Our Top 10 Picks For Dividend Growth Stocks - August 2023

Summary

- This monthly series of articles focuses on DGI stocks that are likely to provide a high rate of dividend growth rather than a high current yield.

- We use our proprietary models to rate quantitatively and qualitatively and select the top ten names from an initial list of nearly 400 dividend stocks.

- The article provides criteria for selecting high-growth dividend stocks and offers a step-by-step guide on how to structure a portfolio based on this strategy.

- We also publish a monthly series titled "5 Relatively Safe and Cheap DGI Stocks," focusing on moderate to high current income-favoring high-yield names.

- Looking for a portfolio of ideas like this one? Members of High Income DIY Portfolios get exclusive access to our subscriber-only portfolios. Learn More »

Olivier Le Moal

In this series of articles, we focus on selecting and highlighting stocks that have been growing their dividends in the recent past at a rapid pace. We also need to ensure that these stocks will likely grow their earnings at a fast pace in the next few years. Due to their hypergrowth, their price generally grows at a fast pace, and they usually do not pay very high current yields. We should be content with a low current yield. However, please keep in mind that nothing is permanent, and with time, their business model matures, or new competition/technology can emerge and change their growth patterns. That's why it may be important that we monitor these stocks at least every quarter.

If you need higher yields, please read the most recent article from our monthly series titled "5 Relatively Safe and Cheap DGI," which focuses on moderate to high current income - favoring high-yield names. Irrespective of the fact whether your goal is high dividend growth or high current income, we always need to pay attention to the quality of companies that we invest in and the price we pay.

Note: Please note that the stocks shortlisted and highlighted in this article are not buy recommendations per se but rather candidates for further research. Please use your due diligence, considering your personal goals and risk tolerance, before making any investments. Also, some of the sections in the article (Introduction, Selection methodology/process, etc.) will be repetitive from month to month for the benefit of the new readers. Such sections would be displayed in "italics," and regular readers could skip them.

Why High Growth Dividend Stocks?

There are two types of dividend stocks that a DGI investor can choose from depending upon their individual situation, goals, and investing time horizon:

- High Growth Low Yield [HGLY]

- Low Growth High Yield [LGHY].

As the names suggest, the HGLY category would have stocks that offer a high rate of dividend growth but usually a low current yield. These stocks would normally have low payment ratios, manageable levels of debt, and rapidly rising earnings.

On the other hand, LGHY-type of stocks would offer a high current yield (generally 3% and higher) but a lower rate of dividend growth. Generally speaking, these companies are more mature and stable businesses that have their hyper-growth period in the rearview but still grow modestly over time to support a low but stable growth in dividends.

Obviously, there will be stocks that fit somewhere in between these two categories, for example, medium growth and medium current yield.

So, who should own HGLY-type stocks? Basically, anyone who is in the accumulation phase and does not need the income currently and/or in the next five to ten years should own some high-growth dividend stocks. In addition, folks, including retirees, who have a large investment capital that generates more income than they need currently (for example, 1.5x or 2x their income needs) should invest at least partially in HGLY type of stocks.

How To Structure A Portfolio Based On This Series

Though it would depend a great deal on your personal goals, risk tolerance, investment methodology, and choices; however, if you wish to make a portfolio based on this monthly series, here is one way to do it

- Make a portfolio budget and provision to have a maximum of 20 to 25 stocks over time.

- Divide your capital (current + future) into 25 equal parts.

- In the first month, buy 5 to 10 positions based on the 10 top stocks for that month.

- From the next month onwards, check for the new stocks appearing in the top 10 list that are not part of your portfolio, and add (as many as your process and budget allow).

- Repeat step 4 until you reach the max 20 or 25 positions.

- When you have reached the max 20 or 25 positions and have no more capital to add, look for new stocks that have made it to the top 10 list and see if any of them should be added based on your further research. If you decide to add a position, you need to find a position you would like to drop and replace it with the new one. You can find an existing position to drop that has not made it to the top 10 during the last several months (for example, during the last six months).

- It may also be recommended to monitor your positions periodically, preferably monthly. Also, make sure that you do not overweight any particular sector or industry segment.

Selection Criteria

We will draw upon our original current month's data set, taken from our other DGI series (5 Relatively Safe and Cheap DGI). We will then apply additional criteria to filter out stocks that have provided a high rate of dividend growth in the recent past and are likely to continue on that path for the foreseeable future.

Please see our original article to get a complete spreadsheet of this dataset. For the sake of clarity, we will list the original filtering criteria below:

- Market cap > $10 billion ($8 billion in a down market)

- Dividend yield > 1.0% (some exceptions are made to include high quality but lower yielding companies)

- Daily average volume > 100,000

- Dividend growth past five years >= 0 (we will check for high growth later).

- Preferably, a minimum of 5 years of positive dividend growth.

Subsequent to the above filter, we calculated a score (Dividend Safety Quality Score) that was derived based on the following factors:

- Current Yield

- Dividend growth history (number of years of dividend growth):

- Payout ratio - Preferably based on Free Cash Flow.

- Past five-year and 10-year dividend growth

- EPS growth (average of previous five years of growth and expected next 3-5 years' growth)

- Chowder number - the sum of the 5-yr dividend growth rate and the current yield

- Debt/equity and Debt/asset ratios

- S&P's credit ratings (Standard & Poor's Global Ratings)

- Distance from 52-week high (current price minus 52-wk high price)

- Sales or Revenue growth for the past five years.

Notes:

1. The original Quality Score was calculated and taken from the spreadsheet, as attached in our most recent monthly article (5 Relatively Safe and Cheap DGI Stocks). The link was provided above in the introductory section.

2. All tables in this article are created by the author unless explicitly specified. The stock data have been sourced from various sources such as Seeking Alpha, Yahoo Finance, GuruFocus, IBD, and CCC-List (dripinvesting).

Additional Criteria for Dividend Growth Stocks

A vast majority of stocks selected so far have raised their dividend payouts for five years or more. However, some may not have raised consistently but have paid dividends for a long duration and raised them only periodically. However, as an additional criterion, now we will filter out stocks that have increased their dividend payouts by an average annual rate of 8% or more (some exceptions are made if the Chowder number is decent). We will also consider stocks that may not have provided a consistent yearly increase but overall have provided a cumulative increase of 30% in payouts in the last five years.

We will now use the following additional criteria to filter out stocks that would fit the mold of High Growth DGI stocks.

- The payment Ratio (on a cash-flow basis or EPS basis) is less than 80%.

- 5-Year Dividend growth is at least 7.5% or greater. This is in line with the growth rate of the benchmark fund, Vanguard Dividend Appreciation Index Fund ETF Shares (VIG). However, if the 5-Year growth rate is less than 7.5%, but the 10-year dividend growth rate is greater than 7.5%, we will keep it.

- Chowder number (5-YR dividend growth plus the dividend yield) >= 9. The Chowder number is the sum of the current yield and the dividend growth rate of the last five years. However, if the 5-YR dividend-growth rate is less than 7.5%, we will check if the 10-YR growth rate is 7.5% or higher.

After we apply these criteria, we are left with 283 stocks on our list. Please note that at this stage, we have applied our base criteria that are loose enough to keep a wide variety of stocks. However, we will now perform additional filtering to get the best possible candidates.

We know that for a stock to grow its dividend rapidly, it must grow its earnings at a very high pace. Without growth in earnings (earnings per share - EPS), the company cannot grow its dividends for long. Sure, some companies may try to do it by taking on more debt, cutting costs, or spending less on R&D and capital, but such measures cannot be sustained long before they start causing wider issues. So, our focus ought to be on earnings growth.

In our spreadsheet, we will add four more columns of data for each of the stocks:

- EPS (earnings per share) Rating

- Last Qtr EPS change % (actual)

- Current Qtr EPS change % (est.)

- Current year EPS change % (est.).

We will now assign weights to these four sets of data for each stock and add them to the original "Dividend Safety Quality Score" to come up with a modified Quality Score tilted in favor of high dividend growth stocks. We will call this column a High-Growth Quality-Score [HGQS]. We will also import the 5-Yr Average Dividend Yield for each stock.

Narrowing Down the List To 40 Stocks

From the above list of 283 stocks, we will select roughly 45 stocks based on the following methodology.

- Top 15 stocks based on the highest HG-Quality-Score (adjusted for sector or industry over concentration).

- Top 10 stocks based on the highest 5-yr dividend growth.

- Top 10 stocks based on the highest 10-yr dividend growth.

- Top 10 stocks based on EPS rating (EPS rating is taken from IBD – subscription required).

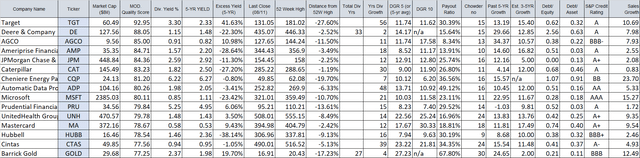

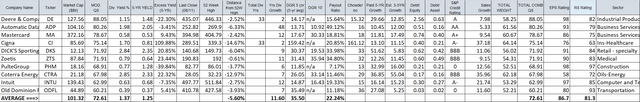

Table-1: Top 15 Highest HG-Quality-Score Stocks:

Table-1B: Top 10 Highest Past Dividend Growth Stocks (5 years):

Table-1C: Top 10 Highest Past Dividend Growth Stocks (10 years):

Table-1D: Top 10 Stocks with Highest EPS Rating:

We will now remove the duplicates from this list as many stocks qualify based on multiple criteria.

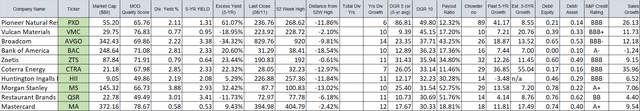

Appeared two times: AGCO, AMH, DE, MA, PXD, ZTS (6 duplicates)

We are now left with 39 (45 - 6) names.

Next, we will remove any stock that has an HG-Quality Score of less than 60. This check will remove three entries (AMH, HII, QSR) from the list, leaving us 36 names.

We will also remove any names where the revenue growth (over the past five years) has been negative. There is none on this list.

We will now calculate the average of EPS and RS (relative strength) ratings and remove any names that have less than 70. This removes AEM, MS, GOLD, and TGT, leaving us 32 names,

Finally, we will remove some stocks to avoid over-concentration from one sector or industry segment.

Banks: We keep JPM and remove BAC.

Insurance: We will keep PRU and remove KNSL.

Finance: We keep AMP and remove ARCC.

IT & Software: We keep AVGO and INTU but remove MSFT.

Industrial: We keep DE and AGCO and remove CAT, HUBB, and CTAS.

Oil Production/Exploration: We will keep CTRA and FANG but remove CQP and PXD.

Home Building: We keep VMC and PHM but remove LEN

Healthcare: We will keep ZTS but remove MCK.

Healthcare: Ins: We will keep CI but remove UNH.

REITs: We keep INVH and remove CUBE.

We are finally left with 20 names, which are presented in the table below:

Table 2: Top 20 High Growth DGI Stocks of the Month:

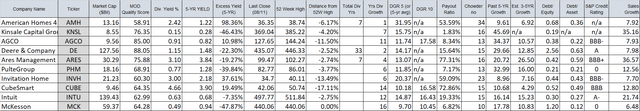

Final Step: Selection of Top 10 High Growth DGI Stocks

This final step of bringing down the number of selections to just ten stocks is a subjective process. We try to keep the group diverse, representing many sectors and industry segments. The readers could certainly come up with their own set of ten companies appropriate for their goals, but they should try to keep the group diversified among different sectors or industry segments. Nonetheless, we describe below how we go about selecting these ten stocks for the month.

- As a first step, we will sort out our list of the above 20 stocks on the basis of sector-Industry-segment and then in descending order of net Quality-score.

- We will select one stock from each industry segment from top to bottom. We will try to select either the top (or the second one) from each of the industry segments.

- We may give some weightage to how a stock is priced currently (in terms of valuation), but some of these high-growth stocks may not trade at cheap valuations.

Here are our top 10 selections for this month.

Current Month (August) List: (DE), (ADP), (MA), (CI), (DKS), (ZTS), (PHM), (CTRA), (INTU), (ODFL).

Previous Month (July) List: (DE), (INTU), (MTB), (ADP), (UNH), (MA), (DKS), (CTRA), (ZTS), (LEN).

Since this methodology is based largely on a filtering process, we would like to mention that many stocks could repeat from one month to the next, but we will also see new stocks making it to the top and replacing some old ones. We do not change stocks just for the sake of changing. This month, seven of ten stocks from the last month are repeating.

Also, it may be interesting to note that Mastercard appeared in our list instead of Visa this month. It is simply a function of our filtering process. But in our opinion, both are equally good candidates and are interchangeable. So, if you were holding Visa, there should be no need to replace it with Mastercard.

Note: Please note that if a stock was in a previous month's list but is no longer selected in the current list, it does not mean the stock is no longer a good choice. If the stock has still scored an HG-Quality score of >70, we think it could still be at least a "hold" (if not a "buy"). The purpose here is to highlight the top candidates every month. Please conduct further research and due diligence before making buy or sell decisions.

Table 3:

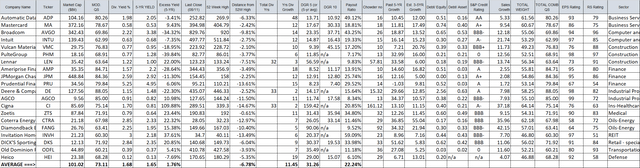

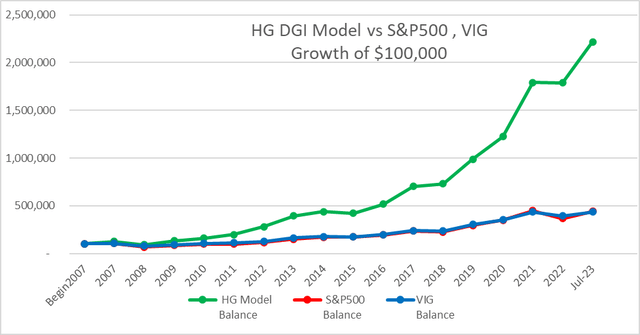

Past Performance

Now, let's see how our model portfolio of these ten high-growth stocks would have performed since 2007 compared to the benchmark Vanguard Dividend Appreciation Index Fund ETF or the S&P 500 (SP500). Incidentally, VIG and the S&P 500 have performed quite similar in the last 15 years. We assume that our model portfolio was invested equally in the ten selected stocks for the entire period. Please remember that this is a back-tested performance, not an actual one. Also, past performance is no guarantee of any kind for the future.

Chart-1:

Note: One of the stocks, ZTS, did not have a history all the way back to 2007, so it was not considered prior to 2014.

Performance of the Previous Month's selections:

(From July 17, 2023, to August 15, 2023.)

The performance comparison is approximately for one month (from the date of the previous month's report to the current month). Although one month is too short to judge the performance of any portfolio; however, it may be worthwhile to compare the performance every month, and this will allow us to calculate the yearly performance of the strategy. We also report the YTD cumulative figures. Obviously, the performance will vary from month to month.

Table-4:

Concluding Remarks

In this monthly article, our primary focus is on selecting high-growth dividend stocks, not just any dividend stock. Usually, such stocks are in their hyper-growth period, and their valuation is generally rich. This is also the reason that their dividend yields are at the low end. So, this list may not be appropriate for income investors but rather for a more selective audience.

Based on our rule-based filtering process, we start with a large number of stocks every month and narrow the list to roughly 20. As a final step, we use subjective analysis and our judgment to select ten stocks that form a diversified group and will likely offer high growth at reasonable values.

High Income DIY Portfolios: The primary goal of our "High Income DIY Portfolios" Marketplace service is high income with low risk and preservation of capital. It provides DIY investors with vital information and portfolio/asset allocation strategies to help create stable, long-term passive income with sustainable yields. We believe it's appropriate for income-seeking investors including retirees or near-retirees. We provide ten portfolios: 3 buy-and-hold and 7 Rotational portfolios. This includes two High-Income portfolios, a DGI portfolio, a conservative strategy for 401K accounts, and a few High-Growth portfolios. For more details or a two-week free trial, please click here.

This article was written by

I am an individual investor, an SA Author/Contributor, and manage the “High Income DIY (HIDIY)” SA-Marketplace service. However, I am not a Financial Advisor. I have been investing for the last 25 years and consider myself an experienced investor. I share my experiences on SA by way of writing three or four articles a month as well as my portfolio strategies. You could also visit my website “FinanciallyFreeInvestor.com” for additional information.

I focus on investing in dividend-growing stocks with a long-term horizon. In addition to a DGI portfolio, I manage and invest in a few high-income portfolios as well as some Risk-adjusted Rotation Strategies. I believe "Passive Income" is what makes you 'Financially Free.' My personal goal is to generate at least 60-65% of my retirement income from dividends and the rest from other sources like real estate etc.

My current "long-term" long positions (DGI-dividend-paying) include ABT, ABBV, CI, JNJ, PFE, NVS, NVO, AZN, UNH, CL, CLX, UL, NSRGY, PG, KHC, TSN, ADM, MO, PM, BUD, KO, PEP, EXC, D, DEA, DEO, ENB, MCD, BAC, PRU, UPS, WMT, WBA, CVS, LOW, AAPL, IBM, CSCO, MSFT, INTC, T, VZ, VOD, CVX, XOM, VLO, ABB, ITW, MMM, LMT, LYB, RIO, O, NNN, WPC, TLT.

My High-Income CEF/BDC/REIT positions include:

ARCC, ARDC, GBDC, NRZ, AWF, CHI, DNP, EVT, FFC, GOF, HQH, HTA, IIF, IFN, HYB, JPC, JPS, JRI, LGI, KYN, MAIN, NBB, NLY, OHI, PDI, PCM, PTY, RFI, RNP, RQI, STAG, STK, USA, UTF, UTG, BST, CET, VTR.

In addition to my long-term positions, I use several "Rotational" risk-adjusted portfolios, where positions are traded/rotated on a monthly basis. Besides, at times, I use "Options" to generate income. I am also invested in a small growth-oriented Fin/Tech portfolio (NFLX, PYPL, GOOGL, AAPL, JPM, AMGN, BMY, MSFT, TSLA, MA, V, FB, AMZN, BABA, SQ, ARKK). From time to time, I may also own other stocks for trading purposes, which I do not consider long-term (currently own AVB, MAA, BX, BXMT, CPT, MPW, DAL, DWX, FAGIX, SBUX, RWX, ALC). I may use some experimental portfolios or mimic some portfolios (10-Bagger and Deep Value) from my HIDIY Marketplace service, which are not part of my long-term holdings. Thank you for reading.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABT, ABBV, CI, JNJ, PFE, NVS, NVO, AZN, UNH, CL, CLX, UL, NSRGY, PG, TSN, ADM, MO, PM, KO, PEP, EXC, D, DEA, DEO, ENB, MCD, BAC, PRU, UPS, WMT, WBA, CVS, LOW, AAPL, IBM, CSCO, MSFT, INTC, T, VZ, CVX, XOM, VLO, ABB, ITW, MMM, LMT, LYB, RIO, O, NNN, WPC, ARCC, ARDC, AWF, CHI, DNP, EVT, FFC, GOF, HQH, HTA, IFN, HYB, JPC, JPS, JRI, LGI, KYN, MAIN, NBB, MCI, NLY, OHI, PDI, PCM, PTY, RFI, TLT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: The information presented in this article is for informational purposes only and in no way should be construed as financial advice or recommendation to buy or sell any stock. The author is not a financial advisor. Please always do further research and do your own due diligence before making any investments. Every effort has been made to present the data/information accurately; however, the author does not claim 100% accuracy. The stock portfolios presented here are model portfolios for demonstration purposes. For the complete list of our LONG positions, please see our profile on Seeking Alpha.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)