Fortinet: The Market Is Overreacting To The Guidance Cut And Providing A Good Buying Opportunity

Summary

- Fortinet is a leading cybersecurity company with a strong business model that sells hardware and software subscriptions focused on data and communication security.

- The integration between Fortinet's hardware and software services creates synergies and allows the company to offer a complete and efficient solution to its customers.

- The cybersecurity market is projected to grow at a compound annual growth rate of 16%, providing significant opportunities for Fortinet's dual-focused approach.

Just_Super

Investment Thesis

After presenting the results of the second quarter of 2023, Fortinet (NASDAQ:FTNT) experienced a 25% drop in its stock price. From my point of view, this decline is unjustified and could represent an opportunity to buy into this terrific company, which I have good long-term prospects for. The market it operates in, its management, competitive advantages, and solid financial position are just a few of the factors that make me so optimistic about this company for the next decade.

Business Model

Fortinet is the second-largest company in the world dedicated 100% to cybersecurity, trailing behind Palo Alto (PANW). The company sells both specialized hardware and software subscriptions for its programs, all of which are focused on ensuring the security of data and communications for businesses in the most efficient manner possible.

Hardware

In this segment, Fortinet sells all the hardware that companies need to build their networks, enabling secure internal and external connections and ensuring data integrity. They offer routers and switches for secure routing and firewalls that guarantee the traffic within the company does not come from potentially harmful sources.

I don't think it's essential to go into detailed explanations of each of these devices, as they would be highly technical and not add much value. However, it is crucial to understand that these are devices that companies require, and their purchase and installation cannot be delayed. Numerous examples exist of companies that didn't have their organization adequately protected and suffered attacks. Therefore, unlike other projects, ensuring the security of organizations cannot be postponed.

All these devices are designed and manufactured by Fortinet itself, which makes the company vertically integrated, providing all the cost advantages that come with it. Additionally, Fortinet's products outperform most of the competition in terms of quality, speed, and efficiency. The company itself compares the average performance of its firewalls with the leading competitors. While it's essential to take such comparisons with caution, as companies often present data in their favor, it still provides a good indication of the quality of Fortinet's products.

Devices comparation (Slide 25)

However, from my point of view, the key to Fortinet's hardware lies in the integration and synergies it creates with its software services and products.

Software and Services

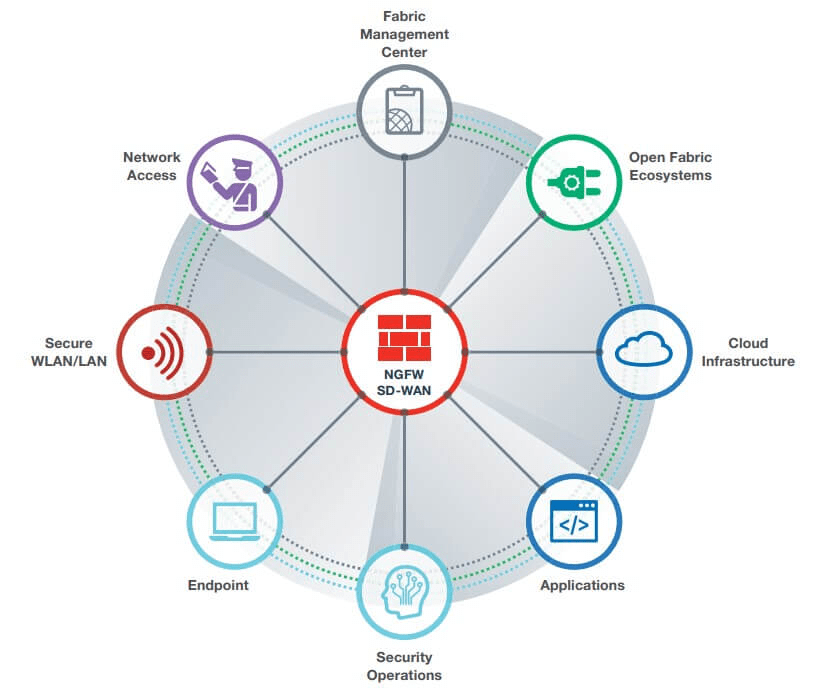

Fortinet offers a wide range of services and software to complement its products. There are so many that we won't go into detail on all of them again, but to give you an idea, Fortinet provides cloud security solutions, email protection, automated threat detection, security for IoT devices, security for wireless networks, and many other services to ensure the security of organizations' data and communications.

As I mentioned earlier, what is truly crucial to me is the synergies created between Fortinet's products and its services and software. To understand this, let's put ourselves in the position of a company that installs a Fortinet firewall in its organization. If the company wanted to add automated threat detection software to the firewall, which company would they most likely choose for this service? Almost certainly, they would choose Fortinet to leverage the compatibility with their hardware.

We must consider that cybersecurity is a highly complex field, and the vast majority of companies lack specialists in this area. Therefore, the simpler the system they have installed, the better it is for them. This is why Fortinet has a significant advantage over players in this market who do not sell hardware. Fortinet is one of the few companies that can offer a complete, integrated, and efficient solution without the need to rely on other companies to complement the service.

Hardware-Software integration (Fortinet Investor Relations)

For this reason, I see Fortinet's hardware products as the Trojan horse that allows them to sell additional value-added services to their customers, which, as we will see later, have very high profit margins.

Another crucial point to mention is that Generative AI has opened up new possibilities within this industry. Let's first consider that with the existence of such tools capable of generating complex code, the number of individuals capable of creating viruses from their homes has increased exponentially.

Furthermore, the rapid development and sophistication of Generative AI technology also means that cybercriminals can potentially exploit these tools to launch advanced attacks. This necessitates continuous research and development to stay ahead of adversaries and mitigate emerging risks." - AnalyticsInsight

However, AI opens a new door for cybersecurity companies like Fortinet, which are already working and offering AI-based solutions capable of automatically detecting potential threats, thus enhancing the performance of their systems and the security of organizations.

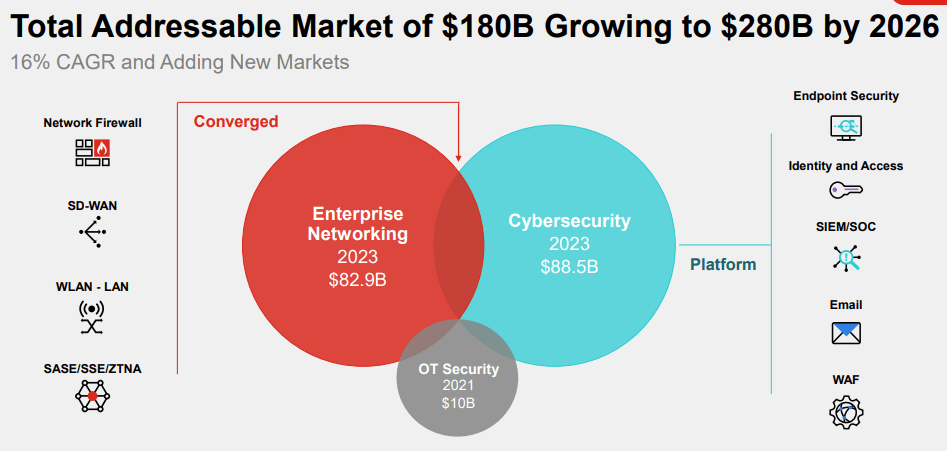

Cybersecurity Market

According to Fortinet's own estimates, they project that the total addressable market for the year 2026 will be around $280 billion, representing a compounded annual growth rate of 16% from this year, 2023. What's most intriguing is that the two largest segments in cybersecurity are networking on one hand and cybersecurity on the other. As we discussed earlier, with their hardware and software products, Fortinet stands out as one of the few players addressing both segments of the market. This dual-focused approach provides them with an advantage over smaller competitors and is where the synergies we mentioned earlier come into play.

Cybersecurity Market (Slide 16)

The remarkable growth that the company anticipates, despite being quite substantial, appears reasonable when considering the macro trends driving the cybersecurity market. The digitization of businesses, the security of cloud infrastructure, the Internet of Things, the metaverse, and the very artificial intelligence we previously discussed are clear tailwinds that will make it imperative for companies and public organizations to increase their expenditure on cybersecurity.

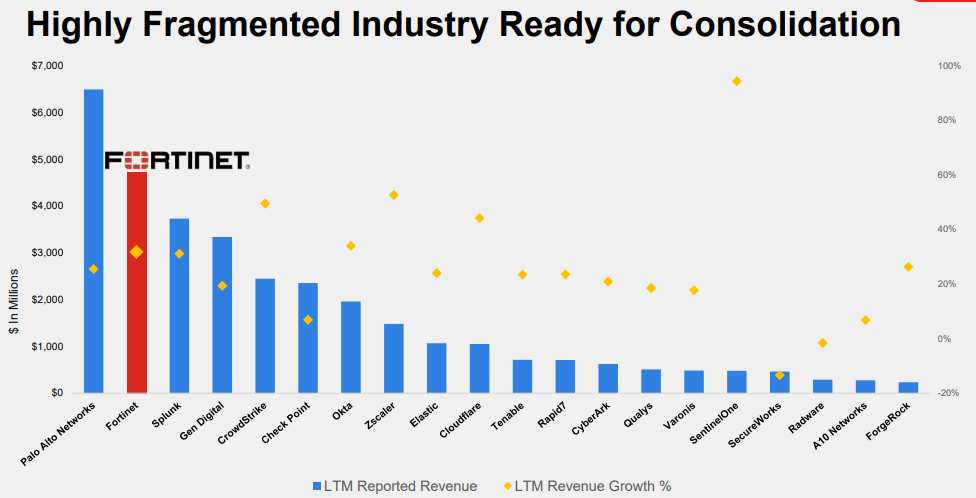

One important aspect to highlight in the cybersecurity market is its high fragmentation. This is normal for such a young market with numerous sub-branches. However, Fortinet sees this as an opportunity rather than a threat. Like in all markets in their early years, there are many competitors, and over time, the larger players consolidate. Therefore, I anticipate that as the market matures, the strongest players will emerge as survivors. As I aim to convey in this article, I believe Fortinet will be one of these winners.

In the following graph, we can observe that Fortinet is the second-largest player, only trailing behind Palo Alto, and the number of smaller competitors is vast. I also find it promising that despite its size, Fortinet is among the companies experiencing the fastest sales growth. This growth is part of the consolidation process we discussed earlier. The larger players are gradually capturing market share from the smaller ones due to operational limitations and their weaker moat compared to others.

Industry Fragmentation (Slide 30)

Income Statement

When analyzing Fortinet's performance, the first thing that stands out is its incredible revenue growth, going from just over 200 million in 2010 to nearly 5 billion currently. This growth represents a compounded annual growth rate of 27%. Furthermore, this growth has been virtually consistent, with no noticeable cyclical patterns in the business up to this point.

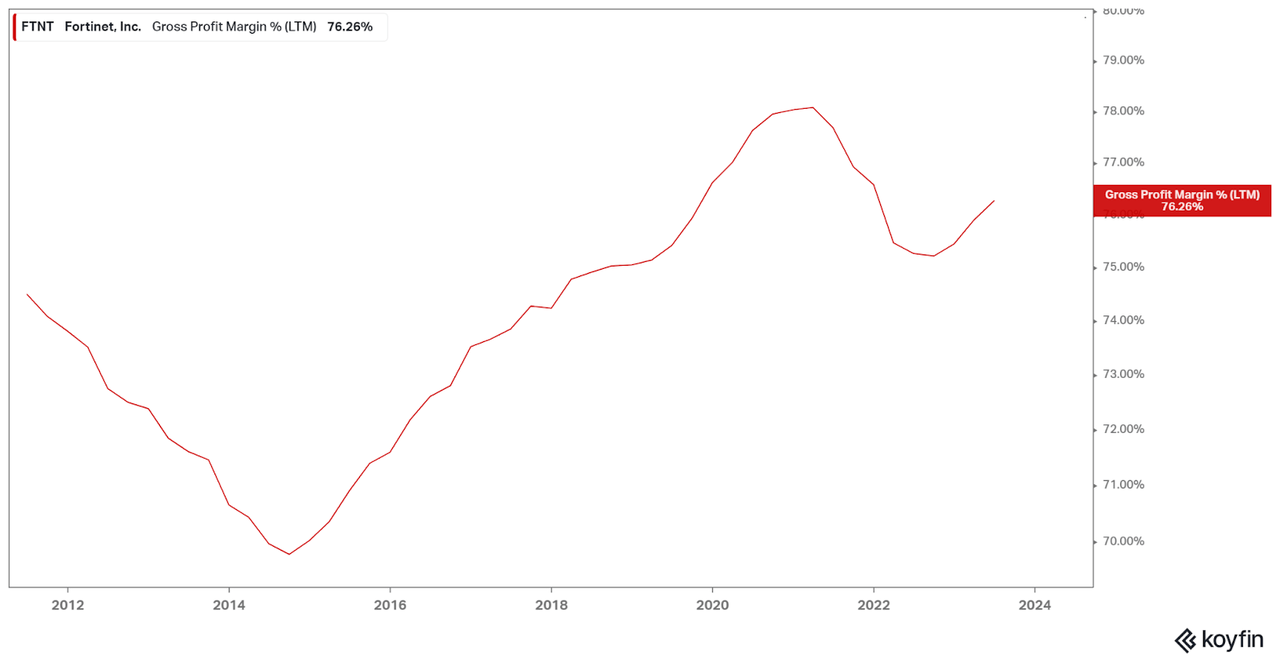

If we look at the company's profitability, what stands out the most to me is its enormous gross margin. This margin has been expanding due to the company's transition towards services. Such transitions have proven highly beneficial for companies, as demonstrated by Microsoft (MSFT) and Amazon (AMZN). The gross margin for the product segment is already impressive at 61%, but what's even more noteworthy is the gross margin for services, which stands at 85%. The total gross margin for the company is 75%. As long as services continue to gain prominence within Fortinet, it's expected that this margin will continue to expand.

Gross Profit Margin % (Koyfin)

On the other hand, the current EBITDA margin stands at 25%, the operating margin at 21%, the net margin at 21%, and the FCF margin is nearly 40%. It's interesting to note that the FCF margin is significantly higher than the net margin, but we will delve into this further in the valuation section. One highly relevant aspect is that these margins are substantially higher than those of its direct competitors, as illustrated in the following graph. This ability to generate profits in such a challenging market, where other players struggle to do so, further attests to the quality of Fortinet.

GAAP Operating Margin (Slide 44)

Balance Sheet

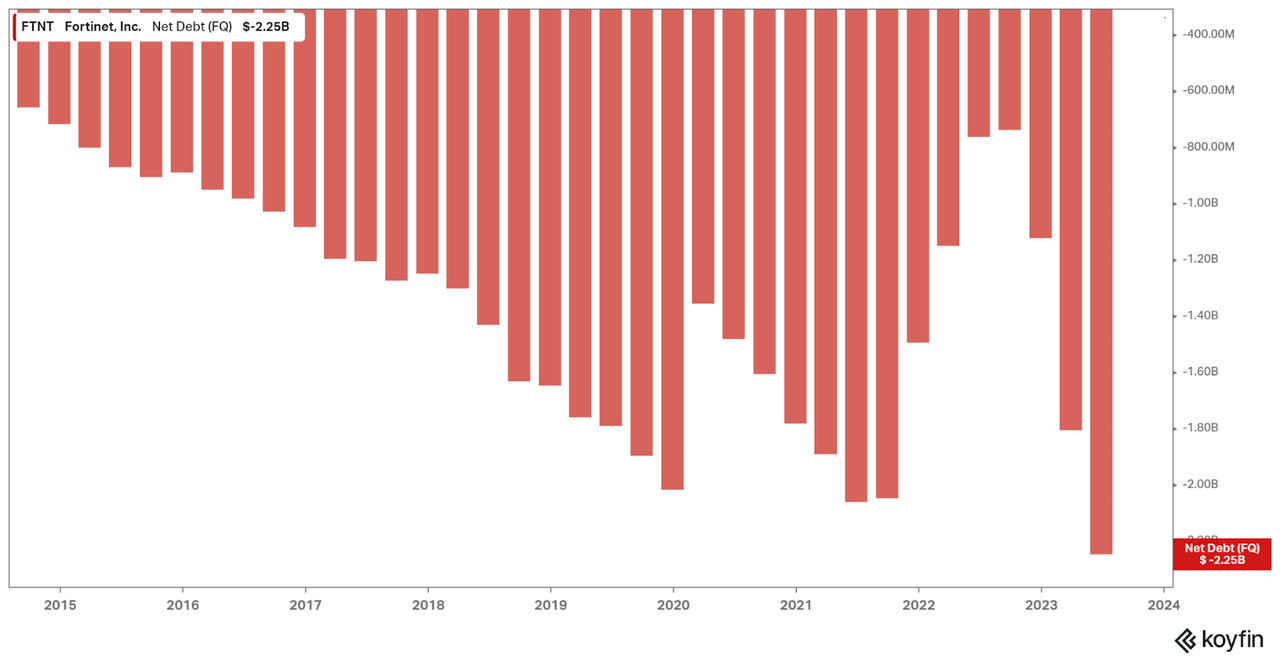

Regarding the company's balance sheet, it is in a very strong position. The business generates all the necessary cash for growth, which means they rarely need to resort to debt issuance. This is a significant advantage, particularly in a fragmented market as we have already seen. It positions Fortinet to potentially make acquisitions of smaller players in the future without compromising the company's finances, or even to increase capital returns to shareholders. In the graph below, we can observe the company's net debt calculated as Total Long-Term Debt minus Cash and Cash Equivalents. As you can see, this debt is negative, and it has been so for many years. This indicates that Fortinet holds more cash than long-term debt, showcasing a very solid financial position.

Management

A key factor in understanding the strong performance thus far and a pivotal element for the company's future growth is its CEO, Ken Xie. He founded the company in the year 2000 and remains its CEO to this day, holding a 16% stake in outstanding shares. Personally, I always appreciate it when company executives have a significant ownership stake, as it aligns their interests completely with those of long-term shareholders.

His accomplishments within the company over these years have been more than evident, achieving an impressive 4000% increase in Fortinet's stock value. He is an individual who possesses an in-depth knowledge of the company and the sector, which provides an added layer of reassurance having him continue as the CEO for more years to come.

Capital Allocation

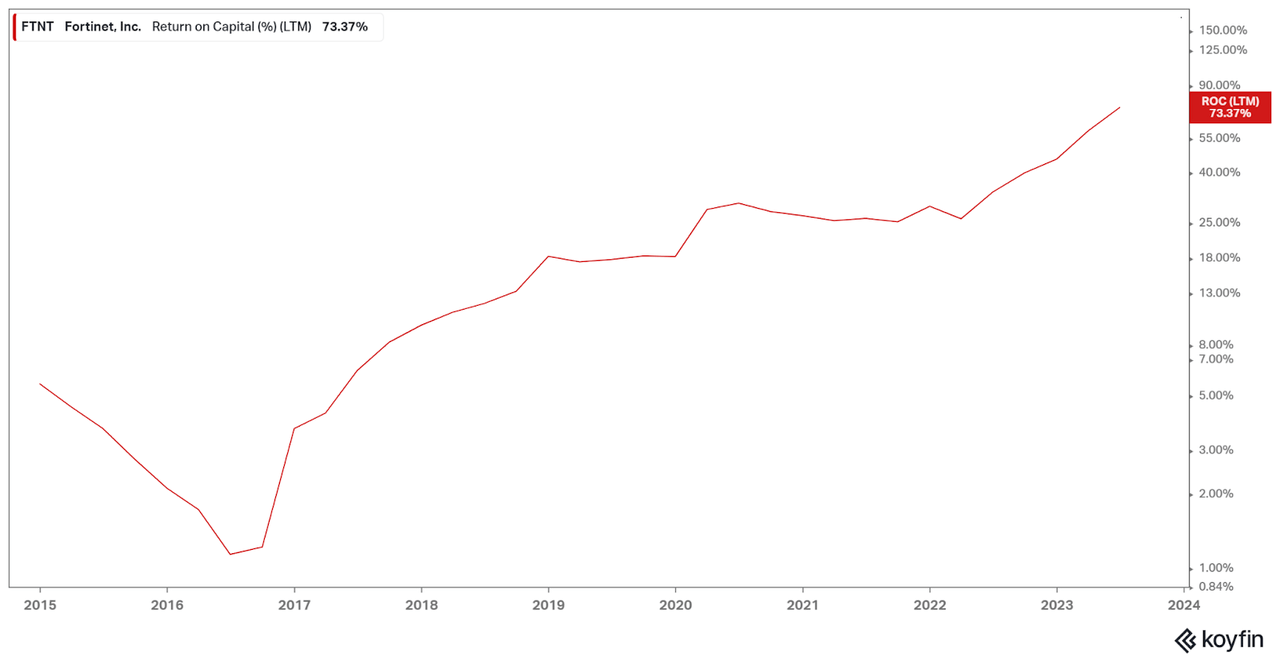

Fortinet's primary use of its cash is to ensure the organic growth of its business. From my perspective, this is the optimal strategy within a young market with substantial growth potential and numerous competitors. Fortinet achieves truly remarkable returns on capital, making this approach even more sensible. As depicted in the following image, the company's Return on Capital (ROC) exceeds 75%. Additionally, Fortinet has the option to embark on acquisitions in the coming years, capitalizing on market fragmentation and its robust financial position as a new avenue for growth.

Furthermore, the excess cash generated is allocated to opportunistic share repurchases, aiming to prevent dilution of shareholders through stock-based compensation and gradually reduce the number of outstanding shares. For dividend enthusiasts, it's important to note that Fortinet currently does not pay dividends, nor do I believe it will in the medium term, as long as it can continue reinvesting in its own business with the high capital returns it consistently achieves.

Risks

The primary risk that has the potential to impact my thesis revolves around the possibility of a reputation loss stemming from security breaches. In the context of the cybersecurity market, reputation holds immense significance, as any company perceived as lacking security could face severe consequences. Therefore, it remains essential to closely monitor Fortinet's ability to maintain its industry reputation and navigate potential security challenges. Additionally, another noteworthy risk is tied to the fact that Fortinet produces a significant portion of its physical devices in Taiwan. Given the heightened military tensions in that region, any conflicts or disruptions on the island could undoubtedly have an adverse impact on Fortinet's operations.

Valuation

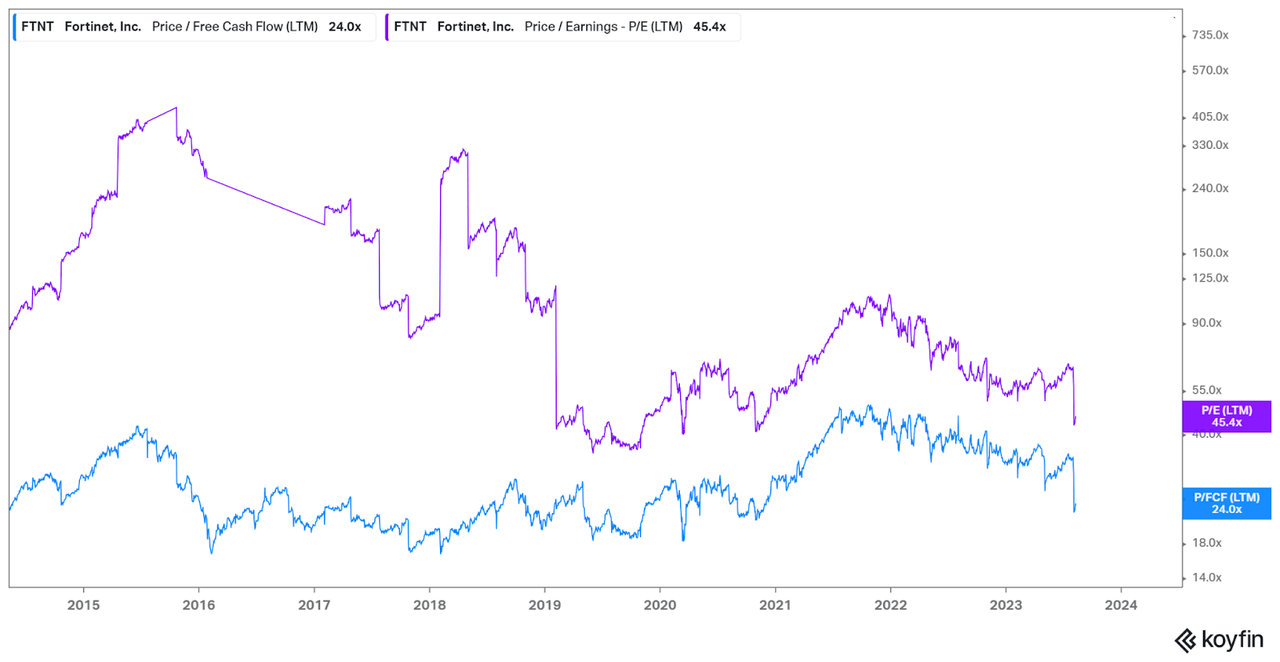

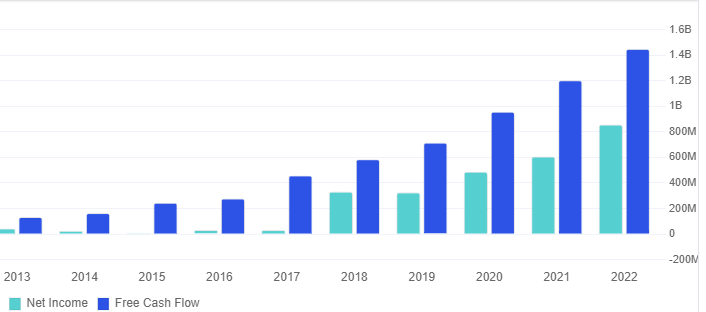

Before attempting to arrive at a valuation for Fortinet, I believe it's important to understand a key aspect. Due to its service-oriented nature, Fortinet often bills its customers well in advance of providing the service. This leads to the situation where free cash flow is considerably higher than net income because the company is receiving cash inflows that can't be recognized as revenue until the service is actually delivered. In the following graph, you can observe that historically, Fortinet's Free Cash Flow has consistently surpassed its Net Income due to this reason.

Fortinet Net Income vs FCF (roic.ai)

This scenario causes historical multiples for Fortinet, when using the P/E ratio, to often appear at absurdly high valuations. However, when we consider the FCF multiple, we see that valuations do indeed appear more reasonable. Such nuances must be carefully considered when conducting valuations, as they can significantly distort reality and lead to misguided decisions. Therefore, for the valuation I am about to conduct, we will utilize FCF as the metric rather than net income.

Taking this into consideration, let's attempt to derive an intrinsic value for Fortinet's stock. For sales growth, I will use 21% for 2023, which was the guidance provided by the company in its recent quarterly results, and 18% for the subsequent two years, as per consensus analyst estimates on Seeking Alpha. Beyond that, we will assume a gradual sales growth deceleration as the market matures.

Let's assume the company's FCF margin gradually recovers to 34.5%. It's worth noting that this estimate might be somewhat conservative, as Fortinet has experienced years with FCF margins of 36%. However, I prefer to exercise caution in my estimations. Finally, considering the annual reduction in outstanding shares of 1.68% since 2018, we will assume that shares will continue to decrease at a similar pace of 1.5% in the coming years.

Applying a multiple of 23 times, which is below its historical average of 28, we arrive at a target price for 2028 of nearly $120 per share. This would imply a doubling of the price from current levels or a compounded annual growth rate of 12.25% from current levels.

Valuation (Author's calculation using data from Seeking Alpha)

Conclusion

Fortinet is a company of exceptional quality, skillfully managed and operating in a market with clear long-term tailwinds. The synergies it creates among its diverse products offer a competitive advantage within this industry that only a handful of players can achieve. From my perspective, the market has overreacted to the slight guidance revision provided in their latest earnings presentation, as it holds negligible significance in the company's long-term performance. Considering the current valuation and its promising future prospects, I confidently assign a buy rating to Fortinet.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)

Increased Positions 567

Decreased Positions 446

Held Positions 156

Total Institutional Shares 1,169ACTIVE POSITIONS HOLDERS

New Positions 176

Sold Out Positions 71