Santander: Latent Earnings Growth In The IB Business

Summary

- Santander is doing well on the NI front, growing its interest income thanks to higher rates in Europe but also not too pronounced deposit beta.

- Moreover, fee income is looking good at Santander and the growing IB segment is already helping despite the depression in M&A.

- Going from being a bit of a no-name in IB to having a bigger franchise with ex-CS bankers, even in the US, will change the profile coming out of the M&A drought.

- At the current PE, Santander is too cheap, considering the pickup in their IB profile.

- Looking for a helping hand in the market? Members of The Value Lab get exclusive ideas and guidance to navigate any climate. Learn More »

Lux Blue

Santander (NYSE:SAN) is a pretty interesting pick right now in the European banking space. They have not been traditionally known for IB, but they are hiring pretty aggressively and trying to up their profile. The IB performance was good at Santander, and there is quite a lot of latent earnings growth in the business that could generate some shareholder returns considering the low valuation. On the retail side, things look decent. Of course there are risks to banking businesses considering the economic climate, but the slower rise in Europe's interest rates and the greater impacts from supply hits are mitigating factors.

Santander Performance H1

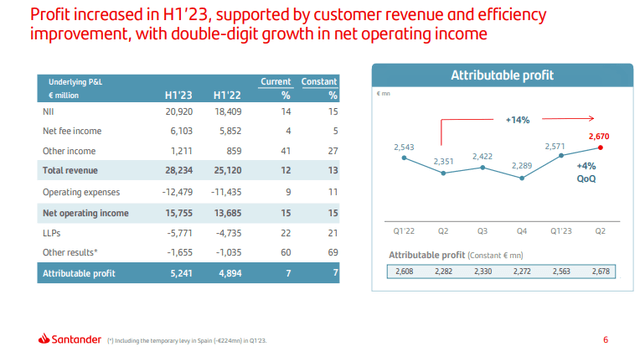

The highlights already look pretty good for Santander:

Firstly, there isn't evidence of pass through of higher rates to savings rates to the degree that it would start affecting NIMs. This is probably structural in Europe, mainly because the options for saving tend to be more limited, and saving substitutes like personal brokerage accounts are usually less penetrated in European markets. It's also because the ECB rate hikes have lagged the US's rate hikes, which has meant less impulse for revision in savings rates. NIs have outpaced customer growth of around 6% and around a similar growth in loan volumes.

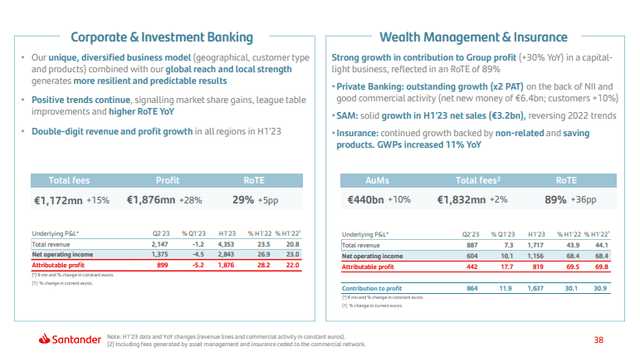

What's a little unexpected is the rather good performance in fee income, which has decelerated among financials since the pressures from the Ukraine war. Transactions are up but tickets are down. There's been a fair bit of help from the IB business which is growing in the mix.

22% is a really solid YoY performance for IB based on our pretty broad coverage of the sector. It's actually the best we've come across so far in the latest quarter. While the European M&A markets have been a bit more solid due to less excess in the 2021-2022 period, the growth is mainly a reflection of a very solid corporate strategy by Santander to grow its presence on the league tables and make its IB business more formidable by hiring in the fallout of the CS collapse. Their franchise int he US has grown, and they've picked up dozens of senior bankers to bolster their ranks.

Bottom Line

There are several factors here besides the already evident growth that makes us bullish on Santander. The IB revenue is already nearing 20% of the mix, but there is a lot of latent growth.

- It takes some years for bankers to fully ramp up, so we haven't seen peak productivity from the new additions.

- The M&A markets are pretty depressed right now, especially in the US where mandates are down about 50%, and ticket sizes have also fallen. There is still declines going on YoY among IB and advisory firms across the coverage universe. But there are green shoots, with sequential strength in many franchises and greater confidence around terminal interest rates making it possible for sponsors to return to the fray.

Meanwhile, Santander trades at a substantial discount to other retail banks, like ING Groep (ING) which is entirely a retail bank. Advisory shops are currently trading at much higher valuations than retail banks, so this doesn't make that much sense. It's cheaper than the other financial players in Spain too who don't have as promising IB divisions. Santander is looking pretty good at a 6x PE. We may start considering them for the portfolio.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it's for you.

This article was written by

Formerly Bocconi's Valkyrie Trading Society, seeks to provide a consistent and honest voice through this blog and our Marketplace Service, the Value Lab, with a focus on high conviction and obscure developed market ideas.

DISCLOSURE: All of our articles and communications, including on the Value Lab, are only opinions and should not be treated as investment advice. We are not investment advisors. Consult an investment professional and take care to do your own due diligence.

DISCLOSURE: Some of Valkyrie's former and/or current members also have contributed individually or through shared accounts on Seeking Alpha. Currently: Guney Kaya contributes on his own now, and members have contributed on Mare Evidence Lab.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)