Universal Technical Institute: A Complicated Tale

Summary

- Today we put Universal Technical Institute in the spotlight. The company provides vocational training in skilled trades and healthcare.

- Universal Technical Institute has recently acquired Concorde Career Colleges and MIAT College of Technology, expanding its offerings and student enrollment.

- Despite positive financial results and growth prospects, UTI stock has struggled to gain momentum due to concerns about demand for tradesmen and tradeswomen in the auto and aviation industries.

- Management is bullish on FY 2024, however. An investment analysis follows in the paragraphs below.

- Looking for a helping hand in the market? Members of The Insiders Forum get exclusive ideas and guidance to navigate any climate. Learn More »

Kunakorn Rassadornyindee/iStock via Getty Images

Live as if you were to die tomorrow. Learn as if you were to live forever. ― Mahatma Gandhi

Today, we look at a small cap concern that has seen heavy buying from a beneficial owner and recently posted quarterly results. The company is profitable but seems somewhat range bound which might make it a decent trading vehicle. An analysis follows below.

Company Overview

Universal Technical Institute, Inc. (NYSE:UTI) (hereafter "Universal" or "the company") is a Phoenix, Arizona based constellation of trade schools, providing vocational training in skilled trades (e.g., auto mechanic) and healthcare to high-school aged, adult, and military students on 33 campuses in 14 states. The company has recently grown through acquisition, with the addition of Concorde Career Colleges in December 2022 (~7,600 students) and MIAT College of Technology in 2021 (~950 students), bringing its total full-time enrollment to 19,812 as of March 31, 2023. Universal was formed in 1965 and went public in 2003, raising net proceeds of $59.0 million at $20.50 per share. Its stock trades just under eight bucks a share, translating to an approximate market cap of $280 million.

The company operates on a fiscal year (FY) ending September 30th. For the avoidance of doubt, FY23 refers to the prior twelve months ending September 30th, 2023.

Operating Segments

Universal views its operations through two segments: Universal Technical Institute and Concord Career Colleges.

Universal Technical Institute operates 16 campuses across nine states, offering 15 degree and non-degree programs and training, including automotive, diesel, motorcycle, and marine mechanics; heating, ventilation, air conditioning, and refrigeration education; welding; wind power and energy technology; robotics and automation; as well as instruction in several aviation vocations. Education is provided under the Universal Technical Institute, Motorcycle Mechanics Institute, Marine Mechanics Institute, NASCAR Technical Institute, and MIAT College of Technology banners. The latter was onboarded for a purchase price of $26 million and expanded the company's offerings to include the aviation and energy markets. As of March 31, 2023, this segment had 12,104 students enrolled in its undergraduate programs, down 3% from the same time in 2022. The employment rate for its eligible graduates in FY21 was 82%, aided by the segment's relationships with 35 OEMs, which have demand for qualified service professionals. The Universal Technical Institute unit generated FY22 Adj. EBITDA of $55.9 million on revenue of $418.8 million as compared to FY21 Adj. EBITDA of $32.5 million on revenue of $335.1 million, representing 72% and 25% improvements, aided somewhat equally from a return to post-pandemic normalcy and the addition of MIAT. In FY21 and FY22, Universal Technical Institute was the company's only operating segment.

That organizational chart changed in FY23 with the onboarding of Concorde for a net cash consideration of $48.7 million in December 2022. Concorde, which has been in business since 1968, operates 17 campuses in eight states, offering over 20 programs in dentistry, nursing, healthcare administration, patient care, as well as physical and occupational therapy. The rationale for the acquisition was the projected need for two million additional healthcare-related jobs in the U.S. from 2021-2031; thus, expanding the company's total addressable market in rapidly expanding disciplines. Before acquisition, Concorde generated Adj. EBITDA of ~$17 million on revenue of ~$200 million in FY22.

In addition to these acquisitions, Universal is opening new campuses, most recently in Austin, Texas and Miramar, Florida, which take approximately three to four years to ramp. Both campuses, which launched in 2022, currently have over 700 active students. With its growing footprint, Universal is expanding its offerings at its campuses, launching 14 new programs across nine Universal Technical Institute campuses in FY23, with plans to launch three new dental hygienist programs in FY24. The company has also been actively purchasing its campuses from its prior landlords, acquiring three since late 2020.

Share Price Performance

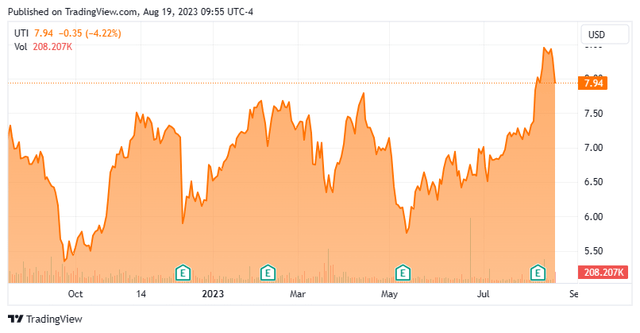

With admission understandably hurt by the pandemic, the company's revenue fell from $331.5 million in FY19 - a year in which it went into the black on an Adj. EBITDA and Adj. free cash flow basis, while rapidly approaching profitability on a non-GAAP net income basis - to $300.8 million in FY20, which was affected by a 2% drop in enrollment. That said, Universal maintained its positive Adj. EBITDA and Adj. free cash flow, while achieving both GAAP and non-GAAP profitability. These metrics further improved in FY21, when the top line rebounded to $335.1 million in FY21. Its stock was trading at a five-year high of $9.76 a share nearly a month prior to the pandemic selloff in March 2020, during which it traded to $2.75 a share. However, despite a clearly improved income statement over the past four years, shares of UTI have struggled to regain meaningful momentum, briefly trading above $11 in April 2022, but spending the preponderance of their time in the mid-to-upper single digits. As inflation and the Fed's response to it became front and center, the market became concerned that demand for auto and aviation tradesmen and tradeswomen would weaken. [However, there is also another shareholder-equity dynamic at play, which will be discussed later.]

Recent Quarterly Results:

It was challenging to glean whether these economic concerns had any merit when the company reported its Q2 FY23 financials on May 19, 2023, positing net income of $0.18 a share (non-GAAP) and Adj. EBITDA of $19.2 million on revenue of $163.8 million versus $0.19 a share (non-GAAP) and Adj. EBITDA of $12.6 million on revenue of $102.1 million in Q2 FY22. Unfortunately, the Q2 FY22 metrics don't include any financials from Concorde - in fact, Q2 FY23 represented the first quarter with a full contribution from the healthcare education platform.

June Company Presentation

Looking solely at the Universal Technical Institute segment, despite the aforementioned 3% drop in enrolled full-time students, new student starts improved 4% from the prior year period. It generated Q2 FY23 Adj. EBITDA of $20.7 million on revenue of $107.6 million as compared to Q2 FY22 Adj. EBITDA of $21.5 million on revenue of $102.1 million, representing a decline of 4% and an increase of 5%, respectively. As for Concorde, it generated Q2 FY23 Adj. EBITDA of $8.4 million on revenue of $56.3 million, but with nothing to compare it to since Universal is posting on an "as-reported" basis.

The best evidence of future performance is in the company's guidance, which remained unchanged with FY23 non-GAAP net income of $16 million (~$0.46 a share), Adj. EBITDA of $60 million, and Adj. free cash flow of $42.5 million on revenue of $602.5 million versus FY22 non-GAAP net income of $35.5 million ($1.05 a share), Adj. EBITDA of $60.2 million, and Adj. free cash flow of $34.9 million on revenue of $418.8 million. All the FY23 projections are based on range midpoints. Student starts, which are still in a range of 22,000 to 23,500 for FY23, is seeing slower enrollment at Universal Technical Institute, which should generate low single-digit revenue growth in FY23. The decreased enrollment there will be offset by slightly higher than anticipated enrollment at Concorde, where revenue is anticipated to be $170-$175 million.

Management was very bullish on FY24, expecting to generate Adj. EBITDA of nearly $100 million on revenue in excess of $700 million.

On August 8th, Universal Technical Institute posted its third quarter numbers. The company had a GAAP loss of five cents a share, six cents above the consensus. Revenues rose over 50% on a year-over-year basis to $153.3 million, nearly $5 million north of expectations. All revenue growth was attributable to the acquisition of Concorde as UTI contributed nearly $101 million of this total while Concorde contributed the rest.

Overall student starts were up 5.3% to 5300, 1967 of those were from Concorde. It was the first time the company achieved same-store start growth at their UTI campuses since the third quarter of 2022. Management tightened its FY2023 revenue guidance to between $602 million and $605 million and moved up its adjusted EBITDA outlook for the year to between $62 million and $64 million. Management also reaffirmed it expects over $700 million in revenue in FY2024 as well as close to $100 million in adjusted EBITDA.

Balance Sheet & Analyst Commentary

At the end of June, the company had approximately $110 available of cash liquidity. Universal does not pay a dividend on its common shares but does pay a semi-annual dividend on its 675,885 (formerly 700,000) shares of convertible 7.5% preferred stock, equaling $5.1 million per annum. Mind-numbing restrictions notwithstanding, the preferred stock, which was issued in 2016, is convertible into 20.3 million common shares at the discretion of the holders (subject to certain caps and other regulatory approvals). For the avoidance of doubt, the conversion is not considered in the fully diluted count, which would increase the common shares outstanding from 34.1 million to 54.4 million. The company also has a way to force conversion, subject to the removal of any caps - more on this shortly.

With the acquisition of Concorde, a concern clearly not up to publicly traded company standards from an accounting standpoint - why else would Universal report on an "as-reported" basis. Since third quarter earnings were posted, Lake Street ($11 price target), Barrington ($10 price target) and Rosenblatt Securities ($11 price target) have all reissued Buy ratings on the stock. On average, they expect the company to deliver non-GAAP net income of $0.09 a share on revenue of $601.2 million in FY23, followed by $0.67 a share (non-GAAP) on revenue of $696.3 million in FY24.

Coliseum Capital Partners, represented on the board by Christopher Shackelton (and who previously owned the 700,000 shares of convertible preferred - electing to distribute it to affiliates and some non-affiliates in September 2020) was recently a buyer of the common stock, increasing its position by 307,650 shares at an average price of $6.67 on June 21-23, 2023. Its ownership interest in the common is currently 15.8%, possibly setting itself to take on a more activist role in the company or more likely betting on a big surge [see below].

Verdict

Admittedly, Argus analyst John Eade is correct in describing the outlook as murky. That said, considering management's outlook for FY24, the stock looks very investible at an EV/TTM Adj. EBITDA of under six.

The real issue holding Universal's stock down has to do with its ability to force conversion of the convertible preferred stock, which could occur if the volume weighted average price (VWAP) of UTI common shares is greater than or equal to $8.33 for 20 consecutive trading days, subject to the removal of any caps.

To keep the conversion from happening and to continue receiving the 7.5% dividend, a sophisticated investor - which Coliseum's affiliates are likely to fall under that category - can simply short the stock when it approaches $8.33 a share (or sell common shares if long), keeping the price down. If circumstances warrant a significantly higher stock price, the holders of the preferred will simply be forced to convert into common shares, thus covering their 'short'. Granted, the short position is currently only 2.2%, but if the stock gets above $8, the short interest will most likely rise significantly. In fact, on three separate occasions in February-May 2022, the stock appeared to trade at a VWAP above $8.33 for 19 consecutive days, only for the twentieth day to suspiciously trade below the forced conversion price. The most suspect event occurred after the company's May 4, 2022 Q2 FY22 earnings release that handily beat Street consensus at both the top and bottom lines, only to see it stock suspiciously crater 27% in the subsequent four trading sessions to get below the $8.33 VWAP on what would have been the twentieth consecutive day.

If shares were to convert at $8.33, the EV/TTM Adj. EBITDA becomes a somewhat less attractive just under 10. However, if management is on target with its FY24 outlook of Adj. EBITDA near $100 million, the dam may finally burst, likely sending shares of UTI significantly higher; thus, the most likely motivation for Coliseum's accumulation.

In the meantime, an investor can essentially play the same game as the current preferred holders with a covered call strategy. That said, the liquidity in the options are extremely thin and the only strike prices that currently apply are $7.50 and $10.00 per share. The better move for those interested in a trading vehicle is to buy below $7 and sell above $8.50 as the downside seems very limited while the upside appears artificially capped.

I have never let my schooling interfere with my education."― Mark Twain

Author's note: This is your chance to try us out – without any strings attached. Activate your two-week free trial period now and see if The Insiders Forum is right for you.

This article was written by

Our Model portfolio's return has almost TRIPLED the return of our benchmark since its launch!

The Insiders Forum's focus is on small and mid-cap stocks that insiders are buying. Some studies have shown that equities with heavy insider purchases outperform the overall market over time. The portfolio managed by Bret Jensen consists of 15-25 top stocks in different sectors of the market that not only are attractively valued but have had some significant insider purchases in recent months. Our goal is to outperform the Russell 2000 (the benchmark) over time. Since its launch in the summer of 2016, the Insiders Forum's model portfolio has generated an overall return of 171.72% as of 08/11/2023. This is almost triple the 58.44% return from the Russell 2000 over that time frame.

• • •

Specializing in profiling high beta sectors, Bret Jensen founded and also manages The Biotech Forum, Insiders Forum, and the Busted IPO Forum model portfolios. Finding “gems” in the biotech and small-cap stock sectors, these highly volatile spaces proven hugely successful have empowered Bret Jensen's own investing portfolio.

• • •

Learn more about Bret Jensen's Marketplace Offerings:

The Insiders Forum | The Biotech Forum | Busted IPO Forum

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.