JEPI Vs. SPYI: One Is The Ultimate High-Yield Retirement Dream ETF

Summary

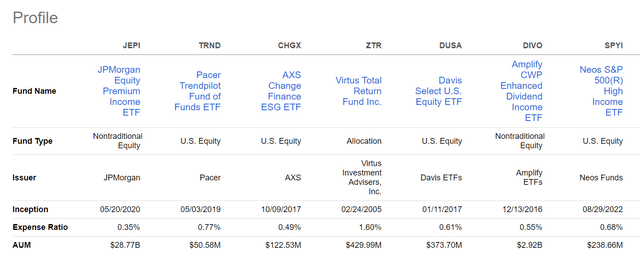

- Option-based stock ETFs like JPMorgan Equity Premium Income ETF and Neos S&P 500(R) High Income ETF have been popular due to their ability to generate yield and protect against market volatility.

- JEPI uses a leveraged covered call strategy to generate income while retaining upside potential, with a portfolio focused on stable earnings.

- SPYI is a promising challenger to JEPI's throne, offering a higher yield and stable income but with higher expenses and limited history.

- SPYI offers potentially higher income though its covered call algos remain untested long-term. It's slightly more tax efficient but not as much as you'd expect from a very low turnover portfolio.

- One of these high-yield low volatility ETFs is the gold standard of covered call ETFs and what I would personally own if I were investing in this asset class.

- Looking for option income ideas that focus on capital preservation? I offer this and much more at my exclusive investing ideas service, The Dividend Kings. Learn More »

Deagreez

Option-based stock exchange-traded funds, or ETFs, like the JPMorgan Equity Premium Income ETF (NYSEARCA:JEPI) were red hot last year because they fell less in a painful market and generated maximum yield when volatility was highest.

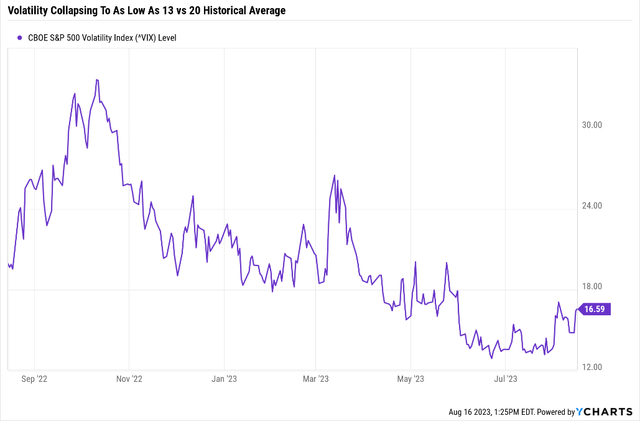

Well, volatility has been collapsing all year. So several Dividend Kings members asked me to follow up on JEPI and compare it with a promising new challenger to the high-yield covered call crown, the Neos S&P 500(R) High Income ETF (BATS:SPYI).

So let's see why one of these high-yield options might be just what you need to retire in safety and splendor in today's freakishly calm market.

How JEPI Has Been Faring In The Steadily Falling Volatility Environment

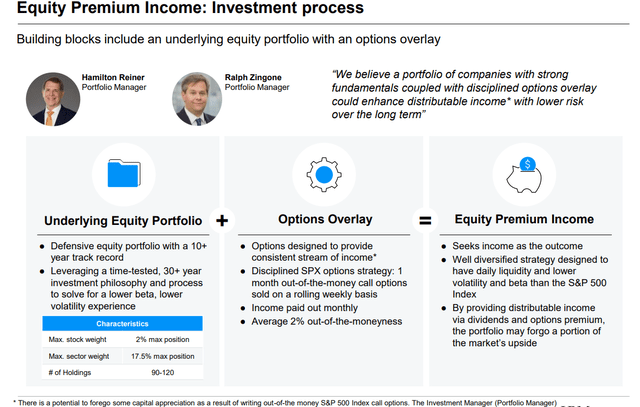

JEPI is run by two veteran derivative managers using exchange-linked notes on 15% of a blue-chip portfolio.

The idea is that, unlike covered call ETFs that cap the upside for the entire portfolio, JEPI is trying to generate income through a kind of leveraged covered call strategy while retaining as much upside as possible.

All while protecting against volatility and capital losses by selecting above-average quality companies.

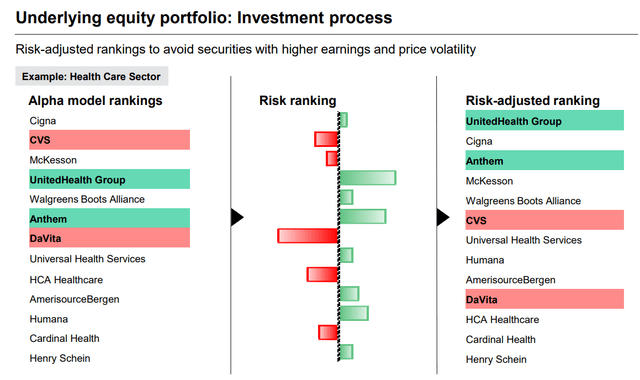

JEPI doesn't just target low-volatility companies and then weight by that; it selects companies with the most stable earnings, thus providing a deeper level of low volatility while minimizing true fundamental risk.

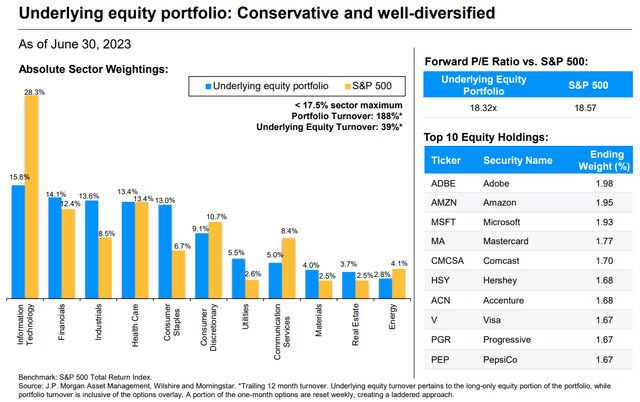

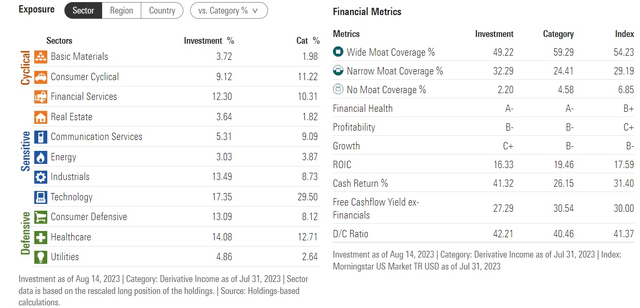

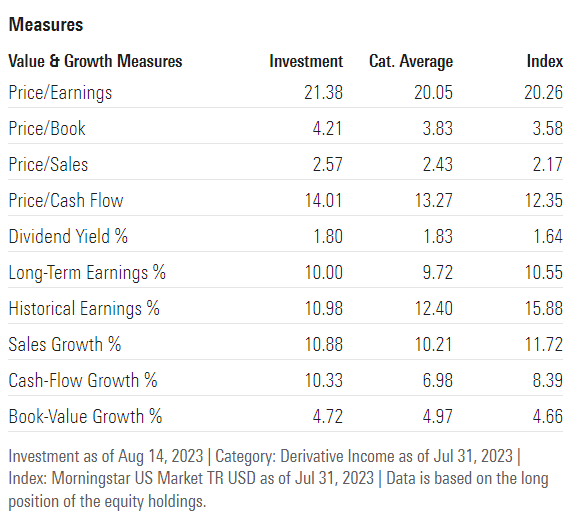

JEPI looks nothing like the S&P because of its 2% risk caps. It owns some overvalued companies, and its overall tech-heavy makeup means valuations are a bit stretched but not nearly as much as the Nasdaq's P/E of 28.

Morningstar

JEPI's portfolio is trading at just 5% above the Nasdaq's 20-year average.

Its underlying portfolio is one Morningstar's analysts think can generate 11.8% returns.

Add in communications (GOOG, META, NFLX) and consumer discretionary (AMZN and TSLA), and JEPI is about 31% tech, pretty much like the S&P.

It's much more diversified, roughly equally weighted among its top holdings.

In the wrong hands, this could end in disaster. In the right hands, it could be like watching Buffett or Hock Tan (of Broadcom) work their magic.

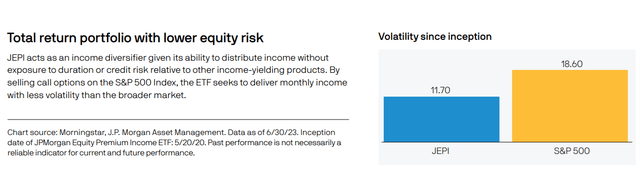

JEPI is designed to earn at least 6% to 10% returns with 65% of the market's volatility.

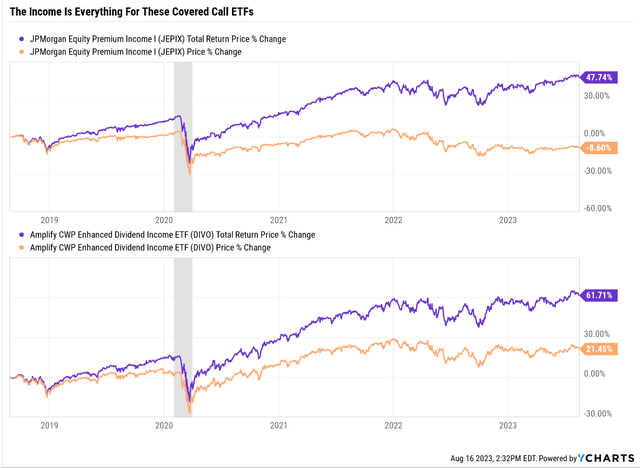

Since launching in May of 2020, a wonderful time for any ETF to get started, JEPI has been 63% as volatile as the S&P, almost perfectly matching its volatility goal.

How about that 6% to 10% target return? Which would be about 1% more than the historical return of a 60/40 portfolio that only yields 2.2%?

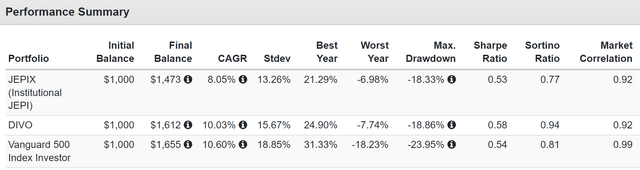

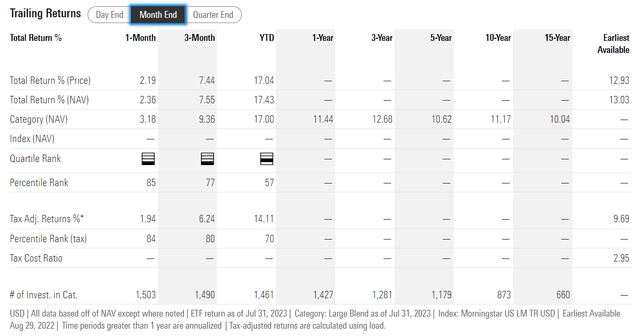

JEPI Historical Returns Since June 2020

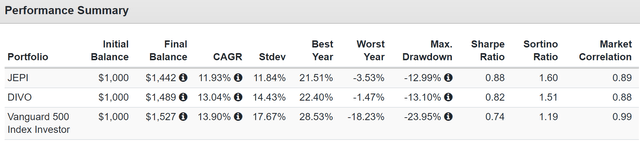

JEPI's goal is to maximize the Sortino ratio, which is excess total return divided by negative volatility.

In other words, alpha is relative to risk-free bonds per unit of scary volatility people hate and fear.

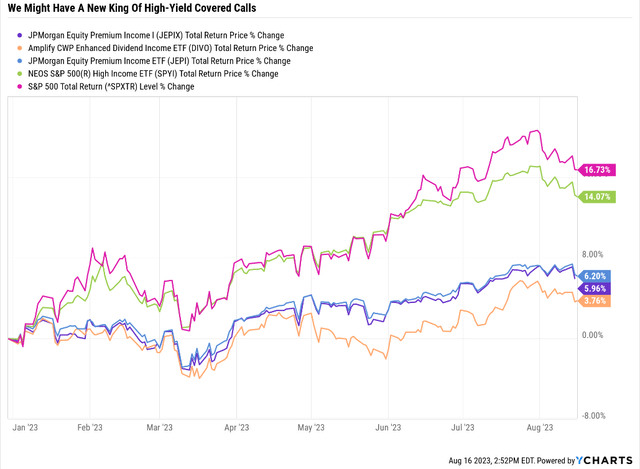

While rivals like DIVO are able to sometimes generate superior returns, that comes at the cost of volatility. Per unit of downside volatility, JEPI remains the king of covered call ETFs, at least as far as I've seen.

Unlike the Sharpe ratio, the Sortino assumes that people are OK with stocks screaming higher at a crazy pace. ;)

JEPI continues to deliver on its goals with solid double-digit returns and very low volatility

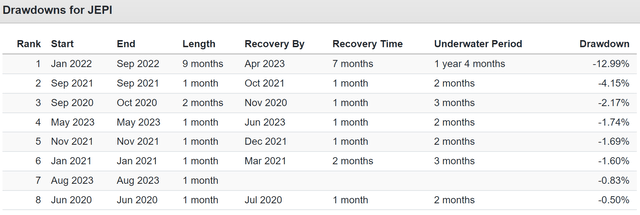

When the S&P fell as much as 28% in October 2022, JEPI only fell 13%, far outperforming its goal of an 18% decline.

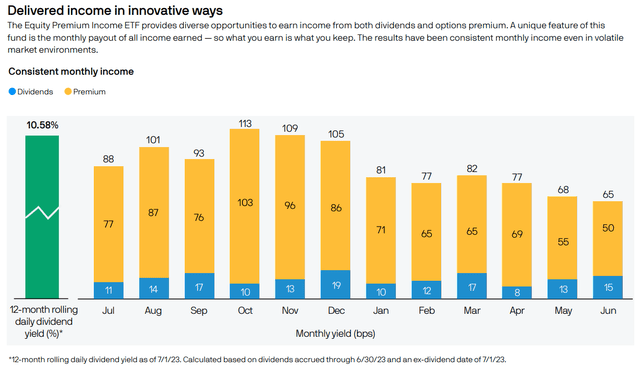

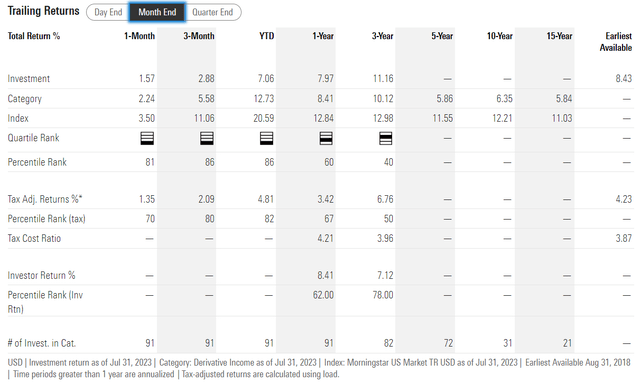

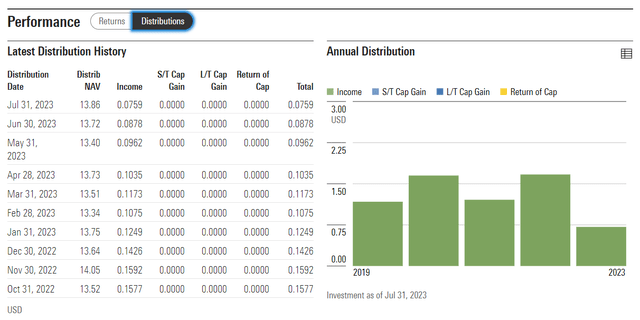

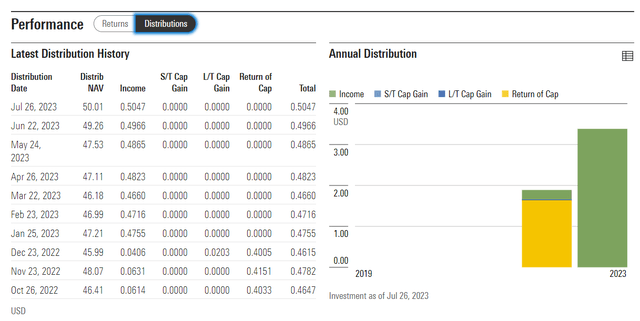

You can see that the amount of monthly income JEPI's managers have squeezed out of the falling volatility environment has trended lower. However, 0.5% monthly income from a freakishly low VIX of 13 is pretty impressive.

Remember that JEPI strives for a 5% to 8% annual option premium, and they were able to deliver 6% with a VIX that has seldom been lower.

JEPI's expense ratio is by far the lowest of its major rivals. That's possible due to JPMorgan's massive scale. Its peers can't afford to keep the lights on if they try to match it on price.

The Downside Of JEPI

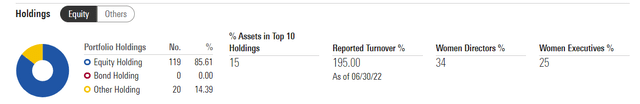

JEPI's turnover is very high, with a new portfolio every four months.

That, combined with the way option income is taxed (as ordinary income) means a very high tax expense ratio.

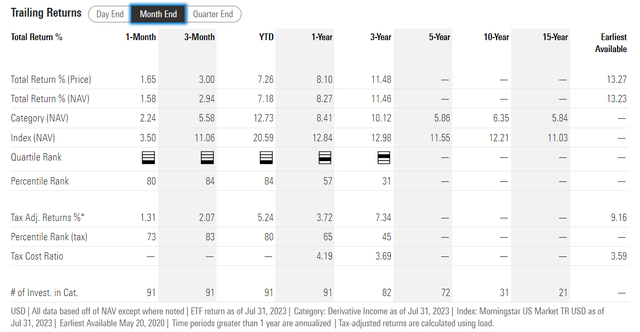

JEPI's 3.6% tax expense ratio is about 25% of its gains. In a Roth IRA or tax-deferred account, it was in the top 31% of its peers in the last three years. It was in the top 45% of peers in a taxable account, slightly above average.

What About The Future?

Historical Returns Since June 2018

JPMorgan Equity Premium Income Fund Class I (MUTF:JEPIX) is the same strategy the managers run; it's just an older institutional fund.

You can see that JEPIX was lower volatility than DIVO, but lower returns over the long term weren't that impressive during the Pandemic. JEPI and DIVO fell 18% to 19%, respectively, in the market's 33% decline.

But DIVO was able to deliver superior and almost market-matching returns ultimately.

JEPIX historically is in the top 40% of its peers slightly and 50th, so dead average when adjusting for taxes.

JEPIX has a relatively stable income; remember that this income is pretty much the entire return. Like bonds, covered call ETFs pay out almost all their total returns as income.

The point is that when JEPI's management says to expect 6% to 10% long-term returns, historically, they have delivered. Just remember those are pre-tax figures, so own JEPI in a tax-free account, or it won't be worth owning.

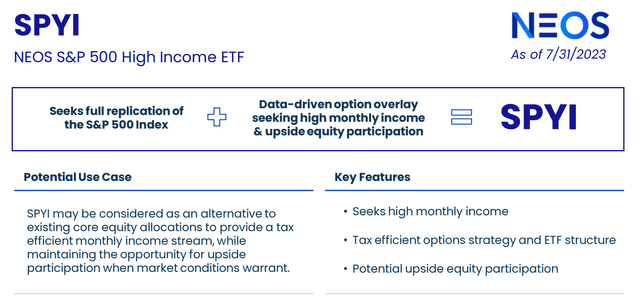

SPYI: Is The Higher Yield Worth It?

SPYI has paid out almost 11% in the past year, a very attractive yield. What's more impressive is that the monthly income has remained stable, unlike JEPI's steadily declining ELN income.

SPYI is more tax efficient than JEPI and is run with a goal of maximum income but also some capital appreciation (like DIVO has accomplished so far).

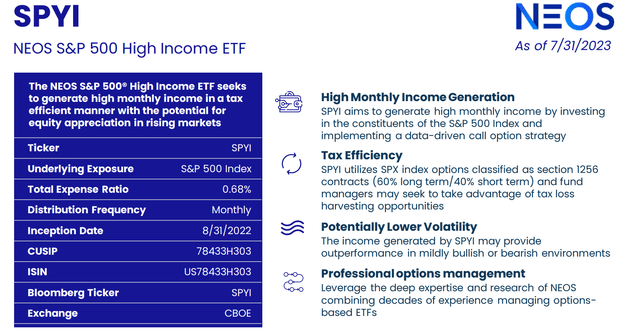

SPYI has nearly twice the expense ratio of JEPI and this ETF has been around for just one year, so there is a very limited history to work with.

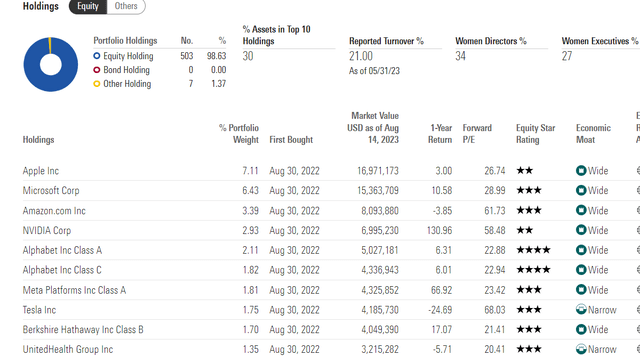

Due to being based on the S&P 500, turnover is a far more reasonable 21%.

The portfolio is S&P 500 with a proprietary covered call algorithm selling calls to generate income.

While SYPI is significantly more tax efficient than JEPI or JEPIX, by about 0.7%, that's still much higher than most ETFs that can keep their tax costs to 1% or less.

The S&P 500 has 4% annual turnover and 0.7% annual tax expenses. That's the difference between JEPI and SYDI.

Management has plenty of experience though only time will tell whether their covered call algo is above average to match the high expenses.

Bottom Line: SPYI Is A Promising But Untested Challenger To JEPI's Throne

JEPI's rockstar status among covered call ETF investors is largely attributable to luck.

It launched at the start of a nearly 100% one-year market rally fueled by $9 trillion in government stimulus and money printing.

It then performed better than expected in a high-volatility 2022 bear market.

So far, SPYI is off to a fantastic start, with 2023 returns that are 85% that of the S&P and far outperforming JEPI and DIVO.

Mind you, those are built on different portfolios, so this is likely beginner's luck for SPYI.

When the magnificent seven drive almost all of the S&P's gains, any portfolio that most closely mimics the S&P will outperform.

Historical Returns Since September 2022

If you zoom out and compare all three ETFs, you can see JEPI remains the king of low volatility high-yield covered call ETFs.

Would I recommend SPYI? I wouldn't personally buy it if I were looking for a covered call ETF. For now, JEPI is doing a great job, better than it was designed to deliver so far.

Given JEPI's low cost and the historically superior volatility-adjusted returns, I would stay with it and put no more than 1% into a challenger like SPYI.

This article was written by

Adam Galas is a co-founder of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 5,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) The Intelligent REIT Investor (newsletter), (2) The Intelligent Dividend Investor (newsletter), (3) iREIT on Alpha (Seeking Alpha), and (4) The Dividend Kings (Seeking Alpha).

I'm a proud Army veteran and have seven years of experience as an analyst/investment writer for Dividend Kings, iREIT, The Intelligent Dividend Investor, The Motley Fool, Simply Safe Dividends, Seeking Alpha, and the Adam Mesh Trading Group. I'm proud to be one of the founders of The Dividend Kings, joining forces with Brad Thomas, Chuck Carnevale, and other leading income writers to offer the best premium service on Seeking Alpha's Market Place.

My goal is to help all people learn how to harness the awesome power of dividend growth investing to achieve their financial dreams and enrich their lives.

With 24 years of investing experience, I've learned what works and more importantly, what doesn't, when it comes to building long-term wealth and safe and dependable income streams in all economic and market conditions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)