The Andersons: Up 50% And Poised For More Upside

Summary

- The Andersons is a well-diversified agriculture player with exposure in trade, ethanol, and fertilizer supply.

- The company's recent 2Q23 results show strong performance in the Nutrient & Industrial and Renewables segments.

- Improved crop conditions, strong ethanol crush margins, and strategic expansion contribute to ANDE's promising trajectory.

- Looking for a helping hand in the market? Members of iREIT on Alpha get exclusive ideas and guidance to navigate any climate. Learn More »

lamyai

Introduction

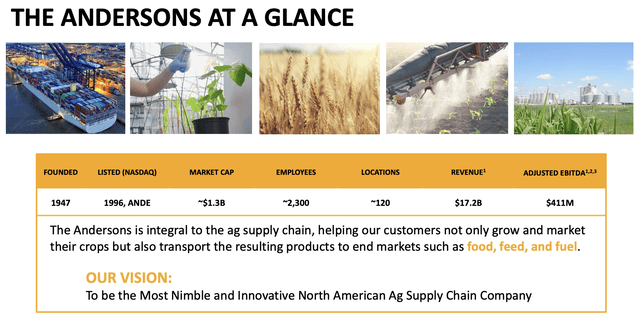

One of the stocks that has been a cornerstone of my agriculture research is The Andersons (NASDAQ:ANDE). This Ohio-based corporation is one of the most well-diversified agriculture players, with significant exposure in trade, ethanol, and fertilizer supply.

The Andersons

The company manages more than 79 facilities to trade close to 40 million tons of crops per year. It also has the capacity to store 180 million bushels of grain, making it a key player in the markets it serves.

In addition to that, it has four ethanol plants capable of producing more than 533 million gallons of ethanol and byproducts like 1.3 million tons of feed products and vegetable oils.

The Andersons

The company also serves farmers through its 37 facilities, where it sells fertilizers and related products. These operations are part of the Nutrient & Industrial segment, which covers three divisions:

- Ag Supply Chain: This division focuses on offering wholesale nutrients and farm-related services primarily in the Eastern Grain belt region. Their wholesale nutrient business involves the formulation, storage, and distribution of dry and liquid agricultural nutrients, along with soil amendments.

- Engineered Granules: This division specializes in the production and distribution of exclusive professional lawn care products, which are mainly targeted at golf courses and the professional turf care market.

- Specialty Liquids: In this division, The Andersons manufactures and distributes a wide range of fertilizers, micronutrients, and soil amendments.

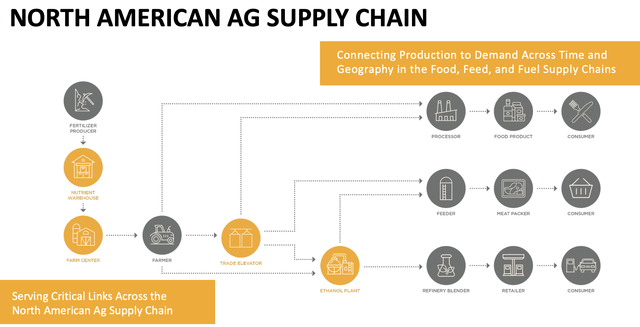

This is what the company's position in the North American agriculture supply chain looks like:

The Andersons

With that in mind, the bull thesis is unfolding nicely.

Since I wrote my most recent article in June article, ANDE shares have risen 19%. They are up almost 40% since my November article. Shares are up 50% year-to-date.

In this article, I'll update my thesis using the company's latest results in new developments in the agriculture sector.

So, let's get to it!

ANDE's Bull Case Remains Strong

This is what I wrote in my prior article (emphasis added):

While the joint venture with ICM faced difficulties, ANDE's overall ethanol business remains promising. The Trade Group reported impressive earnings, capitalizing on market dislocations, while the Renewables segment showed improvement in ethanol crush margins.

Although the Nutrient and Industrial business faced headwinds, future demand is expected to rebound.

I'm glad to say that this bull case is turning out as expected.

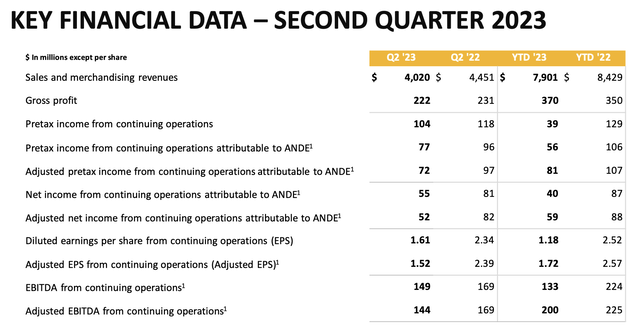

The second quarter of 2023 was the best second quarter in the company's history. Well, except for the second quarter of 2022, which benefited from the war in Ukraine. That was a bit of a one-off situation.

The Andersons

Especially the nutrient and industrial segment stood out, boasting its best performance in 15 years, while renewables also contributed to the quarter's success.

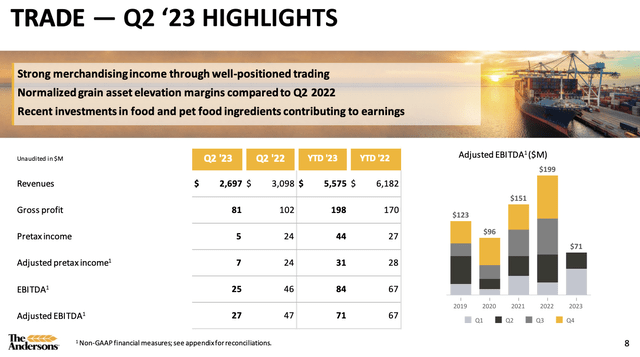

However, we saw a decline in trade results, which was attributed to the previous year's exceptional demand and market volatility due to the Russian invasion of Ukraine.

The Andersons

Despite these tough comparisons, the trade group's year-to-date performance remains ahead of the prior year.

Having said that, during the 2Q23 earnings call, the company noted that improving U.S. crop conditions have the potential to influence the global grain supply outlook.

The weather during the key crop growing season is expected to impact final production, and recent rains in the Midwest are seen as good news for U.S. farmers.

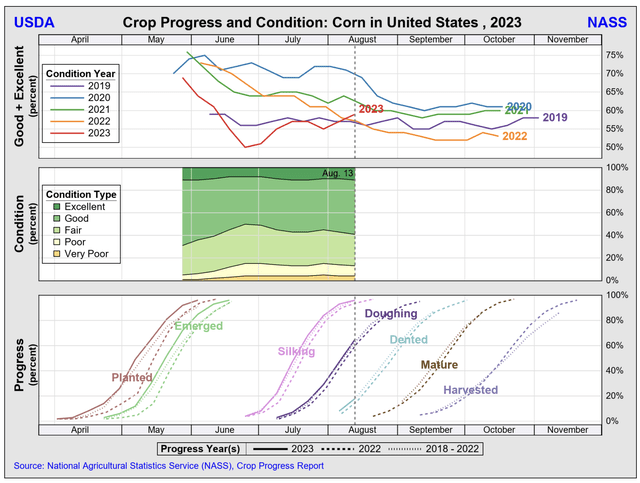

While big parts of the Corn Belt are still experiencing drought, USDA data shows that ANDE's comments are correct. While we were off to a horrible start, crop conditions are now showing significant improvements.

Using corn as an example, 2023 is now shaping up to be a better year than 2019 and 2022.

USDA

Adding to that, sourcing more winter wheat harvest than anticipated and having better qualities in the eastern assets contributed to a favorable position for the company's Louisiana assets for their early harvest.

The diversified portfolio of merchandising and grain assets allows the company to optimize volatility and crop dislocation while adapting to shifts in larger production and carry markets.

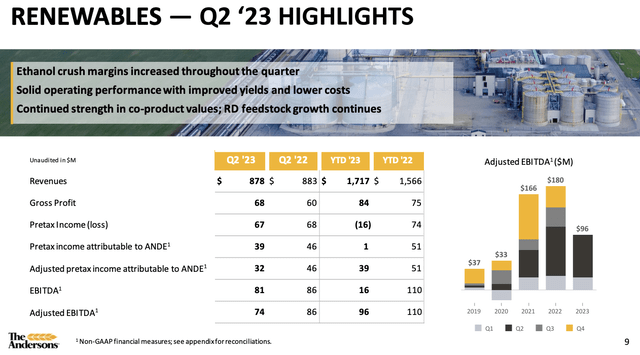

With regard to the renewable segment, ethanol crush margins are historically strong and have surpassed early 2023 expectations.

The chart below shows the ratio between NYMEX ethanol and CBOT corn prices. While I'm painting with a very brought brush here (this isn't scientific), we see that the advantage has shifted to ethanol producers, as corn prices have fallen more than ethanol prices (due to a better supply outlook).

TradingView (NYMEX Ethanol, CBOT Corn)

Speaking of science, Iowa State University has data that shows healthy ethanol profitability. Looking at the data below, we see that the average ethanol producer's income is well-above its capital cost.

Iowa State University

The company's eastern ethanol plants are strategically located with anticipated lower corn costs through harvest.

On top of that, ANDE's focus on enhancing production facilities' efficiency and increasing fermentation capacity is ongoing, and supply arrangements with other producers, distiller corn oil, and other renewable diesel feedstocks are expanding.

The Andersons

ANDE is also evaluating opportunities to reduce the carbon intensity of ethanol production, to potentially benefit from the Inflation Reduction Act.

Furthermore, anticipated solid farm incomes are expected to continue driving the purchasing of crop inputs, including the company's value-added low-salt starters and micronutrients.

The Andersons

Growth in this segment is expected to remain high, although it will be impacted by the timing of harvest and fall application season.

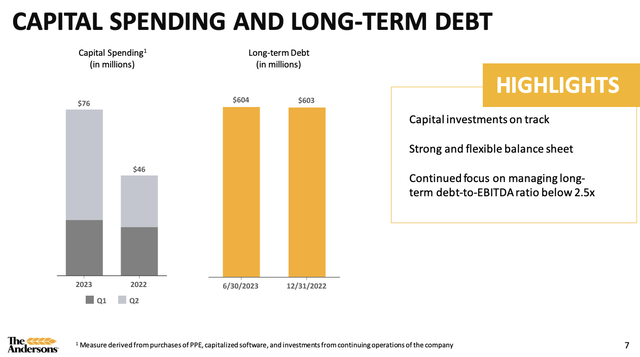

Thanks to these tailwinds, the company generated $118 million in cash flows from operations before changes in working capital for the second quarter of 2023, down from $135 million in the prior year.

Commodity price moderation since the previous spring led to a significant reduction in short-term borrowings, from $1.2 billion in 2022 to $103 million at the end of June 2023.

ANDE has just $600 million in long-term debt and a sub-1.6x gross leverage ratio, which is below the company's 2.5x target.

The Andersons

The company also acquired ACJ International, a company focused on pet food ingredients, which further increases ANDE's footprint in the supply chain.

Valuation

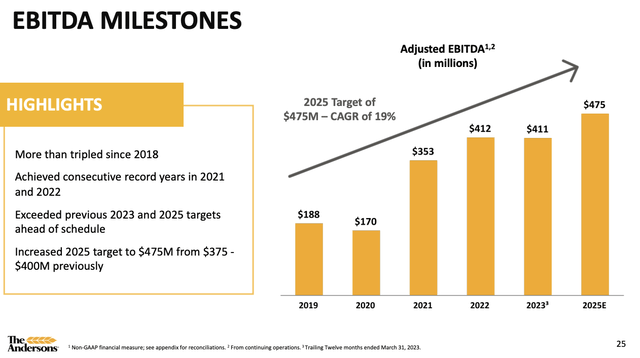

ANDE has a very ambitious long-term plan. While the company is already generating more than twice the amount of EBITDA it generated prior to the pandemic, its plans are to boost adjusted EBITDA to $475 million by 2025.

The Andersons

So far, everything points to long-term success, as the company has excelled in the past quarter when it comes to dealing with demand and price fluctuations in light of weather, geopolitical, and macro developments.

Moreover, despite the stock price surge, ANDE's valuation has come down since June. It is now trading at 7.0x NTM EBITDA, down from 8.1x NTM EBITDA.

The consensus price target has been hiked from $53 to $62, implying another 20% in stock price gains.

I stick to my outlook that ANDE should be trading somewhere between $65 and $70, making me a bit more bullish than the average analyst.

However, as I wrote in almost all prior articles, ANDE is very volatile. It's not a great investment for conservative long-term investors. In that case, I prefer Deere & Company (DE) or Archer-Daniels-Midland (ADM).

I own ANDE as a trade and will likely start selling once it gets close to $65.

Takeaway

The Andersons continues to shine in the agriculture sector, with a diversified portfolio that spans trade, ethanol, and fertilizer supply.

The company's recent 2Q23 results highlight robust performance, especially in the Nutrient & Industrial and Renewables segments. The positive trend is supported by improved crop conditions, strong ethanol crush margins, and ongoing strategic expansion.

ANDE's focus on efficiency, sustainable practices, and expanding partnerships puts it on a promising trajectory.

While the stock price surged 50% year-to-date, the valuation remains favorable, and the consensus price target suggests further gains.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas' FREE book.

This article was written by

Welcome to my Seeking Alpha profile!

I'm a buy-side financial markets analyst specializing in dividend opportunities, with a keen focus on major economic developments related to supply chains, infrastructure, and commodities. My articles provide insightful analysis and actionable investment ideas, with a particular emphasis on dividend growth opportunities. I aim to keep you informed of the latest macroeconomic trends and significant market developments through engaging content. Feel free to reach out to me via DMs or find me on Twitter (@Growth_Value_) for more insights.

Thank you for visiting my profile!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ANDE, DE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.