Kimball Electronics: Growth Is Strong And Likely To Continue

Summary

- Kimball Electronics Inc. has seen steady share price growth and offers appealing investment opportunities.

- The company provides contract electronics and manufacturing services to a wide range of markets, showcasing resilience and a solid balance sheet.

- KE focuses on industrial and manufacturing developments, with consistent revenue and EPS growth, making it a promising investment option.

Moyo Studio/E+ via Getty Images

Investment Summary

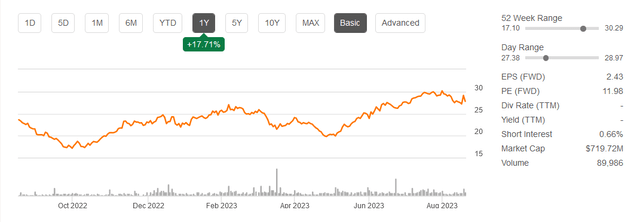

The share price for Kimball Electronics, Inc. (NASDAQ:KE) has been climbing steadily over the last 12 months, but still sits at a very appealing price point given the growth prospects of the company. Averaging over 10% yearly revenue growth in the last 5 years is showcasing the resilience of the business in the face of challenges like the Covid-19 pandemic but also significant supply chain constraints for companies.

Apart from the information technology sector, the company focuses mostly on providing contract electronics and manufacturing services to customers in a wide set of markets like automotive and industrial. With a broad set of customers to service, KE has managed to build up resilience as they boast a solid balance sheet and have over the years also bought back shares too. I find the price to be very appealing and will be rating the company a buy as a result. For investors seeking exposure to a broad set of end markets, KE seems to offer a great opportunity to do so right now.

A Look At The Business

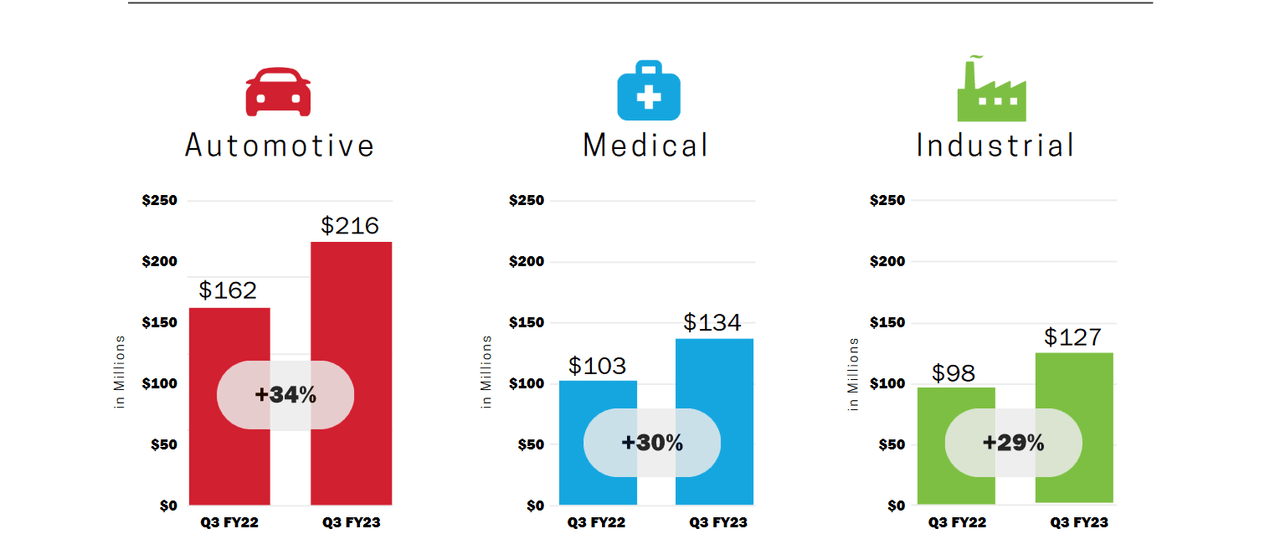

As we know, KE operates in the information technology sector, or more precisely the electronic manufacturing services industry. Here it has managed to gather up a very large and broad set of customers from industries like automotive, medical, and industrials. Investing in KE is a bet on further industrial and manufacturing developments in the US and abroad. The company is leveraging this position to assert its customers with the ability to overcome challenges and headwinds by providing both services and solutions for them. Industrialization and automation of manufacturing processes are some of the key areas that KE focuses on.

Market Postion (Investor Presentation)

The company has as I said built up a solid customer base, with a clear majority being with them for over 10 years. But the company is continuously adding more customers and the existing ones are continuing to catch up and demand more from KE, which results in higher revenues for the company. In conclusion, this has made KE able to grow revenues by over 10% yearly over the last 5 years.

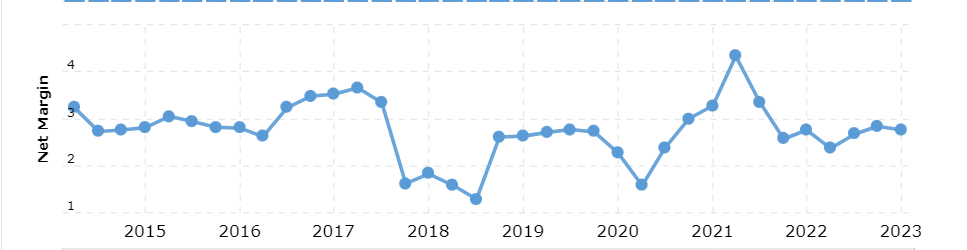

Net Margins (macrotrends)

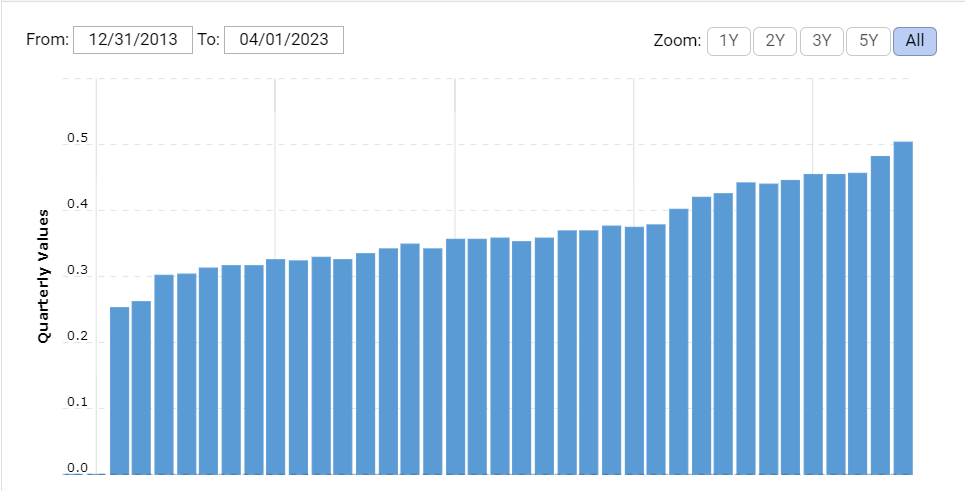

Consistent net margins have also made the company able to buy back shares which have further boosted the EPS growth of the business, netting them over 20% annual growth for it the last 5 years. Investors in the company have been rewarded decently over the last 5 years, with a share price growth of 38%. However, I think over the coming 5 years we can expect larger returns than that, as with time I think KE will eventually reach a p/e similar to the sector of 19%. Trading around 20% below it right now leaves a solid amount of margin of safety but also the potential for medium-term upside potential. As reports from KE continue to impress, I don’t think we are far away from a higher reevaluation of the company.

Risks

Kimball Electronics operates as a relatively compact company, boasting a market capitalization that hovers slightly around $600 - $700 million market cap. This relatively modest market cap is mirrored by the stock's propensity for trading on comparably light volume. Consequently, this characteristic opens the door to potential volatility in the share price. For investors that like to swing trade, this certainly makes KE a good candidate, but I don’t think the long-term investors should be worried as the value of the business still exists and short-term fluctuations in the price are unlikely to derive the buy case for the company in my opinion.

Shares Outstanding (Macrotrends)

In addition to the ongoing narrative of global growth, there exists a variety of additional factors, both macroeconomic and geopolitical, that possess the potential to disrupt this trajectory. Among these potential disruptors, the persistent conflict in Ukraine looms as a significant concern. Should this conflict continue to escalate or spill over into adjacent nations, it could inject considerable uncertainty into the global economic landscape. With a market condition that is looming with uncertainty, I think a lot of companies are going to be worried about making too many investments and potentially overleveraging themselves, that could translate to short-term headwinds for KE, but I still see it as unlikely to persist in the long-term.

End Markets (Investor Presentation)

A related geopolitical wildcard is the prospect of involvement by other major players on the international stage. China, as a powerful and influential nation, can substantially impact the course of global events. Should China or any other nation with an inclination for disruption decide to flex its muscles on the geopolitical front, the carefully woven fabric of global growth could experience unprecedented strain.

Financials

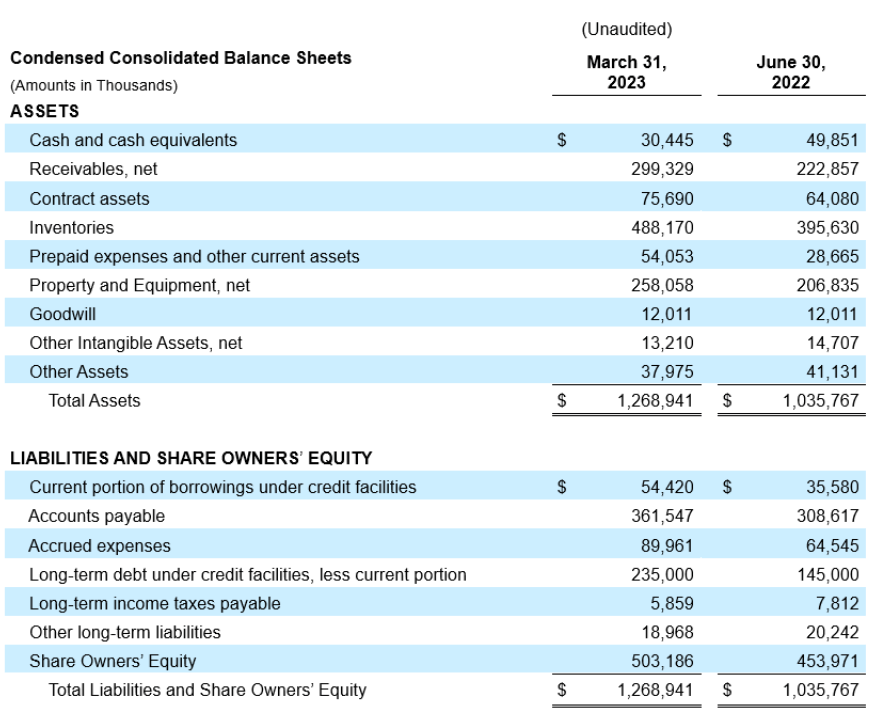

Looking at the financials of KE, I think they remain very solid as they continue building up a solid inventory level and scaling without overleveraging themselves.

Balance Sheet (Earnings Report)

In terms of cash for KE it sits right now at around $30 million and that does show a decrease of $19 million YoY, but KE now has far more in receivables, nearly at $300 million. Inventory levels have also increased quite quickly and are approaching $500 million. This is making up a significant portion of the market cap of KE right now, and the p/b sits at just 1.33 right now. That is a significant discount of 68% to the sector.

Going into the coming quarters, I think investors will be looking for growth in terms of FCF and therefore a reduction of the long-term debts. The company has increased its debt position by nearly 100% over just 12 months, which of course puts them in a less financially free position. However, it doesn't seem to have stopped them from growing its revenues and EPS. I, for one, will be looking out for the higher debt continuing to translate into stringer revenues.

Valuation & Wrap Up

For investors that seek a broad set of exposures to various industries from a more service-oriented way, then I think KE is a very solid opportunity right now. The company has an appealing price point that leaves a solid upside potential in the medium term.

Stock Price (Seeking Alpha)

As more and more manufacturers want to automize tasks and increase margins, KE offers available solutions and a set of services for them to do sit. The appeal of the company comes also from the strong relationship it has with customers, with a larger portion staying with them for over 10 years. I like the nearly 20% discount you get to the sector with KE and will be rating it a buy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.