The Buckle: Reopening A Trade Following Earnings

Summary

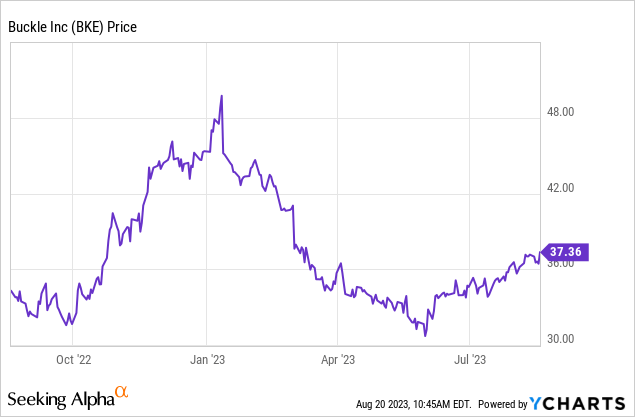

- Buckle's stock has experienced fluctuations but has been on a rally since hitting a bottom in June.

- The specialty retail sector is highly competitive, but Buckle has continued to perform well.

- Despite lower sales, the company's earnings have surpassed expectations, and the stock's valuation is attractive.

- This trade is structured to net 18% returns if executed.

- Looking for more investing ideas like this one? Get them exclusively at BAD BEAT Investing. Learn More »

Riska

Back in November we highlighted The Buckle (NYSE:BKE) for a trade which remains a specialty retailer that we have liked and traded in the past. For that trade, we had a target profit exit of $45. That was hit in January of this year. Since then the stock gave back about 1/3 of its value, and only started to run back up with the market in recent months. Right now, shares are at $37, and while we think longer-term this neat 4% yielding stock is a hold, we do see another opportunistic trade that can be executed.

BKE stock bottomed out in the summer of 2022 and has ebbed and flowed since, hitting another bottom in June and has since been on a rally since. While the consumer has been resilient, the specialty retail space is a dog eat dog world, with massive competition, and may challenges even in 'good' times. You see, it is those who are best managing their inventory, using tactical promotion, and watching costs that succeed. The recent horrible inflation we have seen has only made it more challenging. But we think you can trade this again.

The play

Target entry 1: $37 (45% of position)

Target entry 2: $33 (55% of position)

Stop loss: $31

Target exit: $41

Options consideration: Options suggestions are reserved for trades presented in our investing group, which you can check out below. Generally, a put selling approach for entry or a buy-write can be employed however.

We feel confident that if the market continues to be under pressure in this seasonally weak period, in conjunction with economic data that appears to be starting to soften globally, stocks can fall some more. So, we structured the trade to have a final average in the high $34 range. Should we only get the first leg, the trade will return 11% at close, or about 18% for a full position. These returns can be magnified with dividend payments and options income. Now that said, while specialty retail is a very competitive sector, Buckle has continued its strong performance. Let us discuss.

Performance discussion

The stock started running again in June and July, and August could be a breather, allowing you to get into a position ahead of what should be a strong holiday shopping season. The just reported earnings were better than expected, but mixed in some areas. Long-term, we still rate it a hold, with an opportunistic trading opportunity having emerged. The company beat consensus estimates on the top line, while also surpassing expectations on the bottom line. In fact, the company absolutely crushed estimates. Earnings were much higher than the consensus expected overall.

The top line revenue figure in the Q2 report was a beat, but sales were down from last year. It has been a struggle for many in the specialty retail space this year as inflation has run rampant, but fashion is back. COVID-19 and avoiding social events is becoming more and more of a memory. It is our belief that based on the trends we are seeing for the company, the stock will perform well as we head into the holiday shopping season. Sales came in at $292.4 million and fell 3.2%, but was $2 million better than expected.

So what drove this? Well, the one key metric that we focus on with retailers is comparable sales. They are simply a key figure. So here is where we say things are mixed. While results are better than expected, comparable sales were down. Comparable store net sales decreased 3.3% from comparable store net sales for the prior year's Q2. Online sales which had long been a strength and growing also fell, to our surprise. Online sales dipped 5.6% to $43.6 million compared to net sales of $46.2 million last year. Year-to-date performance is also down from the prior year's first half. Net sales are down 5.9% to $575.3 million from net sales of $611.0 through last year. Comparable sales are also down 6.3% from a year ago.

So with lower sales, we expected earnings to fall. Gross profit was $138.4 million (down from $145 million last year), good for a 47.3% margin. These margins were also pressured. General expenses were up marginally, while selling expenses were up commensurate with sales. Net income was $45.6 million, or $0.92 per share. While this was a decline from the year ago's $1.02 in EPS, it surpassed estimates by a strong $0.11.

So if sales and earnings are falling, why is the stock holding up? Well, first, the company is earning more than what was expected, so there is value there. Second, the valuation of the stock is highly attractive even after the run despite the decline in growth. But third, the Street is assigning a high probability that Q2 2023 was the earnings trough. That could change, if we get a recession, or some other macro event that results in prolonged economic weakness. We discount the possibility of a 'Goldilocks" type scenario, but we also do not see a deep recession possible. The forward view is also positive.

As we look ahead for the rest of 2023, we think the cash position is strong. At the end of the quarter, cash and equivalents totaled $275.5 million. Liabilities remain quite reasonable as well. For 2023, we are looking for $4.00 in EPS at minimum, putting shares at 9X FWD earnings. Very reasonable price to pay here. While we have a hold rating, we do think you can swing trade this one.

Final thoughts

Despite the wide expectations for sales and earnings to fall, results have been coming in better than expected. The valuation here is attractive. We have successfully traded this stock a few times and think you can run another play on. For more trade ideas, with higher conviction, similar to this one, check out our group below.

The #1 service ran by large fund analysts. Come win NOW. Annual prices increase 20% & monthly prices increase 30% September 1st.

Join our community of traders at BAD BEAT Investing, on sale NOW, before prices go up

Our analysts are available all day during market hours for you!

- Learn how to best position yourself in any market

- Available all day during market hours with a vibrant chat

- Swing trade ideas each week, daily market guidance

- Crystal clear entries, profit taking, and stop levels

- We teach you hedging techniques to protect your money

- Stocks, options, trades, dividends, and one-on-one attention

This article was written by

We've made several millionaires! We are VERY proud to have created thousands of WINNERS. We are the team behind the top performing investing group BAD BEAT Investing. Quad 7 Capital was founded in 2017 by a team that consists of a long time investor, health researcher, financial author, professor, professional cardplayer, and hedge fund analysts.

The BAD BEAT Investing service is a specialized carve out of Quad 7 Capital and launched in 2018. The service is run by a team of hedge fund analysts. This a top performing investing group service relative to market returns. It is focused on trading opportunistic inflections, and leveraging mispriced stocks and momentum driven events for rapid-return swing trades, options education, and long-term investments. We also teach investors how to hedge their portfolios. Further, it offers a direct access line to our traders all day during market hours and provides daily market commentary.

Quad 7 Capital as a whole has expertise in business, policy, economics, mathematics, game theory and the sciences. The company has experience with government, academia, and private industry, including investment banking, boutique trading firms, and hedge funds. We offer market opinion and analysis, and we cover a wide range of sectors and companies, with particular emphasis on news related items and analyses on growth companies, dividend stocks, banks/financials, industrials, mREITS, biotechnology/ pharmaceuticals, precious metals, and small-cap companies.

If you want to win, follow us, and if you want to make real money, sign up to BAD BEAT Investing today.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in BKE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.