens opportunities for significant revenue growth in new markets.

- Although I'm fond of TransUnion's business model and long-term growth prospects, the current price is reasonably high, and I would like to see the share price come down before buying.

Casper1774Studio/iStock via Getty Images

Summary

From 2021-2022, with solid recession fears and slowing lending activity, TransUnion's (NYSE:TRU) share price dropped over 50%. But since 2023, with recession fears cooling, TransUnion's share price has regained over 30%, and the market continues to have a bullish sentiment on TRU. From a quality value investing perspective, the company is a great long-term hold - but I would wait for prices to fall before buying more. From a macro perspective, I believe market and economy weakness will likely unfold, opening better opportunities to buy into TransUnion.

Business Model

TransUnion is a leading global information company that focuses on collecting, analyzing, and selling data regarding individuals' credit history - and has recently moved towards the quickly growing "big data" industry. Its revenues come primarily from the United States, but it has much potential to expand globally, especially in India. TransUnion's shares are still 36% below their all-time highs since 2021. TransUnion generates revenue by supplying banks, insurance companies, employers, and individuals with consumer credit rating and reporting services.

The Credit Bureau industry is a highly regulated and concentrated market as the "big three" (TransUnion, Equifax (EFX), and Experian (OTCQX:EXPGF)) dominate most of the market - with TransUnion being the smallest player. The industry is also not very globalized, and revenues mainly come from Western economies with a developed banking sector, leaving more opportunities for global growth. The key driver in the industry is how frequently consumers borrow money, which is heavily affected by macroeconomic trends like inflation, interest rates, employment/income, consumer spending, etc.

Leveraging Big Data

TransUnion has transitioned from being a pure credit bureau to using big data analytics for other purposes, capturing the quickly growing data market, estimated to reach a $103 billion market by 2027. TransUnion can leverage its big data solutions into new markets, which it calls "emerging verticals," well because of its streamlined data collection process. Most big-data companies need to spend significant sums of money to collect data. But as a credit bureau, TransUnion has already gathered decades of information on over a billion consumers and 65,000 businesses internationally. As a credit bureau, it will continue collecting massive amounts of consumer data for decades at no extra cost.

Moreover, TransUnion is most aggressively entering the other verticals of the big data market – which includes telecom, media, insurance, public sector, etc. For example, its recent series of acquisitions include a $3.1 billion acquisition of Neustar, an info-tech firm that serves 60 of the Fortune 100 companies, expanding TransUnion's emerging verticals to $1.2 billion in revenue in 2022.

Early And Aggressive International Expansion

One key difference between the big three is in their geography of focus. TransUnion has a strong presence in international markets, particularly in Latin America, Africa, and Asia, while Equifax and Experian have a more significant presence in the US and Europe. Remember, the big three have an oligopolistic advantage because they were the first to build relationships, establish databases, etc. TransUnion is reinventing that advantage internationally, particularly in India, by being first. Last year, TransUnion's revenue grew organically by 33% in India, 26% in APAC, 16% in Africa, and 12% in Latin America.

In addition, though building business and relationships over 20 years ago, TransUnion now controls 93% of CIBIL, India's biggest, first, and most well-recognized credit bureau. S&P Global (SPGI) predicts that India's GDP growth will average 6.7% through 2031, and banking sector lending has grown 10-11% in the past decade. Emerging economies with rising incomes will need a growing lending market to sustain their growth. Currently, operations outside North America only comprise around 15% of TransUnion's credit bureau business. However, the company is positioned to grow internationally rapidly. As emerging market GDPs grow, their demand for credit and financial institutions should grow even faster.

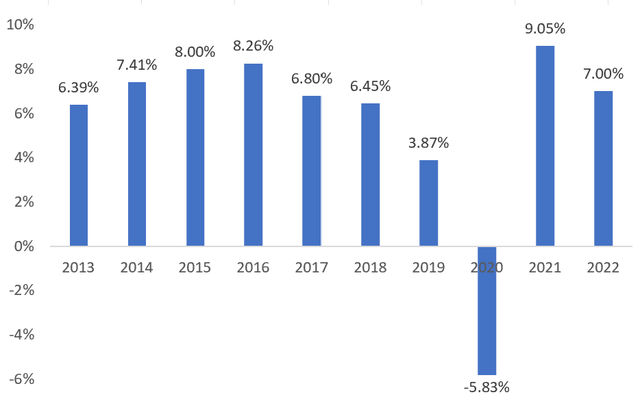

Indian GDP Growth % (Author, World Bank)

Wide Moats, Lucrative Castles, And Weak Invaders

TransUnion's oligopolistic landscape allows it to cut costs by operating in economies of scale while charging a considerable price premium. The company is surrounded by vast moats such that new entrants must compete directly against "the giants," with little room to differentiate, and are unlikely to steal market share. The only competitive force in the credit bureau industry is the big three, which allows TransUnion to operate in an oligopolistic environment with less competition and high margins relative to other sectors (22.6% average net income margin over the last three years).

Tough regulations and existing relationships & infrastructure can explain the industry's moats. Because credit bureaus have an important impact on consumers, regulators make it very difficult for new companies to become recognized and operate as credit bureaus. Additionally, new competitors need access to existing information databases, credit analysis technologies, or relationships with consumers/regulators/lenders, which are crucial to the business. Without those assets, competing against the big three would be like fighting a rifle war with pointy sticks.

TransUnion's Big Risks:

Slowing Lending Activity: banks are becoming more cautious and have raised lending standards. Borrowing is already beginning to shrink as interest rate hikes make borrowing more expensive. This could shrink TransUnion's revenues globally in the shorter term, so we need to consider where the macro is headed.

Debt: although nominal rising rates are a revenue problem, continued rising real interest rates can make debt servicing really expensive, with over $5 billion net debt. The company faces large maturity walls in 2024 (over $1 billion), in 2026 (over $2 billion), and in 2028 (over $2.5 billion). Although the company credit rating is non-investment grade (BB+), with solid free cash flows, TransUnion shouldn't face a solvency issue and can likely refinance before its maturity walls.

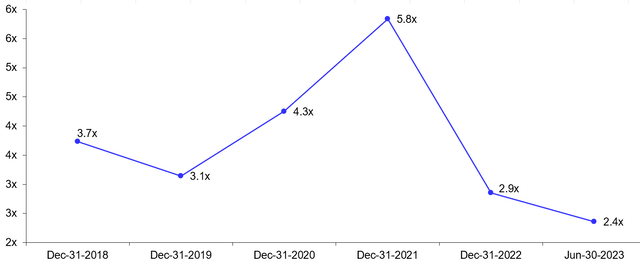

TransUnion Debt/EBIT (Author, Capital IQ)

Privacy lawsuits/data breaches: Major data breaches/lawsuits are rare; however, they can be incredibly costly to credit bureaus - for example, in 2017, Equifax experienced a data breach and was fined $575 million+. I can't add much detail here, because the future is unpredictable, and we can only apply a margin of safety for this.

Value

So TransUnion is a reasonably good business. Now we just need to figure out what it should be priced at. Relatively speaking, its valuations are in line with Equifax and Experian. However, its valuation is still 36% below its 2021 highs, and analysts believe that its share price has further to climb.

Using the following assumptions on a discounted cash flow valuation, we come to an implied share price of around $86, not significantly above the current share price of $79. That being said, my revenue growth assumptions have all been conservative, since TransUnion's "big data" and international segments can reach double-digit growth with improved margins. Although technically, TransUnion would be considered undervalued, an 8-9% upside isn't particularly attractive when 6-Month T-Bills are yielding 5.5%.

The Macro

This article is not meant to analyze the macro, but because TransUnion is very macroeconomic sensitive, I'll outline my general thoughts and why opportunities to invest in TRU may unfold. I believe in the following years, economic growth in many emerging market economies, especially India, will create significant opportunities for TransUnion. In the US, there are three main paths the economy can undergo. 1. Strong Growth (unlikely) - TransUnion's revenues should grow faster than expected, so it is probably a good time to buy. 2. Stagnation (more likely) - TransUnion stock may decline and should be a long-term hold. 3. Recession (fairly unlikely) - TransUnion's share price should significantly drop, which could open up investment opportunities. I believe that the US economy is likely on a path of stagnation, and current equity market valuations are generally high. And although I think TransUnion is a great business, much of the short-term bullish investor sentiment toward the stock is no longer justified.

Conclusion

Although I'm confident that TransUnion's business model is solid and has substantial growth opportunities, I believe the company needs a better margin of safety to be an excellent investment today. The market also knows that TransUnion is a great business - they understand it's expanding into big data and emerging markets. And I believe that today, TransUnion is reasonably priced. However, analyst estimates price the stock at $92, which I believe ignores many macroeconomic risks. That being said, I think it's likely that equity market valuations, along with TransUnion's, may drop, and then investment opportunities will open up.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TRU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Very few shares are owned - the ownership is only to better follow the stock's news and movement.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.