Ginkgo Bioworks: Lack Of Progress Is A Concern

Summary

- Ginkgo Bioworks' second quarter results were poor, with soft results in both the Cell Engineering and Biosecurity businesses.

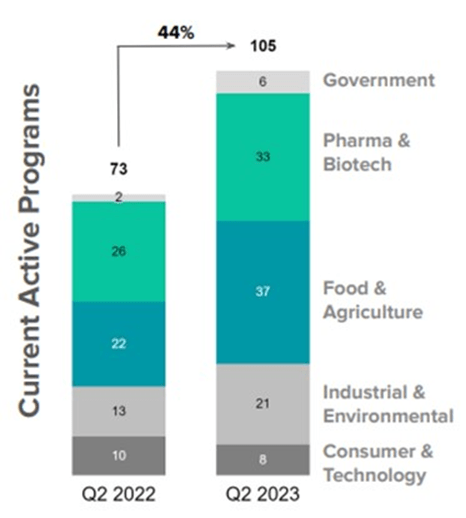

- The company's Cell Engineering projects are tilting towards Pharma & Biotech and Food & Agriculture, which may improve the probability of commercial success.

- In the absence of downstream value creation, there is little to support Ginkgo's valuation. Further progress must be made in this area, or the share price will remain under pressure.

byakkaya

Ginkgo Bioworks' (NYSE:DNA) second quarter results were relatively poor, with both the Cell Engineering and Biosecurity businesses reporting soft results. In addition, declining revenues and higher costs on the back of acquisitions have caused losses to increase significantly in recent quarters. Most of this was expected though, and probably won't change sentiment towards the company significantly. Ginkgo will need projects to begin demonstrating large scale commercial success at some point though if the company's narrative and valuation are to be maintained.

Ginkgo Bioworks

Ginkgo's portfolio of active programs continues to shift towards Pharma & Biotech and Food & Agriculture. This not a surprising development, and I believe it better positions Ginkgo to participate in projects with a higher probability of commercial success. I have previously written about the problems caused by pursuing a platform strategy in an immature industry, and this appears to be playing out. The use of biotechnology in the Pharma & Biotech and Ag industries is more mature, which should help to reduce some of the problems preventing downstream value realization. For example, Pharma & Biotech customers have more experience scaling production and production costs are less likely to be an issue. Ginkgo has added mammalian cells to its existing infrastructure in microbial and fungal to support the pharmaceutical business.

Figure 2: Ginkgo Active Programs (source: Ginkgo Bioworks)

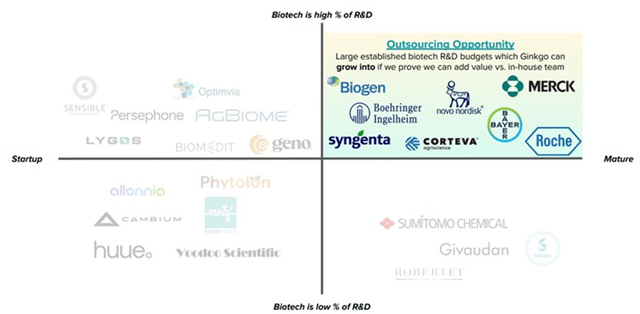

While Biotech & Pharma introduce their own idiosyncratic risks, projects targeting manufacturing improvements could create significant value and have a reasonable probability of success. Ginkgo signed a collaboration agreement with Novo Nordisk (NVO) in 2022 to discover novel expression hosts for biologic production. The pilot phase of this is now complete and the program is moving into the development phase. Ginkgo also signed a collaboration agreement with Merck (MRK) in 2022, focused on engineering enzymes for API production. Ginkgo now has a multi-program collaboration focused on biologics production. Ginkgo believes that these types of programs with established biotech R&D leaders will likely drive near-term performance.

Figure 3: Ginkgo Customers (source: Ginkgo Bioworks)

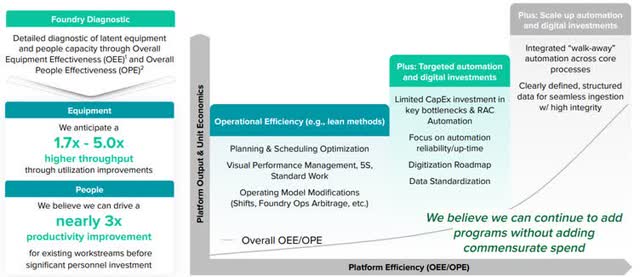

Ginkgo recently established an operations team to improve the productivity of its operations. Ginkgo believes that process improvements can increase throughput 1.7-5x. As a result, Ginkgo expects to continue adding programs with limited CapEx or headcount increases.

Productivity gains were always part of the Ginkgo investment thesis though, with the company constantly referring to things like Knight's Law. The fact that Ginkgo is now specifically highlighting efficiency initiatives feels like a shift in tone, possibly brought about by rapidly declining revenues and mounting losses.

Figure 1: Ginkgo Productivity Initiatives (source: Ginkgo Bioworks)

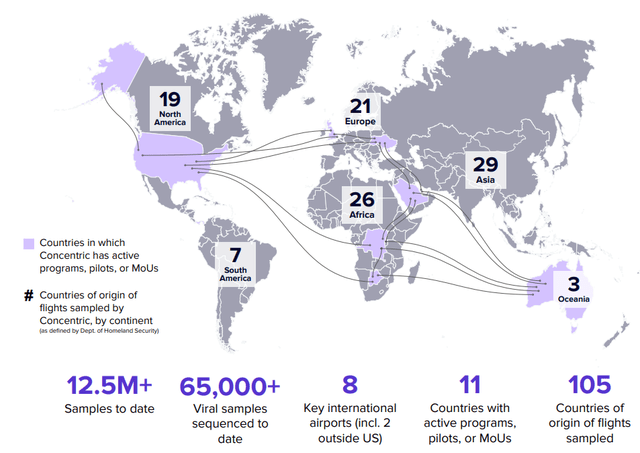

Ginkgo's Biosecurity business is still in the process of adjusting to the post-COVID environment. The K-12 business, which has been responsible for a large portion of revenue, is expected to be largely finished in the second half of the year. Ginkgo is now focusing its resources on the federal government and international opportunities. Ginkgo has new programs spanning both Cell Engineering and Biosecurity with IARPA and DARPA and now has active programs, pilots or MOUs in 11 countries. While this business still has long-term potential, competitive dynamics are unclear, and the business will likely be slow to scale without another catalyst like COVID.

Figure 4: Ginkgo's Biosecurity Business (source: Ginkgo Bioworks)

Related Companies

Ginkgo has previously been criticized for its reliance on related parties for revenue. While the importance of related parties has declined significantly over the past few years, this development may not be as positive as it seems. There is little information available about the commercial success of these companies, but there are signs that some of them are struggling.

Motif Foodworks was founded in 2018 to use synthetic biology to reduce the use of animal products in the food industry. Motif now has several commercial products, including:

- Hemami - plant-based umami flavor

- Appetex - product that helps plant-based meat recreate the texture of animal tissue

Motif also plans on launching plant-based burger patties, plant-based chicken and plant-based pork products in 2023.

While Motif at least has commercial products, the alternative protein market has been struggling due to high costs and a lack of consumer acceptance. Motif doesn't appear to have been spared, laying off an unspecified number of employees in 2022. Motif has also been facing patent infringement claims from Impossible Foods. Motif has questioned the validity of Impossible's patents, but the US Patent Trial and Appeal Board affirmed Impossible's patent in October 2022. A trial set to begin in January 2025.

Arcaea was founded in 2021 to apply synthetic biology to the beauty and personal care products industry. Arcaea's first product is a deodorant that works by supplying a precise nutrient blend that impacts underarm microbes, thereby shifting odor profile by selectively preventing the body's production of odorous compounds. Arcaea is also supposed to be launching brands, but there is limited information available on this front.

Allonnia was founded in 2019 to apply synthetic biology in the waste bioremediation and biorecovery industries. Allonnia's products include:

- Surface Active Foam Fractionation - uses air bubbles to remove harmful PFAS contaminants from the environment

- 1,4-Dioxane Bioremediation - uses a naturally occurring bacterium which metabolizes 1,4-dioxane into water and carbon dioxide

While these companies have commercial products, it is not clear how they are performing. This is somewhat concerning as Ginkgo stands to benefit from downstream value creation, and because Ginkgo is still supposed to perform a large amount of cell engineering for these companies.

Table 1: Ginkgo Related Party Revenue (source: Created by author using data from Ginkgo Bioworks)

The lack of commercial success by related parties should also be viewed in light of difficulties at companies like Cronos (CRON) and Synlogic (SYBX). Commercializing products is difficult, and even where strain engineering projects are successful, there is a high probability of failure.

Financial Analysis

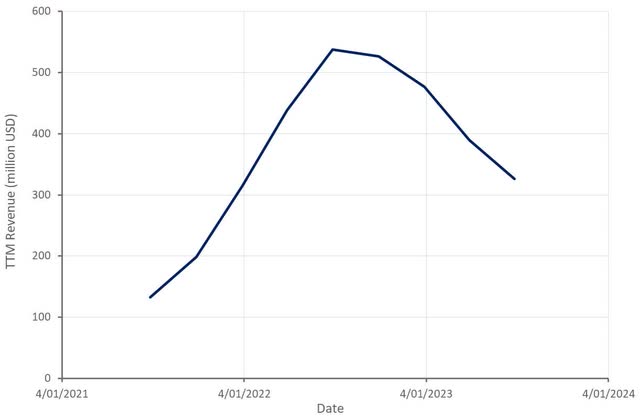

Ginkgo's revenue was down 44% YoY in the second quarter, due mainly to the Biosecurity business normalizing post-pandemic. Cell engineering revenue was 45 million USD, up 2% YoY. Cell Engineering services revenue was up 72% YoY, but the importance of this is questionable given Ginkgo's focus on downstream value. Biosecurity revenue was 35 million USD in the second quarter, a 65% YoY decline driven by the winding down of K-12 COVID testing services.

Figure 5: Ginkgo Revenue (source: Created by author using data from Ginkgo Bioworks)

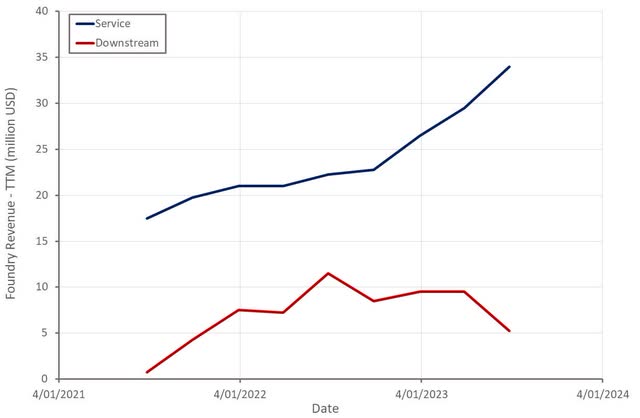

Ginkgo's Cell Engineering business is shifting from cost-plus pricing to a fixed price plus milestone approach due to market conditions. This is expected to present a near term revenue headwind, as less value will be realized upfront. Ginkgo is attributing roughly half of its reduction in Cell Engineering service revenue guidance to the change in the timing of revenue recognition. The remainder has been attributed to soft market conditions.

Ginkgo is maintaining its guidance of 100 million USD Biosecurity revenue in 2023, despite the business already generating around 82 million USD revenue in the first half of the year. Actual revenue is likely to come in well in excess of this, but guidance also suggests that Biosecurity revenue is likely to continue shrinking for at least another quarter.

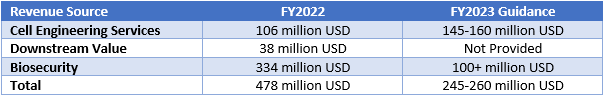

Table 2: Ginkgo Revenue Guidance (source: Created by author using data from Ginkgo Bioworks)

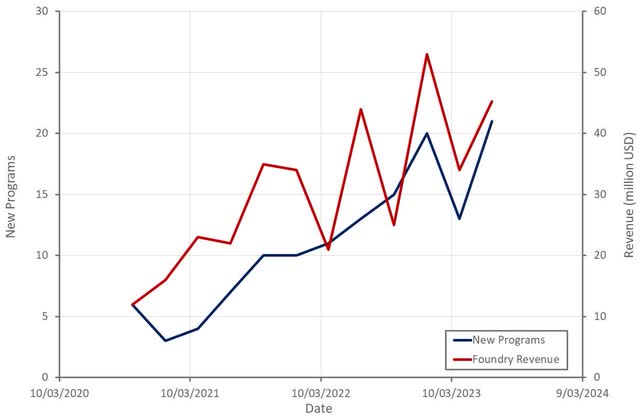

Ginkgo added 21 new cell programs in the second quarter and is currently supporting a total of 105 active programs across 63 customers. The biopharma, food and agriculture and industrial verticals have been areas of strength.

Ginkgo has suggested that revenue is diverging from program starts due to market pressures impacting program size, as well as Ginkgo's own pricing strategy. A subset of programs launching in Q2 and beyond will not have any revenue recognition in 2023.

Figure 6: Ginkgo Cell Engineering Revenue (source: Created by author using data from Ginkgo Bioworks)

While Ginkgo's Cell Engineering Service revenue has been growing rapidly, downstream revenue has been fairly flat over the past 18 months.

Figure 7: Ginkgo Cell Engineering Revenue (source: Created by author using data from Ginkgo Bioworks)

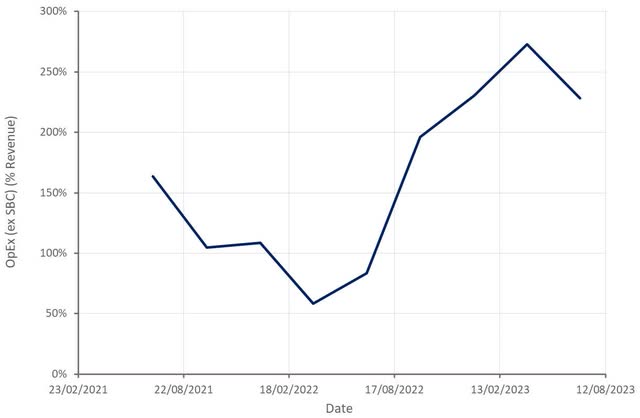

Ginkgo continues to register extremely large operating losses, on the back of both R&D investments and high general and administrative expenses. While SBC compensation expenses have declined significantly over the past 2 years, operating expenses are still high even when ignoring SBC.

R&D expense is currently elevated in part due to Ginkgo's acquisition of Bayer's ag biological facility and Zymergen. General and administrative expenses reportedly included a number of one-time expenses in the second quarter, the majority of which was non-cash.

CapEx in the second quarter of 2023 was 14 million USD, which includes an expansion of Ginkgo's process engineering lab. While Ginkgo's talks a lot about productivity gains, CapEx is still running around 14% of revenue. If this level of CapEx is required to support growth going forward it will drain cash significantly.

Figure 8: Ginkgo Operating Expenses (source: Created by author using data from Ginkgo Bioworks)

Valuation

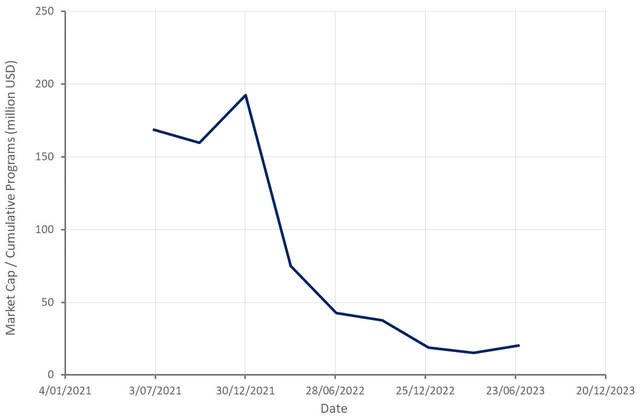

Ginkgo is beginning to look expensive based on a revenue multiple, with revenue continuing to fall sharply. Given Ginkgo's goal of participating in downstream value, this is probably not the right way to think about the company's valuation in the near term though. Ginkgo's market capitalization relative to the number of cumulative programs (proxy for potential downstream value) indicates the company is now looking more reasonably priced.

Ginkgo's value will also likely be dependent on its ability to avoid diluting existing shareholders at an unfavorable share price. Ginkgo's management team has stated that they believe they have sufficient cash to reach profitability, but this is difficult to say at this stage. Ginkgo must both continue to increase productivity and grow rapidly to avoid burning excessive amounts of cash, and in this regard, Ginkgo is somewhat at the mercy of market conditions.

Ginkgo's current difficulties probably do not mean a lot to investors that continue to believe in the Ginkgo story. At some point in the not-too-distant future the company will need to begin realizing downstream value from successful commercial products though. If not, the share price is likely to remain under pressure.

Figure 9: Ginkgo Relative Valuation (source: Created by author using data from Ginkgo Bioworks and Yahoo Finance)

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.