Tetra Tech: Good Near-Term And Long-Term Growth Prospects

Summary

- Tetra Tech Inc's revenue is expected to benefit from a healthy backlog level of $4.4 billion and favorable end market demand.

- Various government infrastructure fundings are expected to provide multiyear tailwinds for TTEK's end market demand.

- The acquisition of RPS Group Plc is expected to provide revenue synergies and boost top-line growth.

phive2015

Investment Thesis

Tetra Tech Inc’s (NASDAQ:TTEK) revenue should benefit from a healthy backlog level of $4.4 billion exiting the third quarter of fiscal year 2023. In addition, the end market outlook for the company’s future revenue growth looks encouraging, as it is supported by secular demand trends for climate change resiliency and the need for energy transition. In addition, various government infrastructure fundings like Infrastructure Investment and Job Act (IIJA), Inflation Reduction Act (IRA), and CHIPS and Science Act are also multiyear tailwinds for TTEK’s end market demand, which should continue to boost backlog and revenue growth. Lastly, I expect good revenue synergies from the RPS Group Plc acquisition to also boost the top-line growth.

On the margin front, the company should benefit from high-margin projects in the backlog driven by TTEK’s AI-led software tools, operating leverage, and cost synergies from the RPS acquisition. So, the company has good revenue and margin growth prospects moving forward. I previously covered the stock in May when I upgraded it and the stock has seen ~10% appreciation since then. The company is still trading below its historical average FWD P/E, based on the FY24 consensus EPS estimate and given its good growth prospects ahead, I continue to have a buy rating on the stock.

Q3 FY23 Earnings

Recently, Tetra Tech Inc reported better-than-expected earnings for its third quarter of fiscal year 2023 with both revenue and EPS beating estimates. Revenue increased by 36% Y/Y to $1.21 billion while adjusted net revenue (revenue net of subcontractor costs) increased by 37.1% YoY to $988 million. Adjusted EPS increased by 19.4% YoY to $1.29 and beat the consensus EPS estimate by $0.11. Adjusted operating income increased by 60 basis points (bps) YoY to 12.1% and adjusted EBITDA margin increased 50 bps YoY to 13%. The increase in revenue was a result of a healthy backlog, good end-market demand, and RPS acquisition synergies. Adjusted EPS and margins increased due to a favorable project mix and operating leverage.

Revenue Analysis and Outlook

Tetra Tech's revenue growth has been benefiting from the good end market demand driven by climate resiliency and the emerging need for renewable energy. In addition, federal infrastructure investments to support these demand trends have also helped the company in increasing backlog and delivering revenue growth.

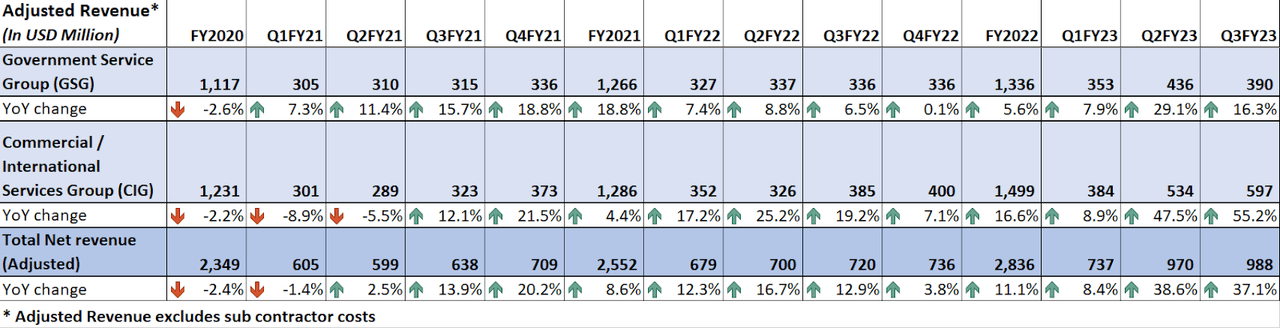

In the third quarter of fiscal year 2023, the growth momentum continued. In addition to healthy end-market demand, the company's revenue growth also benefited from good revenue synergies from the RPS acquisition (acquired in January 2023). This resulted in a net revenue increase of 37.1% YoY to $988 million. Excluding the benefits from the RPS acquisition, net revenue increased by 11% YoY. On a segment basis, the Governmental Service Group (GSG) reported a net revenue increase of 16.3% YoY, driven by good demand for environmental services and digital water programs for both state and local and federal government. The Commercial/International Service Group (CIG) reported a net revenue increase of 55.2% YoY, driven by RPS synergies and good demand in programs for renewable energy internationally. Excluding RPS synergies, CIG’s net revenue saw a 10% YoY growth.

TTEK’s Historical Adjusted Net Revenue (Company Data, GS Analytics Research)

Looking forward, I believe the company should be able to continue delivering revenue growth, benefiting from healthy backlog levels, long-term secular demand trends, federal infrastructure funding, and acquisition synergies.

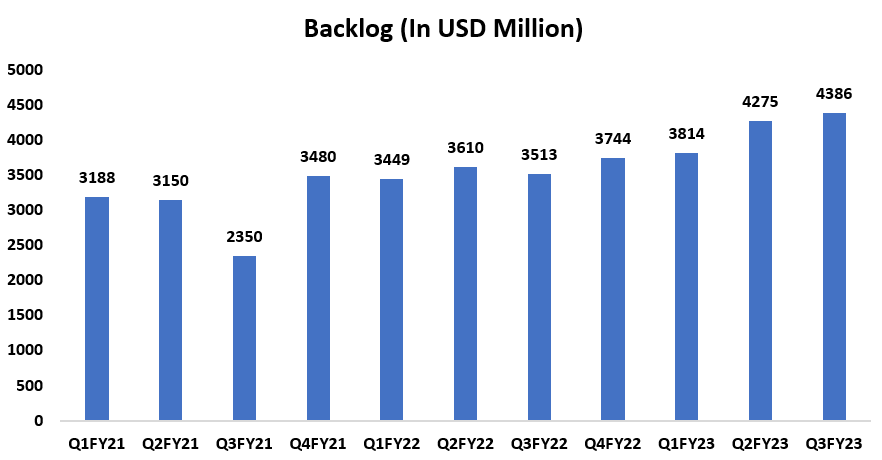

A company’s backlog is one of the major indicators of future revenue growth and for TTEK, this metric is trending in the right direction as the backlog levels in the last quarter grew both year-over-year and sequentially. The company’s backlog in the third quarter of fiscal year 2023 increased 25% YoY and 2.6% sequentially to $4.4 billion. The backlog growth was attributed to favorable end-market demand for water and environment management, and clean energy. Additionally, increasing federal investment in the infrastructure space to further support the growing need for energy transition and climate resiliency, also helped the backlog growth. So, this healthy level of backlog should continue to help the company’s revenue growth moving forward. Moreover, in the Q3 FY23 earning call, management commented that 85% of the next fiscal year's revenue is in the current backlog, providing good visibility for revenue growth in the coming year.

TTEK’s Order Backlog (Company Data, GS Analytics Research)

I expect the backlog levels to further grow in the coming quarters. TTEK’s end market outlook remains healthy as the end market demand is supported by the secular trends from emerging climate change priorities and the growing need for clean and green energy for environment sustainability.

The climate is undergoing negative changes due to various factors like pollution, deforestation, and urbanization, which are creating environmental problems. This has increased the focus on projects related to climate resiliency across the globe to help mitigate the impact of climate change. In line with this, companies across industries and governments across the globe are also targeting the reduction of carbon emissions over the coming years to meet ESG standards. So, changing priorities to handle and mitigate climate change is increasing demand for better environmental management programs where TTEK’s expertise lies. Further, improved environmental management practices are highlighting the urgent need to shift towards renewable energy sources. The focus on sustainability has led to an emphasis on clean and green energy, such as water-based power generation. This transition is essential for reducing greenhouse gas emissions and combating climate change. Again, this trend is also acting in favor of the demand for TTEK’s services.

Moreover, the federal government is also supporting these demand trends through various infrastructure investments. There are currently 3 major legislative actions in the infrastructure space which is helping the company’s end market outlook, namely,

Infrastructure Investment and Job Act (IIJA), a $1.2 trillion funding, and well distributed across TTEK’s markets of water, environment, sustainable infrastructure, and renewable energy.

Inflation Reduction Act (IRA), a $369 billion investment in energy security and decarbonization over the next 10 years, is also providing a good multiyear demand tailwind.

Lastly, the CHIPS and Science Act, a $280 billion funding, including a $53 billion investment focused on reshoring domestic semiconductor manufacturing in the U.S. This act should benefit the company’s high-end, sustainable infrastructure design services which it provides to manufacturing clients including semiconductor companies.

US Federal Stimulus Funding Update (Q3 FY23 Earning Call Presentation)

The company is seeing the rate of flow of funds from IIJA and IRA starting to increase as it helped the company secure various project wins in the third quarter and management expects a strong order pipeline in the coming quarters as well with the support of these fundings. Moreover, the CHIPS Act has just begun to roll out the funding process in the summer. This implies that the order pipeline should further increase as the rate of flow of funds from the CHIPS Act accelerates, giving a boost to backlog growth in the coming fiscal year as well. So, I expect backlog levels to further increase moving forward and keep fueling the revenue growth in the coming years.

Lastly, while the organic growth outlook looks encouraging, the company’s sales growth should also benefit inorganically from the RPS acquisition. TTEK acquired RPS Group Plc (RPS) in January 2023. RPS provides high-end solutions in energy transformation, water, and program management to government and commercial markets globally. The RPS Group has expanded TTEK’s client base and added new geographies, such as Norway and the Netherlands while increasing the program resources in the United Kingdom, the Republic of Ireland, Australia, and the U.S.

So, this acquisition has strengthened the company’s international footprint, which currently comprises 43% of total company revenue. RPS should continue to provide good revenue synergies as management expects RPS to contribute ~$500 million in total revenue for the full year 2023, with synergies accelerating in FY24 as RPS fully integrates with the company. Hence, I am optimistic about the company’s near-term and long-term revenue growth prospects, benefiting from healthy and increasing backlog levels, multiyear demand tailwinds, federal infrastructure investments, and revenue synergies from the RPS acquisition.

Margin Analysis and Outlook

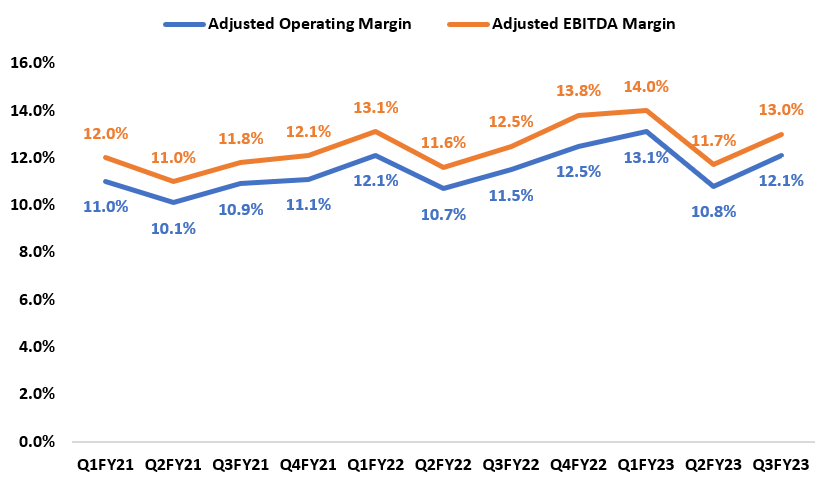

Tetra Tech’s margins over the past couple of years have been benefiting from the strong execution of high-performing and high-margin projects in both segments. In the third quarter of fiscal year 2023, these tailwinds continued to benefit the margin growth. This led to a 60 bps YoY increase in adjusted operating margin to 12.1% and an adjusted EBITDA margin increase of 50 bps YoY to 13%. These margins were partially offset by the RPS acquisition’s lower EBITDA margin. On a segment basis, the GSG segment adjusted operating margin increased 60 bps YoY to 14%, while the CIG segment adjusted operating margin decreased 10 bps YoY to 13.7% due to the RPS acquisition’s lower EBITDA margin.

TTEK’s Historical Adjusted Operating Margin and Adjusted EBITDA Margin (Company Data, GS Analytics Research)

Looking forward, I believe the company should be able to deliver margin growth. One of the major catalysts of TTEK’s margin expansion prospects is its highly productive software tools, which the company calls “Tetra Tech Delta Technologies”. This is a collection of Generative AI tools, such as the generative AI-enabled Fusion map platform, which provides risk mitigation for thousands of miles of rail systems as well as tools for remote sensing and remote assessments for green buildings. According to management, these tools provide meaningful productivity gains and margin improvement opportunities.

In the Q3 FY2023 earnings call, commenting on these AI- tools management said,

So we have all sorts of technology and tools where we can do remote sensing and remote assessments for green buildings for heat loss, heat transfer, damage erosion on things such as sea walls that can actually be seen through 3D cameras can then be identified and have sequential erosion rates and determine what type of operation and maintenance. It allows us to do work that would normally take 100 people 2 years to do can now take 10 people 10 days to do. It costs less dollars to our clients. It actually is more comprehensive and allows preventative work or reconstruction or new technologies such as sea walls, artificial islands or diversion bypasses to be put in place. So all of that is exciting. It typically has moved our margins up on our projects where it's been used anywhere between 200 to 500 basis points, so 2% to 5%. So if we were making 10% before, now we're making somewhere between 12% to 17% just by using the tools.

Now we have about 200 different tools internally. And if a client hires Tetra Tech, they get access to every one of those 200 tools, whether or not they're located in Perth, Australia, Dallas, Texas or Leeds, England.”

These AI-led software tools should continue to help the company’s margins through productivity and efficiencies gains and also help in saving labor costs. Furthermore, the company also increased prices over the past quarters due to increasing end-market demand which should also help the company’s margins moving forward. I also expect, good operating leverage due to increasing revenue to also support the margins in the coming year.

Lastly, the company also aims to increase RPS's EBITDA margin from under 5% in fiscal '22 by almost 3x to over 13% by fiscal 2025 and bring it in line with TTEK’s margin. To achieve this target, the company is gradually integrating RPS’s operations into TTEK’s ERP system and consolidating office spaces. This should generate better cost synergies moving forward and help the margins of both TTEK and RPS. Hence, I am optimistic about the company’s margin growth prospects ahead.

Valuation and Conclusion

Since, the company’s fiscal year ends in September and the current fiscal year is almost near end, l believe looking at FY24 numbers gives a better sense on valuation. Tetra Tech is currently trading at a 26.65x FY24 consensus EPS estimate of $5.94, which is below its 5-years historical average forward P/E of 29.94x. The company usually trades at a high P/E multiple given its good execution history and exposure to water end market which has secular growth prospects. I believe the company has good near-term and long-term growth prospects benefiting from a healthy backlog, favorable end-market demand, federal infrastructure investments, RPS synergies, high-margin projects, and operating leverage. Given the good growth prospects ahead, I don’t think the stock should trade at a discount to historical levels and hence have a buy rating on the stock.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written by Saloni V,

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.