Monogram Orthopaedics Faces Tough Road Ahead For Surgical Robotics System

Summary

- Monogram Orthopaedics, Inc. went public in May 2023 and raised $17.2 million for its autonomous robotic surgical system for knee replacement surgery.

- The company is still in the development stage and will require significant additional capital to fund its plans.

- The stock is an ultra-high-risk investment, and my outlook is to Sell.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

3alexd

A Quick Take On Monogram Orthopaedics

Monogram Orthopaedics, Inc. (NASDAQ:MGRM) went public in May, 2023, raising approximately $17.2 million in gross proceeds in a Regulation A+ IPO that was priced at $7.25 per share.

The firm is in the development stage for an autonomous robotic surgical system for knee replacement surgery.

Monogram Orthopaedics, Inc. is a thinly capitalized company that will likely require significant additional capital to fund its development plans, which will probably take several years before reaching meaningful milestones.

The stock is an ultra-high-risk investment at this stage, and my outlook is to Sell.

Monogram's Overview And Market

Austin, Texas-based Monogram Orthopaedics, Inc. was founded in 2016 to develop partially automated surgical robots for knee replacement surgery.

The company is also developing the ability to provide customized implants and related tools and navigation consumables.

The firm is headed by President and Chief Executive Officer Benjamin Sexson, who joined the company in 2018 and was previously Director of Business Development at Pro-Dex, an OEM manufacturer of orthopedic robotic end-effectors.

The company's primary products under development include the following:

Robotic surgical equipment

Related software

Orthopedic implants

Tissue ablation tools

Navigation consumables

Other tools and instruments.

Notably, the company said it has:

"not yet made 510(k) premarket notification submissions or obtained 510(k) premarket clearances for any of its robotic products. FDA 510(k) premarket clearance is required to market the Company's products, and the Company has not obtained FDA clearance for any of its robotic products, and it cannot estimate the timing to obtain such clearances."

The 510(k) approval pathway is for products that are substantially equivalent to an existing product, as opposed to a de novo pathway for a new device.

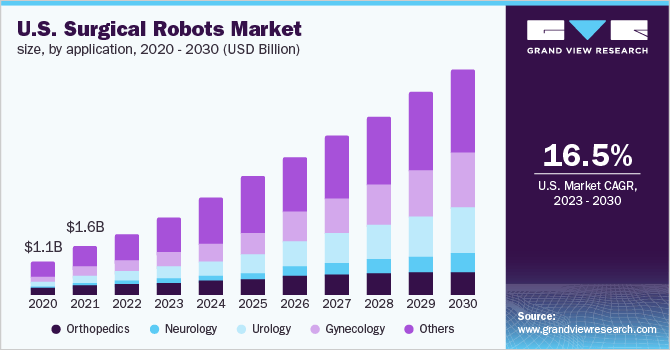

According to a 2023 market research report by Grand View Research, the global market for surgical robots was estimated at $4.4 billion in 2022 and is forecast to reach $16.5 billion by 2030.

This represents a forecast CAGR (Compound Annual Growth Rate) of 18.0% from 2023 to 2030.

The main drivers for this expected growth are a growing shortage of physicians and surgeons and an increasing adoption of minimally invasive procedures and automation.

Also, the chart below shows the historical and projected future growth trajectory of the U.S. Surgical Robots market from 2020 to 2030:

U.S. Surgical Robots Market (Grand View Research)

Major competitive or other industry participants include:

Stryker Corporation

Medrobotics

Smith & Nephew

TransEnterix Surgical, Inc.

Renishaw plc.

Intuitive Surgical

Medtronic

THINK Surgical, Inc.

Zimmer Biomet.

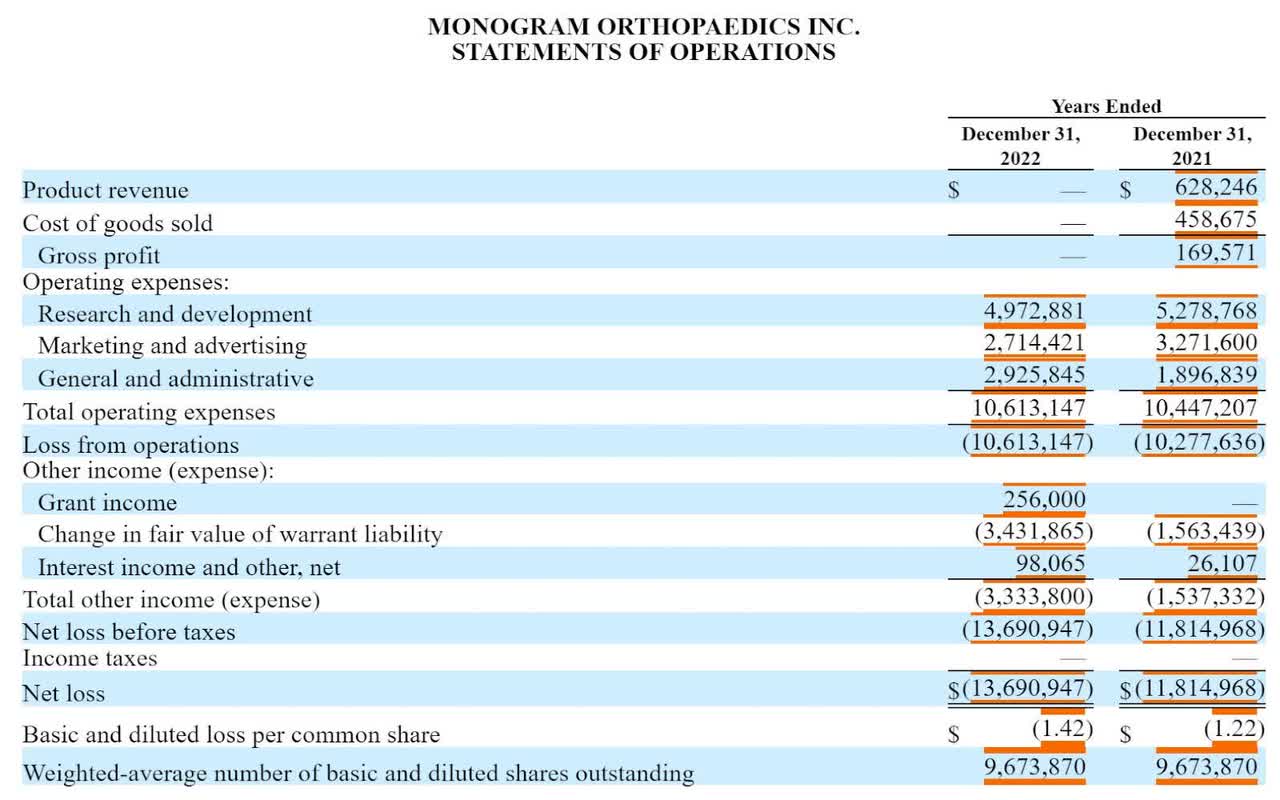

Monogram's Financial Results

The company is still in development stage, and its full-year financial results show little revenue and significant G&A and R&D expenses typically associated with a medical device development company, as shown in the graphic below:

The firm ended the first half of 2023 with $17.1 million in cash and equivalents and no debt.

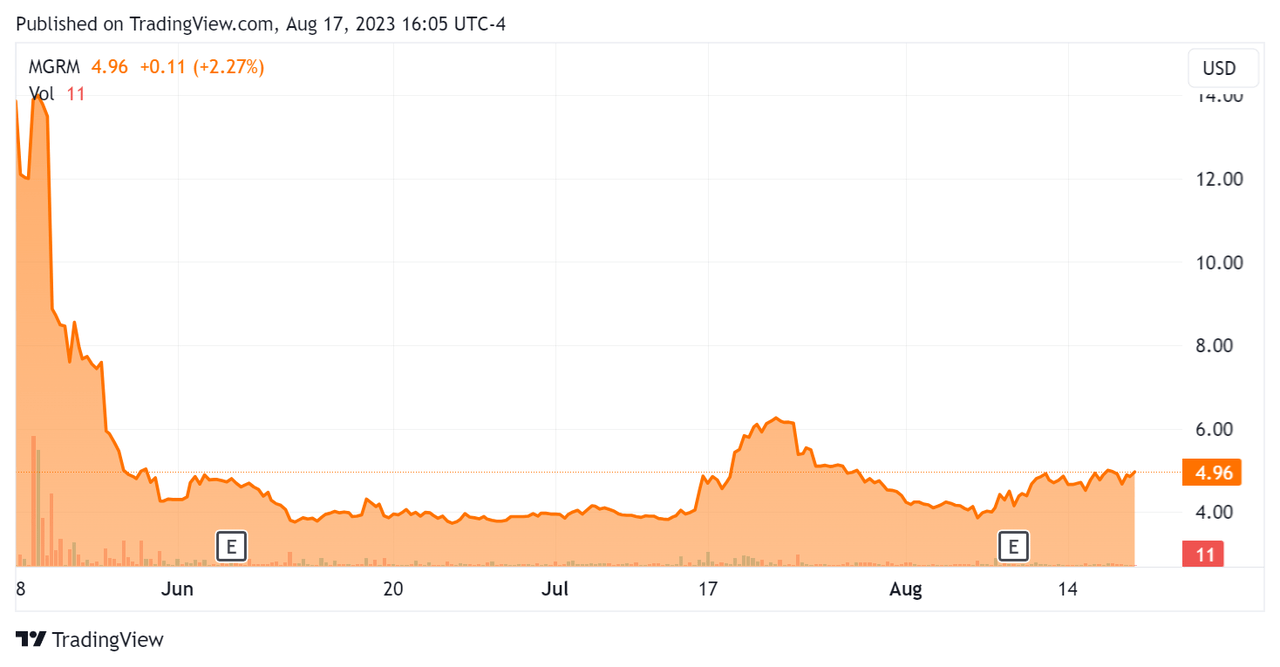

Since its IPO, MGRM's stock price has both risen sharply and dropped precipitously, as the Seeking Alpha chart shows here:

Stock Price Chart (Seeking Alpha)

Risks And Commentary On Monogram Orthopaedics

In its last press release (Source - Seeking Alpha), the company announced the completion of the "development phase" of its autonomous surgical robotic system, essentially stating that it is freezing development of the current generation of the system in favor of the next phase, verification.

Verification will include testing the "accuracy and repeatability" of the software and hardware components of the system.

While management says it is in discussions to partner with "a global distributor" to begin performing surgeries in 2024, the company has yet to operate on a human being with its system.

Performing first-in-man surgeries is an important milestone in the development of a medical device, but prospective investors should be aware that the trials process can take many years before conclusion.

Furthermore, high-tech medical device products can require significant redesign and retooling to meet regulatory approval, causing further delays and requiring significant additional capital to fund.

With only $17 million in hand, that amount will likely provide perhaps 12 months of development funding at best before the company needs to raise additional capital, likely diluting equity investors in the process.

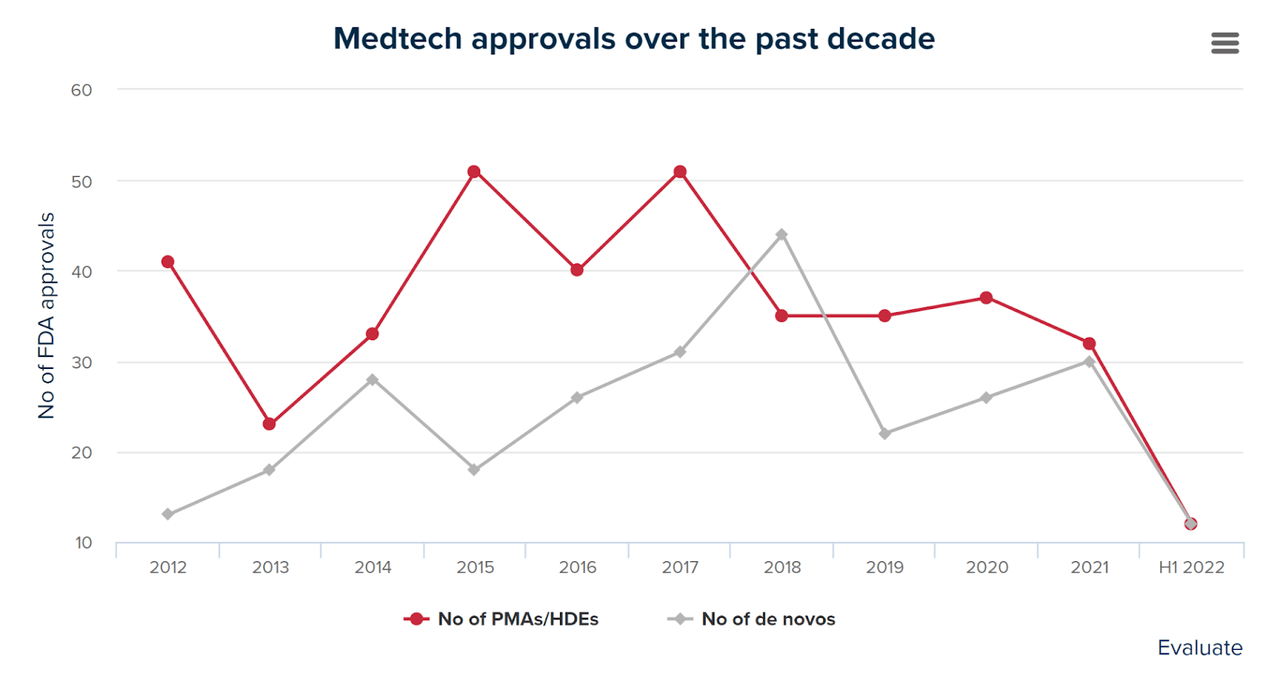

Also, the FDA has been slowing down the approval process for medical device applications due in part to the recent COVID-19 pandemic, which caused the agency to prioritize approvals of drugs and vaccines.

The chart below shows the number of medical device applications approved by the FDA since 2012 through the first half of 2022, according to Evaluate.

Medtech FDA Approvals (Evaluate)

While the agency may be able to make up some of the backlog as it returns to pre-pandemic activity levels and increases headcount, it has never been a quick or easy process.

Many medical device makers take the route of getting approval in other countries before bringing their products to the U.S., with the European Medicines Agency being one of the more amenable regulatory agencies.

Time will tell if the company chooses to pursue device trials in locations other than the U.S. If so, that process may take additional time, investment and complexity to put into effect.

In any event, the company has a long road ahead of it and will likely require a lot of additional capital to fund its ambitious plans.

Potential upside catalysts could include faster-than-expected milestone achievement or a major marquee partner announcement.

However, given the firm's thin capitalization compared to industry giant competitors, early stage of development, and numerous regulatory, trials, development and financing risks, the stock is ultra-high-risk and my outlook is to Sell.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)