Matterport: Growth Remains Strong And Profitability Is The Key Upside Catalyst

Summary

- Matterport's 2Q23 performance exceeded expectations with strong growth in subscription, product, and service revenue.

- The company's strategic alliances and recent price adjustments support sustained subscription revenue growth.

- The biggest obstacle to valuation re-rating is the company's massive losses, but recent operational changes and cost-cutting efforts are expected to improve margins.

AzmanJaka

Summary

Following my coverage of Matterport (NASDAQ:MTTR), which I recommended a hold rating as the stock price has risen to my initial price target of $3.82. This post is to provide an update on my thoughts on the business and stock. I reiterate my hold rating for MTTR despite it continuing to see strong performance as I prefer to wait for headwinds from the real estate sector to clear. As the economy recovers, I expect this headwind to flip into a growth tailwind, which could accelerate growth (I model flat 15% growth to be conservative). The upside catalyst for valuation is MTTR showing better than expected margin improvement, which should help close its valuation gap vs. peers.

Investment thesis

MTTR's 2Q23 performance exceeded consensus expectations, with subscription revenue, total revenue, and margins all slightly surpassing consensus estimates and aligning with the upper range of guidance. Notably, the overall strong performance was underpinned by a robust 58% rise in Product Revenue and a remarkable 113% increase in Service Revenue. Meanwhile, Subscription Revenue experienced a solid 13% growth, which holds particular significance as it constitutes approximately half of the total revenue. Management highlighted that, despite the real estate segment's weakness, other verticals such as construction, travel, hospitality, facilities management, and insurance achieved double-digit growth. I believe the company's strategic alliances with key industry players like Autodesk and Amazon further support sustained subscription revenue growth. Recent price adjustments should also contribute to this growth trajectory. The key obstacle to further acceleration is that 50% of Subscription is driven by the real estate market. Management is still anticipating a prolonged period of weakness in the residential real estate market in the United States. The good news is that this is related to the macro environment, which should improve in the long run.

If you've been following the MTTR story, you know that the company's massive losses are the biggest obstacle to a valuation re-rating, even more so than slow growth. As a result, it was encouraging to see 2Q23 EPS and operating margins that exceeded consensus expectations, thanks to an increase in gross margins and steady efforts to keep costs down. EBIT margins improved to -61%, which is still extremely negative but suggests very high incremental margins. In addition to renegotiations with vendors and the formation of enterprise and go-to-market [GTM] teams, management highlighted other operational changes to cut costs. Management has taken additional steps with the workforce reduction to improve GTM, which should have a noticeable impact on margins in the coming quarters. In my opinion, the restructuring plan will be well received by the investment community, given the criticisms leveled at the company's profitability profile in the past.

The recent announcements of new AI solutions show that MTTR is committed to providing its customers with compelling value-added services, which bodes well for the company's long-term growth prospects. To streamline the processes of interior design-based planning and property management, the company announced in June a new product called Genesis, which employs generative AI to combine the company's new Property Intelligence technology and a spatial library data set of 33 billion square feet. Given the current dearth of data, I expect to see increasing number of customers and contribution margin per customer as MTTR roll out more value-added features through the application of AI. However, management anticipates Genesis' beta release in late summer and GA release by year's end, so the AI impact is not likely to be noticeable until at least FY24 or FY25.

Valuation

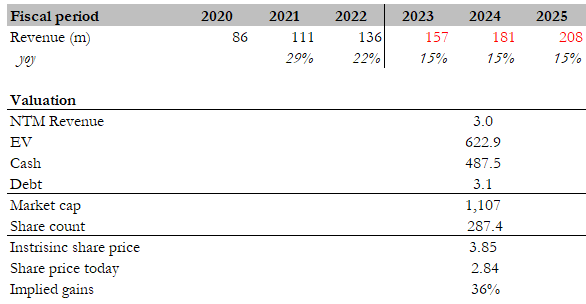

(Own calculation)

I believe the fair value for MTTR based on my model is $3.85. My model assumptions are that MTTR will continue to grow at 15% for the next 2 years after meeting its FY23 guidance. I would highlight that my assumptions are very conservative, as the business is still growing off a small revenue base and was growing at 20+% last year. I am also assuming multiples will stay at the current level as I see the lack of profitability continuing to weigh on valuation. The point of lack of profits is certainly a big overhang if we compare it to MTTR peers, despite my expectation that MTTR can grow faster than the group. However, I think the right timing to long the stock is when we have better visibility on the macro economy outlook (impacting the real estate portion of subscription revenue).

Peers include: Ansys (ANSS), Cadence Design (CDNS), Dassault Systemes (OTCPK:DASTY), Synopsys (SNPS), Aspen Technology (AZPN), PTC (PTC), Bentley Systems (BSY), Autodesk (ADSK), Altair Engineering (ALTR), and Procore Technologies (PCOR). The median forward revenue multiple peers are trading at is 8x forward revenue, the expected 1Y growth rate is 12%, and the median EBITDA margin is 30%.

Conclusion

I reiterate my hold rating for MTTR despite its continued strong performance because of the real estate headwinds. My opinion is to go long the stock when the economic recovery shifts these challenges into growth opportunities. The key valuation upside lies in margin improvement that could close the gap with peers.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.