EWP: Good Increments In Spanish Industries

Summary

- Low-multiple financials in Spain bring down the PE for EWP to an attractive level.

- In particular, Santander, while exposed to some risks in the European economy, is increasingly well-positioned in investment banking.

- At the moment, NIMs continue to rise, and outside of the financial exposures is the recession resistance of utilities. EWP looks alright.

- Looking for a helping hand in the market? Members of The Value Lab get exclusive ideas and guidance to navigate any climate. Learn More »

CGinspiration/E+ via Getty Images

The iShares MSCI Spain ETF (NYSEARCA:EWP) follows a bunch of companies in the Spanish markets. There's a decent amount of skew to the top several holdings, and the ETF is focused on financials and utilities companies that on balance are attractive, in particular Santander (SAN). At the current PE, the ETF seems like a good proposition considering the positive force from some of the largest holdings.

EWP Breakdown

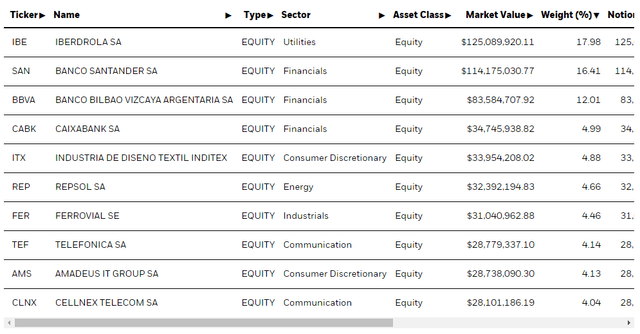

Here are some of the top holdings:

The substantial skew is evident, with the top two holdings dominating more than 30% of the allocations.

Iberdrola (OTCPK:IBDSF) is the largest, being a comprehensive generation and networks utility player in Europe. Some of the negatives are behind them, like the RIIO changes in the UK for their networks business. In fact, tariff revisions have supported their network businesses across geographies due to the inherent indexing to inflation in how regulatory WACCs are calculated. In the meantime, their capacity has continued to steadily grow, and a good pricing environment has contributed nicely to EBITDA. Disposals are reducing debt load and the net income growth excluding the one-offs from capital gains is at 21%. It's a very green play, with European green equities generally coming at a relatively deep discount compared to green propositions in the US.

Santander is the other major holding. They've been doing well by picking up a lot of wayward bankers from the fallout in financial institutions earlier this year. Prior to that the company has also committed to growing its investment banking franchise which has for a long time been pretty underwhelming on the league tables to actually achieving a strong result bolstering fee income which has otherwise been lagging in the banking sector. Continued customer growth as well as larger NI spreads has helped the net profit grow about 20%, a very solid result considering the banking environment. There are downside risks if the last leg of inflation is really sticky and rates have to come up more in order to battle inflation. This could grow reserves but also fuel deposit beta and start eroding the NI margins. However, the emerging balancing act between inflation and economic considerations, at least in the US, gives us an idea for when the rate hiking may come to an end. However, the ECB does not have a dual-mandate, so greater focus on stamping out inflation should be expected for European markets.

Bottom Line

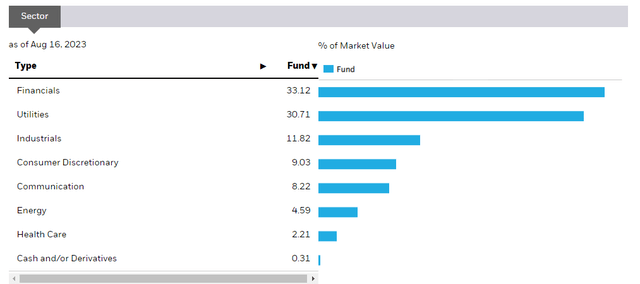

Sectoral Exposures (iShares.com)

Overall, the sectoral exposures are pretty solid from a recession resistance point of view. Labour market dynamics being stickier in Europe as well as proximity to the situation in Ukraine makes recessionary pressures more likely in Europe than in the US. Recession resistance is appreciated. Moreover, in the utilities businesses there tends to be explicit inflation protection insofar there is exposure to regulated utilities businesses. Moreover, there is transmission into electricity prices from inflation.

At a 10x PE, EWP looks pretty decent, and tells us that maybe there's value in Spanish financials at this point in time. Santander in particular could be singled out by investors who want to increase their exposure to greenshoots in the investment banking and M&A world after an extended drought in activity.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Thanks to our global coverage we've ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it's for you.

This article was written by

Formerly Bocconi's Valkyrie Trading Society, seeks to provide a consistent and honest voice through this blog and our Marketplace Service, the Value Lab, with a focus on high conviction and obscure developed market ideas.

DISCLOSURE: All of our articles and communications, including on the Value Lab, are only opinions and should not be treated as investment advice. We are not investment advisors. Consult an investment professional and take care to do your own due diligence.

DISCLOSURE: Some of Valkyrie's former and/or current members also have contributed individually or through shared accounts on Seeking Alpha. Currently: Guney Kaya contributes on his own now, and members have contributed on Mare Evidence Lab.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.