Dutch Bros: Positive Turnaround In SSS Is A Good Signal

Summary

- I recommend buy due to BROS potential for growth.

- The company reported strong financial 2Q23 results, surpassing estimates in EBITDA and net income.

- The positive turnaround in same-store sales and successful traffic-driving initiatives indicate a promising growth trajectory for Dutch Bros.

Svetlana_nsk/iStock via Getty Images

Summary

Dutch Bros (NYSE:BROS) operates and franchises drive-thru shops that focus on serving hand-crafted beverages. I am recommending a buy rating as I believe BROS can continue to grow at the current fast pace, meeting consensus estimates. The potential for growth is huge if we compete against large players like Starbucks (SBUX) in the US. A potential catalyst to drive valuation upwards would be BROS reducing its leverage ratio and turning FCF positive faster than expected.

Financials/Valuation

BROS reported results on August 8th, printing $249.9 million in revenues, $48.6 million in reported EBITDA, and a net income of $20.8 million. While revenue missed consensus estimates by a small amount, BROS surprised estimates in EBITDA and net income by a huge margin.

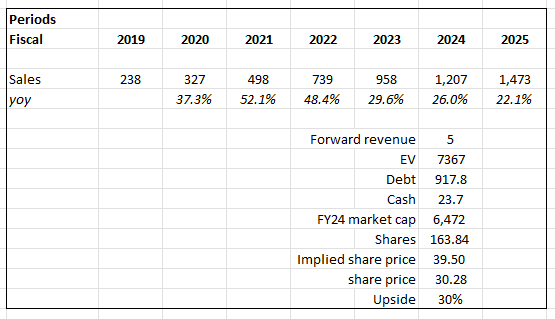

Based on my view of the business, BROS should be able to grow at what consensus is expecting, given the positive momentum so far and the size relative to other large players (like SBUX). To put things into perspective, SBUX has 16k units in the US and BROS only has less than a thousand, indicating a large runway. Using the consensus growth rate, BROS should generate $1.4 billion in revenue in FY25. I am assuming BROS will sustain its current forward revenue multiple (5x), a premium vs. other QSR peers (such as SBUX, Wendy's (WEN), Shake Shack (SHAK), Sweetgreen (SG), etc.), given its strong growth profile (BROS is expected to grow 20+% while peers are expecting to grow mid- to high teens). As I mentioned below, the catalyst driving valuation up (back to BROS historical multiple of 8x) is likely when BROS turns FCF positive or sees its leverage ratio go down.

Based on author's own math

Comments

The one metric that I was paying attention to was SSS, which has been negative for the past 4 quarters, especially with 1Q23 decelerating further from 3Q22 and 4Q22. As such, the 3.8% SSS reported in 2Q23 was a very strong indicator, in my opinion, that the trend might be turning, and BROS should be able to continue this growth given the easy comps last year. Also remember that BROS faced a 300bps headwind in sales transfer, so if we adjust for that, SSS is actually higher on a normalized basis.

Note on sales transfer impact: Additionally, opening new shops in existing markets may negatively impact sales at our, and our franchise partners', existing shops, even if it increases overall AUV in a region. The consumer target area of our shops varies by location, depending on a number of factors, including population density, other local retail and business attractions, area demographics, and geography. Our core business strategy anticipates achieving an ideal AUV through multiple mid-volume shops in a single region to infill and reduce the number of high-volume shops in order to provide continued efficient service. However, existing shops could also make it more difficult to build our and our franchise partners' consumer base for a new shop in the same market. Sales transfer between our shops may become significant in the future as we continue to expand our operations and could affect our sales growth, which could, in turn, harm our business. (BROS 10-k)

Franchisee SSS remained strong at 7% as BROS carried out numerous traffic-driving initiatives, which was a positive sign for the company's SSS as a whole. In particular, the Mangonada LTO was rolled out across the country in 2Q23, and it significantly surpassed projections by capturing over 10% of the menu share right off the bat. Aside from the success of this particular product, I think this says a lot about BROS ability to identify consumer trends and preferences. This ensures that BROS will always be relevant. Positive traction in the Dutch Bros app and rewards, in addition to product innovation, was a pleasant surprise. To me, the app and rewards represent largely unrealized potential for personalized marketing. The current number of Rewards members is 6.2 million, and they generate 65% of all revenue. Put another way, BROS is able to push targeted promotions for 65% of its revenue, reducing its cost of customer acquisition. According to management, they are also seeing improvements across cohorts in terms of frequency, which I believe is partially driven by this rewards program. As BROS continues to scale this, I think the long-term margin profile could further improve as CAC goes down (from reduced ad spend) and CLTV goes up (from increased frequency).

Second, rewards. We have seen continued momentum in our rewards program following the end of March refresh. That refresh enables us to invest more surgically, bringing even more exciting promotions to Ducth Rewards members, who make up almost 65% of our transactions. Source: Q2 2023 earnings call

Apart from the strong SSS performance, BROS should have no issues continuing to expand its unit count as the momentum remains strong. For perspective, BROS total units have increased by 25% since FY22, which I find amazing given the macro situation. Management is guiding FY23 for at least 150 system openings, and given the historical opening rate (FY22 opened 100 and YTD FY23 opened 83), I think it is likely that management will hit this target, bringing FY23 total units to 821. More than topline and SSS performance, BROS really delivered on the profit front, where EBITDA came in at $48.6 million (19.4% margin), beating consensus by a significant amount ($39.5 million and 15.5% margin). The beat was mainly driven by lower labor cost and COGS. Labor-wise, I anticipate ongoing benefits from enhanced scheduling capabilities, decreased employee churn (from 70% in 1Q23 to 60%+ in 2Q23), and cheaper labor in the eastern US market.

A slight risk for BROS is that its balance sheet continues to bloat. Total debt has now reached $783 million, driving net debt to $760 million. As of LTM, the business now has a leverage ratio (ND/EBITDA) of 7.7x. While I am optimistic about the growth runway, I have concerns that the balance sheet will continue to weigh on valuation. The worst-case scenario is that BROS needs to raise equity to strengthen its balance sheet. If we look at consensus estimates, BROS is only expected to generate positive FCF in FY27. The balance sheet and FCF dynamic might cause some investors to shun the stock.

Risk & conclusion

I see the main risk for BROS as the portability of its brand to other regions in the United States. Suppose BRO's products are not well received in other parts of the US; this would significantly reduce the TAM and growth runway for BROS. Once the market recognizes this, valuations will see a sharp derating.

In conclusion, BROS positive turnaround in SSS presents a promising signal for its growth trajectory. With a focused expansion strategy and successful traffic-driving initiatives, the company has demonstrated its ability to adapt to consumer trends and preferences. BROS EBITDA margins performance and potential for improved cost dynamics through enhanced scheduling and labor management provide a solid foundation for profitability. Overall, Dutch Bros' strategic positioning, innovative approach, and improving SSS performance suggest a favorable outlook, though potential risks related to regional brand acceptance should be vigilantly monitored.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.