What I Wish I Knew Before Investing In REITs

Summary

- REITs are now very opportunistic.

- But not all REITs are worth buying.

- I give tips that you should help you avoid painful losses.

- High Yield Landlord members get exclusive access to our real-world portfolio. See all our investments here »

DNY59

Right now, real estate investment trusts, or REITs, are priced at their lowest valuations in years. They are often trading at large discounts relative to the fair value of their real estate, and offering high dividend yields.

The idea of buying real estate at 60–70 cents on the dollar with the added benefits of professional management, diversification, liquidity, and passive income is very compelling to many, and as a result, we are now seeing a lot of new investors flock to the REIT sector (VNQ).

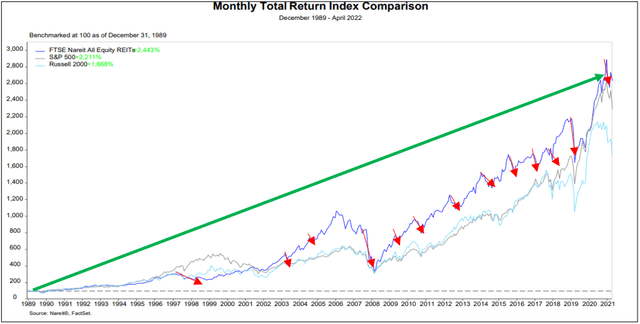

Many of these investors may not have previously considered REITs, but they now see a contrarian opportunity to buy REITs while there's blood on the street because historically, this has always paid off in the recovery:

But unfortunately, a lot of these new investors will end up picking the wrong REITs due to their lack of sector expertise, and it will ruin their investment results.

Not all that glitters is gold in the REIT sector and quite a few companies are either overleveraged, poorly managed, or exposed to troubled sectors.

As a result, stock selection is especially important, as performance disparities can be massive from one REIT to another.

Just consider the following example:

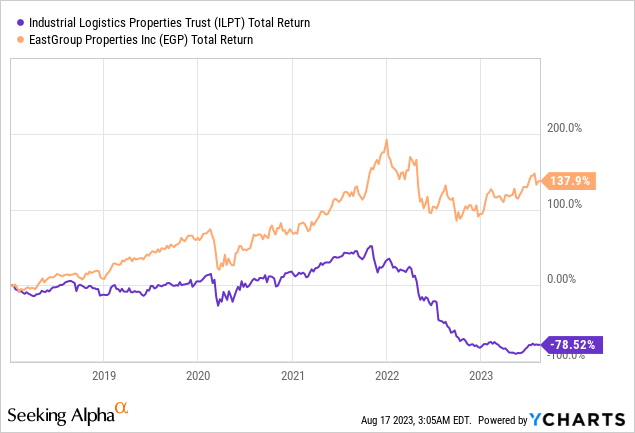

EastGroup Properties (EGP) and Industrial Logistics Properties Trust (ILPT) are both REITs that specialize in industrial properties. However, one has done very well over time for its shareholders, while the other has suffered significant losses:

It just shows you how important it is to first learn the basics of REIT stock selection before you start investing in them.

Here are 5 things I wish I knew before I got started over 10 years ago:

#1 - Capex Can Decimate Your Investment

Real estate generally gains value over time, but it still requires maintenance capex to assure that it remains in good shape.

It is one of the biggest expenses in real estate and yet, it is one of the most overlooked by investors.

Investors will commonly make the mistake of looking at cash flow, dividend payout, and debt metrics without adjusting for the impact of this capex and as a result, they will think that:

- A REIT is cheaper than what it really is.

- A REIT has a safer dividend than it actually is.

- And its debt is lower than in reality.

This then leads to poor selection and painful losses. I am talking from experience. Overlooking the growing need for capex was my biggest mistake when I invested in CBL & Associates Properties (CBL) years ago.

It is also important to recognize that capex can greatly vary depending on the property sector and the market conditions. To give you an example, capex is generally high in the office sector, but now it will grow even further as landlords will need to reconfigure their offices to adapt to the changing needs of their tenants. There's a lot of vacant space as well, and so the tenants really hold a lot of bargaining power, and it will be very costly to landlords.

At High Yield Landlord, we generally favor property sectors that are less impacted by capex. This includes net lease properties, casinos, industrial properties, and cell towers to give you a few examples. American Tower (AMT) does not need to constantly reinvest in its cell towers... and Realty Income (O) passes all these costs to its tenants.

#2 - The Quality of Managers Can Vary Very Significantly

It is very tough to become the CEO of a publicly listed REIT and generally speaking, if you have made it so far, it probably means that you are a very driven individual with great real estate skills.

But even then, there are huge differences in management quality, and in most cases, this is because some managers are better aligned with shareholders than others.

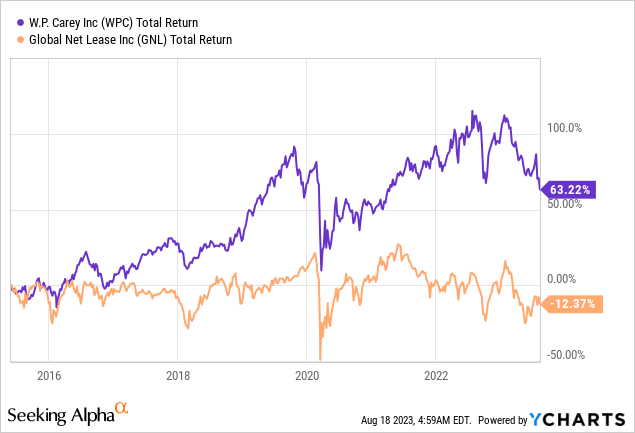

Here is a good example for you: W. P. Carey (WPC) and Global Net Lease (GNL) are similar net lease REITs that focus mainly on industrial net lease properties, and they both also have some exposure to Europe. But despite having similar strategies, their long-term performance is day and night:

WPC has done a lot better because its management is well-aligned with shareholders and focused on growing on a "per-share" basis.

GNL, on the other hand, has been the victim of what we call "empire building." I believe that they have tried to grow at all cost, diluting shareholders in the process, because a larger portfolio would justify higher compensation for its managers.

GNL has always been a lot cheaper than WPC and offered a higher dividend yield, but despite that, its total returns have been a lot worse.

So make sure that the management is good. Without that, all the rest is meaningless.

#3 - The Dividend Should Be An Afterthought

A lot of new REIT investors will start with the dividend.

Its yield and payout frequency are primary factors in their stock selection process.

But in reality, it should be the opposite. The dividend and its frequency should really be just an afterthought.

The dividend itself is just a capital allocation decision, and it does not have any impact on the value of the underlying properties or the cash flow of the REIT.

Therefore, your main focus should be the underlying fundamentals of the REIT, not its dividend yield.

I would add that it is also a mistake to favor a REIT just because it pays a monthly dividend instead of a quarterly one. Today, lots of investors will favor Realty Income as an example because of its monthly dividend, when in reality, some of its peers are more compelling in my opinion.

Getting a monthly dividend may feel nice, but it also increases costs to the REIT, which are ultimately paid by the shareholders. Paying quarterly reduces costs, and it also gives the REIT more flexibility with its liquidity. This is why most REITs pay quarterly.

#4 - You Shouldn't Select REITs Based On Their Quarterly Results

I often see REIT investors avoid certain specific REITs because they recently reported poor quarterly results and, in turn, they will favor some others because of good recent performance.

But in many cases, it is the exact opposite of what you should do.

Investors will commonly overreact to quarterly results, good or bad, and this will then cause REITs to become overvalued or undervalued based on short-term results.

In reality, the impact of quarterly results really shouldn't be that significant because real estate should be valued based on decades of expected future cash flow. So don't make the mistake of focusing too much on short-term results. The bigger picture is a lot more important when selecting REITs.

#5 - The Best Opportunities Are Often Abroad

Finally, a lot of investors make the mistake of only looking at REITs that are based in the US, even when those offer worst risk-to-reward than comparable REITs abroad.

The self-storage sector is perhaps the best example.

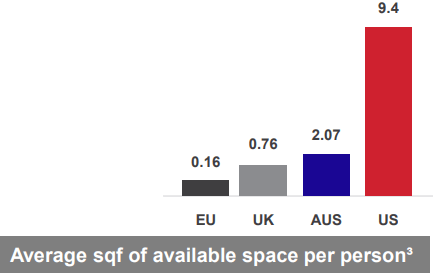

Today, the U.S. self-storage market is heavily overbuilt and competition is very significant. But the UK self-storage market is a lot healthier with just 1/10th of the U.S. supply per capita and the growth outlook is a lot more compelling:

Big Yellow

Despite that, a lot of investors will favor U.S. self-storage REITs like Public Storage (PSA) simply because they are overlooking European options.

Don't make that mistake.

The "Landlord" Approach To Picking REITs

A final tip is to keep it simple and invest in REITs as if you were investing in rental properties:

- Buy real estate at a discounted price

- Make sure to have a good manager

- Focus on the long-term prospects

- Don't get distracted by short-term results

- And don't get lazy and overlook foreign REITs.

I think that such simple principles can go a long way and improve your results when investing in REITs.

If you want full access to our Portfolio and all our current Top Picks, feel free to join us at High Yield Landlord for a 2-week free trial

We are the largest and best-rated real estate investor community on Seeking Alpha with 2,500+ members on board and a perfect 5/5 rating from 500+ reviews:

You won't be charged a penny during the free trial, so you have nothing to lose and everything to gain.

Start Your 2-Week Free Trial Today!

This article was written by

Jussi Askola is a former private equity real estate investor with experience working for a +$250 million investment firm in Dallas, Texas; and performing property acquisition in Germany. Today, he is the author of "High Yield Landlord” - the #1 ranked real estate service on Seeking Alpha. Join us for a 2-week free trial and get access to all my highest conviction investment ideas. Click here to learn more!

Jussi is also the President of Leonberg Capital - a value-oriented investment boutique specializing in mispriced real estate securities often trading at high discounts to NAV and excessive yields. In addition to having passed all CFA exams, Jussi holds a BSc in Real Estate Finance from University Nürtingen-Geislingen (Germany) and a BSc in Property Management from University of South Wales (UK). He has authored award-winning academic papers on REIT investing, been featured on numerous financial media outlets, has over 50,000 followers on SeekingAlpha, and built relationships with many top REIT executives.

DISCLAIMER: Jussi Askola is not a Registered Investment Advisor or Financial Planner. The information in his articles and his comments on SeekingAlpha.com or elsewhere is provided for information purposes only. Do your own research or seek the advice of a qualified professional. You are responsible for your own investment decisions. High Yield Landlord is managed by Leonberg Capital.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of O; WPC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (26)

Dividend yield is a function of current share price.. many of the higher quality reits trade at a premium so the actual Dividend is lower than its peers

I love collecting income from my REITS.Thanks for the article!

Oh. Can’t forget my tag line. mreits are terrible investments.

Thoughts on Mpw at $6.5 ... risk / reward heavily tilted in investors favor I'd think

That actually is avoiding the question... all companies spin information in the most favorable light for them ...

WsJ is not what it used to be...