Vital Energy: Strong Oil Production Performance

Summary

- Vital has increased its oil production guidance by 20% since the start of 2023.

- Some of this is from acquisitions, but even without acquisitions its oil production guidance would have been boosted by 8%.

- Vital is now projected to generate $96 million in 2H 2023 free cash flow.

- Debt remains substantial (and increased due to its acquisitions), but appears manageable at current oil prices.

- Looking for a helping hand in the market? Members of Distressed Value Investing get exclusive ideas and guidance to navigate any climate. Learn More »

zhengzaishuru

Vital Energy's (NYSE:VTLE) operational performance has been pretty good so far in 2023. It has increased its oil production guidance for the year by approximately 8% (excluding the impact of acquisitions). Including acquisitions, Vital's oil production may end up around 20% higher than its original expectations.

Vital is now expected to generate around $96 million in free cash flow during the second half of 2023 at current strip prices. It has a significant amount of debt, but this debt does appear to be manageable at mid-to-high $70s oil.

A key to Vital's results going forward will be its realized prices for natural gas and NGLs, since those commodities make up over 50% of Vital's production. Vital realized only $8.39 per BOE for its non-oil production in Q2 2023, but realized over double than back in 2021.

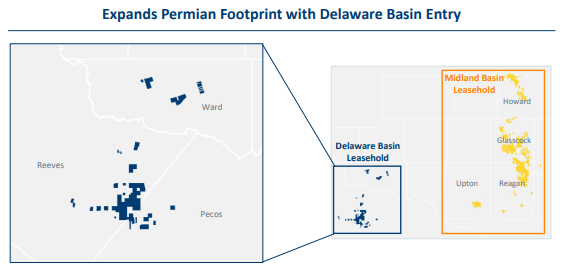

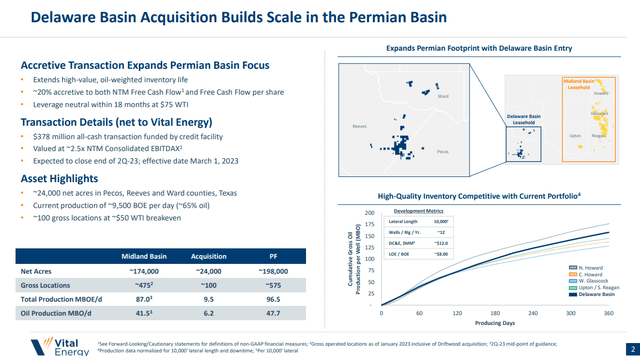

Forge Acquisition

Vital Energy closed on its acquisition of Forge Energy II Delaware at the end of Q2 2023. This purchase was done in partnership with Northern Oil & Gas (NOG), with Vital paying $391.8 million in cash for 70% of Forge's assets. The initially reported purchase price was $378 million before the purchase price adjustments.

Vital's 70% share translates into 24,000 net acres with approximately 9,500 BOEPD (65% oil) in current production. Vital expects the Forge assets to add approximately 5,000 BOEPD in full-year production, indicating expectations for roughly 10,000 BOEPD in 2H 2023 production.

Forge Acquisition (vitalenergy.com)

Vital also is allocating $50 million in additional capex to the Forge assets, so Forge should generate around $30 million to $35 million in 2H 2023 free cash flow during the second half of the year.

Vital is also adding around 100 gross locations with an average breakeven price that it estimates at $50 WTI oil. This gives Vital around 8 to 9 years of oil-heavy inventory now (assuming close to 70 gross wells per year). However, the majority of that oil-heavy inventory is in Glasscock County, which has oil production that averages less than the Howard County wells that Vital has been focusing on developing.

Vital's Inventory (vitalenergy.com)

Guidance Changes

Vital mentioned that it has outperformed its production expectations with a combination of improved based production plus strong productivity from new wells. In July, it increased its full-year oil production guidance to a range of 40,000 to 43,000 barrels per day. This is 6,000 barrels per day higher than its original guidance, with 4,300 barrels per day attributable to its Forge and Driftwood acquisitions and 1,700 barrels per day attributable to production outperformance.

In August, Vital further increased its production expectations, primarily due to stronger base production. It now expects 41,900 to 43,400 barrels per day in average 2023 oil production, which is an 8% increase from its original guidance after factoring out the added production from its acquisitions.

Vital also trimmed its expectations around its full-year capex budget by around $20 million, and now expects to spend between $665 million and $695 million for the full year.

Notes On Realized Prices

Vital's realized prices for its NGLs and natural gas production ended up quite low in Q2 2023, but still not as bad as I was expecting. Excluding derivatives, Vital realized $12.63 per barrel for its NGLs and $0.71 per Mcf for its natural gas, for an average of $8.39 per BOE for its non-oil production.

Vital did not have any hedges for its NGLs and with derivatives it realized $1.45 per Mcf for its natural gas.

Vital's realized prices should improve in the second half of 2023. While still not particularly high, I believe that it can average close to $14 per BOE for its non-oil production during the second half of the year.

2H 2023 Outlook

Vital is now expected to average approximately 90,650 BOEPD in production during the second half of 2023. This includes 43,900 barrels per day of oil production, for a 48% oil cut.

At current strip prices for the second half of 2023 (including $78 to $79 WTI oil), Vital is projected to generate $758 million in oil and gas revenues, while its hedges have an estimated negative $18 million in value.

Much of that negative hedge value comes from Vital's Waha basis hedges. Vital has basis swaps covering around 81% of its 2H 2023 natural gas production at negative $1.53 to Henry Hub. The Waha basis differential has narrowed significantly, helping Vital's unhedged natural gas realized prices, but resulting in projected hedging losses on those basis hedges.

| Barrels/Mcf | $ Per Barrel/Mcf (Realized) | $ Million | |

| Oil | 8,077,600 | $79.25 | $640 |

| NGLs | 4,214,980 | $15.00 | $63 |

| Natural Gas | 26,322,120 | $2.10 | $55 |

| Hedge Value | -$18 | ||

| Total Revenue | $740 |

This leads to a projection of $96 million in free cash flow for Vital during the second half of 2023.

| $ Million | |

| Lease Operating Expense | $123 |

| Production and Ad Valorem Taxes | $49 |

| Marketing and Transportation | $20 |

| Cash G&A | $37 |

| Interest | $70 |

| Capital Expenditures | $345 |

| Total Expenses | $644 |

Net Debt And Valuation

Vital's projected 2H 2023 free cash flow would reduce its net debt to $1.46 billion at the end of 2023, assuming no working capital changes. This is 1.4x its annualized 2H 2023 EBITDAX (based on my projections above).

Vital's debt remains something to monitor, but it appears to be manageable in a mid-to-high $70s oil scenario at least. Vital's 9.5% unsecured bonds due January 2025 have been trading around par recently.

I estimate Vital's value at around $74 per share at long-term $75 WTI oil if it can also realize prices for its non-oil production that are similar to 2021 levels. In 2021 Vital realized $2.63 per Mcf for its natural gas and $22.08 per barrel for its NGLs, resulting in a blended price of $18.78 per BOE for its non-oil production.

Conclusion

Vital Energy has increased its full-year expectations around oil production by 20% from its original guidance, with 60% of that increase coming from acquisitions and 40% from production outperformance.

Vital is now projected to generate $96 million in free cash flow during the second half of the year. Vital's debt burden is significant, but it does appear manageable at mid-to-high $70s WTI oil. Improved prices for NGLs and natural gas (from Q2 2023 levels) will also help Vital.

Vital's debt makes it relatively risky, but I also believe that it can be worth around $74 per share at long-term $75 WTI oil, also assuming that natural gas and NGL prices can rebound to 2021 levels.

Free Trial Offer

We are currently offering a free two-week trial to Distressed Value Investing. Join our community to receive exclusive research about various energy companies and other opportunities along with full access to my portfolio of historic research that now includes over 1,000 reports on over 100 companies.

This article was written by

Elephant Analytics has also achieved a top 50 score on the Bloomberg Aptitude Test measuring financial aptitude (out of nearly 200,000 test takers). He has also achieved a score (153) in the 99.98th percentile on the WAIS-III IQ test and has led multiple teams that have won awards during business and strategy competitions involving numerical analysis. In one such competition, he captained his team to become North American champions, finishing ahead of top Ivy League MBA teams, and represented North America in the Paris finals.

Elephant Analytics co-founded a company that was selected as one of 20 companies to participate in an start-up incubator program that spawned several companies with $100+ million valuations (Lyft, Life360, Wildfire). He also co-founded a mobile gaming company and designed the in-game economic models for two mobile apps (Absolute Bingo and Bingo Abradoodle) with over 30 million in combined installs.

Legal Disclaimer: Elephant Analytics' reports, premium research service and other writings are personal opinions only and should not be considered as investment advice. Only registered investment advisors can provide personalized investment advice. While Elephant Analytics attempts to provide reports that include accurate facts, investors should do their own diligence and fact checking prior to making their own decisions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)