The Philadelphia Fed MFG Survey Shakes Up The Outlook

Summary

- The Philadelphia Fed MFG survey shows a positive reading for the first time in a year, signaling a potential end of recession forecast.

- Economic reports, such as the retail sales report, indicate a refusal of the economy to continue its deceleration.

- The housing market, which previously showed resilience, is now experiencing the highest mortgage rates in over 20 years.

- However, the Fed emphasizes the job market, where some slowing is evident right now. The Fed and the bond market appear to be in different planetary orbits.

imaginima

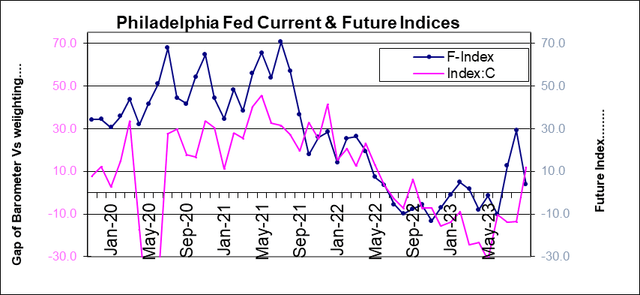

The Philadelphia Fed MFG survey is more than a one-off regional survey

The Philadelphia Fed Survey of manufacturing for August has jumped to a value of plus 12 from minus 13.5 in July. This positive reading is the first in a year: since August of 2022. The chart shows there's been a series of negative current and future index readings since 2022; Having a negative future and current index reading in the same month has been a reliable signal of oncoming US recession. Once that signal turns on it doesn't have to stay lit all the way through the recession, simply turning it on once has been enough to signal that recession is coming. The chart shows that signal has been triggered a number of times since 2022 but now the signal is off. The current index is positive. The future index is positive. The components up and down the line of the current index have moved substantially up from their weakest levels. The Philadelphia index no longer looks like it's signaling recession. Ranked among data back to 1969, the headline current index at a 51.6 percentile standing is above its median. When data are presented as percentile standings their medians are represented by a value of 50%. New orders, prices received, and hours worked are all series above their respective medians on this long timeline.

Unexpected revival in Philadelphia (Haver Analytics and FAO Economics)

The economy refuses to continue its deceleration

A number of economic reports have turned up stronger including the retail sales report for July and these numbers are having a marked impact on the bond market although so far the Federal Reserve seems to be locked in on the notion that whatever is going on with economic activity it's of a secondary nature since it is happy that some of the air has been coming out of the inflation balloon. As happy as the Fed might be, that is shortsighted because if the economy is going to spark back up it's hard to imagine that inflation is going to continue to downshift. For the moment there is contradictory ebullience in stocks and loathing in bonds. Federal Reserve officials seem to be whistling past the graveyard as they think they're following their GPS map to a soft landing. Maybe not.

For a while the housing market was showing some resilience and bounce back but now mortgage rates have hit their highest mark in more than 20 years.

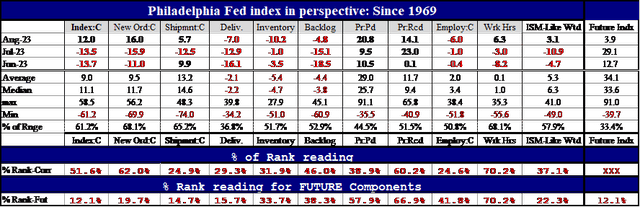

Philadelphia Fed survey weakens broadly (Haver Analytics and FAO Economics)

The Philadelphia Story…is it also America's story?

The Philadelphia Fed manufacturing index has been around for a long time, over many business cycles and so we know it pretty well. This index is now showing a significant rebound in August; its prices-paid metric jumped sharply although prices received receded in August. On the month hours worked moved up sharply, while the employment gauge backed off. What we seem to be seeing is an increase in orders, shipments continue to be positive, firms seem reluctant to add to payrolls, but they've had a demand for labor services which they have filled by working existing workers longer hours. In doing that, they avoid dipping into the labor pool which firms complain is shallow, expensive, and doesn't offer the skills that they need. Also by using extra hours instead of extra people firms retain flexibility in the event that the rebound that the economy is experiencing proves to be short. But, on balance, this story from the Philadelphia Fed survey is definitely upbeat.

Over the years even though this is only the district Bank of Philadelphia this survey has proved to be a reasonably good bellwether for the US economy itself because there's a reasonable amount of manufacturing that goes on and the belly of the economy around the Philadelphia region.

Other quirky findings

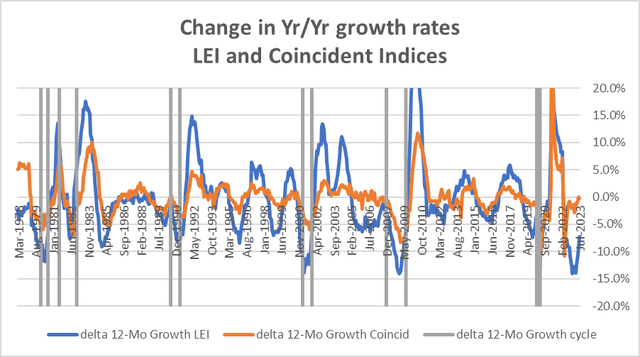

An additional quirky development comes from the leading economic index, where growth rates between the coincident and leading indices have separated. In fact, the 12-month change in the LEI growth rate and the 12-month change in the coincident index growth rate have just gone through eight months of their largest discrepancy on data since the early 1970s. Like the Philadelphia Fed survey this isn't a 'why' report it's a 'what' report. The failure of the coincident index to weaken in step with the weakness of leading economic index may have seemed peculiar to you; if it did, your gut was giving you the right signal, because that separation has been unprecedented. This now leaves us the job of having to sort out the reasons why.

Coincident Index refuses to follow weakened LEI lower (Haver Analytics and FAO Economics)

Unprecedented gap in change in LEI and Coincident Index growth rates.

Traditional signal or relationships at risk

The inverted yield curve and the Philadelphia Fed future and current indices have been extremely reliable predictors of recessions in the United States back since the late 1960s. All of a sudden these two metrics seem to be on the verge of creating forecast errors. The Board Staff at the Fed has pulled back the forecast of recession that it had put on the table. Other private sector economists have joined them and looking at these data reports you can see why. The monthly job reports have shown some slowing but they're still showing a great deal of growth and with this kind of growth combined with the ongoing pressure on wages, consumers, even with inflation running strong, have been maintaining enough financial momentum to keep spending going. Meanwhile the Fed is getting cold feet over rate hikes.

There's a great deal of focus on the savings that had been built up during Covid largely because the government sent money out without much of an income test. Only the wealthiest, the very wealthiest people, failed to get Covid checks. Covid checks went to many people who were still relatively affluent and not in need of money. On top of that there are several Joe Biden sponsored programs including his inflation reduction act and the build back better program that are shoveling money into municipal governments. The construction sector around the country has been quite active.

Amid all this activity the Federal Reserve has been reluctant to raise the federal funds rate to levels that they had raised it to in the past to stop inflation. The Fed has instead focused its policy and has aimed its rhetoric on the attainment of something called the soft landing. Still these are mythological beasts that have never visited the US economy. Now if you listen to a few select officials and some liberal economists they will tell you about soft landings that the economy has had in the past. They have designated what I consider some peculiar periods to be soft landings. But the kind of soft landing that we have never seen is a soft landing that develops in the aftermath of virulent inflation. Any time the Fed has had to chase down an excessive inflation rate to induce price stability, the only way the Fed has been able to do that is by running a recession.

Soft landings at least have better PR than results

The Fed has not been able to take high inflation and bring it down to a sustainable level using a soft landing strategy. It hasn't happened. In fact the great danger is the periods that the Fed, and other economists, want to designate as soft landings are often periods in which there has been some slowing in the economy, where no recession has developed, but in the aftermath the inflation rate has risen. Currently, the inflation rate has been too high for too long it has fallen too little, the falling inflation so far is mostly confined to the headline. The fall in the core inflation rate is far less convincing and the distance core inflation has to go in order to get to the Fed's target is still substantial. It's hard to understand how anyone thinks we will get there without running a significant period of substandard growth.

And the labor market?

Meanwhile, the labor market is extremely tight the market power has swung over to labor where organized labor is obtaining big raises in its collective bargaining rounds while ordinary firms and small firms that report data to the NFIB (the National Federation of Independent Businesses) continue to report to that they have no plans to raise labor compensation… and yet they have been raising labor compensation consistently for quite a number of months. This is because, whether they have plans for it or not, the labor market is tight and if they want to hire they need to meet market standards. Still, these are the same firms that complain that they can't find the kind of skilled labor that they seek. In short there's nothing in this economy or in the trend for its growth rate or in the conditions in the labor market that make me think we're on the verge of reducing inflation to its price stability mark. All we've been able to do is to move inflation down from extremely high levels to moderately high levels - levels that are looking sticky.

And, in this cycle, the Federal Reserve has clearly been subject to political pressures. It changed its framework agreement to emphasize the labor market more and achieving its inflation target less. It has been pressured to pay attention to climate change in assessing banks making lending decisions. It has been pressured to keep the unemployment rate lower longer because a lower unemployment rate is helpful in creating jobs for minorities. This tactic took the Fed's best anti-inflation tool out of its hands- that is being preemptive with policy. The Fed not only was not preemptive with policy it allowed inflation to run over the top of its target for over a year - a full year of target overshooting before it raised the federal funds rate at all - and this was a central bank that gave us 'forward guidance' on inflation and told us that it had a strict 2% target that it would pursue. It's very hard to see the Fed in these circumstances already unwilling to raise interest rates, being successful on the inflation front. Yet, the Fed is promising that it's going to keep interest rates higher for longer…I'm thinking that the Fed will not have the backbone to do that. It has not demonstrated any of that backbone to date.

Impediments to inflation progress

The next big thing that's going to get in the way of making objective monetary policy is going to be proximity to the federal elections. In economist terms, for the way we think about policy and the lags involved, we are already in the window where policy is going to be having an impact on the economy during the elections. And, of course, politicians are worried about that. But they're also worried about appearances and so politicians are very concerned about whether the Fed is going to be raising or cutting interest rates as we head for the election date. But the real question is going to be how the economy has been prepared to perform during that period. Right now, it looks like the economy is engaged in a reacceleration and if that continues we're going to be looking at rising inflation going into the elections and it will be hard for the Fed to be faced with that kind of a situation and to not raise interest rates further.

Why inflation is coming… more than going

In short the forward guidance and the dots that the Fed put on its map already appear to be obsolete. Just as it looked just as though the Fed might be starting to get tough, and it wasn't looking for any kind of rate cuts ahead, we have heard in public statements a number of Fed members engaged in some verbal backsliding. We see mention of such positions in the Fed 'minutes' as well. But now we're seeing some strengthening in economic data. The Fed did not keep hiking rate up above the trailing 12-month inflation rate. It paused. It lost its mojo, its momentum, its chance to take control. However, it is talking about some weakening and easing in labor market data. And it certainly looks as though the Fed and the bond market are on different pages in different books. From what I see here and now I do not see the Fed holding the line on interest rate cuts. Failing to hike rates more, the Fed will also fail to hold them high enough long enough. The only question here is the timeline over which this will play out

The Fed's true goal

Powell seems to be committed to a soft landing. Rather than committing to break the back of inflation and to make sure that it solves the problem that it created, the Fed wants to redeem itself by pulling a rabbit out of its hat and achieving a soft landing for the economy. But the problem with soft landings is the most instances of soft landings historically have also been periods in which the inflation rate did not go all the way back down to where we're supposed to be. Alan Blinder has said that he considers the 1969-70 recession to be more of a soft landing than a recession (a recessionette!) because output only fell by six-tenths of a percentage point in that cycle from peak to trough. But the unemployment rate did go up by 2.6 percentage points and when that recession was over the inflation rate was higher, not lower than before it began, and in very short order it was moving higher again. This episode was not a policy success. So, if that's an example of a soft landing I sure hope we don't have another one. But thinking about this sent me fishing on the internet, and, however disturbing you find these prospects, you may find this clip from Saturday Night Live's Dan Ackroyd entitled 'inflation is our friend' at least as partial compensation for your worries here.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Timeliness issue here...since this report was just released

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)