Tencent Holdings: Quality At A Great Price

Summary

- Tencent is an innovative IT growth company with high earnings growth and significant free cash flow.

- The company has faced weakened growth and margins due to regulatory influences.

- Despite challenges, Tencent maintains a strong competitive position and solid unique selling propositions.

Nikada

Stock Analysis: Tencent Holdings Limited

Tencent (OTCPK:TCEHY) is one of the world's leading IT technology companies and has achieved incredible growth over the past 15 years. However, the success story has stalled in the last few years and the market seems to have doubts about the company. In this stock analysis, we take a close look at the company's key framework data and potential risks to evaluate whether the success story from the past could continue. In addition, we consider whether it would make sense to invest at the current price.

Overview

TCEHY is a Chinese IT and multimedia conglomerate headquartered in Shenzhen. Among other things, it is active in the areas of messaging, social networks, games, payment services, video software, work software, music and online advertising. In addition to its own activities, there are a number of large corporate investments, such as Tesla, Activision Blizzard, Supercell, Snapchat, Discord and Riotgames. Thus, it is clear that the company is very broadly diversified.

TCEHY has a self-contained ecosystem, with the social media and messaging areas forming the backbone of the services and a large number of other apps and app solutions being offered on this basis. All areas benefit from the AI segment in which solutions for speech recognition, image processing and machine learning are developed and implemented in the existing apps and services.

The company is divided into three divisions, according to the annual report. The value-added services segment accounts for about 52% of the company's total revenue, while fintech and business services account for 32% and advertising 15%. Later in the analysis, this distinction is important because both the growth and profitability of each division differ greatly.

In recent years, Tencent has made a rapid rise to become one of the largest internet companies in China and has also been a very profitable investment for investors, with an average annual share price increase of 16.26%. That being said, challenges to the company's growth and margins have emerged in recent years.

Opportunities and Risks for Growth

TCEHY is a company that has benefited greatly from China's economic upturn and digitalization in recent years. An important aspect here is that TCEHY generates around 90% of its sales in China and is therefore heavily dependent on the development of the country. Thus, in some cases very high growth rates in sales and profits were achieved in the years up to 2021. In the last six years alone, profit can boast a CAGR of 28.68%. However, this will hardly be possible due to an increasing competitive situation, stronger regulatory restrictions as well as an already very high market penetration.

The regulatory factor plays an important role when considering growth. The Chinese government wants to strengthen competition between companies and avoid monopolies. It could be that the government aims at "breaking up" larger groups so that the individual services have to be offered in different apps or solutions of the competition have to be provided access to the TCEHY ecosystem.

Furthermore, among other things, as part of a 2021 law, the playing time of teenagers was limited in time, which has a huge impact on TCEHY as one of the largest providers of mobile games. At the same time, the possibility of in-game purchases was also restricted, which poses an additional challenge, as games that are often offered for free are financed through such purchases. Finally, the approval of new games by the government was also suspended in 2021, which had a major impact on TCEHY's business.

Another challenge is the competitive situation, as many of TCEHY's products compete with those of large companies. One example is Ant Group's Alipay, which is a subsidiary of Alibaba Group. This competes with TCEHY's TenPay in the payment services market. Thus, in its core markets, TCEHY competes with Alibaba, Baidu, NetEase and many other providers.

In addition to looking at the challenges to growth, one should also look at the opportunities. For example, TCEHY has built a very strong and comprehensive system of products and services over the past few years. In addition, it has made a number of strategic acquisitions and partnerships, enabling it to establish a foothold in many areas of daily life.

In the future, growth will be determined by organic growth in China, international expansion, especially in Asia, and strategic acquisitions. TCEHY is excellently positioned here, as sufficient financial resources are available for both expansion and acquisitions. At the same time, it should be taken into account that it will be difficult to maintain the growth of recent years in China due to the size and high market penetration in the domestic market.

However, the high economic dependence on China should be taken into account. Since, as already mentioned, 90% of sales are currently generated on the domestic market, a recession on the Chinese market would also be reflected in TCEHY's figures.

Considering the development in 2022, it becomes clear that growth in the areas of value-added services (-1% y/y) and online ads (-7% y/y) tended to decline. Only the Fin-Tech segment (+3% y/y) made gains. The reasons for this were in particular the regulatory restrictions already mentioned.

Looking at the figures from the current report for Q2 2023, it is clear that TCEHY has returned to the growth path and revenue increased 11% y/y. This can be attributed in particular to the Online Ads (+34% y/y) and Fin-Tech (15% y/y) segments.

Based on current developments, organic revenue growth of around 10-15% can be assumed for the coming years. Growth opportunities include, in particular, expansions into new markets, possible acquisitions, and the launch of new innovative products.

Profitability

In the years before Corona, TCEHY managed to generate very high margins with a high and steadily increasing free cash flow. However, these have decreased over time due to a tighter competitive situation, regulatory restrictions. For example, the gross margin has decreased from 54% in 2015 to 41% in 2022 and the free cash flow has also decreased for the first time in the two previous years.

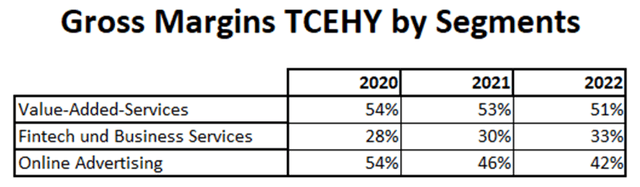

Another reason for the reduction in margins is TCEHY's expansion into business areas that can only display lower profitability. Thus, the declining margin can be attributed, among other things, to the ever-increasing share of "Fintech and Business Services" and "Online Advertising". If the Fintech area is left out of the equation, for example, the reduction in the margin of the company as a whole is significantly lower. Thus, the reduction in the margin is not only attributable to weaker business, but also in particular to the expansion of segments with weaker profitability, as can be seen from the following table.

Gross Margins TCEHY and peer group (Created by author using data from annual reports 2016-2022)

Based on the figures for the second quarter presented on August 16, 2023, it is clear that the measures taken in the previous year to cut costs and increase margins have been successful and that the impact of the regulatory restrictions is also easing. Among other things, the net margin increased by 6.2 ppt to 32.3%. This trend is expected to continue in the coming period. In the long term, rising margins from the fintech segment in particular should play a decisive role.

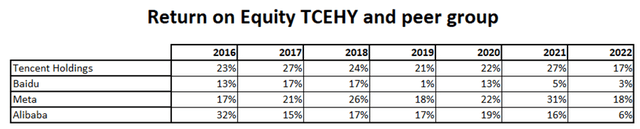

RoE TCEHY and peer group (Created by author using data from annual reports 2016-2022)

Tencent's return on equity has also decreased, especially in the past year. However, it is still well above the competitors in some cases and should return to normal in the medium term, provided that no further regulatory restrictions are introduced by the Chinese government.

Stability

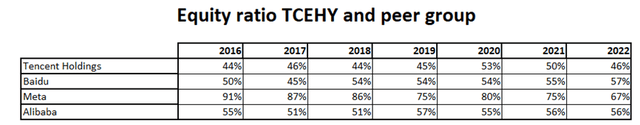

TCEHY has a very good balance sheet and is solidly financed. A look at the equity ratio of the company over time as well as the peer group makes it clear that the technology companies are financed relatively conservatively and with a high equity ratio despite stable high cash flows.

Equity ratio TCEHY and peer group (Created by author using data from annual reports 2016-2022)

When looking at the financing, it is worth looking at the gearing of the company, which is also in a very solid range at 9%, so that one would not have to worry about the financial stability of TCEHY.

In addition, a look at the balance sheet reveals that the company has a high cash position of USD 22 billion, which could be used for debt repayment, but also for expansion or acquisitions.

Despite the acquisitions made so far, there is only a very small amount of goodwill on the balance sheet, so that high amortization of goodwill is not foreseeable.

Dividend

Since TCEHY is a growth company despite its enormous size, the dividend only plays a subordinate role. Nevertheless, it should be mentioned at this point that high free cash flows are generated every year, which would enable a high dividend payout. Currently, the pay-out ratio is only 12.56%, so there is a lot of growth potential here. Investors who value high, fast-growing and very secure dividends are in a rather poor position here, as, among other things, the dividend was not increased in 2022 and it thus became clear that dividends are not considered a high priority by the company's management.

Competition

TCEHY has a strong and complementary ecosystem of different products and services, most of which are market leaders in their respective market segments. The high level of brand awareness and the diversity of the products offered within the ecosystem represent a clear unique selling proposition compared to the competition.

The high market share and the correspondingly high margins speak for a strong positioning compared to the competition and a pricing power towards the customers. Nevertheless, it is important to emphasize that the competitive situation in the technology industry is very dynamic and can develop differently depending on the region and business area. Tencent has a strong market position in many of these areas, but competition remains intense as other companies also strive to innovate and increase their market share.

As TCEHY's competitors include companies such as Alibaba (BABA), ByteDance (BDNCE), Baidu (BIDU), SONY (SONY), Netflix (NFLX), Apple (AAPL), Microsoft (MSFT), Alphabet (GOOG) and Amazon (AMZN), unique selling propositions and adaptability to new market conditions play a crucial role. Here, TCEHY has managed to build a large moat through high awareness and market penetration in massaging services and social media, which allows them to reach a large number of customers to offer their paid services. In other areas, such as cloud services or payment services, there are currently few competitive advantages, so that only lower margins can be achieved here.

In the future, the competitive situation could become a challenge due to both the dynamic market environment and the regulations imposed by the Chinese government.

Risks

Although the individual aspects have already been mentioned in the respective sections, from my point of view, it is important to reconsider the risks of TCEHY.

TCEHY faces regulatory challenges caused by changing regulations, censorship, and government restrictions. An example of this is the ban on in-game purchases for under 12-year-olds and time limits on mobile games. In this regard, regulation aims to protect children and young people in games and social media, ensures content regulation in accordance with government guidelines, and addresses data protection and cybersecurity. In addition, certain regulatory actions are intended to strengthen competition and counteract monopolistic tendencies.

In a dynamic technology industry where trends emerge quickly, it is essential for TCEHY to stay up to date and not miss any crucial trend. The social media sector and the gaming industry in particular are constantly evolving and require tremendous innovation and adaptability.

The dependence on a few central products in the Tencent ecosystem is another challenge. For example, advertising revenue is closely tied to the use of the WeChat app.

Despite international operations and expansion plans, TCEHY remains heavily dependent on the Chinese market. Changes in the Chinese economy or politics could have a significant impact on the company.

Valuation

Let's take a look at the valuation of TCEHY. Here we first look at the multiples P/E, P/C and P/S ratio. Based on the chart below, we can see that the P/E ratio over the last 15 years has averaged 29.68 and is currently around 15. The same applies to the P/C, which has averaged 20.45 over the last 15 years and is currently 15.5. The P/S was also 9.33 in the last 15 years, while it is currently 4.7.

P/E ratio TCEHY 2014 - present (Aktienfinder.net)

It quickly becomes clear that TCEHY is favorably valued relative to recent years. This can be attributed in particular to the weaker growth, the somewhat reduced margins and the uncertainty in the context of regulatory restrictions.

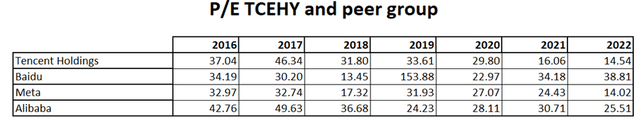

A comparison of multiples with competitors also underlines the company's current favorable valuation.

P/E TCEHY and peer group (Created by author using data from annual reports 2016-2022)

I like to make an initial valuation using the multiples based on relatively simple assumptions. In this case, I have assumed earnings growth of 8-12% for the next five years and a P/E range between 10 and 30. Based on these assumptions, I have calculated various scenarios. In the base scenario, which is the midpoint between the best and worst case, I determined a fair value of around USD 75, which is an indication of significant undervaluation.

Another valuation method I used in the analysis is the discounted cash flow method. For the calculation of the fair value, a number of assumptions had to be made. In terms of growth, I made the assumption that sales growth will be 12% for the next five years and then go down to 8%. For the perpetuity growth rate, I have assumed 4%. I have set the operating margin at 20% of sales, which assumes a slight recovery compared to 2022, but is still well below the average of recent years. To calculate the discount factor, I have assumed a cost of equity of 9.8% and a cost of debt of 7.5%. Based on this information, I obtained a fair value of 68 USD. This shows that TCEHY is clearly undervalued. In my view, this is the case because a lot of uncertainty regarding the described risks is currently priced in and the market is first waiting to see whether the growth rates and margins from the previous years can be achieved again.

Summary

The analysis has shown that TCEHY is an innovative growth company with high margins, solid finances, and good prospects for the future. At the same time, the strong growth and high margins are uncertain in the future due to a number of influencing factors. This is also reflected in the relatively favorable valuation of the company. For long-term and risk-taking investors, the current price of TCEHY represents a presumably favorable opportunity to invest.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.