Ventas: A High-Quality Entry Point For Quality Healthcare

Summary

- Ventas, Inc. is a highly-rated healthcare REIT with above-average fundamental safety and a good yield.

- The company has a strong portfolio in the healthcare space, including senior housing, outpatient medical providers, and hospital and care facilities.

- While the healthcare REIT sector has underperformed, Ventas has outperformed its peers and has the scale and safety to navigate the market.

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

Sean Anthony Eddy

Dear subscribers,

In this article, I'm going to take a look again at Ventas, Inc. (NYSE:VTR), one of the highest-rated and highest-quality healthcare real estate investment trusts, or REITs, we currently cover and consider a "BUY."

Ventas is a company I've covered in mixed articles, but I haven't covered it in any sort of company-specific articles here. So, that is what I am going to do. The company has an above-average level of fundamental safety. And yes, compared to some healthcare or adjacent REITs like Medical Properties Trust, Inc. (MPW), it doesn't have as high a yield, but it's still a very good yield and upside for what's being offered.

I have a small position in Ventas. As of right now, due to FX, I'm not keen on expanding significantly - but this is a product of FX, not appeal. I'll show you why that is below.

Ventas and its operations - quality is core here

The healthcare REIT space is not a massively pleasant space to be in, if we look at the current 1-year RoR for many of the REITs here. Plenty of declines, and with payout ratios edging up, there are companies that could be poised for a potential dividend cut.

My approach for this is multi-pronged.

When it comes to plays like MPW, I'm currently waiting in the wings for what the company decides to do with its dividend. Not because I don't believe the company is attractive at this price even with a cut - but because I believe that with a cut, the company would likely drop another 5-15% and present a massively appealing entry point.

At that point, I would expanding my current trivial stake in MPW to a significant stake for a higher-risk speculative play - around 1%.

Ventas is different than MPW.

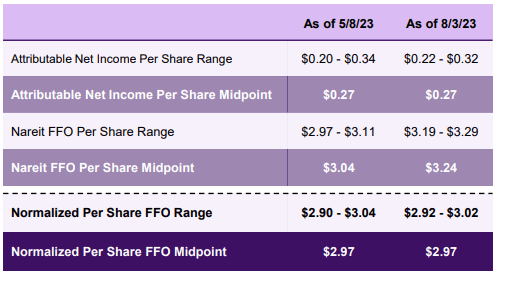

The company is amongst the market-leading businesses in the space, being an S&P 500 (SP500) REIT with market-leading assets and exposures across subsectors in the healthcare space. The company relatively recently reported Q2 2023, and its current estimate for 2023 is to generate nearly $3/share in funds from operations ("FFO").

Ventas IR (Ventas IR)

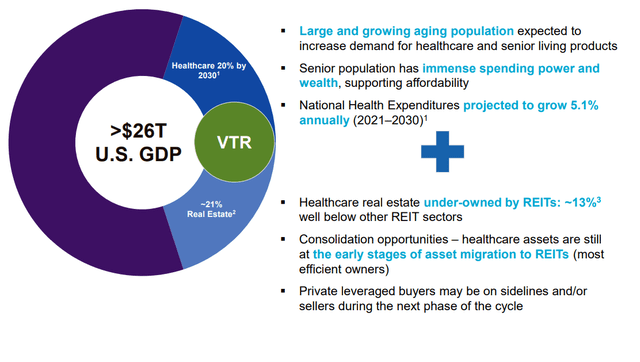

The fundamental arguments for Ventas are the arguments I've heard for healthcare/eldercare REITs since I started investing in the American markets many years ago. It's the "Silver Tsunami," or the rapid aging population, expected to increase demand for both healthcare and senior living products and services.

Now, if I go back 10 years and look at some of the theses presented, it quickly becomes apparent that the bullish expectations for this sector have not materialized. At least not yet (and I believe they likely never will, not in full).

The reasons for this are complex, but some of the higher-level reasons are an overall pushback from society with regard to expenses, weighing down profitability, and far too optimistic profitability estimates overall. Maybe this will turn around going forward, but I'll continue to view it as an uncertain sector, perhaps even on par with CRE.

That means that if we go into the space, and we're not looking for speculative bargains, we need to go into the highest quality.

Because while many of these REITs presents picture exactly like this...

...as someone who is currently managing over 500 employees, though publicly, in a healthcare/eldercare organization, I will tell you that there are reasons for this lack of consolidation and why Health care real estate typically isn't owned this way, and why risks are higher than you might expect.

At least, unless you choose the most qualitative players out there - like Ventas.

Ventas has made a name for itself with over a quarter-century worth of history, over $32B in enterprise value, BBB+ credit rating, and 18% annualized TSR since 1999 - which beats the market and most other REITs.

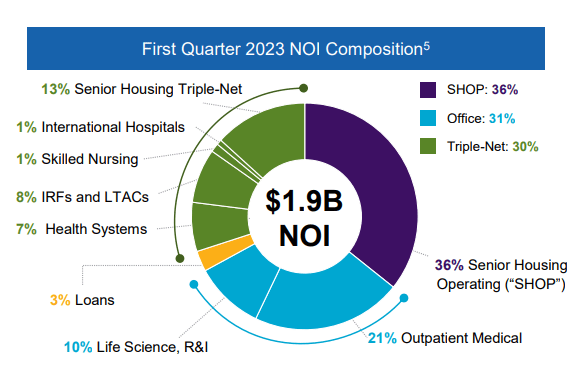

Ventas is the second-largest U.S. senior housing owner, active in 46 states, has 14,000+ Outpatient medical providers with over 35M visits and manages real estate for over 17 top-tier units, and is in the 90th+ percentile in NIH funding. Together with its Hospital and care facilities with almost 7,000 beds in 19 states, the company has one of the most comprehensive healthcare portfolios in existence in any REIT.

Ventas NOI Split (VTR IR)

While some may be quick to throw Senior Housing Operating ("SHOP") under the bus, I say that there is SHOP, and then there is Ventas SHOP. Any company that has been around for over a quarter of a century, not only deserves your attention, it deserves you not to take hasty decisions or judgments with regard to its safety. The brands associated with the company are many and well-known.

I don't have an issue with considering the upside from the changing demographics as something to invest in. Just, as I mentioned, not as big as some expect, because I believe there will be significant governmental pushback on spending/pricing for the care, which will eat into margins for all of these companies and REITs. That's why I only tend to go for massively mispriced assets, like MPW, or quality players, such as VTR.

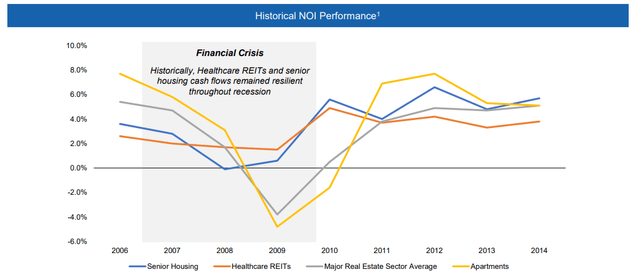

This company, thanks to a market cap of tens of billions, has the scale and safety to navigate this marketplace - and with its barely 61% FFO normalized payout, that 4%+ yield is very safe. While healthcare REITs have essentially underperformed the sectors including housing, apartments, and averages significantly since the Great Financial Crisis ("GFC") or 2012, they may be poised for a swing back up.

With regards to potential turnouts, if we see either a soft landing or recession, it doesn't really matter to this company. A soft landing is expected to result in improving cash flows and repricing for the inflationary environment, and even a recession scenario is expected to be characterized by demographic demand, and slack in the labor market should cause the expenses in SHOP to trend downward, in turn supporting margin expansion and NOI growth. Recession will also have only a negative limited impact on outpatient care and other subsectors of SHOP, expecting continued growth.

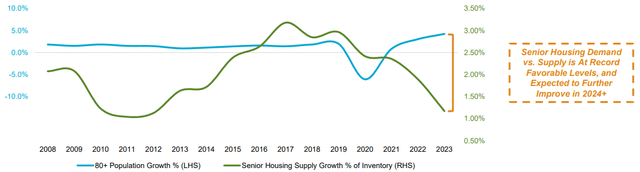

Healthcare investors have been betting on the imbalance in supply and demand for senior housing to result in a massive turnaround for years at this point. First, as a trend that was expected - now as an imbalance that has actually materialized, and in a very significant way.

As I mentioned, few people seem to really be "building" here. So, the bullish arguments are certainly all here, for those that want them. 2Q23 was positive as well. Same-store cash NOI growth of 7% led by growth in SHOP and compounding growth in the other subsegments saw the company move up, leading to the ability to confirm full-year outlooks at that $2.97 level.

Expenses are, in some ways, increasing. Interest rate expenses are obviously increasing, as we might expect for what's going on macro-wise. But the company is also optimizing its portfolio structure. It sold 24% in an Ardent OpCo to a third-party investor for $50M, reducing ownership of Ardent. It successfully refinanced a senior secured loan, paying down one maturing in August of 2023, improving the interest to a fixed blended rate of 4.5% from one of around 7% due to the LIBOR structure.

The company's work is far from over - but the company's size and portfolio give it the necessary elbow room to optimize without the need for compromise, while also being able to declare in effect "We know that this is currently sub-par, but it's better for us to hold it than to sell it off/refinance at sub-par terms".

Not all REITs have the flexibility to do this - and certainly not with BBB+.

My main issue with Ventas has always been, you guessed it, the valuation of the business. It's my opinion that Healthcare REITs, despite what has been perceived as value, have been mispriced for an actual far higher cost pressure/risk than what has been perceived.

And with Ventas, we're even talking about a REIT that factually, has outperformed peers in the sector.

Ventas has an interesting portfolio structure. The straight office portions and triple-net segments of its portfolio act as significant defensive buffers that change little. SHOP is the "growth" segment, but this comes at the price of exposure to occupancy, inflation, and the entire interest rate/margin economic cycle. It's also, if we want to invest in REITs with typical REIT segments, this is the least typical of those segments, but it's still due to its relative portfolio size, part of what will drive the company's performance and results over the next half-decade given the stability of the non-SHOP segments.

You need to understand this. That means that you should be SHOP-positive if you invest in VTR. I am SHOP-positive.

You should also believe that the company can manage the sources of headwinds here - which primarily are cost increases derived from overall inflation, and wage inflation, as well as the situation in the overall labor market. Again, over time I believe that the company can handle this, despite a not-superb rent coverage.

With annual guidance excellent (though flat YoY), I move into valuation here.

Ventas - plenty to like about the company's valuation here, with double-digit potential upside.

Like many REITs, one of the questions in this macro environment we need to look at when considering this investment is how much growth we're likely to see from Ventas on a forward basis. The current estimate for the company's 2023E FFO is at the level of 2022. Forward growth seems primarily to come from SHOP, which is perhaps one of the most macro-correlated segments we have.

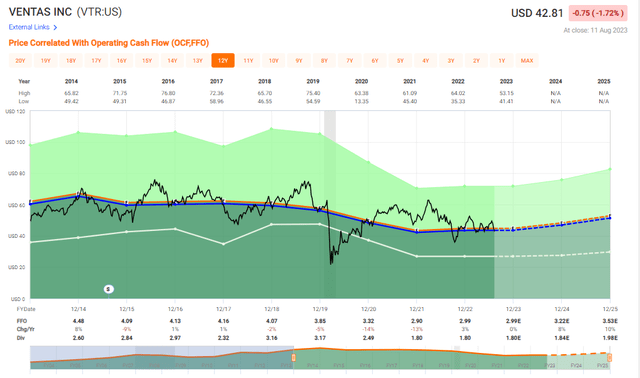

This explains why the company hasn't really "moved" much for the past 2-3, beyond some volatile swings that you could have profited off of.

My thesis for Ventas is actually based in large parts upon these swings.

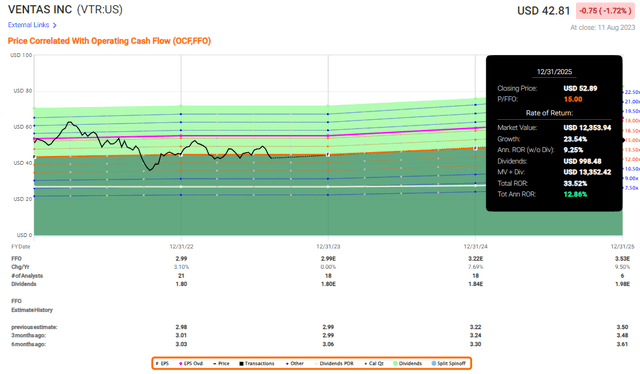

Ventas Valuation (Ventas Valuation)

Ventas tends to stick fairly close to its 15x P/FFO average over time. Swings up and down, yes. But this just means you get both opportunities to buy and opportunities to rotate. The more extreme the upswing or downswing, you should act in accordance with this.

Fall 2022 saw a record-low valuation of around 12.5x P/FFO for the past 2 years. Now we're at around 14.3x. This is not the best opportunity we've had, but it's good enough to act on, for sure.

The upside based just upon a 15x P/FFO normalization based on current estimates is close to 13% annually.

While my own demands are usually based on a 15% annualized, there may be reasons to compromise based on quality, fundamentals, or yield. I consider this good enough to perhaps accept that 2% lower per year.

In my work, I've been through the options chains both on the Put and the Call side, considering if we can get attractively-priced plays with better RoRs than that 13% annually. However, we've seen a premium decline, especially on the put side for the past few months and since the start of the year. Where it was once easier to get a 12-16% annualized RoR, we now can barely get 9%. What buy-write plays exist don't offer 15%+ at an attractive price here.

For that reason, I would consider the common share investment to be the way to go for Ventas here. The company has a high degree statistically of meeting analyst targets. A miss ratio of only 8% on a 2-year basis with a 20% MoE (Source: FactSet). S&P global price targets for the company come to around $52 on average, based on a $45 low to a $68 high. 12 out of 18 analysts are currently positive on the company. I'll add my voice to the chorus here.

This is a relatively safe yield, a safe income for you to invest in, as I see it. However, I would caution that growth might not be as easy to come by as the company expects, or as the market seems to expect. This is a more difficult segment than some, even industry experts, seem to at times give it credit for.

For that reason, I'm a "BUY," but I'm also saying that other REIT subsectors have qualitative plays worth considering.

Thesis

- Ventas is a class-leading healthcare REIT with one of the best fundamentals in the industry. It also comes at a comparatively low yield of only around 4.2%. The upside is that based on the overall payout ratio, this is a very safe dividend.

- I view the company as attractive when it goes into undervaluation. This is typically characterized by sub-15x P/FFO, which is where we now are. The upside to a more fair-value multiple based on fundamentals and the upside is now double digits.

- For that reason, I view VTR as a "BUY" here.

Remember, I'm all about:

1. Buying undervalued - even if that undervaluation is slight, and not mind-numbingly massive - companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn't go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

I won't call it "cheap" here, but I will call it a "BUY" with an upside.

The company discussed in this article is only one potential investment in the sector. Members of iREIT on Alpha get access to investment ideas with upsides that I view as significantly higher/better than this one. Consider subscribing and learning more here.

This article was written by

Mid-thirties DGI investor/senior analyst in private portfolio management/wealth management for a select number of clients. Invests in USA, Canada, Germany, Scandinavia, France, UK, BeNeLux. My aim is to only buy undervalued/fairly valued stocks and to be an authority on value investments as well as related topics.

I am a contributor for iREIT on Alpha as well as Dividend Kings here on Seeking Alpha and work as a Senior Research Analyst for Wide Moat Research LLC.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MPW, VTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment. Short-term trading, options trading/investment, and futures trading are potentially extremely risky investment styles. They generally are not appropriate for someone with limited capital, limited investment experience, or a lack of understanding for the necessary risk tolerance involved. The author's intent is never to give personalized financial advice, and publications are to be viewed as research and company interest pieces. The author owns the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in the articles. The author owns the Canadian tickers of all Canadian stocks written about.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)

Paul