Just Eat Takeaway: Future Uncertain As Fundamentals Deteriorate, Stock Undervalued

Summary

- After reporting excellent growth over the last 5 years, driven in part by the COVID-19 pandemic, the business is now struggling for traction as fundamentals deteriorate.

- The intensification of competition poses a significant threat. Rivals are reporting positive growth and maintaining market share, while Just Eat faces hurdles in both.

- The company's expansion strategy has not borne fruit as anticipated, leading to substantial market share loss and challenges in the American market.

- Despite these significant challenges and my doubts regarding its long-term success, the stock's current undervaluation presents a short- to medium-term investment opportunity.

petekarici/iStock Unreleased via Getty Images

Investment thesis

I initiate my coverage of Just Eat Takeaway.com N.V. (OTCPK:JTKWY) with a buy rating following my in-depth research of the company and the food delivery industry. While I am quite bearish on the company's long-term prospects and competitive position, the current undervaluation offers significant downside protection, even if the company were to underperform my conservative estimates.

Just Eat is a significant player in the global online food ordering and delivery sector. While it capitalized on the pandemic-induced surge in demand and exhibited impressive growth in the last five years, recent challenges have cast doubts on its sustained success. The last 1.5 years have been marked by declining metrics. The user base, restaurant partners, and order volumes have dwindled, signaling potential customer attrition and market share erosion.

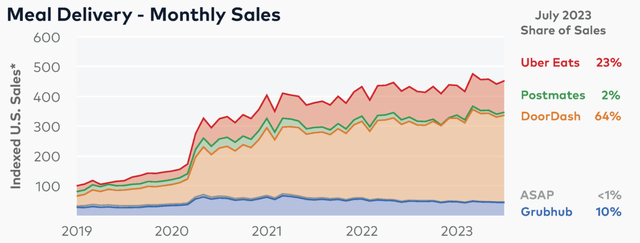

The intensification of competition, particularly from Uber (UBER), Deliveroo (OTCPK:DROOF), and DoorDash (DASH), poses a significant threat. Rivals are reporting positive growth and maintaining market share, while Just Eat faces hurdles in both areas. The company's expansion strategy, notably its acquisition of Grubhub in the US, has not borne fruit as anticipated, leading to substantial market share loss and challenges in the American market.

Despite fast profitability improvements, future growth prospects remain uncertain. The European food delivery industry presents growth potential, but the company's ability to maintain its market share and tackle competition raises concerns. I deem management's long-term targets as overly optimistic.

Despite these significant challenges and my doubts regarding its long-term success, the stock's current undervaluation presents a short- to medium-term investment opportunity. Conservative projections, considering an EBITDA multiple of 7x, indicate significant upside potential and a very decent margin of safety.

A struggling leader in the food delivery industry

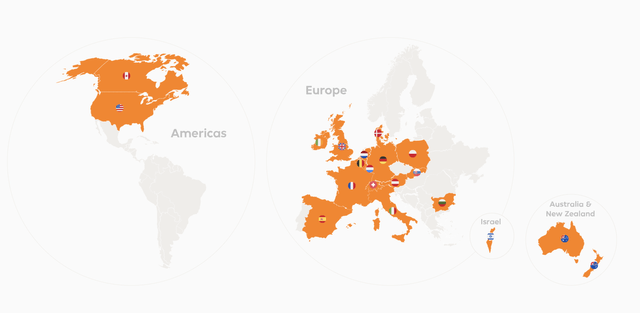

Just Eat Takeaway.com is a prominent multinational online food ordering and delivery platform, serving as a bridge between hungry customers and a vast network of restaurants across the globe. Established through the merger of Just Eat and Takeaway.com and the acquisition of Grubhub, the company boasts an extensive reach in various markets, making it one of the world's largest and most comprehensive food delivery platforms.

Just Eat's international presence (Just Eat Takeaway.com)

Operating in numerous countries, Just Eat offers users the convenience of browsing an array of culinary options, placing orders online, and having their favorite dishes delivered to their doorsteps. The platform's user-friendly interface, seamless ordering process, and diverse restaurant selection contribute to its popularity and growth and have helped it become one of the leading players in the European food delivery industry.

The company was one of the largest beneficiaries of the COVID-19 pandemic as this resulted in people massively increasing food delivery activity as eating outside of the house was often not possible due to lockdowns. As a result, the company has been able to grow revenues at a CAGR of over 26% over the last five years, massively increasing its size and expanding its operations, allowing it to report FY22 revenue of over €5.5 billion and seeing 61 million active users on its platforms annually.

However, the last 1.5 years have been more challenging than any other period in its relatively short history as COVID-19 tailwinds disappeared and the company faces increased competition from the likes of Uber, Deliveroo, DoorDash, and many other competitors. As a result, the company has been struggling for traction, both in terms of growth and profitability.

Looking at the last five years could give investors an unjustified bullish narrative, while in reality, the business has been struggling quite a bit for traction over the last 1.5 years, both in terms of growth and profitability, with it losing users, restaurants on its platform, and order volume declining. For example, the number of users on the Just Eat platform declined 6% YoY in 2022 and another 7% in the first half of 2023. As history has shown, losing users is never a positive signal and should alarm investors, especially if the underlying industry and competitors reported positive growth.

While demand for food delivery has not fallen as significantly as was often feared by analysts, competition in the industry has heated up as demand has eased off. Whereas Uber reported double-digit order growth for its delivery segment in the most recent quarter and saw growth accelerate sequentially, Just Eat still reported a 4% GTV (Gross Transaction Value) decline on top of an 8% decline in the year-ago quarter. Clearly, the Just Eat business is having a harder time today compared to Uber and it is important investors look closely at the business developments, which create a mixed picture.

For FY22, Just Eat also saw its orders decline to 657 million, down 15% YoY and decline another 12% in the first half of 2023. Yet, these declines were largely anticipated for this year and the decline in orders was slightly offset by a higher average order value as a result of high inflation.

Even more crucial, the company also lost 30,000 restaurants on its platform as this number declined from 310,000 at the end of 2021 to 280,000 at the end of 2022. For a food delivery platform, a large offering of restaurants is key to attracting more users and setting yourself apart from the competition. As Just Eat is losing restaurants on the platform, its competitive position weakens, and these are crucial aspects to consider for investors.

Both analysts and Just Eat management seem to focus on the company's improving profitability profile and hang on to the earnings growth it has shown over the last decade, while I expect the company to struggle to get its GTV growth above 10% again, meaning its long-term targets are incredibly opportunistic and out of reach.

The company aims to generate a positive cash flow by FY24, but it will not be overly significant even if it reaches this target. I see no easy way to achieve substantial profitability here, and the best way to reach it is by focusing its efforts on the better-performing regions in Western Europe and the UK and selling its operations in the US, Australia, and Southern Europe. The company's international expansion efforts have been unsuccessful, limiting its TAM, but I will discuss this further in this article.

Overall, I am quite bearish on the company and don't view it as an attractive investment today as I believe the company has no significant competitive advantage, will be losing market share to competitors over the next couple of years, and does not see a way to substantial profitability in combination with meaningful growth. Yes, I expect the company to expand its margins over the next couple of years, but significant bottom-line profitability will take longer. In my view, current estimates by both management and analysts are too opportunistic.

A strong market position in Europe but the US is lagging, and the company is likely to exit Southern European countries

Today, Just Eat is the industry leader in several European countries like the Netherlands, the UK, and Germany. As the UK is the largest food delivery industry in Europe, Just Eat's market share here is crucial and the latest data shows that it holds a very solid 45% market share, closely followed by Deliveroo which also sits in the 40% range, with Uber coming in at third place.

Meanwhile, one of the most promising European food delivery markets is Germany as this one is seeing quite impressive growth due to increased adoption of the service. Today, Just Eat is favorably positioned to benefit from this growth but is facing tough competition from Uber, which is rapidly expanding its operations in the country.

Overall, the company's European operations look solid as it holds very decent market shares in these markets. The company today operates across most countries in Western/Northern Europe and has a foothold in the US through Grubhub, as well as operations in Australia and Southern Europe.

Just Eat acquired Grubhub back in 2020 for a staggering €6.4 billion as part of its global expansion strategy but it has not been a happy one as Grubhub has been struggling over recent years to fight off competitors like Uber and DoorDash. Whereas the company still held an 18% market share in the US food delivery market at the time of the acquisition, this has now fallen to just 10% as of July 2023, meaning it lost 8% in market share in just two years.

Following these market share losses and weak market position, Grubhub has been a drag on the group results for Just Eat. In the latest quarter, Grubhub reported a 12% decline in GTV against positive growth in the Northern Europe operations and only a 1% decline in the UK.

As a result, the company has been looking to sell the business for a little over a year but has yet to find the right buyer. Still, management has indicated that it is not rushing the sale of its US operations as it is looking to minimize the loss on the segment. However, this will most likely come in far below €2 billion, making it a horrible investment for Just Eat. Furthermore, as Grubhub continues to lose market share, I do not see this price go up as management looks for the right offer. The one positive to mention here is that Grubhub is finally at a breakeven point, which could potentially boost the value of its operations somewhat. Still, selling Grubhub at a loss of over €4.5 billion after two loss-making years is far from a positive.

The sale of its US operations comes after it, earlier in 2022, already sold its stake in Brazilian food delivery firm Ifood for a little under €2 billion, through which the company completely exited the South American market. It is no secret that the last couple of years after the COVID-19 pandemic have been tough for Just Eat as demand has dropped a bit, which has slowed its growth. Furthermore, the food delivery market continues to be a tough one to make a profit in, which is also dragging on the Just Eat business.

While it once had the ambition to become a global player and the worldwide leader in food delivery, it is safe to say that it failed at this. Its US operations clearly aren't developing in the right direction, and with management actively looking to exit the region, its global presence is increasingly shrinking.

I even expect the company to decrease its international presence further over the next several years as I believe it will also soon exit its Australian operations and possibly even southern and eastern Europe so that it can focus its efforts on increasing its market share in its largest and most important countries in North and Western Europe.

I believe this would be a good move by management. While this would very much limit the company's TAM, such a move of streamlining the business could create more stability, an improved investment case, and a more sustainable business model as the company has already reached a 5% EBITDA margin in Northern Europe.

In conclusion, while the sum of parts may be higher than its current market cap, I believe this is justified as I expect the business to deteriorate further as it will struggle to fight off competition and will have to sell operations outside of Western Europe at lower-than-expected multiples. It is hard to award a valuation to all its struggling operations.

A solid industry outlook but increasing competition limits Just Eat's growth potential

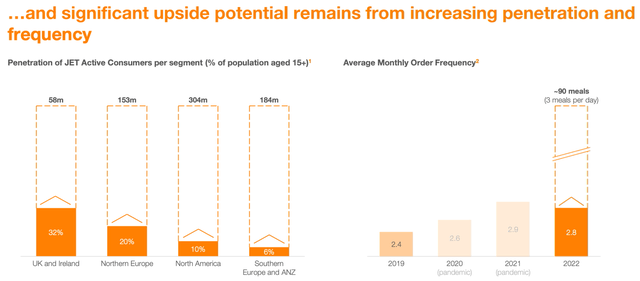

According to data from Statista, the European food delivery industry is poised to grow at a CAGR of 12.3% through 2027. This growth will be primarily driven by increased penetration, the massive growth in grocery deliveries, and the growth in ghost kitchens.

The most significant of these growth drivers is the still low penetration as penetration in the European food delivery market is still rather low at 24.9% but is expected to grow to 36.5% by 2027. This will be a solid growth driver for the food delivery industry and should remain meaningful until the end of the decade.

Food delivery penetration (Just Eat Takeaway.com)

Based on an expected 2023 market size of €122 billion and the expectation of Just Eat to report a GTV of €28 billion, Just Eat currently holds a market share in the European food delivery market of 23%, meaning it should be well positioned to benefit from the expected growth if it can maintain this market share, which is what I view as the largest risk here.

As the moat or competitive advantage in food delivery is very minor, it is hard to fight competition as the only levers for Just Eat include more attractive pricing, a larger offering, and higher discounts for its users. This is why I believe it will be hard for Just Eat to maintain its position as competition increases.

It is crucial to understand here that being the largest in an industry with very thin margins gives you a significant advantage. Due to its size and far better profitability, Uber is able to offer much more attractive customer discounts to win market share or offer more attractive deals to restaurants to join its platform.

Therefore, it will be hard for Just Eat to fight off Uber in particular, which I view as the strongest global player in food delivery. Uber also has ambitious growth plans in Western Europe where it has already conquered the French food delivery market with a market share approaching 50%. Furthermore, Uber is now fully focused on other large European delivery markets like Germany, The Netherlands, and Spain, whereas it recently exited the Italian market.

As Uber increases investments to grow its share in the European food delivery market, it will be taking share from Just Eat as Uber simply has superior financial resources which are crucial in this industry. Uber has much more financial firing power, is already driving solid profits through its delivery platform, and seems to be taking market share across European countries.

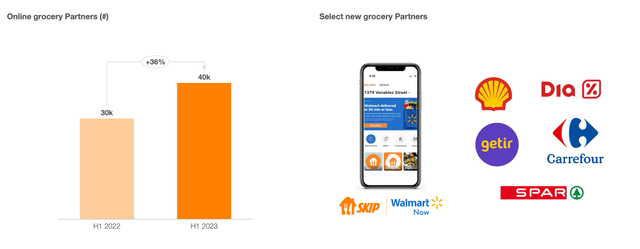

The one positive for Just Eat is that it is seeing solid momentum in grocery delivery expansion on its platform. In the first half of 2023, the company reported a 36% increase in the number of online grocery partners. With grocery being a faster-growing vertical in the food delivery industry, I expect this to work in Just Eat's favor regarding its market share.

Grocery partner growth (Just Eat Takeaway.com)

Management believes it should be able to double its 2022 GTV over the next few years to €60 billion in the medium term but at current growth rates and going by the industry outlook and potential for market share losses, this seems impossible to achieve.

Using management's FY23 outlook, we should expect FY23 GTV to be flat to down slightly YoY, resulting in a GTV of around €28 billion. Even if the company were to see significantly improved demand in FY24 and FY25, a GTV of €36 billion seems to be the most positive scenario, while a more likely scenario in my eyes should result in an FY25 GTV of closer to $32 billion.

Recent results are nothing to cheer about

Recent financial results, while including some positive developments, also included a number of serious negatives which I believe are reasons for concern, as I already indicated earlier in this article for some metrics.

Just Eat reported its H1 2023 results a couple of weeks ago and reported a GTV decline of 7%. This decline for Just Eat was largely driven by the North American and South European regions as these reported GTV declines of 10% and 13%, respectively. Meanwhile, the North European and UK business segments started reporting positive GTV growth again as these both reported GTV growth of 3% YoY, resulting in a positive first half for these two operating regions.

GTV growth by region (Just Eat Takeaway.com)

Still, this GTV decline reported by Just Eat stands in sharp contrast with competitors such as Deliveroo, Delivery Hero (DHERO), and Uber who all reported positive gross booking growth of 3%, 8%, and 12%, respectively, indicating that Just Eat is actively losing market share.

Furthermore, Just Eat reported negative growth on several other metrics as well, like active customers declining by 7%, orders declining by 12%, and revenue declining by 7%. Revenue came in at €2.59 billion, primarily driven by Northern Europe. At the same time, North America and Southern Europe continued to be a drag on the overall performance by reporting double-digit declines.

It is these underlying declines that worry me the most. Of course, losing market share against competitors is bad, but the company losing active users, seeing a significant decrease in orders, and even losing restaurants on the platform are factors that can have a long-term impact, and as these grow for competitors at the same time, this indicates that the Just Eat platform is losing strength.

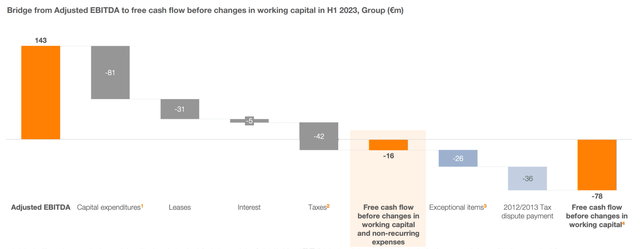

The one highlight in the earnings report was that, despite the top-line weakness, the company was able to boost profitability and report a positive EBITDA result of €143 million against a loss of €134 million in the first half of 2022. Furthermore, the company is also closing in on reporting a positive free cash flow, which it should be able to report by FY24.

Just Eat FCF (Just Eat Takeaway.com)

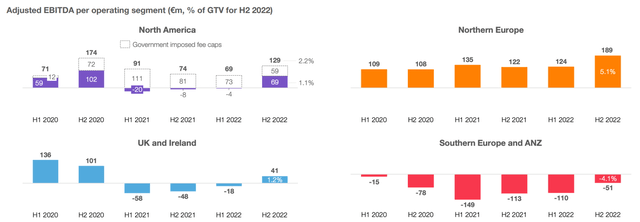

The overall margin development for Just Eat does also look solid as it has been able to meaningfully improve margins over recent years across all its regions. After several years of increased investments during COVID-19, the company has shifted its focus back to profitability, which is working well. However, I expect this improvement rate to slow down significantly over the next couple of years as the company will have to start a new investment cycle to hang on to its market share and expand operations. Therefore, I am projecting little margin improvements over the next couple of years.

EBITDA developments by region (Just Eat Takeaway.com)

Outlook & Valuation

For FY23, management now guides GTV growth to come in between a 4% decline and growth of 2%. This indicates that investors should expect growth to accelerate in the year's second half. Furthermore, the FY23 EBITDA is expected to sit around €275 million, up from €19 million in 2022. Management also maintained its long-term goals, but as I said before, these seem very opportunistic.

As for my long-term expectations, for now, we will have to assume all segments remain as they are, but please keep in mind that there is a significant probability of Just Eat selling some of its operations, as discussed before. If they were to end or sell operations in underperforming regions, this could boost its growth prospects and especially its profitability outlook, though, on a lower GTV base as North America, Southern Europe, and Australia account for half of its GTV as of H1 2023.

As for profitability, the company's long-term EBITDA target sits at 5%. Last quarter, this target was met by the Western/Northern European region, and therefore, also in part due to the company's strong position in this region, I believe that if the company were to spin off most of the underperforming regions, among which is Grubhub, it could report an EBITDA margin of 4%-5% (of GTV) by FY25. Yet, I chose to remain more conservative in my estimates.

I believe profitability will be held back by underperforming regions like North America and Southern Europe, and an EBITDA margin in the range of 2% to 3% is likely, especially as heated competition in key regions will force the company to grow costs at a faster pace to maintain its market share, impacting margins.

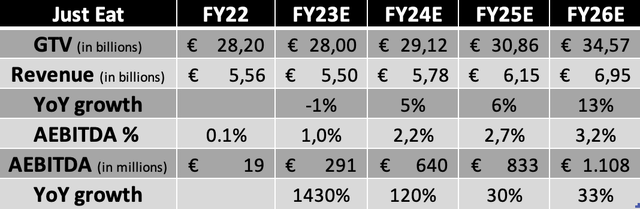

These are my financial projections based on my research of the company and the underlying industry.

Moving to the valuation, I believe a conservative EBITDA multiple of 7x, which sits below the European stock market average of 12x and its peer average of 9/10x, rightfully accounts for the company's recent struggles, possible market share losses and its somewhat unpredictable outlook due to possible region exits.

Based on this multiple, I calculate a FY25 price target of €27. Going with an annual return of 12.5%, which would be the minimal return to aspire when investing in a high-risk stock like Just Eat, I believe a current fair value share price sits around €20, leaving an upside of about 54% from its current depressed share price of around €13.

Conclusion

Looking at the company fundamentals and developments over the last couple of years, as well as its growth outlook, I would be urged to give the shares an avoid/sell rating as I believe there are better-positioned companies out there to benefit from the growth in the food delivery industry. I still believe this is the case and am not a huge fan of Just Eat as a long-term investment due to its deteriorating fundamentals and underperformance to peers.

Yet, at the same time, the current share price and valuation, even based on a conservative sales growth and margin expansion outlook, looks rather attractive as a medium-term trade of around 2/3 years. The current valuation offers significant downside protection, even if growth comes in far below my current estimates. There is much value on the table here and I believe that the current share price offers an attractive entry point for investors to benefit from, even when I am quite bearish on the company's prospects and long-term potential.

As a result, I do rate shares a buy as the current undervaluation is unjustified. For those looking for a shorter-term trade, the current undervaluation of the shares should deliver excellent value, although with a slightly higher risk profile. I would recommend investors to keep a close eye on its rapidly developing fundamentals.

Yet, for investors looking for a long-term buy and hold, Just Eat is not the right choice, and for those investors, I recommend looking further at the likes of Uber and DoorDash as excellent players in the food delivery industry.

With a 1-year price target of €23 and an upside of 77%, I rate Just Eat Takeaway.com N.V. a buy.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.