Tilly's Q2 2023 Preview: The Picture Is Growing Worse

Summary

- Tilly's, a specialty retailer, has experienced a significant decline in its bottom line over the past few quarters.

- The company's financial performance has been negatively impacted by factors such as inclement weather and inflationary pressures.

- Tilly's upcoming financial results for the second quarter are expected to show further deterioration, leading to a downgrade in its rating to a soft 'sell'.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

felixmizioznikov/iStock Editorial via Getty Images

Unless I am already bearish on a company, I take no pleasure in seeing a company's share price drop. The thought of somebody else losing money has never been pleasant to me. However, it is imperative to remain as objective as possible and as unbiased as possible when it comes to evaluating various investment prospects. This also involves being flexible with your views, ultimately changing them as the data suggests you should. The reason why I bring this up is because, at this time, I've decided to take a more bearish stance on Tilly's (NYSE:TLYS), a specialty retailer that focuses on the sale of casual apparel, footwear, accessories, and even some hard goods. Even though the company has no debt on its books, and it enjoys a tremendous amount of cash relative to its market capitalization, the bottom line has worsened for it considerably over the past couple of quarters. It would not take much for the company to become an attractive opportunity again. But with even management and analysts bearish as the firm's earnings approach, I cannot help but to be pessimistic at this time.

Times are tough

In early January of this year, I wrote an article that took a rather neutral stance on Tilly's. At that time, I recognized that 2022 was gearing up to be a rather difficult year for the company. This was especially true when it came to the company's bottom line. But because the company had no debt on its books and enjoyed a surplus of cash, I ended up rating it a 'hold' to reflect my view that shares should generate upside or downside that would be more or less in alignment with what the broader market would experience over a similar window of time. Since then, things have not gone according to plan. The stock is down 3.2% at a time when the S&P 500 has shot up 14.3%.

I am a firm believer that the market can be inefficient fairly regularly. However, I do think the recent pain that shareholders have seen relative to the market was probably justified. As an example, we need only look at financial performance covering the first quarter of the 2023 fiscal year. During that time, sales came in at $123.6 million. This plunge came even as the number of stores operating for the company expanded from 241 at the end of the first quarter of 2022 to 248 the same time this year.

The real pain, then, involved a 17.5% plunge in comparable store sales. Management attributed this to a combination of factors, most notably an extended period of unseasonably cold and wet weather in February and March of this year. This was especially problematic in California, where 40% of the company's stores are located. However, they also cited inflationary pressures on the company's young customer demographic. This pressure was severe. I say this because, according to the data provided, all geographic markets and all merchandising departments for the company, with the exception of its footwear category, saw double-digit comparable store sales declines on a year-over-year basis.

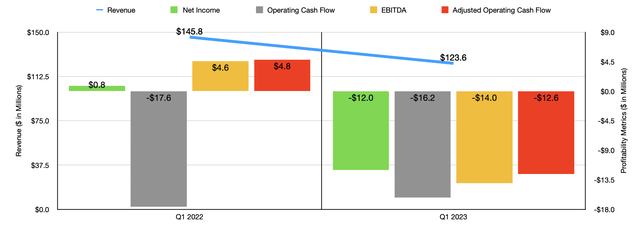

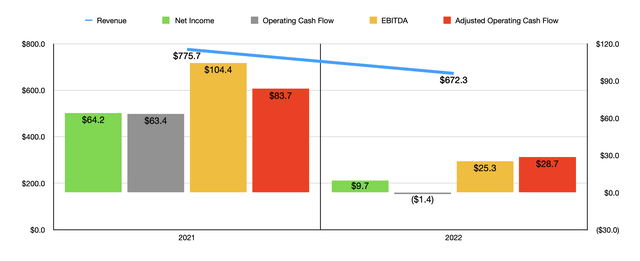

This drop in revenue brought with it a seismic shift in the profits the company generates. It went from generating a net profit of $0.8 million in the first quarter of 2022 to a net loss of $12 million during the first quarter of this year. While the revenue decline definitely did a number on the company, it's important to point out that the firm's gross profit margin dropped by 2.9% because of higher markdowns as the company aimed at handling its inventory levels. This hit on the bottom line also translated to pain when it came to cash flow. Yes, operating cash flow did improve from negative $17.6 million to negative $16.2 million. But if we adjust for changes in working capital, we would have actually seen a decline from $4.8 million to negative $12.6 million. Meanwhile, EBITDA for the business went from $4.6 million to negative $14 million. As I mentioned already, the first quarter was not the only time that the company saw pain. For context, in the chart above, you can see financial results for 2022 compared to 2021. This pain has been building up for a while now.

Unfortunately, knowing what we know now, it's rather difficult to value the company. You can't exactly value the firm when all of its profitability metrics are in the red. We could value it using data from 2021 or 2022. But if financial results are going to be painful for a while, that will make the company look more attractive than it ultimately is. We do know that the company has no debt, and it has $93.4 million in cash and cash equivalents on its books. That is a tremendous amount of cash considering that the firm's market cap is only $263.8 million.

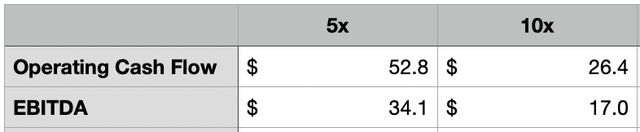

In the table above, I decided to ask the question of how much cash flow the company would need to generate in order to trade at either 5 times or 10 times on a price to adjusted operating cash flow basis or on an EV to EBITDA basis. As you can see in that table, the levels that would need to be achieved are not out of the question when you consider how the business performed in 2021. But the big unknown is how long we will have to wait before a full or partial recovery comes about, if it ever does.

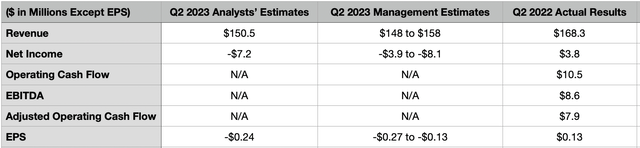

One positive item to discuss is that, after the market closes on August 31st, the management team at Tilly's is expected to announce financial results covering the second quarter of the 2023 fiscal year. This will give investors the opportunity to reassess the company and to see if maybe there are signs of improvement. But in my opinion, the picture is not looking great leading up to that point. You see, management even forecasted revenue for the quarter of between $148 million and $158 million. That would be down from the $168.3 million reported the same time last year. And in this case, the company cannot blame some of the decline on inclement weather. They did say that overall comparable store sales will drop by 10% to 15% on a year-over-year basis in order to reach this sales figure, with an increase in store count only partially offsetting that pain. For context, analysts are currently forecasting revenue of $150.5 million.

On the bottom line, the picture is also unpleasant. Analysts are forecasting a loss per share of $0.24, while management has said that the loss should range between $0.13 per share and $0.27 per share. The analyst estimate implies a net loss of $7.2 million, while if management is accurate, we should see a loss of between $3.9 million and $8.1 million. For context, in the second quarter of 2022, Tilly's achieved profits of $3.8 million. Estimates and guidance have not been provided for other profitability metrics. But in the table above, you can see how those figures looked in the second quarter of 2022. Very likely, most or all of these metrics will decline on a year-over-year basis.

Takeaway

Based on the data at my disposal, I do believe that investors would be right to be worried about Tilly's. The company continues to show top line and bottom line deterioration. While inclement weather almost certainly played a role in some of the pain earlier this year, the overall picture for the company is worsening outside of that. There also seems to be a general consensus involving analysts and management that the second quarter will also be rather painful. So until we see some sign that the picture for the company will definitely improve, I've decided to downgrade it to a soft 'sell' at this time.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.